Ethena is goated fr. Tokenizing the basis trade was attempted before Ethena but none were as well executed.

I Don’t Think You Understand How Great Ethena Is

Anyone can replicate delta-hedging at a small scale.

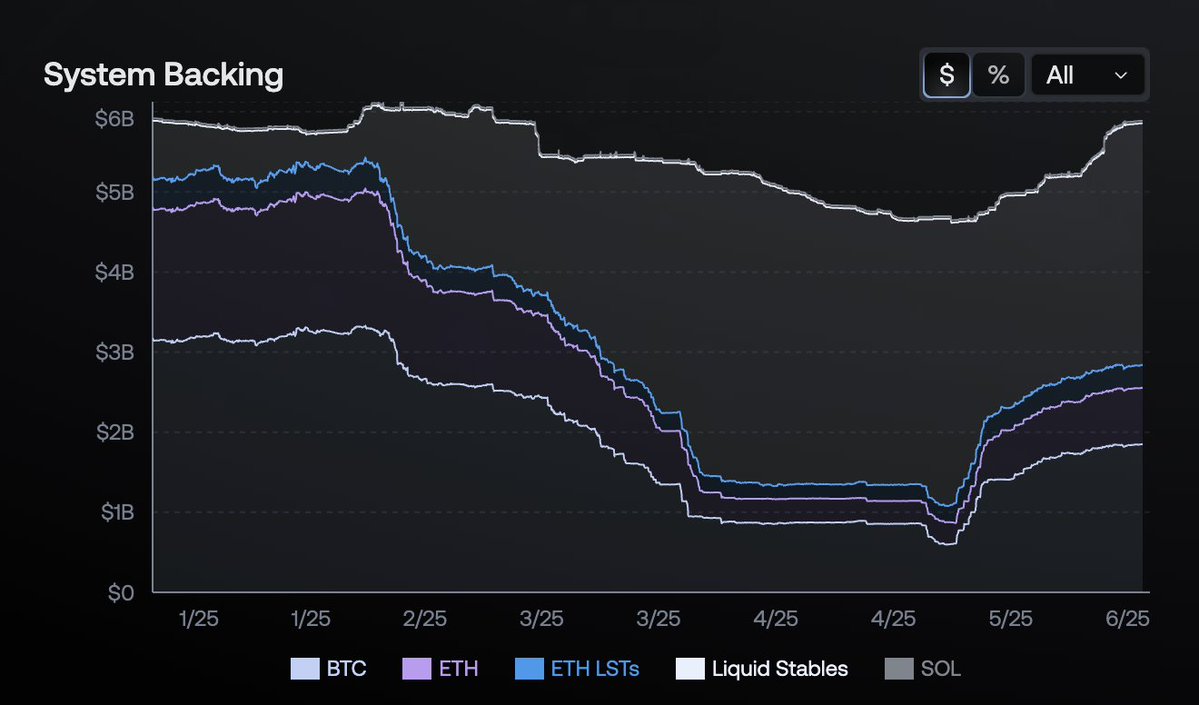

Scaling to $5B and rebalancing collateral across multiple venues 24/7 is another universe; yet just 26 people (@gdog97_, @ConorRyder, @sshxbt, @n2ckchong, @lingchenjaneliu among them) keep USDe’s peg rock-solid every single day. That’s insane.

Analytics, automation, and credit lines all balloon with size, making it nearly impossible to match Ethena overnight.

Instead of parked dollars, Ethena holds ETH, BTC, SOL, LSDs, USDtb and shorts the same stack on Binance, OKX, Bybit (Hyperliquid probs next). Price zigs, hedge zags, net $1.

When perps lean long, shorts collect funding; add staking rewards and USDe pays double-digit APY with zero printed subsidies. If funding turns negative, hedges shrink while reserve + staking carry the yield.

Ethena’s edge is less about clever hedging math and more about what can’t be forked:

- Institutional rails: You only run multi-billion shorts at Binance, OKX, Bybit if you’ve cleared the legal, credit-line, and custody gauntlet.

- 24/7 risk desk: Bots rebalance exposure across venues in milliseconds; assets live with Copper/Fireblocks, not in hot wallets. One exchange hiccups, collateral evacuates before X notices.

- Elastic yield. When perp funding is positive, USDe pays double-digit APY. If funding flips negative, Ethena dials hedges down, leans on staking, and taps its reserve.

Execution, not the idea, is the moat.

Next stop: $25 B float. iUSDe will wrap the same engine in compliance for funds and corporates. Telegram onboarding + the Converge chain pull in retail and TradFi simultaneously, a flywheel of liquidity → stability → yield.

Ethena turns volatility into cash flow and does it calmly. If USDe scales like T-bills did in TradFi, we’re only in inning one.

17

4.05K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.