This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

LDO

Lido DAO Token price

0x5a98...1b32

$0.68964

-$0.13019

(-15.88%)

Price change for the last 24 hours

How are you feeling about LDO today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

LDO market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$689.64M

Network

Ethereum

Circulating supply

1,000,000,000 LDO

Token holders

52113

Liquidity

$5.56M

1h volume

$51,924.84

4h volume

$502,905.71

24h volume

$2.10M

Lido DAO Token Feed

The following content is sourced from .

丰密KuiGas🔆

It's a bit hanging, and you can pick up your hair when you say a word

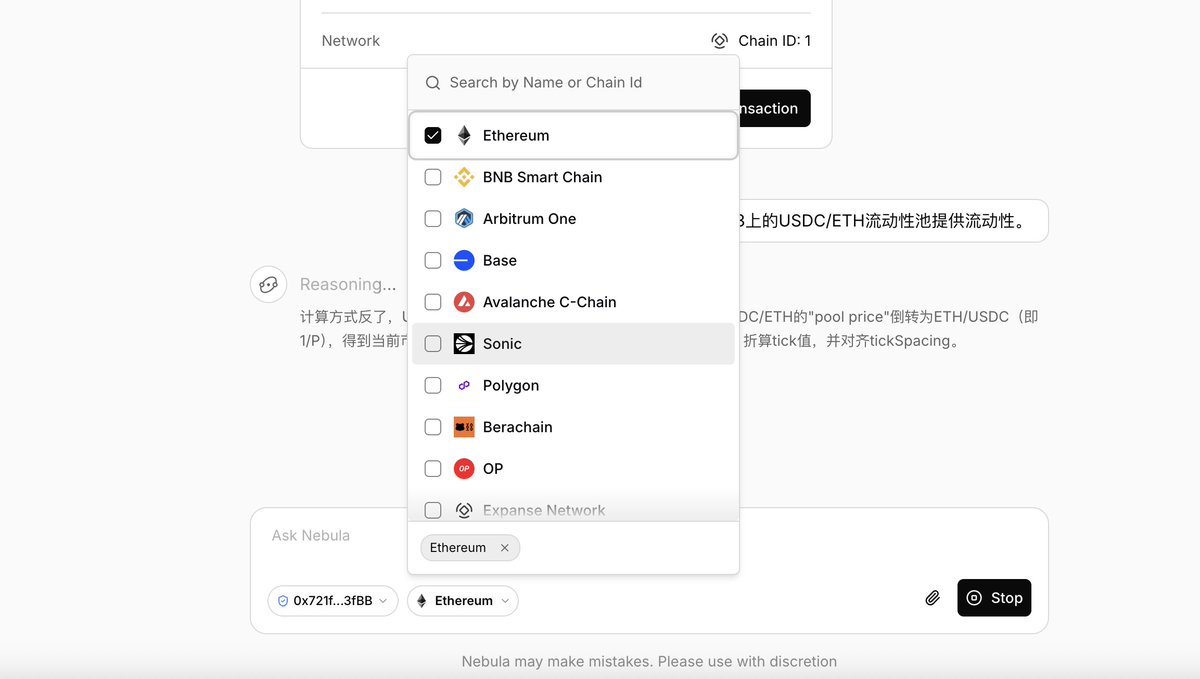

Thirdweb launches Nebula v0.1, a DeFi Ai product, with the core of simplifying complex on-chain financial operations into "natural language conversational interactions".

Meaning: Use spoken instructions to help you operate DeFi protocols, such as currency swaps, lending, market making, and asset management, without the need to manually click back and forth.

Make complex on-chain financial operations as easy as chatting with ChatGPT.

Use:

✅ Arbitrary chain asset swaps and bridges

> cross-chain bridging + token swaps

> example is the phrase: "Swap my 100 USDC on Ethereum for ETH on Optimism" to perform a cross-chain operation.

✅ Intelligent operation of lending protocols

> has built-in support for 50+ DeFi protocols, such as: Uniswap, Aave, Compound, Curve, Balancer, Lido, etc.

> can directly operate with words, such as: "Lend my WETH to Aave and stake USDC"

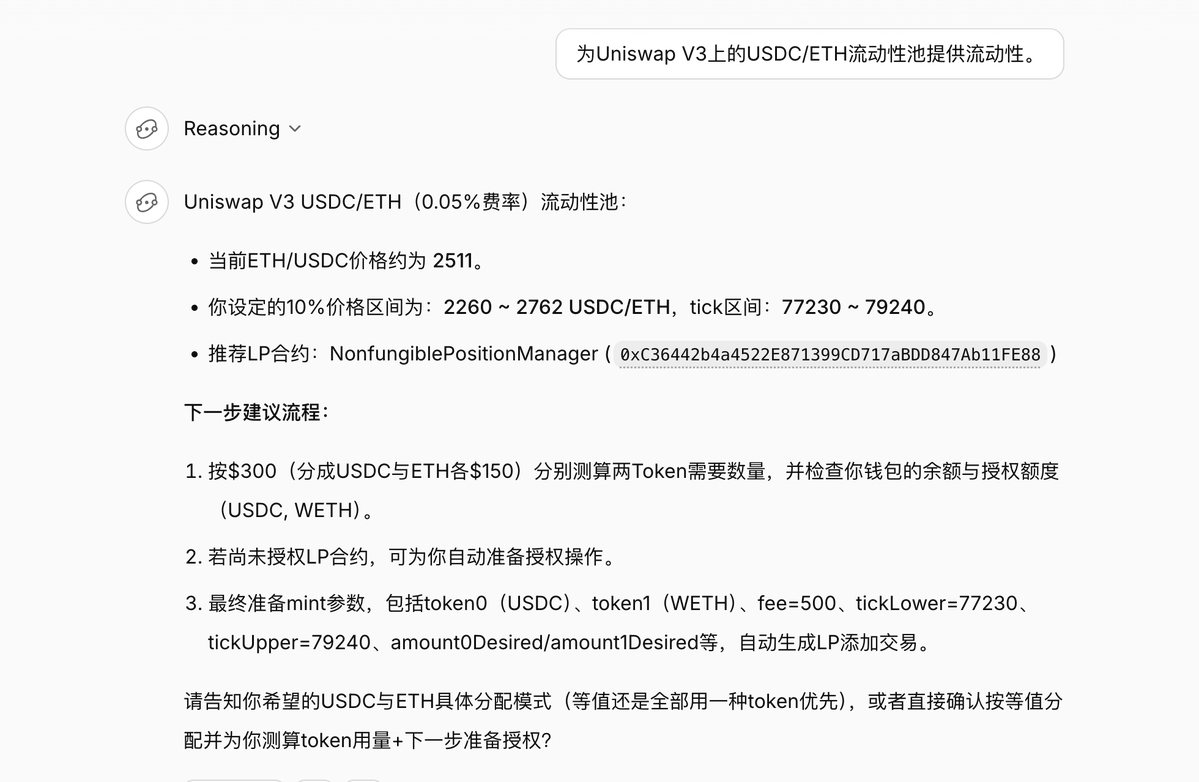

✅ Intelligently manage liquidity positions

> you could say: providing liquidity for the USDC/ETH liquidity pool on Uniswap V3.

> it automatically finds the best parameters, authorizes the token, sets the range, and submits the transaction.

✅ Perform complex operations in one sentence:

"Check my aUSDC balance" → to check the balance of borrowed and borrowed assets

"Collect fees" → collect all LP revenues

"Remove my position" → to undo all liquidity

"Burn my unused NFTs" → clean up your wallet of useless NFTs

I don't know much about code personally, but it's interesting to take a look at it, and a few highlights below 👇

1. Support full-chain support: L1 + L2 network full coverage

2. AI intelligent understanding + execution of transactions: There is no longer a need to open multiple DApps, calculate slippage, process authorization, sign and other cumbersome steps

3. Suitable for beginners and veterans: new users can easily complete complex operations, and experts can execute strategies more efficiently.

Thirdweb @thirdweb is a Web3 development platform, in fact, Thirdweb has always been a very well-known platform for deploying tokens and NFTs. I've been tracking me for a long time.

The project was @HaunVentures by @katie_haun-led Haun Ventures, the queen of crypto, who was once the general partner of the famous a16z.

Practical operation:

Open it

1. Find a network with low gas, L2 that has not issued coins, such as BASE and Linea

2. Connect the wallet and try a small amount.

3. A few blind instructions, operated by Thirdweb Nebula. This is Defi Ai

If you lose a bit of gas @kuigas, that's normal. If you lose some money, that's normal

thirdweb

LAUNCH 🚀

AI for Defi.

◆ Swap/bridge any token on any chain

◆ Use 50+ lending protocols on L1s and L2s

◆ Create, manage and earn rewards from liquidity positions

Manage your money with natural language.

24.55K

19

Nick Sawinyh 🧘♂️ reposted

Devansh Mehta

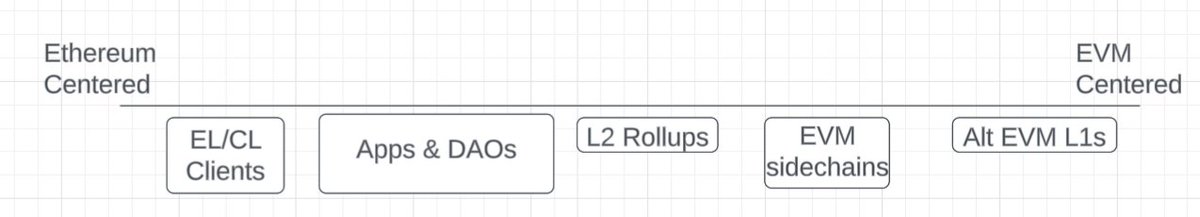

ive been thinking recently on the difference between being EVM aligned vs Ethereum aligned

why does the distinction matter?

if we want the ecosystem to solve its public goods challenge, projects should pay for the software that THEY depend on

> Asking an alt L1 like Avalanche to pay for ethereum centered goods like clients is a non starter

but would they give money to the solidity team?

Maybe, since they are evm equivalent & AVAX app developers use solidity for their smart contracts

> what is the value of side chains like Polygon that use their own validators (but still settle on Ethereum) vs inherit ETH security directly like an L2?

(i) UI value: ethereum wallets can access their apps, and

(ii) option value: if an app decides the chain is not for them, it's much easier to switch to another L2 or ETH L1 than to solana

so expanding EVM network effects is good for Ethereum, but its not inevitable that ethereum wins if EVM wins

> Unlike sidechains, L2 rollups directly use ETH validators for security and consume blockspace

a common worry is rollups becoming big and bootstrapping their own validator network to reduce reliance on ethereum

i think such worries are overblown as unbundling is the trend (like cloud) and most L2s are more focused on use cases than having their own security

even if it happens, its hard for them to escape the EVM which still bring the benefits (i) and (ii)

> Apps and DAOs with an onchain treasury have a lot more stickiness

one of Ethereums biggest strengths is emerging from the wealth effect when ETH went up in 2021 with foundational projects like Gnosis, ENS, Kleros and Golem with decades of runway to achieve their goal

along with newer ones like Arbitrum, Aave, Uniswap, Lido that have PMF and strong revenue streams

If we contrast with solana which had their wealth effect more recently, ethereum has more foundational projects, are more onchain and also apply to broader use cases

> finally we have the EL/CL clients & validators that make ethereum function and produce blocks

they rise and fall with ethereums ship but lack a connection with other parts of the ethereumverse that can assure their longevity

there is a win-win way to connect these threads, from the alt EVM L1s to the core ethereum clients. We just gotta figure out how

10.32K

0

LDO price performance in USD

The current price of lido-dao-token is $0.68964. Over the last 24 hours, lido-dao-token has decreased by -15.88%. It currently has a circulating supply of 1,000,000,000 LDO and a maximum supply of 1,000,000,000 LDO, giving it a fully diluted market cap of $689.64M. The lido-dao-token/USD price is updated in real-time.

5m

+0.00%

1h

+0.24%

4h

-3.20%

24h

-15.88%

About Lido DAO Token (LDO)

LDO FAQ

What’s the current price of Lido DAO Token?

The current price of 1 LDO is $0.68964, experiencing a -15.88% change in the past 24 hours.

Can I buy LDO on OKX?

No, currently LDO is unavailable on OKX. To stay updated on when LDO becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of LDO fluctuate?

The price of LDO fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Lido DAO Token worth today?

Currently, one Lido DAO Token is worth $0.68964. For answers and insight into Lido DAO Token's price action, you're in the right place. Explore the latest Lido DAO Token charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Lido DAO Token, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Lido DAO Token have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.