The stablecoin market has skyrocketed to $267b , doubling in just a year. Talk about rapid mainstream adoption!

With game-changing moves like the GENIUS Act and insights from the USA's Project Crypto, now's the time to let your stablecoins do the heavy lifting as this sector takes off.

I've dropped 3 threads on yield-bearing stablecoins, with juicy yields as usual. Missed them?

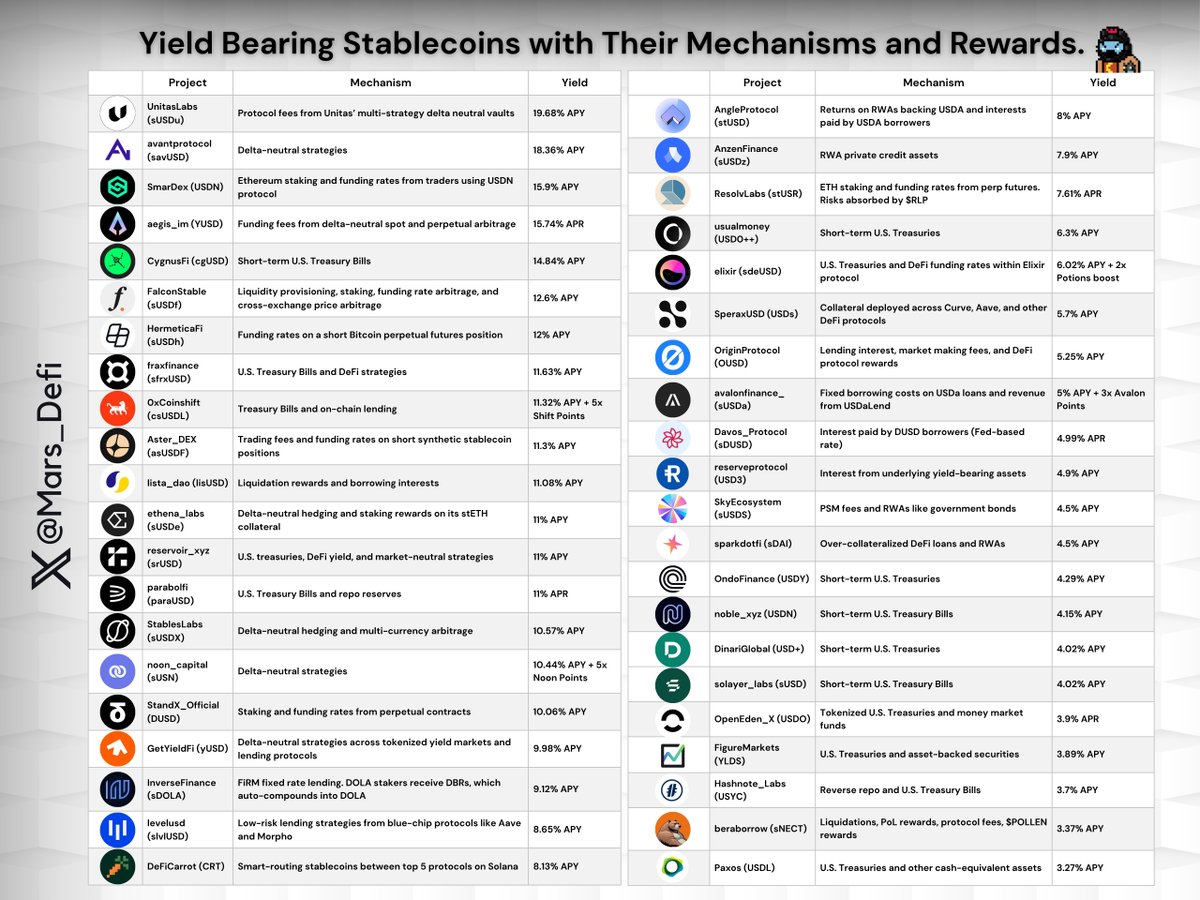

Here's a quick summary of all the stables I covered.

You can also use the infographics as a guide.

_____________

✦ @UnitasLabs (sUSDu)

⇒ Mechanism ➝ Protocol fees from Unitas’ multi-strategy delta neutral vaults

⇒ Yield ➝ 19.68% APY

✦ @avantprotocol (savUSD)

⇒ Mechanism ➝ Delta-neutral strategies

⇒ Yield ➝ 18.36% APY

✦ @SmarDex (USDN)

⇒ Mechanism ➝ Ethereum staking and funding rates from traders using USDN protocol

⇒ Yield ➝ 15.9% APY

✦ @aegis_im (YUSD)

⇒ Mechanism ➝ Funding fees from delta-neutral spot and perpetual arbitrage

⇒ Yield ➝ 15.74% APR

✦ @CygnusFi (cgUSD)

⇒ Mechanism ➝ Short-term U.S. Treasury Bills

⇒ Yield ➝ 14.84% APY

✦ @FalconStable (sUSDf)

⇒ Mechanism ➝ Liquidity provisioning, staking, funding rate arbitrage, and cross-exchange price arbitrage

⇒ Yield ➝ 12.6% APY

✦ @HermeticaFi (sUSDh)

⇒ Mechanism ➝ Funding rates on a short Bitcoin perpetual futures position

⇒ Yield ➝ 12% APY

✦ @fraxfinance (sfrxUSD)

⇒ Mechanism ➝ U.S. Treasury Bills and DeFi strategies (staked frxUSD is dynamically allocated to the highest yield source to generate yield)

⇒ Yield ➝ 11.63% APY

@0xCoinshift (csUSDL)

⇒ Mechanism ➝ Treasury Bills and on-chain lending

⇒ Yield ➝ 11.32% APY + 5x Shift Points

✦ @Aster_DEX (asUSDF)

⇒ Mechanism ➝ Trading fees and funding rates on short synthetic stablecoin positions

⇒ Yield ➝ 11.3% APY

✦ @lista_dao (lisUSD)

⇒ Mechanism ➝ Liquidation rewards and borrowing interests

⇒ Yield ➝ 11.08% APY

✦ @ethena_labs (sUSDe)

⇒ Mechanism ➝ Delta-neutral hedging and staking rewards on its stETH collateral

⇒ Yield ➝ 11% APY

✦ @reservoir_xyz (srUSD)

⇒ Mechanism ➝ U.S. treasuries, DeFi yield, and market-neutral strategies

⇒ Yield ➝ 11% APY

✦ @parabolfi (paraUSD)

⇒ Mechanism ➝ U.S. Treasury Bills and repo reserves

⇒ Yield ➝ 11% APR

✦ @StablesLabs (sUSDX)

⇒ Mechanism ➝ Delta-neutral hedging and multi-currebcy arbitrage

⇒ Yield ➝ 10.57% APY

✦ @noon_capital (sUSN)

⇒ Mechanism ➝ Delta-neutral strategies

⇒ Yield ➝ 10.44% APY + 5x Noon Points multiplier

✦ @StandX_Official (DUSD)

⇒ Mechanism ➝ Staking and funding rates from perpetual contracts

⇒ Yield ➝ 10.06% APY

✦ @GetYieldFi (yUSD)

⇒ Mechanism ➝ Delta-neutral strategies across tokenized yield markets and lending protocols

⇒ Yield ➝ 9.98% APY

✦ @InverseFinance (sDOLA)

⇒ Mechanism ➝ FiRM fixed rate lending. DOLA stakers receive DBRs, which auto-compounds into DOLA

⇒ Yield ➝ 9.12% APY

✦ @levelusd (slvlUSD)

⇒ Mechanism ➝ Low-risk lending strategies from blue-chip protocols like Aave and Morpho

⇒ Yield ➝ 8.65% APY

✦ @DeFiCarrot (CRT)

⇒ Mechanism ➝ Automated optimization vault that smart-routes deposited stablecoins between the top 5 protocols on Solana

⇒ Yield ➝ 8.13% APY

✦ @AngleProtocol (stUSD)

⇒ Mechanism ➝ Returns on the RWAs backing USDA and interests paid by USDA borrowers

⇒ Yield ➝ 8% APY

✦ @AnzenFinance (sUSDz)

⇒ Mechanism ➝ RWA private credit assets

⇒ Yield ➝ 7.9% APY

✦ @ResolvLabs (stUSR)

⇒ Mechanism ➝ Ethereum staking and funding rates from perp futures position. Risks are absorbed by Resolv’s liquid token, $RLP

⇒ Yield ➝ 7.61% APR

✦ @usualmoney (USD0++)

⇒ Mechanism ➝ Short-term U.S. Treasuries

⇒ Yield ➝ 6.3% APY

✦ @elixir (sdeUSD)

⇒ Mechanism ➝ U.S. Treasuries and funding rates from DeFi activities within Elixir protocol.

⇒ Yield ➝ 6.02% APY + 2x Potions boost

✦ @SperaxUSD (USDs)

⇒ Mechanism ➝ Deploying collateral across DeFi protocols like Curve Finance and Aave

⇒ Yield ➝ 5.7% APY

✦ @OriginProtocol (OUSD)

⇒ Mechanism ➝ Interests from lending, fees from market making, and protocol rewards from DeFi strategies

⇒ Yield ➝ 5.25% APY

✦ @avalonfinance_ (sUSDa)

⇒ Mechanism ➝ Fixed borrowing costs on USDa loans and revenue from USDaLend

⇒ Yield ➝ 5% APY + 3x Avalon Points

✦ @Davos_Protocol (sDUSD)

⇒ Mechanism ➝ Interests paid by those borrowing DUSD (based on the Federal Reserve’s borrowing interest rate)

⇒ Yield ➝ 4.99% APR

✦ @reserveprotocol (USD3)

⇒ Mechanism ➝ Interests from its underlying yield-bearing assets

⇒ Yield ➝ 4.9% APY

✦ @SkyEcosystem (sUSDS)

⇒ Mechanism ➝ Fees from its Protocol-Owned Stability Mechanism (PSM) and RWAs like government bonds

⇒ Yield ➝ 4.5% APY

✦ @sparkdotfi (sDAI)

⇒ Mechanism ➝ Over-collateralized DeFi loans and RWAs

⇒ Yield ➝ 4.5% APY

✦ @OndoFinance (USDY)

⇒ Mechanism ➝ Short-term U.S. Treasuries

⇒ Yield ➝ 4.29% APY

✦ @noble_xyz (USDN)

⇒ Mechanism ➝ Short-term U.S. Treasury Bills

⇒ Yield ➝ 4.15% APY

✦ @DinariGlobal (USD+)

⇒ Mechanism ➝ Short-term U.S. Treasuries

⇒ Yield ➝ 4.02% APY

✦ @solayer_labs (sUSD)

⇒ Mechanism ➝ Short-term U.S. Treasury Bills

⇒ Yield ➝ 4.02% APY

✦ @OpenEden_X (USDO)

⇒ Mechanism ➝ Tokenized U.S. Treasury bills and money market funds.

⇒ Yield ➝ 3.9% APR

✦ @FigureMarkets (YLDS)

⇒ Mechanism ➝ Short-term U.S. Treasuries and asset-backed securities

⇒ Yield ➝ 3.89% APY

✦ @Hashnote_Labs (USYC)

⇒ Mechanism ➝ Reverse repo and U.S. Treasury Bills

⇒ Yield ➝ 3.7% APY

✦ @beraborrow (sNECT)

⇒ Mechanism ➝ Liquidations, PoL rewards, protocol fees, and $POLLEN rewards

⇒ Yield ➝ 3.37% APY

✦ @Paxos (USDL)

⇒ Mechanism ➝ Short-term U.S. Treasuries and other cash equivalent assets

⇒ Yield ➝ 3.27% APY.

Yield-bearing stablecoins are definitely one of the best plays this cycle. Low risk, high yield? Sounds like the perfect yield farming recipe.

To dive into the threads properly ;

For more contents like this, i am tagging some solid DeFi chads.

@stacy_muur

@ahboyash

@Flowslikeosmo

@phtevenstrong

@zerototom

@Degenerate_DeFi

@arndxt_xo

@eli5_defi

@0xAndrewMoh

@Moomsxxx

@0xCheeezzyyyy

@Hercules_Defi

@TheDeFinvestor

@thedefiedge

@TheDeFiPlug

@twindoges

@the_smart_ape

@0xDefiLeo

@splinter0n

@Haylesdefi

@defi_mago

@Defi_Warhol

@Tanaka_L2

@thelearningpill

@poopmandefi

@kenodnb

@CryptoShiro_

@CryptoGideon_

@Louround_

@crypthoem

@YashasEdu

@Eugene_Bulltime

@TheDeFISaint

@wacy_time1

8.51K

94

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.