OKX + Autowhale: A Powerful Institutional Partnership for Europe

OKX Institutional has partnered with Autowhale to integrate our market leading MiCA-regulated exchange with Autowhale’s advanced digital asset trading infrastructure.

Autowhale offers a holistic solution that combines high-speed trade execution, real-time portfolio management, and advanced algorithmic trading tools—designed to support institutions in deploying and managing custom trading strategies. Autowhale provides a singular, ready-to-use infrastructure product that integrates:

Execution System: Engineered for precision and speed.

Portfolio Management System: Comprehensive tools for real-time portfolio oversight and optimization.

Algo Trading Infrastructure: A robust framework for deploying and managing diverse trading strategies

This partnership provides a comprehensive, compliant solution for institutions within the EEA to enter digital asset markets with confidence:

Regulated: OKX’s MiCA license ensures compliant, secure access across the EEA,

to all 30 EEA member states. This significantly de-risks institutional participation, ensuring compliance with the highest European standards.

Best Execution: Autowhale's advanced execution algorithms now route directly to OKX's order books for deep liquidity enabling superior price discovery and best execution for even the largest institutional trades.

Comprehensive solution: From strategy deployment to custody and reporting the partnership offers a comprehensive solution.

Institutional-Grade Security & Compliance: A fully regulated and secure framework that meets the highest standards required by large corporations, mitigating operational and regulatory risks.

Expanded Opportunities: Institutions can confidently explore a broader range of digital asset strategies, from hedging and yield generation to proprietary trading, knowing they are operating within a robust and regulated environment.

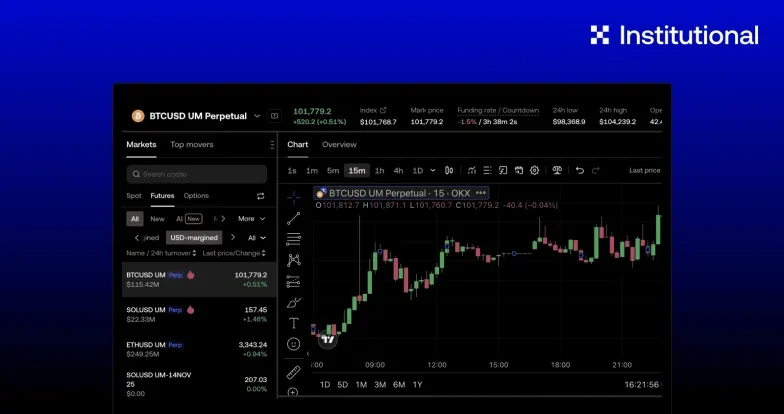

Seamless Integration: Access to complex crypto markets is streamlined through the Autowhale Terminal reducing operational overhead and facilitating integration with existing financial workflows.

What’s next

We’re continuing to invest in integrations with crypto-native and traditional order management and execution systems (OEMS) to help more market participants seamlessly connect their existing workflow to digital asset markets.

Contact the OKX institutional team to see how we can support your business.