This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

STRD

STRIDE price

6Y7krD...3G7r

$0.00014825

+$0.00011948

(+415.23%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about STRD today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

STRD market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$148.25K

Network

Solana

Circulating supply

999,997,119 STRD

Token holders

222

Liquidity

$144.03K

1h volume

$6.70M

4h volume

$6.70M

24h volume

$6.70M

STRIDE Feed

The following content is sourced from .

Strategy’s foray into preferred stock: financial innovation or a giant Ponzi?

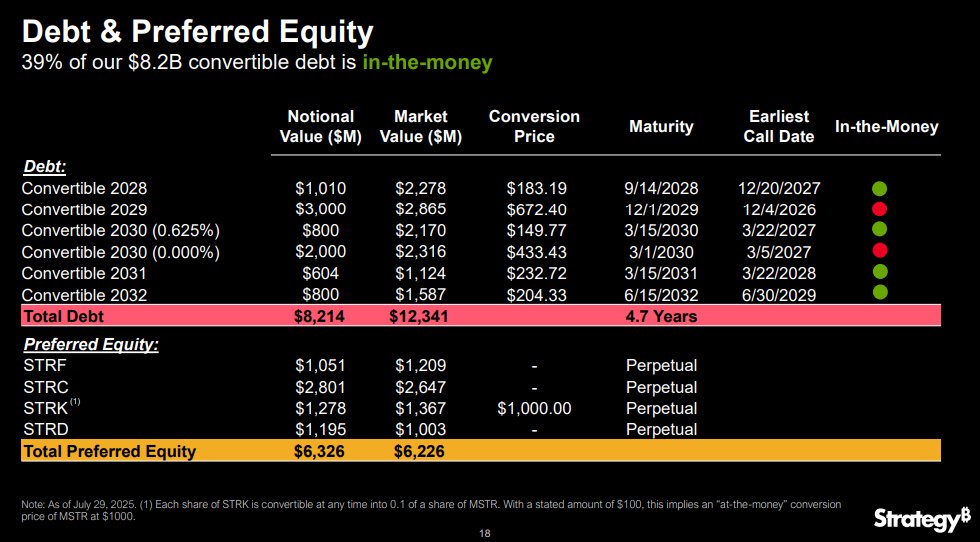

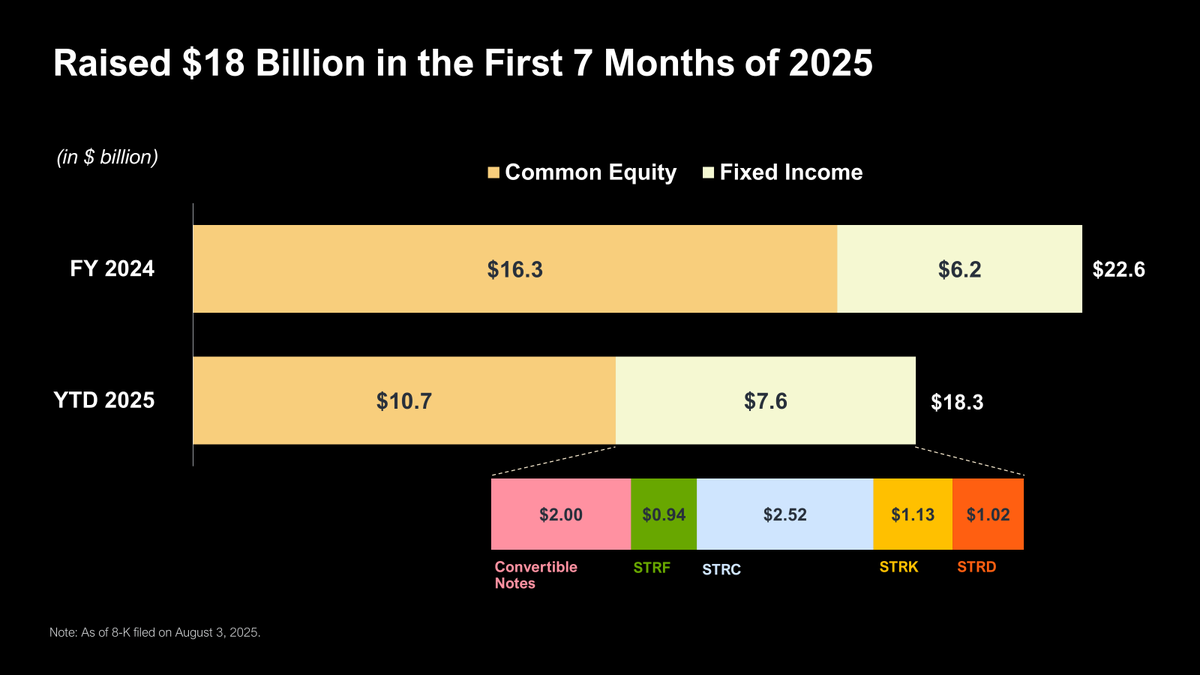

- In addition to convertible debts (which carry an extremely low average interest rate of 0.421%), Strategy has recently issued a large amount of preferred shares (STRF, STRC, STRK, STRD) with dividends/interest obligations, bringing its annual payout burden to $614M.

- Through these dividend-paying preferred shares, Strategy aims to diversify its funding sources and tap into the income product market, competing with money market funds and high-yield bonds. Investors receive higher yields compared to deposits or Treasuries while also gaining exposure to Bitcoin/Strategy. STRC was especially successful, raising $2.5B, five times more than expected.

- While diversification and entry into the income market are positive, the surge in dividend obligations is a heavy burden. Interest expenses from convertibles were only $35M annually, but with the new preferreds, total payout obligations have soared to $614M — 17.5x higher. Notably, Strategy generates no meaningful cash flow from its core operations.

- So how does a company with no operating cash flow cover these payments? By issuing more stock. In other words, part of the proceeds from common stock sales is used to cover interest/dividend obligations.

- So who is actually buying Strategy’s stock? A major source of demand comes from gamma traders — those who sell Strategy call options and hedge by buying the underlying shares. These traders don’t care about Bitcoin or Strategy’s fundamentals; they simply profit as long as the stock’s volatility remains high. Conversely, if Strategy’s stock volatility declines, option activity diminishes, and the gamma-driven demand for Strategy shares also weakens.

- Strategy’s preferred share issuance is therefore a bold gamble. If it succeeds, it could disrupt multi trillion-dollars income product market and attract massive capital inflows. But currently, it lacks sufficient trust and liquidity. At this stage, traditional high-yield bonds still offer a better risk/reward profile than Strategy’s preferred shares imo.

- Strategy could fall into a death spiral, with a probability of perhaps 20–30%, triggered by risks such as: 1) Bitcoin price decline; 2) Decline in MSTR stock volatility and reduced gamma trading demand; 3) mNAV compression; 4) The $3B 2029 convertible bond coming due when MSTR stock is below $672.4 (currently $375); 5) Credit market stress and poor demand for preferred shares; 6) A major hack

- Whether Strategy will be remembered as a financial innovation or a giant Ponzi remains uncertain. The same goes for the broader “crypto treasury” bubble currently in vogue — no one knows when it will burst. What seems clear (at least from common sense) is that companies with no sustainable cash flow (including PoS-based “treasury” firms that rely only on token sales) are unlikely to sustain such leverage and financial engineering for long.

Strategy often promotes the idea of “Intelligent leverage.” But while there may be such a thing as intelligent but risky leverage, there is no such thing as intelligent and safe leverage. Financial history suggests that insufficiently regulated derivatives and leverage inevitably lead to destructive collapses.

42% of $MSTR capital deployed in 2025 is debt. $7.6B out of $18.2B total.

That is the LEVERAGE in a Leveraged Bitcoin Equity, and is the arbitrage available to LBEs that are able to achieve scale.

Failing to attack fixed income markets in size means eventual irrelevance to the Speculative Attack that LBEs represent.

STRD price performance in USD

The current price of stride is $0.00014825. Over the last 24 hours, stride has increased by +415.23%. It currently has a circulating supply of 999,997,119 STRD and a maximum supply of 999,997,119 STRD, giving it a fully diluted market cap of $148.25K. The stride/USD price is updated in real-time.

5m

-19.55%

1h

+415.23%

4h

+415.23%

24h

+415.23%

About STRIDE (STRD)

STRD FAQ

What’s the current price of STRIDE?

The current price of 1 STRD is $0.00014825, experiencing a +415.23% change in the past 24 hours.

Can I buy STRD on OKX?

No, currently STRD is unavailable on OKX. To stay updated on when STRD becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of STRD fluctuate?

The price of STRD fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 STRIDE worth today?

Currently, one STRIDE is worth $0.00014825. For answers and insight into STRIDE's price action, you're in the right place. Explore the latest STRIDE charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as STRIDE, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as STRIDE have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials