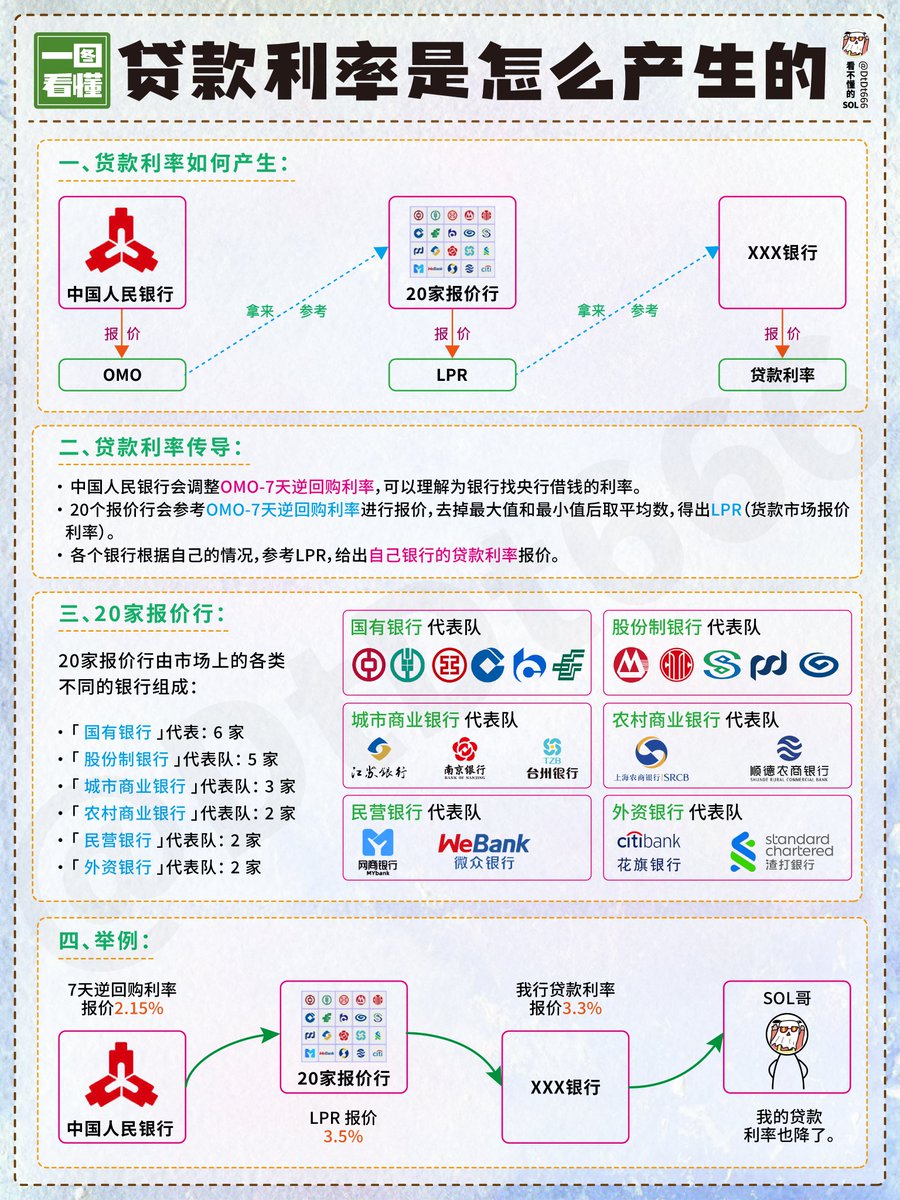

A picture to understand: how is your loan interest rate generated?

In addition, it is extended to the brothers' science popularization:

The government determines the benchmark interest rate.

The real interest rate long-term interest rate is determined by the market.

Interest rate is the price of money.

Interest rate fluctuations are equivalent to market fluctuations, and the central bank, which represents the government, can be considered the biggest market maker in this market.

The so-called manipulation of market prices requires a large amount of supply and demand in hand.

Essentially the same as manipulating potato prices.

For example, in this vegetable market, you want to control the price of potatoes at three yuan a whole catty, and you can't just have a lot of potatoes in your hand, but also a lot of money.

If your potatoes sell for 3 yuan a catty, others will not be able to sell them if they sell 3.1.

But what if someone else sells 2.9? You use money to buy all 2.9 potatoes.

Therefore, the government's ability to manipulate market interest rates depends on the chips in the government's hands!

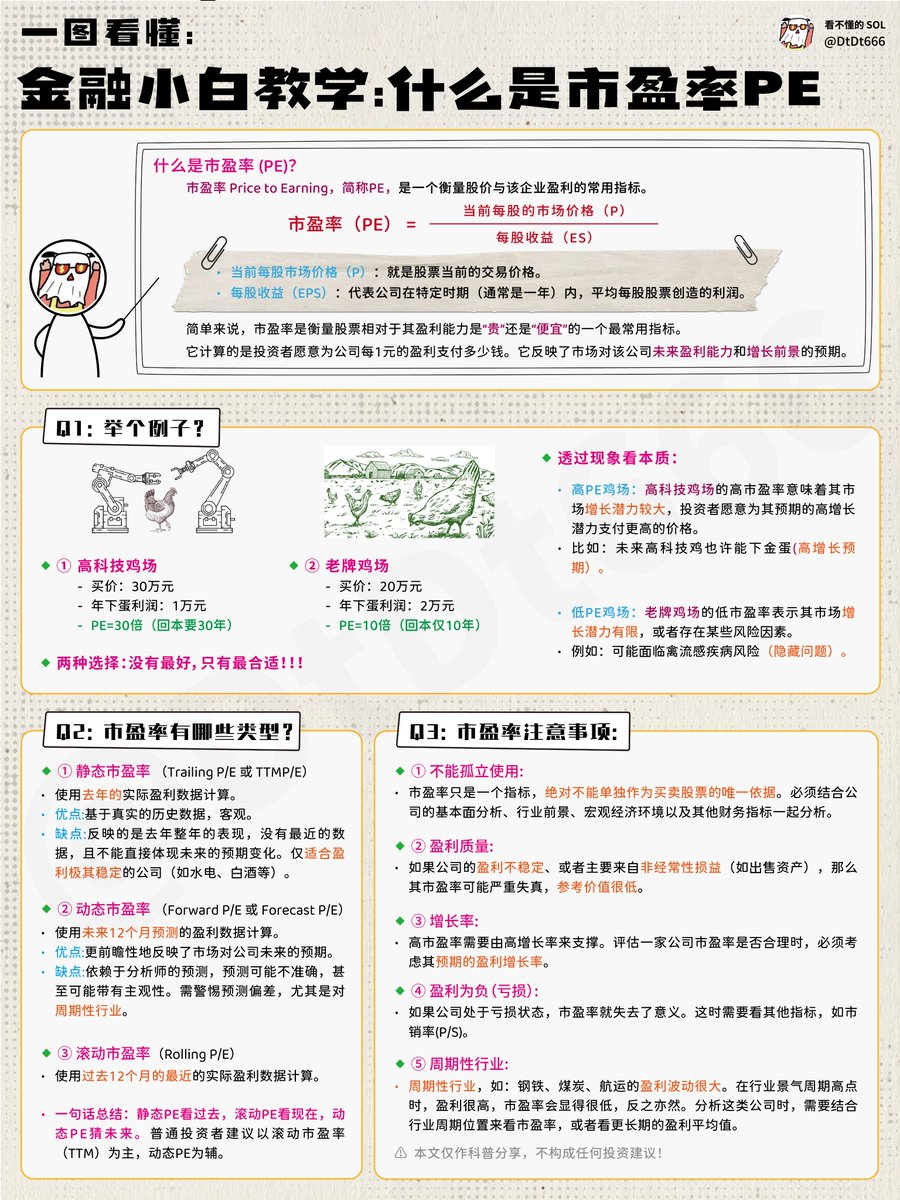

Finally, someone clarified the "price-earnings ratio": what is the "price-earnings ratio"? It is worth reading 10 times for retail investors

First of all, the brothers look at the calculation method of the price-earnings ratio: price-earnings ratio = market value ÷ net profit of the current year;

What exactly does it mean?

For example, the market value of Company A is 10 billion, and it has earned 500 million this year.

Then the price-earnings ratio is 100÷5=20; If Company A earns 2 billion this year, then the price-earnings ratio is 100÷20=5;

The price-earnings ratio measures the time it takes to recover the stock investment, the price-earnings ratio is 5, it takes 5 years, the price-earnings ratio is 100, it takes 100 years, some classmates asked, do you need 100 years to invest? There really is, not only 100, but also 200 and 300, which will be detailed below!

So under the same conditions, the lower the price-earnings ratio, the better! But remember that under the same conditions, this will be explained in detail below.

There is also an algorithm that is price-earnings ratio = stock price per share ÷ earnings per share, this conversion will be confused, in fact, it is divided by the total share capital on the basis of market value and current annual net profit, we can understand it in a mathematical way, the denominator and numerator are divided by the same number (this number is the total share capital, the total share capital is equivalent to the number of shares, how many shares are divided into a company's shares, usually the 100 shares we buy, is 100 shares), the result is unchanged, because the market value is divided by the total share capital, It is equal to the stock price per share, and the current annual net profit divided by the total share capital is the earnings per share.

So how can this thing be analyzed specifically?

Question 1: When we see a company, let's take a look at its price-earnings ratio, some are more than 200, some are only about 5, what is the difference?

Analysis 1: The price-earnings ratio is essentially an expectation value given to stocks by the market, the larger the number, the higher my expectations for you, and the lower the vice versa, then the price-earnings ratio of different industries is different, and it is meaningless to compare the price-earnings ratio out of the industry; Generally speaking, the price-earnings ratio of the banking industry is very low, generally around 5 to 7, because everyone's growth expectations for banks are already very low, and most of the banking industry is extremely large-scale and has a low growth rate; The real estate industry is generally around 5 to 10, because the future growth rate is also limited; The semiconductor industry is generally above 100, because this part is the engine of future economic growth, and the market has extremely high expectations for him; The new energy industry is generally around 30 to 50; the communication industry is generally around 50; If it is meaningless to compare price-earnings ratios in different industries, the Chaoyang industry will generally be much larger than traditional enterprises. So when we look at the price-earnings ratio, we must first understand the average of the entire industry.

Question 2: How to view the P/E ratio dynamically?

Analysis 2: The price-earnings ratio is the same as our life, to look at it dynamically, he is living a very poor life today, it does not mean that it will be like this in the future, maybe when will it get rich, then the company is the same, stocks are a kind of estimation of the future, remember, not now, not in the past, so the dynamic concept is very important, for example, Company A can earn 2 billion this year, the market value is 10 billion, the price-earnings ratio is 5, this is indeed very low, so can you make so much next year, the price-earnings ratio changes with profits, Whether a company is worth investing in needs to observe whether it can still make so much money in the future, and roughly estimate its growth rate, for example, a technology company, the price-earnings ratio is now 200, but if the profit increases tenfold next year, then the price-earnings ratio will become 20, which is very cheap; If a company's price-earnings ratio is now 20, but next year's money is only one-tenth of this year's, then the price-earnings ratio will be sharply enlarged! Big bull stocks often exist in the first situation, and plummeting stocks often appear in the second situation, so don't purely think that low is good, some things are expensive and expensive, some things, cheap and cheap, the key is that you have to know the company you buy and its industry very well!

Question 3: What should the price-earnings ratio be combined with?

Analysis 3: Always linked to the price-earnings ratio is the growth rate of the company's net profit, you must know that if a company's profit can be stable for a long time and maintain a certain amount of growth, this profit logic is relatively strong; If a company has a low price-earnings ratio now, but profits have been falling, the price-earnings ratio is constantly amplifying, the risk of this loss is extremely large, so in addition to looking at the price-earnings ratio, a company's net profit growth rate is an extremely important indicator, here is a new indicator, PEG, the price-earnings ratio is PE (of course, PE also has the meaning of private equity, the context is different, the meaning is different, don't be confused), what does PEG mean? That is, PEG = price-earnings ratio÷ net profit growth rate, for example, if a company's price-earnings ratio this year is 20, next year's net profit growth rate can reach 30 points, PEG=20÷30=0.67, then this value is better, and if the company can maintain this growth in the long term, then the medium and long-term is a good investment target, and the PEG value is less than 1 is more appropriate. If a company's price-earnings ratio is 10 this year, but the growth rate next year is only 5 points, PEG=10÷5=2, but this is more expensive, and the investment value is lower than that of the previous company.

So you can see that many companies have a very low price-earnings ratio, and the stock price has been falling, because the market believes that the company's growth rate next year is very low, or even negative growth, for the company with an amplified price-earnings ratio, it is a very poor investment target, if you buy this kind of stock, there is a high probability of loss, so don't fall into the trap of low price-earnings ratio, you must have a deep understanding of the company and the industry, and see the future prospects of this company.

This explains why some technology companies, why the price-earnings ratio exceeds 200, still rises, because the market estimates that his future net profit will continue to tell growth, the price-earnings ratio will decrease sharply, and the expectation that the price-earnings ratio will decrease is the reason for his rise, of course, some garbage companies have a very high price-earnings ratio, but they can't maintain growth, this kind of enterprise, is the black hole of investment, the key to investment is to have the ability to discern whether a company really has the strength to maintain rapid growth!

Question 4: How to do it in practice?

Analysis 4: When we see a new company, the price-earnings ratio is 50, I don't know if it is good or bad, we need to conduct in-depth research on this company, study the prospects of this industry at least the next 3 years, whether it can maintain a growth rate of at least 20%, study the status of this company in the industry and the moat, whether it can continue to be higher than the industry average, if it can, this is a good investment target, if it can be higher, of course it is better; If not, it is even a negative growth industry, and the company's position in the industry is very average, even if the stock goes up and down every day, don't touch it! Another thing to note is that the investment value of companies that do not grow in profit and revenue is also very limited, and some companies have okay profits every year, and the price-earnings ratio is not high, but they have almost stopped growing, and this kind of future expectation will not be very warm!

About value investing

(1) Low valuation and high growth, the former is often certain, while the latter is not.

When undervaluation falls into low growth due to the overall economic downturn, it is an excellent time to buy. Because the laws of the economy are always high and low, and they repeat themselves. Once the economy improves and the undervaluation returns to a reasonable valuation, there will be excellent returns.

When undervaluations encounter liquidity problems, such as rising interest rates, the stock market is unattractive, such as the stock market overexpanding, but based on liquidity, it will always return to a reasonable level, so once it is restored, the valuation will be repaired.

Of course, the best state is low valuation plus high growth, so when the low valuation returns to a reasonable area, it will obtain the profits brought by the company's rapid growth and the profits brought about by rising valuations.

In short, because of the low valuation caused by the long-term deterioration of non-companies, a good buying point is generated; Similarly, when the market is generally undervalued, because the economy is always growing, there is a high degree of certainty in future earnings.

The reason why undervaluation buying is king is that some temporary problems will always pass, and the price will return to value after people's emotions change.

(2) The biggest lie in the world is to shout danger when undervalued; When the valuation is high, it is called safety.

Many people are worried about the macroeconomy that they are unable to pay attention to. (They simply do not have the ability to tell which is a real economist and which is false; They also don't know that there are many factions of economists, and there are two factions of bullishness and bearishness, and if there is a third faction, then they are neutral. The economists they identify with are often lay economists, because the more laymen they say, the simpler what they say; There are only laymen and fake economists who dare to say that they know everything. Of course, there are also some people who have excess energy and like to watch the world economy, but unfortunately they seem to be talking about the European and American economies, but in fact they don't make sense.

If they are realistic and think about a simple fact that can be easily argued, it is that even a financial crisis is no worse than a stock PE being cut in half. In the subprime mortgage crisis in the United States, did the U.S. economy lose 50 percent? European debt crisis, is Europe's economic loss 50%? At most, we see that economic growth has stalled. The PE of the stock is cut in half, which can make a stock fall from 20 yuan to 10 yuan.

Therefore, when shareholders talk about economic problems, it is better to care more about whether the valuation of the stocks he buys is too high. Because even if the company is not profitable for one or two years, it will only lose more than ten or twenty percent of the profit; And if you buy stocks that are too overvalued, once they return, they will burn jade.

High valuation is the root of all evil; Undervaluation leads to future wealth; The story repeats itself. Let's look at Buffett's investment in Coca-Cola.

In 1988, when Buffett bought Coca-Cola, Coca-Cola's price-earnings ratio was nearly 15 times. In the ten years from 1988 to 1998, the compound growth rate of Coca-Cola's net profit was 14.7% (slightly less than 15%), and the stock price reached 66 yuan at the end of 1998, with a price-earnings ratio of 46.47 times! The increase in net profit coupled with the increase in valuation has allowed Buffett's net investment value to increase by 12.64 times over the past ten years, with an annual return on investment of 28%, which is a standard Davis double click. From 1998 to 2011, Coca-Cola's net profit still grew at a compound annual growth rate of 10%, but the stock price did not change in the past thirteen years, but the price-earnings ratio fell from 46.47 times to 12.7 times, a lost thirteen years.

(3) Most people's expectations for the market are short- and medium-term expectations.

It's not a long-term expectation, just like an acre of land, you can expect it to have a bad harvest or a good harvest next year, but the yield of an acre of land actually has a fixed number. The long-term average yield of an acre of land is 1,000 catties, and when its annual output is 1,300 catties or 700 catties, the value of the acre of land actually does not change much. In real life, people set prices based on the long-term stable yield of this acre of land. But in the stock market, because of the existence of Mr. Market, when it is 700 catties, the price of 500 catties is given; When it is 1,300 catties, give the price of 1,500 catties.

In addition, the long-term returns of most good companies are relatively certain. In the long run, the yields of these excellent companies, except for a very small number of companies, are mostly not much different. Therefore, if two equally good companies have huge valuations, under normal circumstances, people will worry about whether there is an overdraft problem, or they will be happy to find that some companies are seriously undervalued due to market turbulence.

Investment is based on high probability and common sense. Undervaluation, in addition to comparing with itself, is also compared with other companies in this group. Those who overestimate will inevitably fall, and those who are underestimated will inevitably move forward. The brilliant (overdraft) will be dusted; And the abandoned one will eventually be found. All changes are inseparable from their roots, this sect, this origin, is value, that is, it does not come from the price of the game but purely from the company's return. And when we assume that other variables are the same, starting only from the perspective of valuation, undervaluation is of course the king of kings. underestimate 50%, you can take advantage of 5-7 years of hard work of a good company; Overestimation of 100% means that the profits of this good company for 5-7 years have been taken away in advance.

(4) Don't think about the day when the macroeconomy will always be bad,

Because the macroeconomy will always move from cloudy and rainy days to spring flowers, buy in the cold wind and sell after the sun and rain. Because people are always so easily influenced by the outside world, and at the same time they don't know that it is just the rotation of the seasons, only the alternation of morning and evening, and the ebb and flow of the tide.

Fan Zhongyan described it like this: If the rain is drizzling, it will not open for months; the wind howls, and the turbid waves emptiness; The sun and stars shine faintly, and the mountains are lurking; Merchants and travelers are not good, and the masts are destroyed; The twilight is dark, the tiger roars and the monkey cries; It was a desolate and sad feeling.

After the seasons rotate: to spring and Jingming, the waves are calm, the sky is bright, and the sky is blue; The sand gulls soar and gather, the brocade scales swim, and the fragrant orchids on the shore are lush and green. And sometimes the long smoke clears, the bright moon stretches for a thousand miles, the floating light leaps gold, the quiet shadow sinks into the jade, and the fishermen's songs respond to each other; how endless is this joy? Climbing this tower brings a sense of openness and joy, forgetting both honor and humiliation, holding a cup of wine in the wind, and feeling joyful.

Buying at an undervaluation is to see the rotation, alternation, rise and fall, know that the sun will rise, know that there is no problem that cannot be solved, and calculate the spring plowing, summer planting, autumn harvest and winter storage through historical experience to determine the twenty-four solar terms.

54.22K

188

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.