This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

UST

Unstable Tesla price

6wPt8R...dmtB

$0.0010529

+$0.00074240

(+239.07%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about UST today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

UST market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$105.29K

Network

Solana

Circulating supply

99,999,996 UST

Token holders

213

Liquidity

$120.99K

1h volume

$4.77M

4h volume

$4.77M

24h volume

$4.77M

Unstable Tesla Feed

The following content is sourced from .

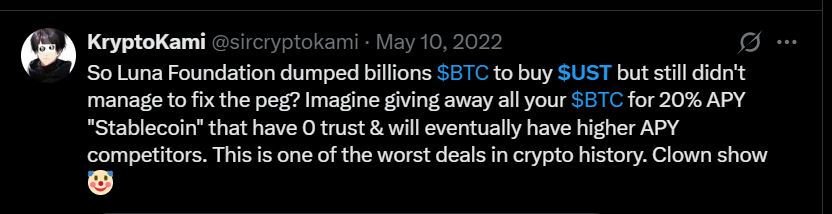

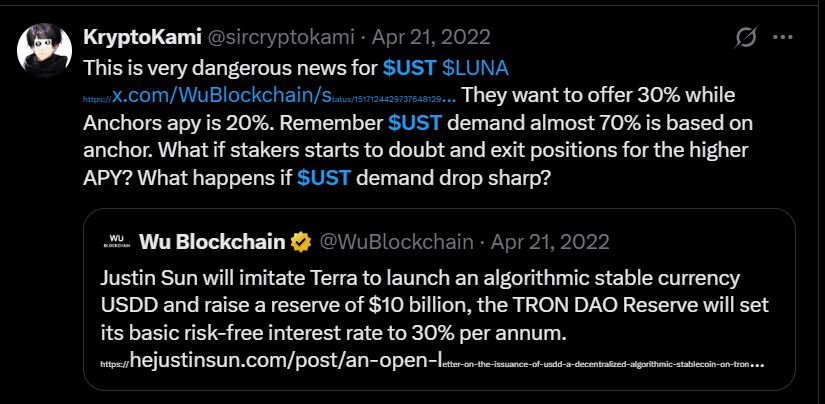

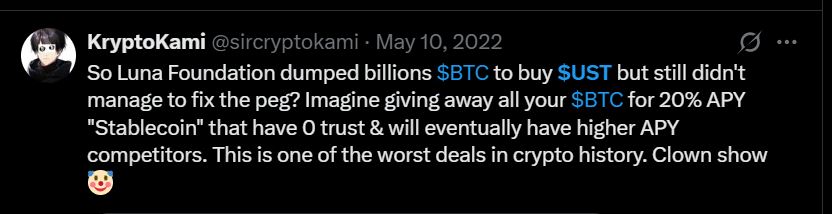

Do Kwon has pleaded guilty as part of a plea deal.

Apparently the plea deal limited his jail time to a maximum of 12 years but the judge can still overrule that and give him more?

Seeing this news made me go back and watch part of the @UpOnlyTV episode where @MartinShkreli tells Do Kwon that jail isn't so bad.

Also remember when Do said that Terra Labs would own more bitcoin than Satoshi?

📈 Major Headlines:

• Bullish to debut on NYSE (BLSH) Aug 13: 30M shares @ $32–33, aiming for $990M raise & $4.8B valuation. Backed by Blackstone & ARK Invest.

• $WLFI seeks $1.5B for a listed entity merging token governance & corporate structure.

• Ripple gets unprecedented SEC Reg D exemption to sell XRP securities privately, sparking legal debates.

• Do Kwon mulls guilty plea in $40B #TerraUSD collapse case.

• Stripe x Paradigm 💳 teaming up to build Tempo, a payments-focused L1 blockchain.

Real-time, AI-powered market insights, only with SWFTGPT!

📲 Listen now:

股票代币化全景图:从实股托管到衍生品化,如何打通最后一公里?

撰文:imToken

股票代币化,正在成为 2025 年 TradFi 与 Web3 融合的最佳叙事。

rwa.xyz 数据显示,今年以来,股票类代币化资产的规模已从几乎为零跃升至数亿美元,背后则是股票代币化正从概念加速走向落地——经历了从合成资产到实股托管的模式演进,并正向衍生品等更高阶形态延伸。

本文将简单梳理股票代币化的模式演进,盘点核心项目,并展望其潜在的发展趋势与格局变化。

来源:rwa.xyz

一、美股代币化的前世今生

什么是股票代币化?

简单来说,就是将传统股票通过区块链技术映射成数字代币,每个代币代表底层资产的一部分所有权,这些代币可以在链上 7×24 小时交易,突破了传统股市的时间和地域限制,让全球投资者都能无缝参与。

如果从 Tokenization 的角度来看,美股代币化,其实并不是什么新概念(延伸阅读《「股票代币化」热潮背后:Tokenization 叙事的演化路线图》),毕竟早在上一轮周期中,Synthetix、Mirror 等代表性项目已经探索出一整套链上合成资产机制:

这种模式不仅允许用户通过超额抵押(如 SNX、UST)铸造、交易 TSLA、AAPL 等「美股代币」,甚至还能覆盖法币、指数、黄金、原油,几乎囊括一切可交易资产,原因便在于合成资产模式是通过跟踪基础资产,超额抵押以铸造合成资产代币。

譬如用户可质押 500 美元的加密资产(如 SNX、UST),进而铸造出锚定资产价格的合成资产(如 mTSLA、sAAPL)并进行交易,整个运作机制采用预言机报价 + 链上合约撮合,不存在真实交易对手,因此理论上可实现无限深度、无滑点的流动性体验。

不过该模式并未真实拥有对应股票的所有权,只是在「赌」价格,那就意味着一旦预言机失效或抵押资产暴雷(Mirror 即倒在了 UST 的崩盘上),整个系统都会面临清算失衡、价格脱锚、用户信心崩溃的风险。

来源:Mirror

而这波「美股代币化」热潮的最大区别,便在于采用了「实股托管 + 映射发行」的底层模式,这种模式目前主要分为两种路径,核心差异仅在于是否拥有发行合规资质:

一类是以 Backed Finance(xStocks)、MyStonks 为代表的「第三方合规发行 + 多平台接入」模式,其中 MyStonks 与富达合作实现 1:1 锚定真实股票,xStocks 通过 Alpaca Securities LLC 等购入股票并托管;

另一类则是 Robinhood 式的持牌券商自营闭环,依托自身券商牌照完成从股票购入到链上代币发行的全流程;

从这个角度来看,此轮股票代币化热潮的关键优势是底层资产真实可验证,安全性与合规性更高,也更容易被传统金融机构认可。

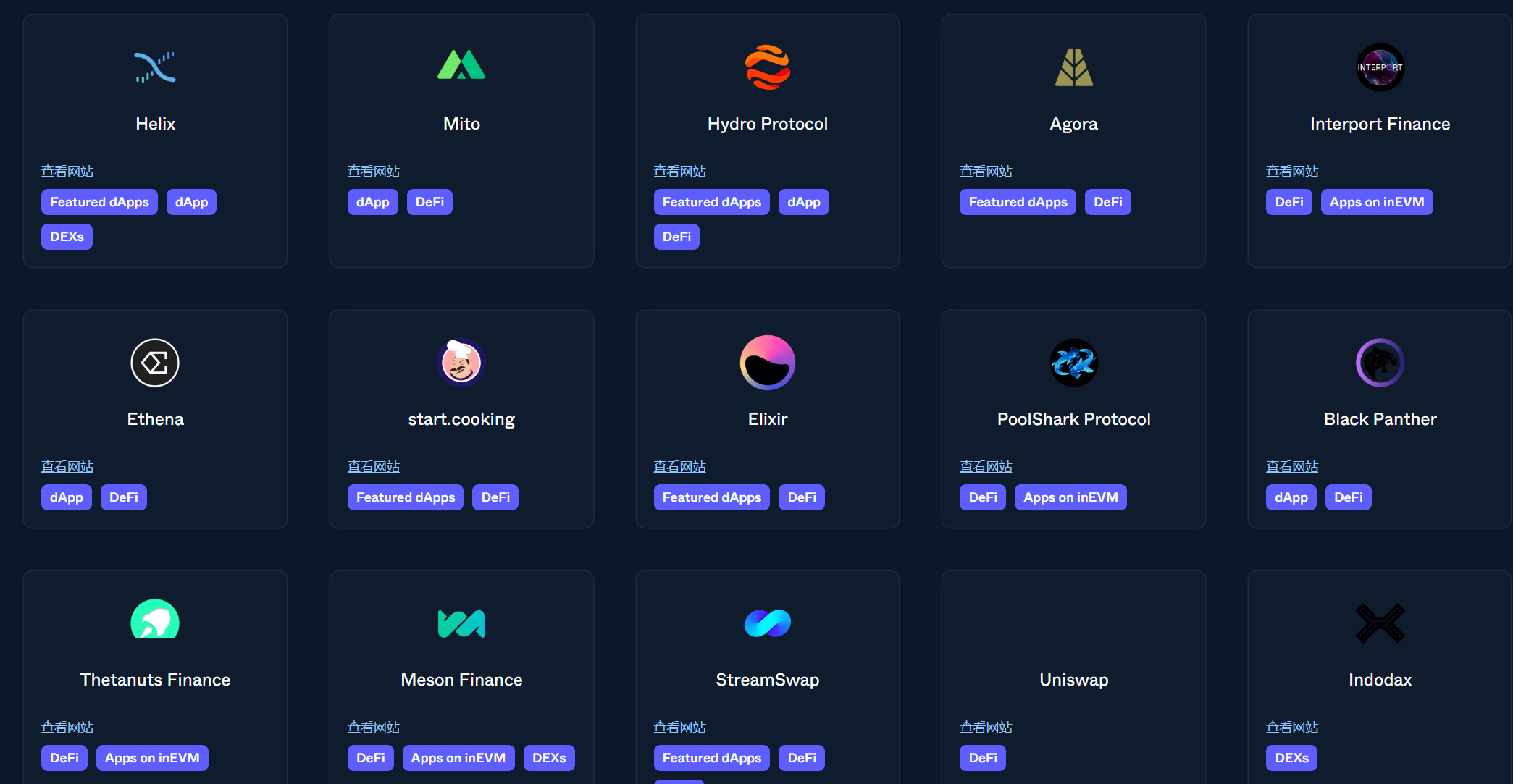

二、代表项目盘点:从发行到交易的上下游生态

从运行架构上来看,一个功能完善的代币化股票生态,其实至少需要包含基础设施层(公链、预言机和结算系统)、发行层(各发行方)、交易层(CEX/DEX、借贷等衍生交易平台)等层级,缺少任何一层,生态都难以实现安全发行、有效定价和高效交易。

围绕这一框架,我们可以看到当前市场的主要参与者,正围绕不同环节展开布局。考虑到基础设施(如公链、预言机、结算网络)相对成熟,发行与交易环节才是代币化股票竞争的主战场,故本文将重点盘点这些直接影响用户体验和市场流动性的代表性项目。

Ondo Finance:RWA 龙头的股票化延伸

首先自然是 Ondo Finance,作为 RWA 代币化赛道的龙头项目,其最初定位为链上债券与国债的代币化平台,且截止发文时,Ondo Finance 依托美国国债的两大旗舰产品 USDY 和 OUSG,依旧在 RWA 代币化赛道中牢牢占据体量前十的核心位置。

来源:rwa.xyz

不过从去年开始,Ondo Finance 就尝试将版图扩展至股票市场,包括通过与 Anchorage Digital 等受监管的托管与清算机构合作,将真实美股安全托管并在链上发行等额代币化资产,这种模式不仅为机构投资者提供合规保障,也在链上构建跨资产流动性池,让代币化股票能够与稳定币、RWA 债券等资产进行组合交易。

而且上个月 Ondo Finance 也与 Pantera Capital 拟推出 2.5 亿美元基金,以支持 RWA 项目,Ondo 首席战略官 Ian De Bode 表示,这些资金将用于收购新兴项目的股权和代币。

Injective:为金融类 RWA 量身定制的公链

Injective 一直以「金融基础设施」为核心定位,是专注于高性能金融应用的公链之一,自主研发的链上撮合与衍生品交易模块,使其在延迟、吞吐量以及订单簿深度等方面均具备针对性优化。

截至目前,Injective 生态已聚合超过 200 个项目,涵盖去中心化交易所(Helix、DojoSwap)、链上借贷(Neptune)、RWA 平台(Ondo、Mountain Protocol)、NFT 市场(Talis、Dagora)等多个领域。

在 RWA 赛道,Injective 的优势主要体现在两方面:

资产品类覆盖广:以 Helix 为代表的 Injective 生态项目,已支持包括美股科技股、黄金、外汇等多种代币化资产交易,拓展了 RWA 在链上的资产谱系;

与传统金融的直连能力:Injective 已与 Coinbase、Circle、Fireblocks、WisdomTree、Galaxy 等知名金融机构建立合作,打通了从链下托管、清算到链上映射、交易的闭环流程;

得益于这种定位,Injective 更像是 RWA 专属的公链底座,为发行方提供稳定的合规落地与资产管理通道,为交易平台和聚合工具提供高速、低成本的执行环境,也为未来股票代币化的衍生品化、组合化奠定了基础。

来源:Injective

MyStonks:链上美股流动性的先行者

作为这一波美股代币化领域的先行者,不少用户应该都在链上接触过 MyStonks 发行的代币化美股,它也是与富达合作确保链上代币资产完全锚定真实股票。

交易体验上,MyStonks 采用订单流支付(PFOF)机制,将订单流路由至专业做市商进行撮合,从而显著降低滑点与交易成本,并提升订单的执行速度与深度。对普通用户而言,这意味着在链上交易美股时,既能享受接近传统券商的流动性,又能保留全天候交易的优势。

值得一提的是,MyStonks 并未将自己局限在链上现货交易,而是在积极拓展衍生品、借贷、质押等多元化金融服务,未来用户不仅可以进行美股代币的杠杆交易,还能将持仓作为抵押品获取稳定币流动性,甚至参与组合投资与收益优化策略。

Backed Finance:跨市场的合规扩展者

与 MyStonks 聚焦美股不同,Backed Finance 的布局从一开始就更具跨市场与多资产的视野,一大亮点在于合规模式与欧洲 MiCA 监管路线的高度契合。

其中团队基于瑞士法律框架开展业务,严格遵循当地金融监管要求,在链上发行完全锚定的代币化证券,并与 Alpaca Securities LLC 等合作伙伴建立了股票购入与托管体系,确保链上代币与链下资产之间的 1:1 映射关系。

在资产范围上,Backed Finance 不仅支持美股代币化,还覆盖 ETF、欧洲证券及特定的国际指数产品,为全球投资者提供了多市场、多币种、多标的的投资选择,这意味着投资者可以在同一个链上平台上同时配置美股科技股、欧洲蓝筹股以及全球大宗商品 ETF,从而打破了传统市场的地域与时间限制。

Block Street:代币化股票的流动性释放器

Block Street 作为目前少数专注于代币化股票借贷的 DeFi 协议,则将视线瞄准了更下游、也更具潜在爆发力的流动性释放方向。

这也是目前代币化股票的「交易层」尚属空白的一个细分赛道,以 Block Street 为例,它直接面向持有者提供链上抵押与借贷服务——用户可以将 TSLA.M、CRCL.M 等代币化美股直接存入平台作为抵押品,按抵押率获得稳定币或其他链上流动资产,实现「资产不卖、流动性到手」的资金利用模式。

Block Street 上周刚刚上线测试版本,可以体验将代币化股票转化为可流动的资本,让持仓者在不卖出资产的情况下释放资金,这也算是填补了代币化股票在 DeFi 借贷领域的空白,值得观察后续类似的借贷、期货等衍生品方向会不会为代币化股票市场构建一条「第二曲线」。

来源:Block Street

三、如何进一步拆掉围墙?

客观来说,这一波新热潮下的美股代币化,最大的进步,就是「实股托管」模式 + 消解入门门槛维度:

任何用户只需下载一个加密钱包、持有稳定币,便能随时随地通过 DEX 绕开开户门槛与身份审查,直接买入美股资产——没有美股账户、没有时差、没有地域与身份限制。

但问题在于,当下大部分产品仍是聚焦于发行与交易层的第一步,本质上仍停留在数字凭证的初始阶段,并未将其真正转化为可广泛用于交易、对冲和资金管理的链上金融资产,这意味着它们在吸引专业交易者、高频资金与机构参与方面存在明显不足。

这有点像 DeFi Summer 之前的 ETH,彼时它不能借出、不能做担保、不能参与 DeFi,直到 Aave 等协议赋予其「抵押借贷」等功能,才释放出千亿级流动性,而美股代币要突破困局,必须复刻这种逻辑,让沉淀的代币成为「可抵押、可交易、可组合的活资产」。

因此如果说代币化美股市场的第一曲线是交易规模的增长,那接下来第二曲线则是通过金融工具的扩展,提高代币化股票的资金利用率与链上活跃度,这样的产品形态,才有可能吸引更广泛的链上资金流,形成完整的资本市场循环。

在这个逻辑下,代币化股票的即时买卖之外,「交易层」更丰富的衍生交易就尤为关键——无论是像 Block Street 这样的 DeFi 借贷协议,还是未来支持反向头寸和风险对冲的做空工具、期权与结构化产品。

核心便在于谁能先做出可组合性强、流动性好的产品,谁能提供「现货 + 做空 + 杠杆 + 对冲」一体化链上体验,比如让代币化的美股在 Block Street 中作为质押品完成资金借贷、在期权协议中构建新的对冲标的、在稳定币协议中构成可组合资产篮子。

总的来看,股票代币化的意义,不仅在于把美股、ETF 搬上链,更在于它打开了现实世界资本市场与区块链之间的「最后一公里」:

从发行层的 Ondo,到交易与跨市场接入的 MyStonks、Backed Finance,再到流动性释放的 Block Street,这一赛道正逐步构建起自己的底层基础设施与生态闭环。

RWA 的主战场,之前主要是美债 - 稳定币在独领风骚,那当机构资金加速进场、链上交易基础设施不断完善,代币化的美股变成可组合、可交易、可抵押的活资产,股票代币化无疑有望成为 RWA 赛道中最具规模与增量的资产类别。

UST price performance in USD

The current price of unstable-tesla is $0.0010529. Over the last 24 hours, unstable-tesla has increased by +239.07%. It currently has a circulating supply of 99,999,996 UST and a maximum supply of 99,999,996 UST, giving it a fully diluted market cap of $105.29K. The unstable-tesla/USD price is updated in real-time.

5m

-3.88%

1h

+239.07%

4h

+239.07%

24h

+239.07%

About Unstable Tesla (UST)

UST FAQ

What’s the current price of Unstable Tesla?

The current price of 1 UST is $0.0010529, experiencing a +239.07% change in the past 24 hours.

Can I buy UST on OKX?

No, currently UST is unavailable on OKX. To stay updated on when UST becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of UST fluctuate?

The price of UST fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Unstable Tesla worth today?

Currently, one Unstable Tesla is worth $0.0010529. For answers and insight into Unstable Tesla's price action, you're in the right place. Explore the latest Unstable Tesla charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Unstable Tesla, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Unstable Tesla have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.