市场投资人不愿重视借币鲸鱼一次借币一百万颗蓝代替你抛售。

Market investors are reluctant to pay attention to borrowing whales who borrow 1 million LAN at once to sell on your behalf.

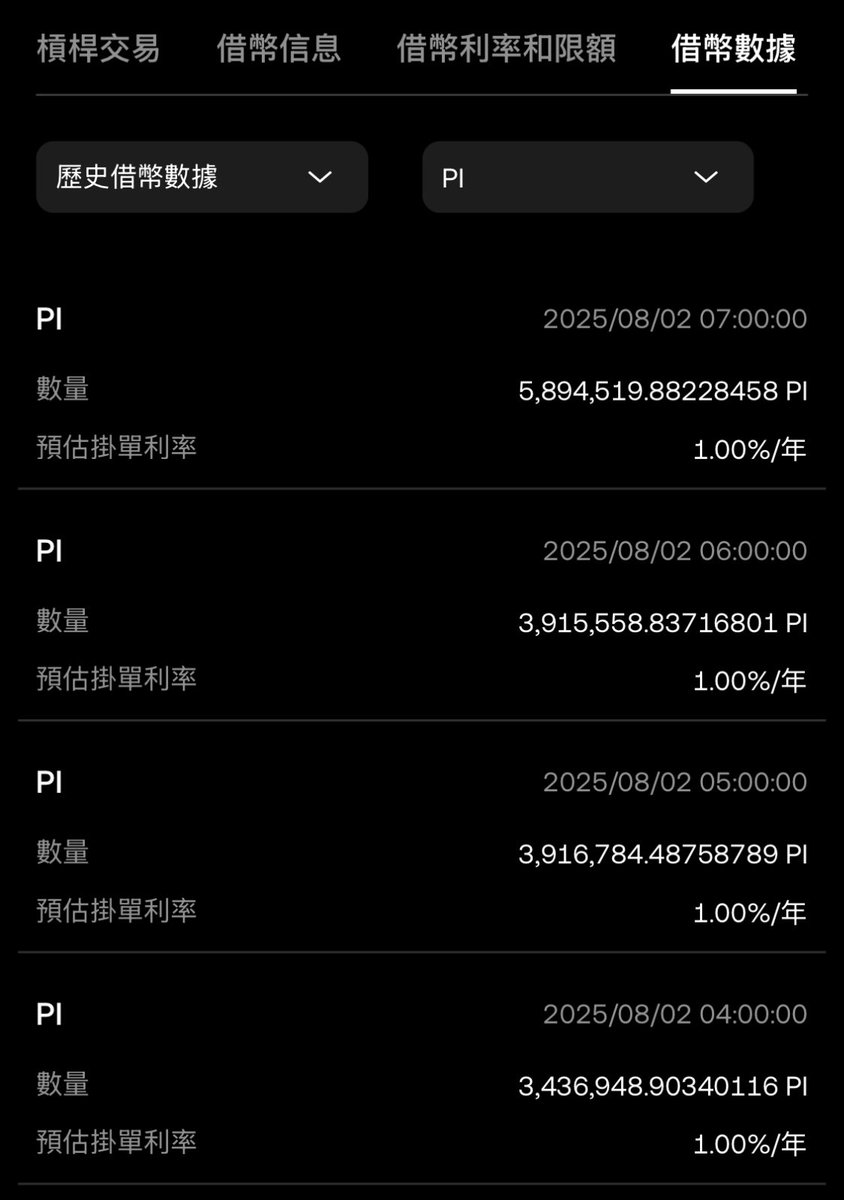

Just now, a borrowing whale seized the opportunity, borrowing 1.9 million PI from an exchange to sell on your behalf.

Yet, it’s clear the market will blame PCT for this issue again, and the bad actors will ultimately go unpunished. Because those staking on exchanges are complicit in the selling.

If community investors are unwilling to confront borrowing whales, they have no right to complain.

Should we demand that PCT ban exchanges from offering borrowing functions, and revoke their KYB status if they provide such functions?

If the community fails to consistently respond to countering whales, just wait for 0.1 to arrive.

在刚刚的借币鲸鱼逮到机会,从交易所一次借入190万颗pi来代替你抛售。

然而可知市场又会将这个问题怪罪PCT,坏人终究不会受到惩罚。 因为质押在交易所的人都是抛售的共犯。

如果社区投资人不愿采取对抗借币鲸鱼,那么就没资格抱怨。

是否应要求PCT禁止交易所提供借币功能,如果使用借币功能应下架其KYB资格。

如果小区才不长期响应对抗鲸鱼,就等着0.1的到来。

#PI

#pi

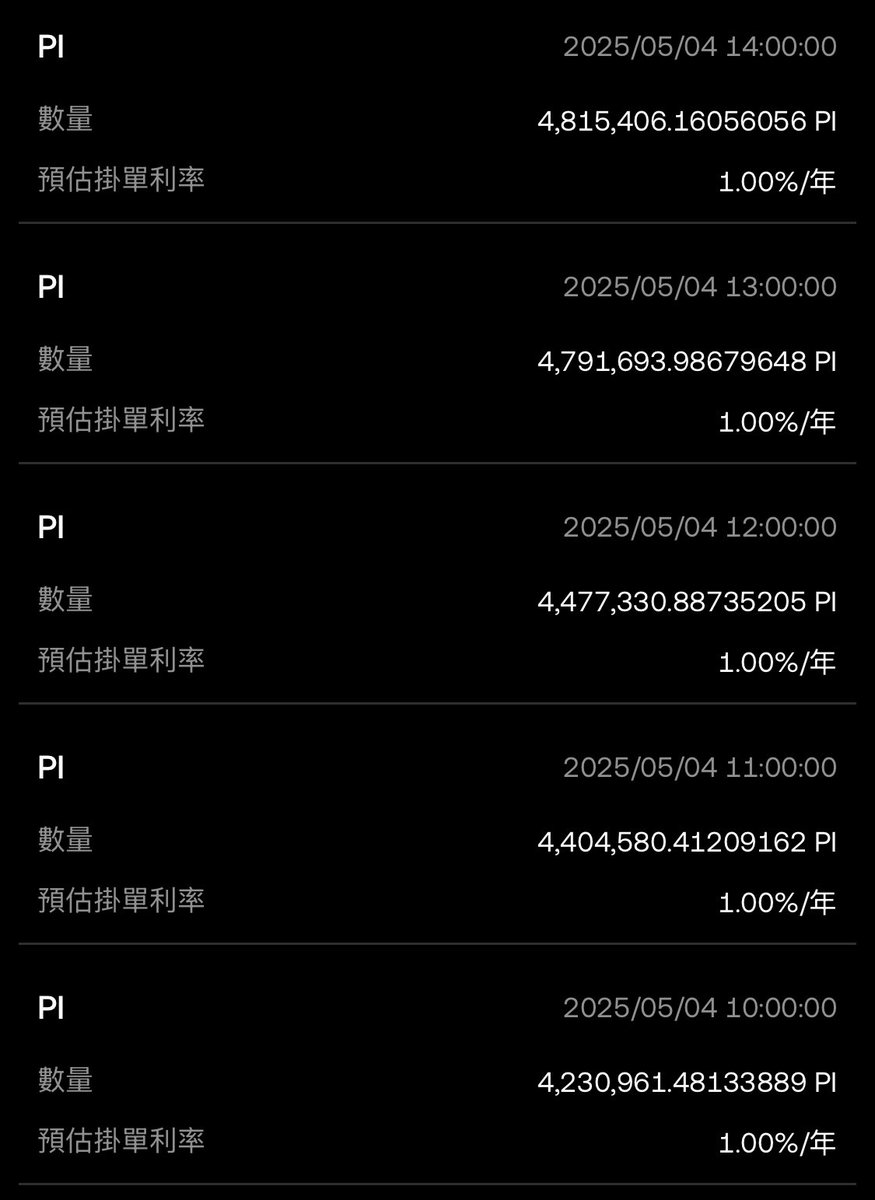

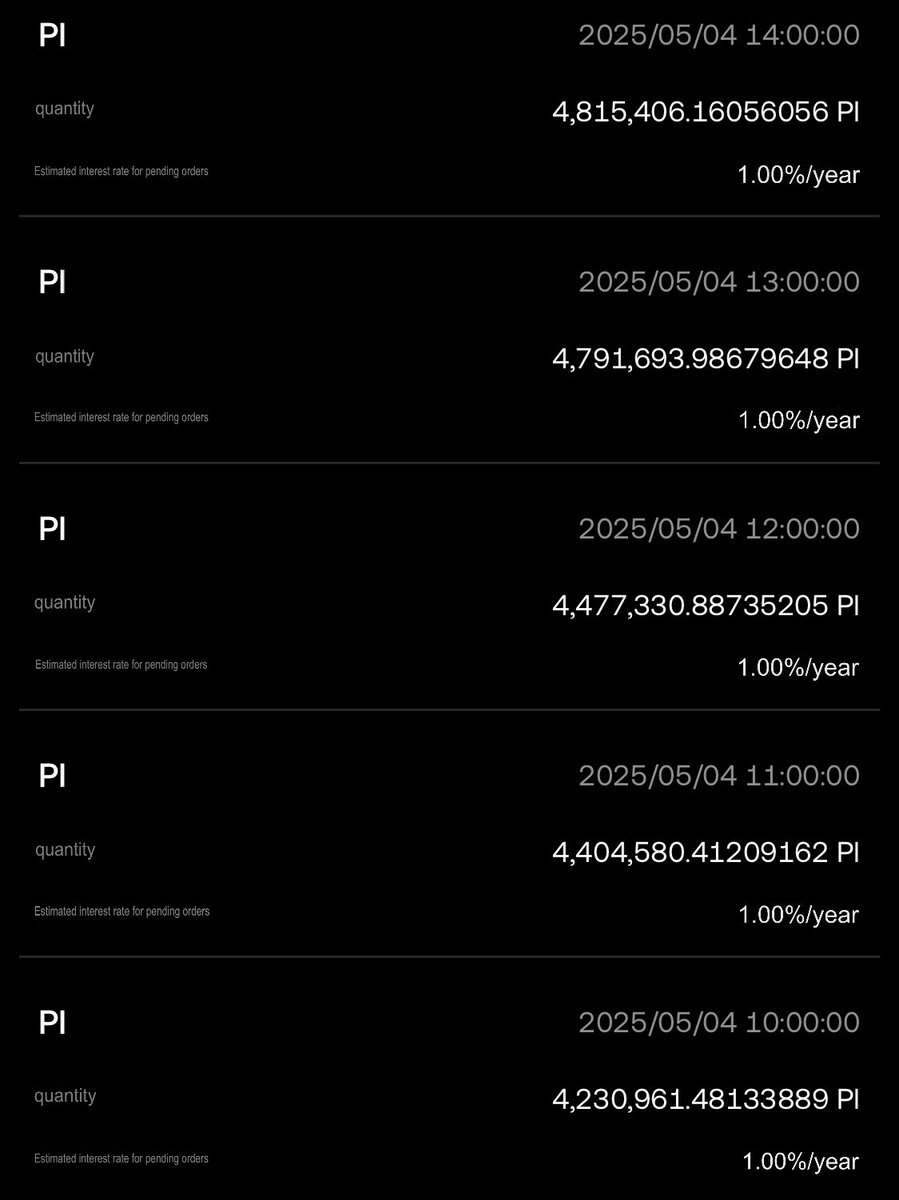

借贷pi的鲸鱼正在从借贷池一次借百万颗pi来代替你抛售。

Thank you to GCV for taking this issue seriously and actively promoting it.

Do not stake Pi on exchanges or use Yu’ebao, as whales are borrowing millions of Pi from lending pools to sell on your behalf.

You invest in Pi hoping for price increases to gain profits. However, the more you stake, the more you enable whales to suppress the price.

Many believe long-term investment means expecting the ecosystem to bear merchants’ costs indefinitely to support the price. Merchants cannot withstand long-term price losses and will eventually exit entirely, causing the ecosystem to collapse.

Like now, if Pi’s price is lower than electricity costs, miners have no reason to pay 1 yuan to the power company for 0.5 yuan worth of Pi.

Smart people know they can buy 1 Pi directly instead of halving their returns. Thus, miners will also collapse, and the ecosystem will die.

Methods to counter whales:

1. Do not stake Pi on exchanges. Do not use Yu’ebao to stake Pi.

2. Drain the exchanges’ lending pools. Convert 1% APY low returns to 34% accelerated mining rewards.

3. Whenever data shows whales borrowing and selling Pi, causing price dips, it’s an opportunity to buy low. Let’s agree to buy at low prices, pull the price up, and make the whales lose money.

感谢GCV也重视这个问题来大力宣传。

不要在交易所质押pi,也不要使用余币宝,因为鲸鱼正在从借贷池一次借百万颗pi来代替你抛售。

你看好pi而投资pi是希望价格上涨来获得收益。 然而,你质押的越多,就让鲸鱼帮你把价格压的越低。

大多人认为的投资长期,是期望生态长期消耗商家成本来替你扛着价格。 商家是无法抵抗长期价格亏损,最终会全面退出,生态会崩溃。

如同现在pi价格低于电费,那么,矿工根本不需要缴费给发电厂1元才获得0.5元的pi。

聪明人都知道直接购买pi可以获得1pi,为什么要自己减半。 因此矿工也会崩溃,最终生态会死亡。

对抗鲸鱼的方法:

1.不要在交易所质押pi。 不要使用余币宝质押pi。

2.清空交易所的借币池。 1%apy的低收益转为选择34%挖矿增速。

3.每当从数据上看见鲸鱼借贷pi并且抛售而产生价格下冲时,这是低价买进的机会。 让我们共识低价购买,拉起价格,让鲸鱼亏钱。

#pi

你们爆仓的金额,是借币鲸鱼全部给你拿走的。 而你们还在骂PCT。

借币鲸鱼拍拍屁股跟你说谢谢,然后谢谢交易所提供借币功能让你们爆仓。

借币鲸鱼总共借了五百万颗抛售,这些都是投资人喜欢质押赚点小利息的结果。

质押的投资人,全都是砸盘的共犯,然后还在怪罪PCT。

7.67万

33

本页面内容由第三方提供。除非另有说明,欧易不是所引用文章的作者,也不对此类材料主张任何版权。该内容仅供参考,并不代表欧易观点,不作为任何形式的认可,也不应被视为投资建议或购买或出售数字资产的招揽。在使用生成式人工智能提供摘要或其他信息的情况下,此类人工智能生成的内容可能不准确或不一致。请阅读链接文章,了解更多详情和信息。欧易不对第三方网站上的内容负责。包含稳定币、NFTs 等在内的数字资产涉及较高程度的风险,其价值可能会产生较大波动。请根据自身财务状况,仔细考虑交易或持有数字资产是否适合您。