In this week’s research piece, some puzzles have started to emerge as crypto treasury companies continue to proliferate, plus we look at the market implications of the changes to the crypto ETF landscape brought about by the SEC’s recent approvals. 🧵 👇

Crypto treasury companies have emerged as one of the enduring themes of the current cycle. While these companies have approached the market with different approaches and backers, their structures are fairly simplistic at a high level. These corporations issue equity and debt instruments, then use the proceeds to buy their preferred treasury crypto asset.

How does a treasury company increase its crypto holdings per share or generate crypto “yield”? There are only three mechanisms: 1) issuing stock at a premium to NAV 2) issuing debt (including converts and preferreds) or 3) active treasury management. That’s it.

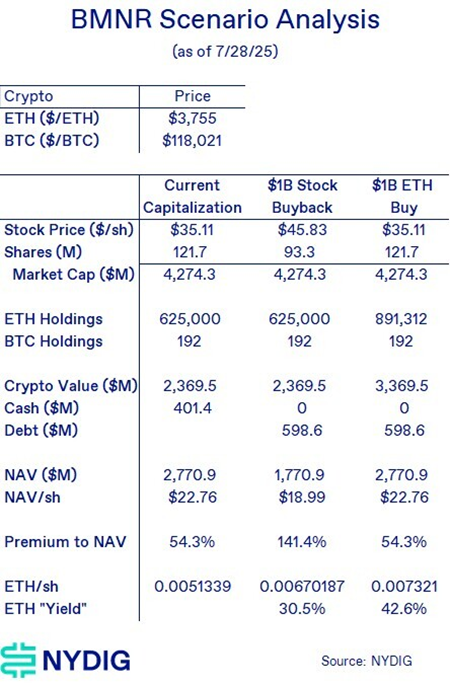

While corporates have been tripping over themselves rushing to issue equity and debt, last week we saw the first crypto treasury stock repurchase announcement from Bitmine Immersion Technologies (BMNR).

Because BMNR is using cash (and likely will issue debt) to repurchase the shares, the action generates positive “yield” on an ETH/sh basis, but as we show, it is suboptimal for shareholders compared to using the same amount of cash, and using it to just buy ETH.

Why might the company choose to repurchase its stock rather than accumulate more ETH? One likely reason is to support the share price following selling pressure from the recently registered $250 million PIPE (Private Investments in Public Equity).

There’s one final observation we have from our analysis of crypto treasury deals involving SRM Media. The company underwent massive change recently, pivoting to become a TRON (TRX – the cryptocurrency) treasury company, changing its name to Tron Inc. and ticker to TRON, naming TRON (the blockchain) founder Justin Sun as a special advisor, and engaging in a $100M Convertible Preferred PIPE, funded entirely with TRON (TRX) tokens, and whose investor base consists solely of Justin Sun’s dad.

A registration statement appears to have been filed, but not deemed effective yet. Still the deal has generated a cool ~17x (paper) return, which, with warrants, could amount to (again paper) profits of $3.3B (there are some restrictions).

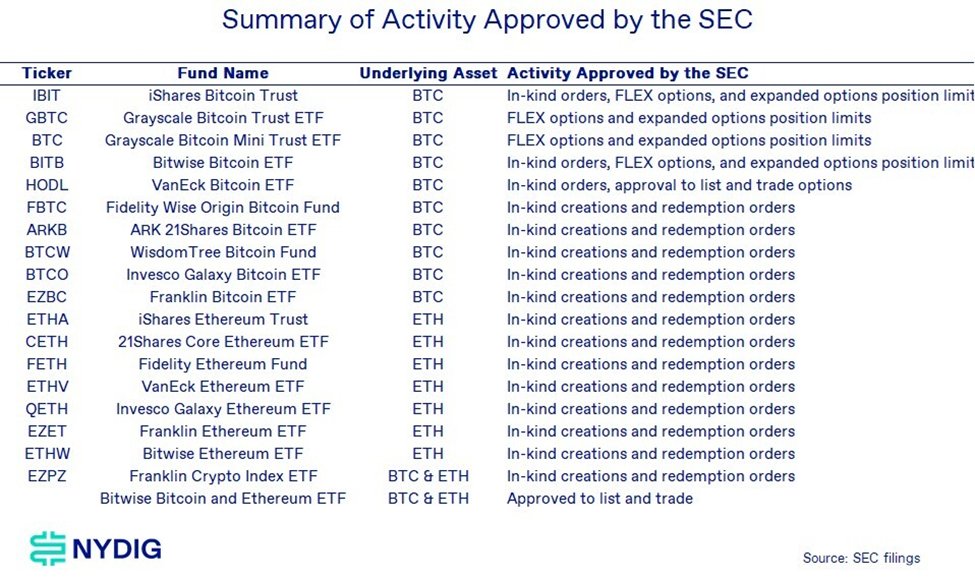

Last Tuesday, the SEC issued a sweeping set of regulatory approvals impacting a broad range of crypto-related financial instruments. Among the decisions, the agency authorized in-kind creation and redemption orders, FLEX options trading, and a tenfold increase in options position limits for two ETFs.

In-kind orders, the ability for Authorized Participants (APs) to create or redeem ETF shares by delivering or receiving the underlying digital assets (BTC or ETH), were a key feature sought by ETF sponsors before the initial bitcoin ETF approvals in 2024. For ETF sponsors, this restriction added operational complexity and ultimately increased costs for investors. ETF shares likely had a higher tracking error to NAV as a result.

One key omission in the approval of in-kind creation and redemption orders is Grayscale products (GBTC, BTC, ETHE, ETH), simply because the changes were never requested. This is a noted change from December 2023, when Grayscale executives met with the SEC, pushing for in-kind orders.

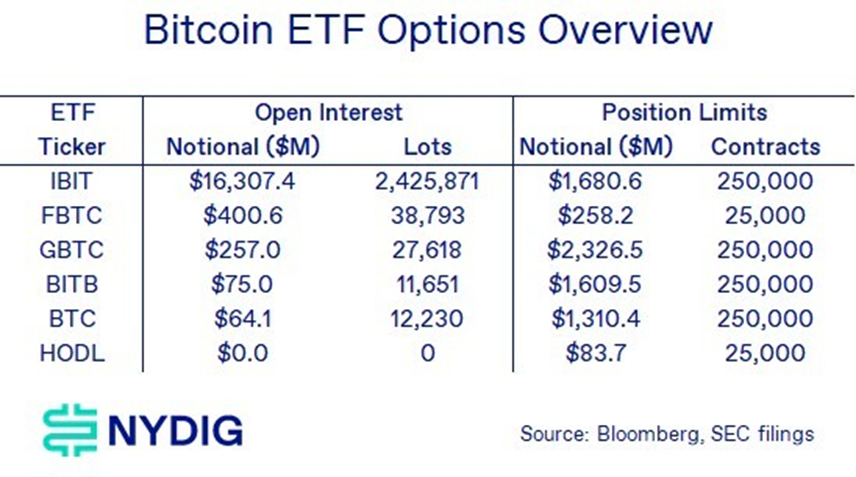

The other big change ushered in by the SEC was a change to individual position limits regarding the total number of contracts. When the SEC approved options on (some) bitcoin ETFs in November 2024, it set an initial position limit of 25,000 contracts. It has now upped that by a factor of 10x for all ETFs with options, except for FBTC.

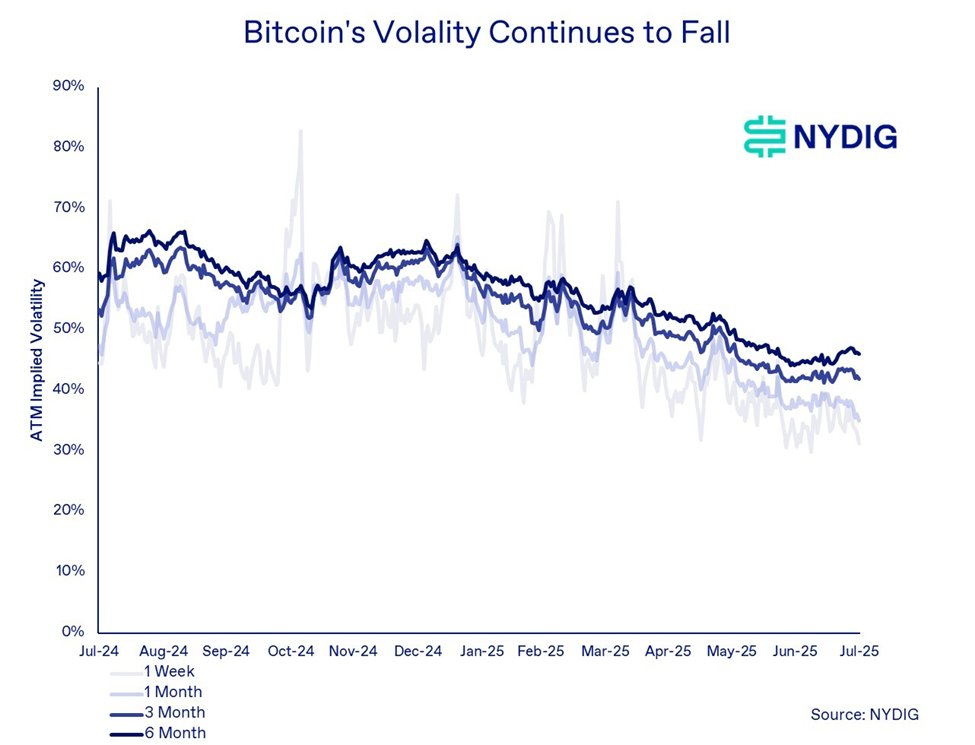

The recent increase in options position limits is likely to further suppress bitcoin’s volatility. This change enables more aggressive implementation of options strategies, like covered call selling, used to enhance returns on core positions. While bitcoin’s volatility has been in secular decline, it remains relatively attractive for volatility harvesters, especially given the broad compression of volatility across traditional asset classes.

Subscribe to our newsletter for weekly bitcoin insights and analysis that matter. Delivered directly to your inbox on Fridays. Subscribe here:

5.29K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.