This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

TAIKO

Taiko Token price

0x30c6...fc61

$0.47303

+$0.014579

(+3.18%)

Price change for the last 24 hours

How are you feeling about TAIKO today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

TAIKO market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$9.25M

Network

BNB Chain

Circulating supply

19,546,828 TAIKO

Token holders

1218

Liquidity

$295,716.40

1h volume

$65.23M

4h volume

$178.88M

24h volume

$545.05M

Taiko Token Feed

The following content is sourced from .

TrustWallet中文频道

📰 Trust Wallet Hot Spot Express|Monday, June 16

📈 TOP3 Trading: $KOGE | $TAIKO | $EGL1

🔥 MEME Hot List TOP3: $Fartcat | $USELESS | $USDP

Today's Hot Express:

1️⃣ Metaplanet issued another $210 million in zero-coupon bonds to buy BTC

2️⃣ Crypto KOL Unipcs made a floating profit of more than $2 million on USELESS, and the overall purchase of 44 tokens is still at a loss

3️⃣ A whale address is suspected of clearing 1,605 ETH after holding the currency for nearly 1 year, with a loss of $480,000

4️⃣ A whale address deposited 595.19 billion PEPE into Binance

5️⃣ Polyhedra: The ZKJ/KOGE transaction was caused by a series of anomalous on-chain transactions in a short period of time today

6️⃣ Insider: Coinbase and Gemini will receive EU crypto licenses from Luxembourg and Malta, respectively

Show original

11.98K

1

Nathan

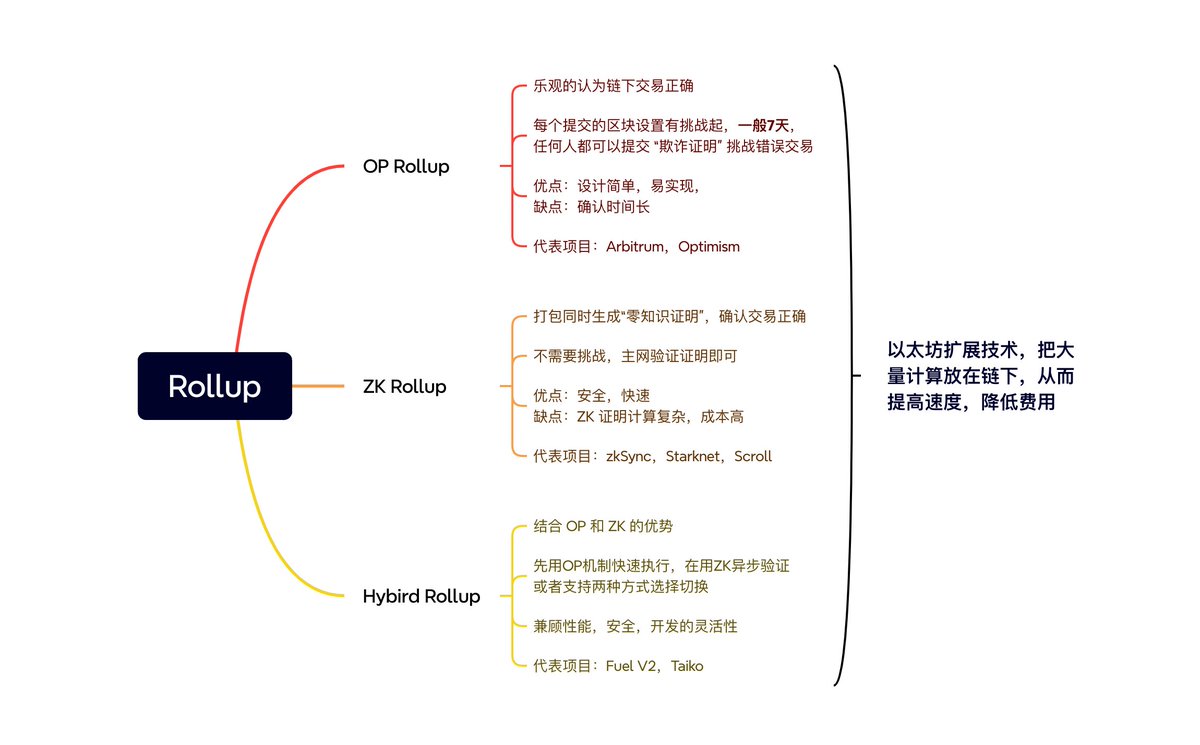

What is a Rollup

Rollup is a technology that scales Ethereum by "rolling" a large amount of computation and data from the main chain and putting it off-chain, and only submitting critical data to the chain, thereby increasing speed and reducing fees.

➣ Optimistic Rollup

▰ "optimistically" that off-chain transactions are correct

▰ Set a challenge period for each committed block (usually 7 days)

▰ During this period, anyone can submit a "fraud proof" to challenge the wrong transaction

Advantages: Simple calculation and easy implementation

Cons: Long waiting time for withdrawals (due to challenging periods)

Representative projects: Arbitrum, Optimism

➣ ZK Rollup

▰ Generate a zero-knowledge proof when packaging a transaction to prove that the transaction is correct

▰ There is no need for a challenge period, the main chain verifies this proof to confirm that the transaction is valid

Pros: Secure, fast withdrawals

Disadvantages: ZK proof is computationally complex and expensive to develop

Representative projects: zkSync, Starknet, and Scroll

➣ Hybrid Rollup

▰ Combine the advantages of both Optimistic and ZK

▰ The design may be fast executed by the optimistic mechanism first, and then asynchronous verification through ZK proof, or the two verification methods can be switched

The goal: to balance performance, security, and development flexibility

Representative projects: Fuel V2, Taiko (hybrid verification to be adopted)

Show original

7.35K

5

TVBee

Brothers, Brother Bee has a name for foresight, right?

As I have said more than once before, Brother Bee has the attribute of avoiding pits.

I often use GMGN to read information, but I have never authorised it.

As for Twitter, more than one organisation has contacted Brother Bee. On the one hand, Brother Bee is a third-party independent analyst, and on the other hand, it is not suitable to hang which one or not to hang, so he simply does not hang up.

Why didn't you dare to authorise the GMGN? Because GMGN doesn't have code auditing.

Code audit does not mean that it is safe, but at the very least, a project is willing to spend money to find a formal organisation to conduct an audit, and has a long-term business plan. (What's more, there are projects that have been audited and returned to rug)

The previous article collated some of the newer DEX audit reports. Among them, it is specifically written that GMGN does not have code audits.

Of course, GMGN has bug bounties and has paid a total of $3,000 so far.

Although this form of brainstorming and extensive discussion can also find a lot of risks. But projects that don't have code audits are a bit reassuring.

Audit or not, several audits, audit institutions, these can reveal not only the safety information of the project, but also the level of the project. The best projects are with well-known auditors, and may even seek code audits from more than one auditor.

It is said that the reward promoted by GMGN to KOLs is very substantial (I don't know if the total amount exceeds the 3,000 dollars of this bug bounty). So why don't you want to pay for a professional team to do a code audit?

So Brother Bee uses GMGN, but never authorises it.

By the way, I was in a bit of a hurry when this article was published, and I didn't find the code audit agency of UniversalX at that time, but later I found it on Github, the code audit report by Slowfog Audit, by the way.

TVBee

SUI Ecosystem DEX #Cetus Is Code Security Audit Really Sufficient When Attacked?

The cause and impact of the attack on Cetus are not yet clear, but we can first take a look at the code security audit of Cetus.

For the uninitiated, we can't understand the specific technology, but this audit summary can be understood.

➤ Certik's audit

Certik's code security audit of Cetus found only 2 minor hazards that were resolved. There are also 9 informational risks, 6 resolved.

Certik gave an overall rating of 83.06 and a code audit score of 96.

➤ Other audit reports from Cetus (SUI Chain)

A total of 5 code audit reports are listed on Cetus' Github, excluding Certik's audit. It is estimated that the project team also knew that Certik's audit was a formality, so it did not include this report.

Cetus supports both Aptos and SUI chains, and the 5 audit reports are from MoveBit, OtterSec, and Zellic, respectively. Among them, MoveBit and OtterSec audit Cetus's code on the Aptos and SUI chains, respectively, and Zellic should also audit the code on the SUI chain.

Because it was Cetus on the SUI chain that was attacked this time, we will only look at the audit report of Cetus on the SUI chain below.

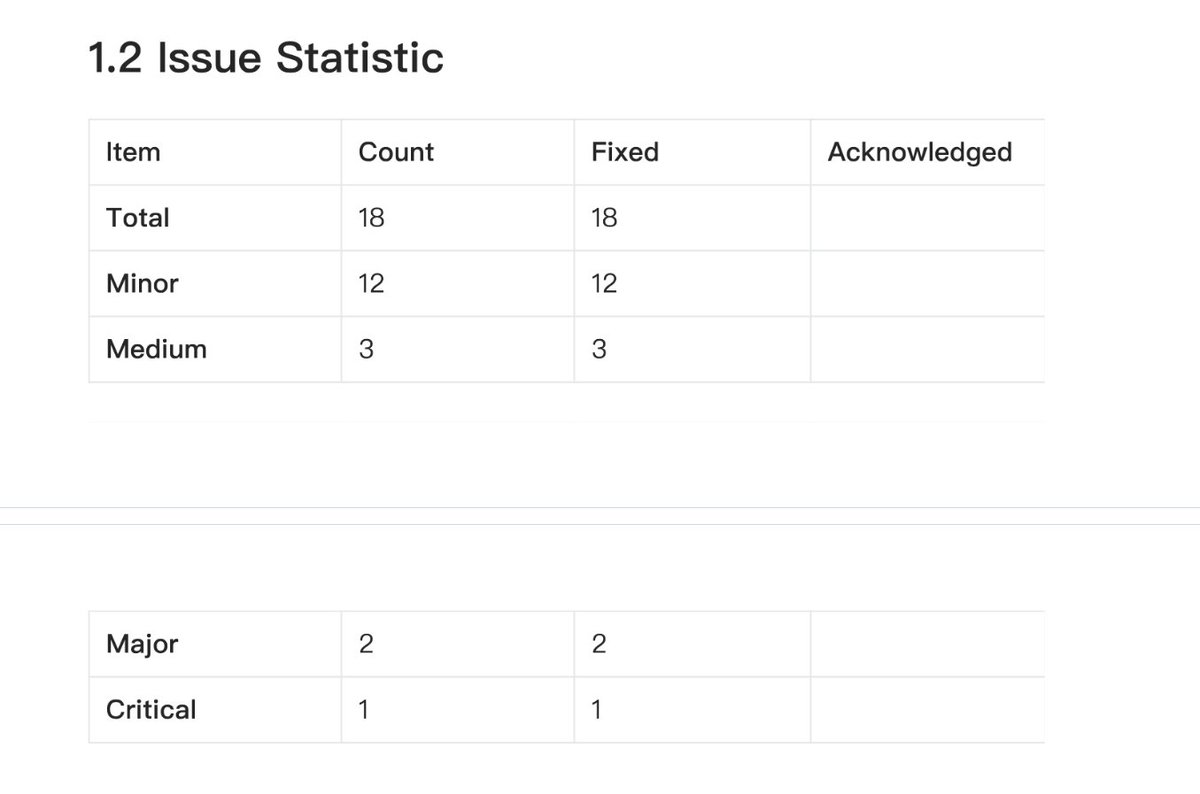

❚ Audit report from MoveBit

The report was uploaded to Github on 2023-04-28

If we don't understand the specific content of the audit, we can find a table like this to see the number of risk issues listed in the report at each level, and how well they are resolved.

MoveBi's audit report on Cetust found a total of 18 risk issues, including 1 fatal risk issue, 2 major risk issues, 3 medium risk issues, and 12 mild risk issues, all of which have been resolved.

There are more problems than Certik has found, and Cetus has solved them all.

❚ Audit report from OtterSec

The report was uploaded to Github on 2023-05-12

OtterSec's audit report on Cetus found a total of 1 high-risk issue, 1 medium-risk issue, and 7 informational risks, and the screenshots were not taken because the report table did not directly show the resolution of the risk issue.

Among them, both high-risk and medium-risk issues have been resolved. Informational risk issues, 2 resolved, 2 fixed patches submitted, and 3 more. After a rough study, these 3 are:

•The code of Sui and Aptos versions is inconsistent, which may affect the accuracy of price calculation of liquidity pools.

• Lack of paused state verification, no verification of whether the liquidity pool is in a paused state at the time of swap. If the pool is suspended, it may still be possible to trade.

• Convert U256 type to U64 type, if the value exceeds MAX_U64 it will cause overflow, which may lead to calculation errors in the case of large transactions.

It is uncertain whether the attack is related to the above issues.

❚ Audit report from Zellic

The report was uploaded to Github in April 2025

Zellic's audit report on Cetus identified three informational risks, none of which were fixed:

• A function authorisation issue that allows anyone to call to deposit fees into any partner account. It doesn't seem to be risky, it's saving money, not withdrawing money. So Cetus didn't fix it for the time being.

• There is a function that is still referenced by a deprecated generation, and the code is redundant, which seems to be risky, but the code is not prescriptive enough.

• One of the UI rendering issues in the NFT display data could have been character-based, but Cetus used the more complex TypeName data type in the Move language. This is not a problem, and it is possible that Cetus will develop other features for NFTs in the future.

Overall, Zellic found 3 ozone layer sub-issues, which are basically risk-free and belong to the code specification aspect.

We have to remember these three auditors: MoveBit, OtterSec, Zellic. Because most of the auditors on the market are good at EVM audits, these three auditors belong to the Move language code auditors.

➤ Audit & Security Level (Take the new DEX as an example)

First of all, projects that have not been audited by code are subject to a certain amount of Rug risk. After all, he is not even willing to pay for this audit, and it is difficult for people to believe that he has a desire to operate for a long time.

Secondly, Certik audit is actually a kind of "human audit". Why is it a "human audit", Certik has a very close cooperation with coinmarketcap. On coinmarketcap's project page there is an audit icon, which clicks on it to take you to Certik's navigation platform, skynet.

coinmarketcap, as a platform owned by Binance, indirectly enabled Certik to establish a partnership with Binance. In fact, Binance and Certik have always had a good relationship, so most projects that want to list on Binance will seek Certik's audit.

Therefore, if a project seeks Certik's audit, it is likely to want to list on Binance.

However, history has shown that the probability of an attack on a project audited only by Certik is not low, such as DEXX. There are even projects that have been FUG, such as ZKasino.

Of course, Certik also has some other security help, not only code auditing, Certik will scan websites, DNS, etc., and there are some security information other than code auditing.

Third, many projects will seek 1~more than one other high-quality audit entities to conduct code security audits.

Fourth, in addition to professional code audits, some projects will also carry out bug bounty programs and audit competitions to brainstorm and eliminate vulnerabilities.

Because this is a DEX product, let's take some newer DEXs as examples:

---------------------------

✦✦✦GMX V2 is a code audit conducted by 5 companies, including abdk, certora, dedaub, guardian, and sherlock, and launched a single bug bounty program of up to $5 million.

✦✦✦DeGate, a total of 35 companies from Secbit, Least Authority, and Trail of Bits conducted code audits, and launched a single bug bounty program of up to $1.11 million.

✦✦✦DYDX V4 is a code security audit conducted by Informal Systems, and a single bug bounty program of up to $5 million has been launched.

✦✦✦HyperLiquid conducts code security audits by HyperLiquid, and has launched a single bug bounty program of up to $1 million.

✦✦UniversalX is audited by Certik and another expert auditor (the official audit report has been temporarily removed from the shelves)

✦GMGN is special in that there is no code audit report found, only a single bug bounty program of up to $10,000.

➤ Write at the end

After reviewing the code security audits of these DEXs, we can see that even DEXs like Cetus, which are jointly audited by 3 auditors, are still vulnerable to attacks. Multi-agent audits, combined with vulnerability bounty programs or audit competitions, ensure relatively secure security.

However, for some new Defi protocols, there are still problems in code auditing that have not been fixed, which is why Brother Bee pays special attention to the code audit of new Defi protocols.

107.79K

64

TAIKO price performance in USD

The current price of taiko-token is $0.47303. Over the last 24 hours, taiko-token has increased by +3.18%. It currently has a circulating supply of 19,546,828 TAIKO and a maximum supply of 19,546,828 TAIKO, giving it a fully diluted market cap of $9.25M. The taiko-token/USD price is updated in real-time.

5m

+0.05%

1h

+1.15%

4h

+3.36%

24h

+3.18%

About Taiko Token (TAIKO)

TAIKO FAQ

What’s the current price of Taiko Token?

The current price of 1 TAIKO is $0.47303, experiencing a +3.18% change in the past 24 hours.

Can I buy TAIKO on OKX?

No, currently TAIKO is unavailable on OKX. To stay updated on when TAIKO becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of TAIKO fluctuate?

The price of TAIKO fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Taiko Token worth today?

Currently, one Taiko Token is worth $0.47303. For answers and insight into Taiko Token's price action, you're in the right place. Explore the latest Taiko Token charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Taiko Token, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Taiko Token have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.