This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

SOL

Everything, Everywhere, Everyone price

5Khm1r...pump

$0.0000041331

-$0.00025

(-98.40%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about SOL today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

SOL market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$4.13K

Network

Solana

Circulating supply

999,771,332 SOL

Token holders

151

Liquidity

$7.54K

1h volume

$0.00

4h volume

$25.05

24h volume

$1.38M

Everything, Everywhere, Everyone Feed

The following content is sourced from .

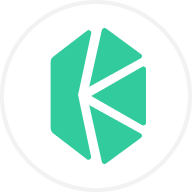

A picture to understand: how is your loan interest rate generated?

In addition, it is extended to the brothers' science popularization:

The government determines the benchmark interest rate.

The real interest rate long-term interest rate is determined by the market.

Interest rate is the price of money.

Interest rate fluctuations are equivalent to market fluctuations, and the central bank, which represents the government, can be considered the biggest market maker in this market.

The so-called manipulation of market prices requires a large amount of supply and demand in hand.

Essentially the same as manipulating potato prices.

For example, in this vegetable market, you want to control the price of potatoes at three yuan a whole catty, and you can't just have a lot of potatoes in your hand, but also a lot of money.

If your potatoes sell for 3 yuan a catty, others will not be able to sell them if they sell 3.1.

But what if someone else sells 2.9? You use money to buy all 2.9 potatoes.

Therefore, the government's ability to manipulate market interest rates depends on the chips in the government's hands!

看不懂的sol

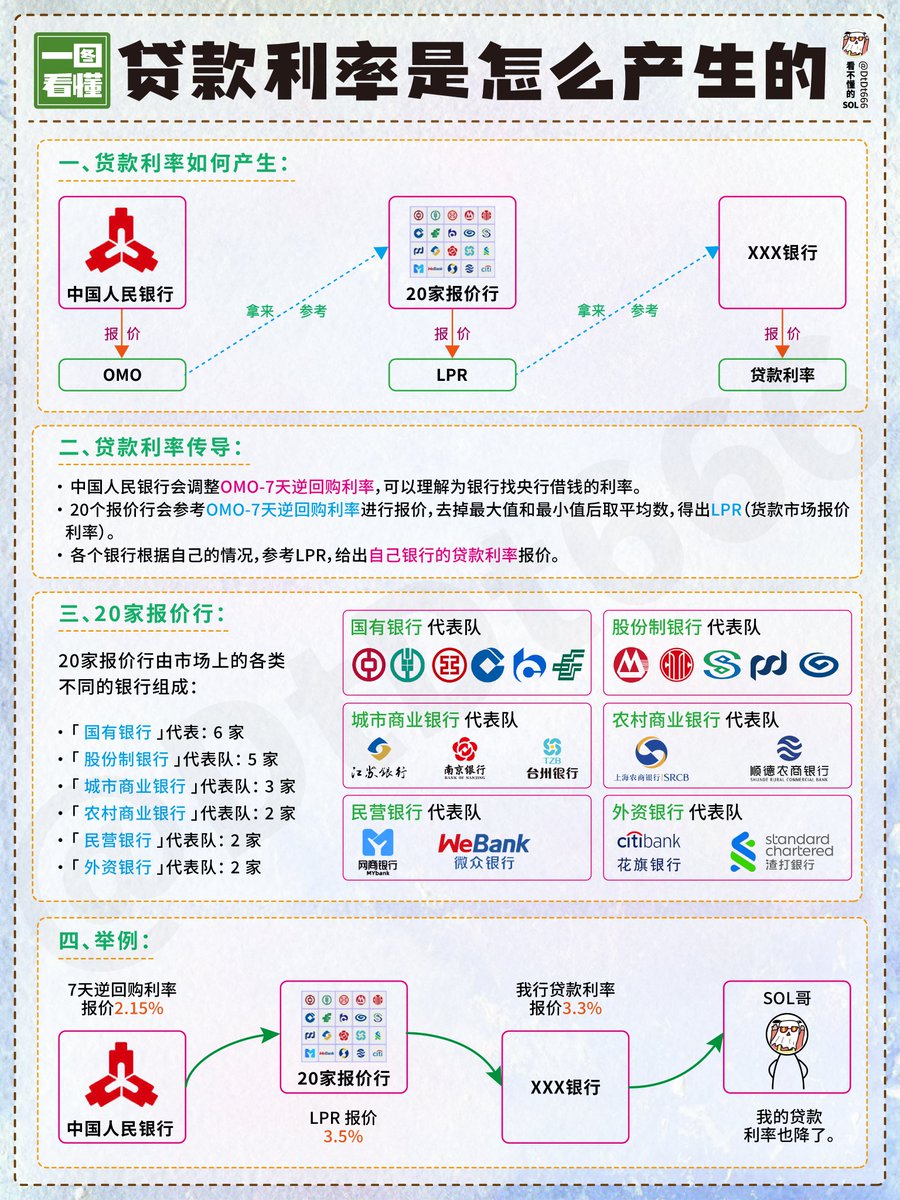

终于有人把“市盈率”说清楚:什么是“市盈率”?值得散户深读10遍

首先兄弟们来看市盈率的计算方式:市盈率=市值÷当期年度净利润;

具体是什么意思呢?

怕萌新兄弟无法理解,我们还是用利润讲解一下基础概念,比如A公司市值是100亿,今年赚了5亿,

那么市盈率就是100÷5=20;如果说A公司今年赚了20亿,那么市盈率就是100÷20=5;

市盈率衡量的就是收回股票投资所需要的时间,市盈率是5,就需要5年,市盈率是100,就需要100年,有同学就问了,需要100年还有人投资?还真有,不仅100有,200,300的都有,下面会具体说!

所以同等条件下,市盈率当然是越低越好!但是记得是同等条件下,这个下面会具体讲解。

还有一种算法是市盈率=每股股价÷每股收益,这个转换很多同学都会懵,其实都是在市值和当期年度净利润的基础上除以了总股本,我们可以用数学的方式去理解,分母和分子都除以了一个相同的数字(这个数字就是总股本,总股本就是相当于份数,把一个公司的股票分成了多少份,平常我们购买的100股,就是100份),结果是不变的,因为市值除以总股本,就等于每股股价了,当期年度净利润除以总股本就是每股收益了。

那么这个东西怎么拿来具体分析呢?

问题一: 当我们看到一个公司之后,去看一下他的市盈率,有些200多,有些只有5左右,区别在哪里?

解析一:市盈率本质上是市场给股票的一种期望值,数字越大,我对你的期望就越高,反之越低,那么不同的行业市盈率就不一样,脱离行业去比较市盈率是没任何意义的;一般来说,银行业市盈率很低,一般在5到7左右,因为大家对银行的增长期望已经很低的,银行业大都规模极大,增长率偏低;地产行业一般在5到10左右,因为未来的增长率也有限了;而半导体行业普遍都在100以上,因为这部分是未来的经济增长引擎,市场对他的期望极高;新能源行业一般在30到50左右;通信行业一般在50左右;如果如果是不同的行业比较市盈率是没有意义的,朝阳行业普遍会比传统企业大很多。所以我们看市盈率,首先就要了解整个行业均值。

问题二:如何动态地看待市盈率?

解析二:市盈率跟我们生活一样,要动态看待,他今天过的很差,不代表以后也会这样,说不定什么时候就发财了,那么企业也是一样的,股票是对未来的一种估测,记住,不是现在,也不是过去,所以动态的理念很重要,比如说,A公司今年能赚20亿,市值是100亿,市盈率就是5,这个确实很低,那么明年能否赚这么多呢,市盈率是随着盈利而变化的,一个公司是否值得投资,需要观测未来它是否还能赚这么多钱,以及大概估测其增长率,比如一个科技公司,市盈率现在是200,但是如果明年利润翻十倍,那么市盈率就会变成20,就很便宜了;如果一个公司市盈率现在20,但是明年赚的钱只有今年的十分之一,那么市盈率就会急剧放大!大牛股往往存在于第一种情况,暴跌股往往出现在第二种情况,所以不要纯粹以为低就是好,有些东西贵有贵的理由,有些东西,便宜也有便宜的道理,关键你要对你购买的公司以及其行业很了解!

问题三:市盈率要跟什么结合看?

解析三:和市盈率永远联系在一起的是企业净利润的增长率,大家要知道,如果一个公司的利润可以长期稳定,并且保持一定幅度的增长,这种盈利的逻辑就比较强;如果一个公司现在市盈率很低,但是利润一直在跌,市盈率在不断放大,这种亏损的风险极大,所以除了看市盈率,一个公司的净利润增长率是伴随着的一个极其重要的指标,这里就有了一个新的指标,PEG,市盈率就是PE(当然,PE还有私募股权的意思,语境不一样,意思不一样,大家不要混淆了),PEG是什么意思呢?也就是PEG=市盈率÷净利润增长率,打个比方,如果一个公司今年的市盈率是20,明年的净利润增长率能够达到30个点,PEG=20÷30=0.67,那么这个数值就是比较好的,而这个公司如果长期能够保持这种增长,那么中长线就是一个很好的投资标的,PEG这个数值低于1就比较合适了。而如果一个公司今年市盈率是10,但是明年增长率只有5个点,PEG=10÷5=2,反而这个要更加贵,投资价值低于前一个公司。

所以大家可以看到,很多公司市盈率很低,股价还是一直跌,因为市场认为明年这个公司增长率很低,甚至负增长,对于市盈率放大的公司,就是一个极差的投资标的,如果购买这种股票,大概率会亏损,所以不要陷入低市盈率的陷阱,一定要对公司和行业有深刻的了解,看这个公司未来的前景。

这就解释了某些科技公司,为什么市盈率超过200了,仍然一直涨,因为市场估测他未来的净利润会持续告诉增长,市盈率会急剧降低,市盈率降低这个预期才是他涨的原因,当然有些垃圾公司市盈率也很高,但是却无法保持告诉增长,这种企业,就是投资的黑洞,投资的关键在于要有能力辨别一个公司是否则真的有实力维持高速增长!

问题四:如何实际操作?

解析四:当我们看到一个新的公司,市盈率是50,我不知道是好是坏,就需要我们去对这个公司进行深入研究,研究这个行业至少未来3年的前景,是否能够至少保持20%以上的增速,研究这个企业在行业的地位以及护城河,是否能够连续高于行业均值,如果可以,这就是一个不错的投资标的,如果能够更高,当然就更好了;如果不行,甚至是一个负增长的行业,而这个企业在行业地位又很一般,这种公司哪怕股票天天涨停,也不要去碰!还有一个需要注意的是,利润和营收不增长的企业,投资价值也是很有限的,有些公司每年的利润都还行,市盈率也不高,但是就是几乎停止增长了,这种未来的预期也不会很暖心!

关于价值投资

(一)低估值和高增长,前者往往具有确定性,而后者没有确定性。

当低估值因为总体经济不振,陷入低增长,是极好的买入时机。因为经济的规律总是高低相间,周而复始。一旦经济转好,低估值回到合理估值,就会有极佳的回报。

当低估值遇到流动性的问题,比如利率提高股市缺乏吸引力,比如股市过度扩容,但基于流动性总是会回到合理的水平,因此,一旦恢复,估值就会得到修复。

当然,最佳的状态是低估值加上高成长,那么,当低估值回到合理区域,就会获取公司快速增长带来的利润以及估值上升带来的利润。

简而言之,因为非公司长期转坏产生的低估值,就产生了很好的买点;同样,当大盘总体处于低估值的状态,因为经济总是增长的,所以,未来的收益就具有了极高的确定性。

低估值买入是王道的原因,就在于一些暂时性的问题总是会过去的,在于人们情绪转换后,价格又回到价值的身上。

(二)世界上最大的谎言,就是低估值的时候喊危险;高估值的时候喊安全。

很多人成日关注自己没有能力关注的宏观经济,忧心忡忡。(他们根本没有能力分辨哪个是真的经济学家,哪个是假的;他们也不知道经济学家是有很多派别的,看多看空本来就有两派,如果有第三派,那么就是中立的。他们认同的经济学家,往往是外行经济学家,因为往往越外行的人,说出来的东西越浅白;也只有外行的假冒的经济学家,敢说自己什么都懂。)当然,还有一些人精力过剩,喜欢看世界经济的,可惜的是他们谈起欧美经济貌似头头似道,实则狗屁不通。

如果他们现实点,回头好好想想一个简单的可以轻易论证的事实,那就是:即使是金融危机,也不比一个股票pe被腰斩更严重。美国次贷危机,美国的经济损失了百分50吗?欧债危机,欧洲的经济损失百分50了吗?我们看到的,最多也就是让经济增长停滞罢了。而股票的pe被腰斩,就可以让一个股票从20元跌到10元。

因此,股民谈经济有问题,不如多关心他买的股票是否估值太高了。因为即便公司一两年不盈利,也不过损失百分十几二十的利润罢了;而买太高估值的股票,一旦回归,就是玉石俱焚。

高估值是万恶之源;低估值带来未来的财富;故事周而复始。让我们看看巴菲特投资可口可乐。

1988年,巴菲特买入可口可乐时,可口可口市盈率近15倍。1988年到1998年十年间,可口可乐净利润复合增长率为14.7%(略低于15%),1998底年股价达到66元,市盈率46.47倍!净利润的增长加上估值的提升,让巴菲特十年的投资净值增长12.64倍,年投资回报率达28%,这是一个标准的戴维斯双击。1998年到2011年,可口可乐的净利润年复合增速仍然有10%,但十三年间股价没有变化,只是市盈率从46.47倍下降至12.7倍,失落的十三年。

(三)大多人对市场的预期,是中短期预期。

不是长期的预期,就像一亩田,你可以预期它明年收成不好或者大好,但一亩田的产量其实是有个定数的。一亩田的长期平均产量是1000斤,当它有一年的产量是1300斤或者700斤的时候,这亩田的价值其实变化不大。在现实生活中,人们是根据这亩田长期稳定的产量进行定价的。但在股市中,因为市场先生的存在,因此当它是700斤的时候,就给500斤的价格;当它是1300斤的时候,就给1500斤的价格。

此外,大多好的公司长期的收益是相对确定的。拉长时间,这些优秀的公司收益率,除了极少数公司,大多相差不大。因此,如果两个同样的好公司,他们的估值相差巨大,正常情况下,就让人担心是否有透支的问题,或者,会欣喜的发现某些公司因为市场的乱流而产生严重低估。

投资是从大概率出发的,是从常识出发的。低估值,除了和自身对比之外,还和这个群体里的其他公司对比。高估的必然回落,低估的必然前行。辉煌的(透支)将蒙上尘埃;而遗弃的最终会被发现。万变不离其宗,这个宗,这个本源,就是价值,就是不通过博弈的价格而纯粹来源于公司的回报。而当我们假设其他变量相同,只从估值这个角度入手,低估值当然就是万王之王。低估百分50,就可以轻取一个好公司5-7年的辛苦经营;高估百分百,则意味这个好公司5-7年的利润事先被人领走了。

(四)不要去考虑宏观经济永远变坏的一天,

因为宏观经济总是会从阴天,雨天走向春暖花开,买在寒风萧瑟,卖在阳光雨露后。因为人们总是如此容易被外界影响,同时又不知道只是季节轮转,只是晨昏交替,只是潮涨潮落。

范仲淹如此描述到:若夫霪雨霏霏,连月不开;阴风怒号,浊浪排空;日星隐耀,山岳潜形;商旅不行,樯倾楫摧;暮冥冥,虎啸猿啼;满目萧然,感极而悲者矣!

而季节轮转后:至若春和景明,波澜不惊,上下天光,一碧万顷;沙鸥翔集,锦鳞游泳,岸芷汀兰,郁郁青青。而或长烟一空,皓月千里,浮光跃金,静影沈璧,渔歌互答,此乐何极!登斯楼也,则有心旷神怡,宠辱偕忘、把酒临风,其喜洋洋者矣!

低估值买入,是看清了轮转、交替、涨落,知道太阳会升起,知道没有解决不了的问题,是通过历史的经验确定二十四节气来推算的春耕夏种秋收冬藏。

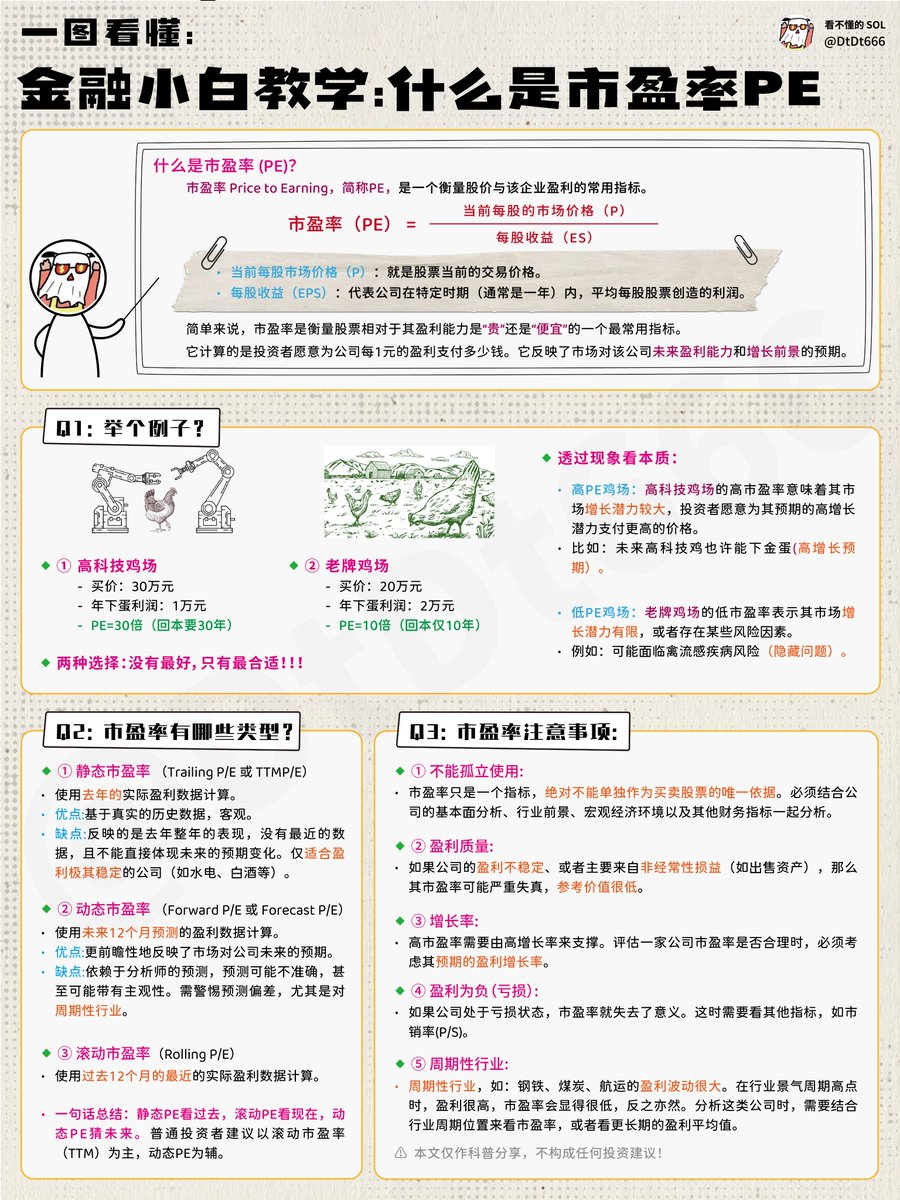

Continue to support $CHAO with actions, just bought more than 2,000 U, as long as the market value is less than one million, it will not move, this morning @shoutdotfun finally paid a salary, and only received more than 2,000 U, plus other tokens, I don't know how his system is calculated? Anyway, it is very good to receive more than 2,000 U in a week, and the salary of the cow and horse office workers who work overtime to death may not be so much, although this week is very tiring, but it is still a little small, thank you @shoutdotfun let me have the first time in my life to slap my mouth, and thank you for having a salary for two consecutive weeks, everyone hurry up and participate, use my link, how to mouth?

You can climb the previous article, thank you

Welcome to leave a message on my side with the following tags, let's stroke together

$Chao $PYTHON $Poge $ENERGY #SHOUT $shout $BANE $FAN $MGANG $UDOG $BOOM $666 $SCAT

SOL price performance in USD

The current price of everything,-everywhere,-everyone is $0.0000041331. Over the last 24 hours, everything,-everywhere,-everyone has decreased by -98.40%. It currently has a circulating supply of 999,771,332 SOL and a maximum supply of 999,771,332 SOL, giving it a fully diluted market cap of $4.13K. The everything,-everywhere,-everyone/USD price is updated in real-time.

5m

+0.00%

1h

+0.00%

4h

-2.72%

24h

-98.40%

About Everything, Everywhere, Everyone (SOL)

SOL FAQ

What’s the current price of Everything, Everywhere, Everyone?

The current price of 1 SOL is $0.0000041331, experiencing a -98.40% change in the past 24 hours.

Can I buy SOL on OKX?

No, currently SOL is unavailable on OKX. To stay updated on when SOL becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of SOL fluctuate?

The price of SOL fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Everything, Everywhere, Everyone worth today?

Currently, one Everything, Everywhere, Everyone is worth $0.0000041331. For answers and insight into Everything, Everywhere, Everyone's price action, you're in the right place. Explore the latest Everything, Everywhere, Everyone charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Everything, Everywhere, Everyone, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Everything, Everywhere, Everyone have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.