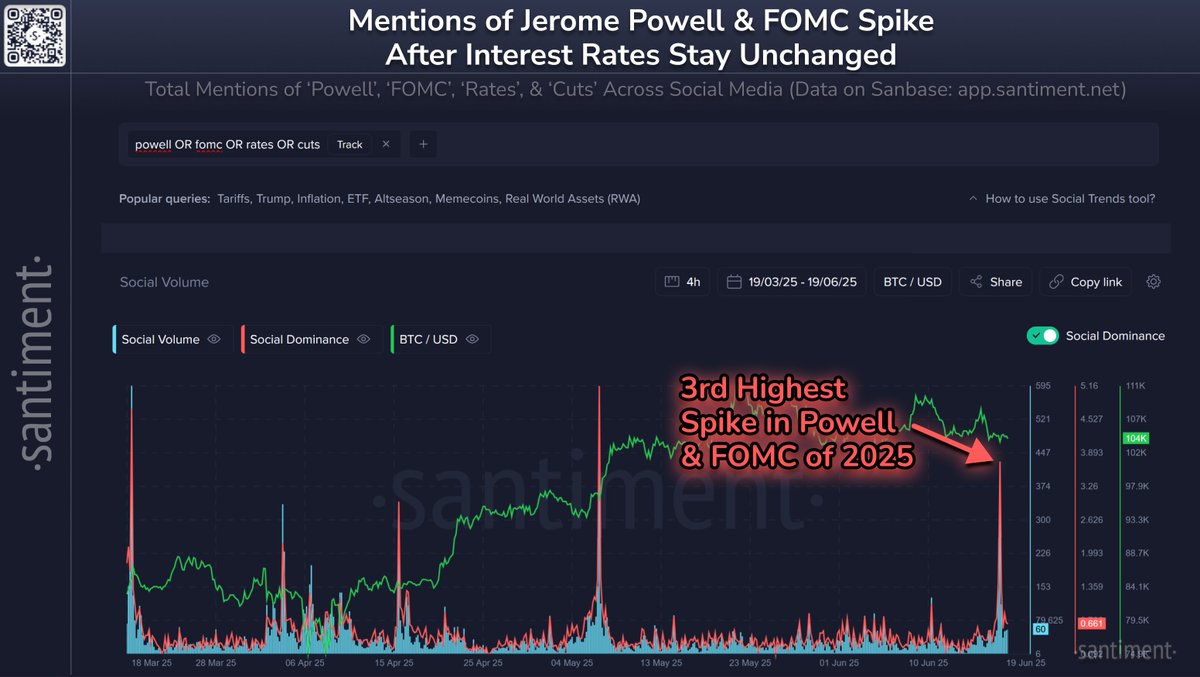

🇺🇸🏦 With Trump expressing his disappointment in Jerome Powell & the FOMC leaving interest rates unchanged, social media has erupted with discussions. Crypto, like global stock markets, stand to benefit if and when rate cuts happen again.

Currently, Bitcoin is -6.8% below its May 22nd all-time high. And the S&P 500 is -2.6% below its February 19th all-time high. Expect for the Trump administration and the Fed to continue to clash over the future direction of monetary policy.

Trump is likely to pressure Powell and the Federal Reserve to lower rates in an effort to stimulate markets and bolster economic sentiment. Powell, however, may continue resisting political influence, arguing for a more cautious approach based on inflation data and long-term economic stability.

4

2.37K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.