This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

SER

Solana Equity Reserve price

A8Cd91...x8xP

$0.000071477

+$0.000042097

(+143.28%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about SER today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

SER market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$71.80K

Network

Solana

Circulating supply

999,997,615 SER

Token holders

192

Liquidity

$100.83K

1h volume

$4.81M

4h volume

$4.81M

24h volume

$4.81M

Solana Equity Reserve Feed

The following content is sourced from .

내가 그리는 두가지의 시나리오 $ETH

1. 상승 시나리오

- 여전히 ETF의 유입은 지속적

- 비트마인과 샤프링크의 공격적인 이더리움 매집도 지속되고 있음

- 현재 가격대에 매물대는 굉장히 얇을 것(원화 기준으로는 신규 진입자 뿐이고 달러 기준으로 봐도 2024년 트럼프 당선 이후의 고점을 훨씬 웃도는 가격대 이므로)

- 아직 나스닥의 거래일이 하루 이상 남았다는 점. SER 들의 ATM을 통해 조달할 자금이 아직 남았다는 말이고 이는 곧 이더리움의 구매력을 의미함

2. 하락 시나리오

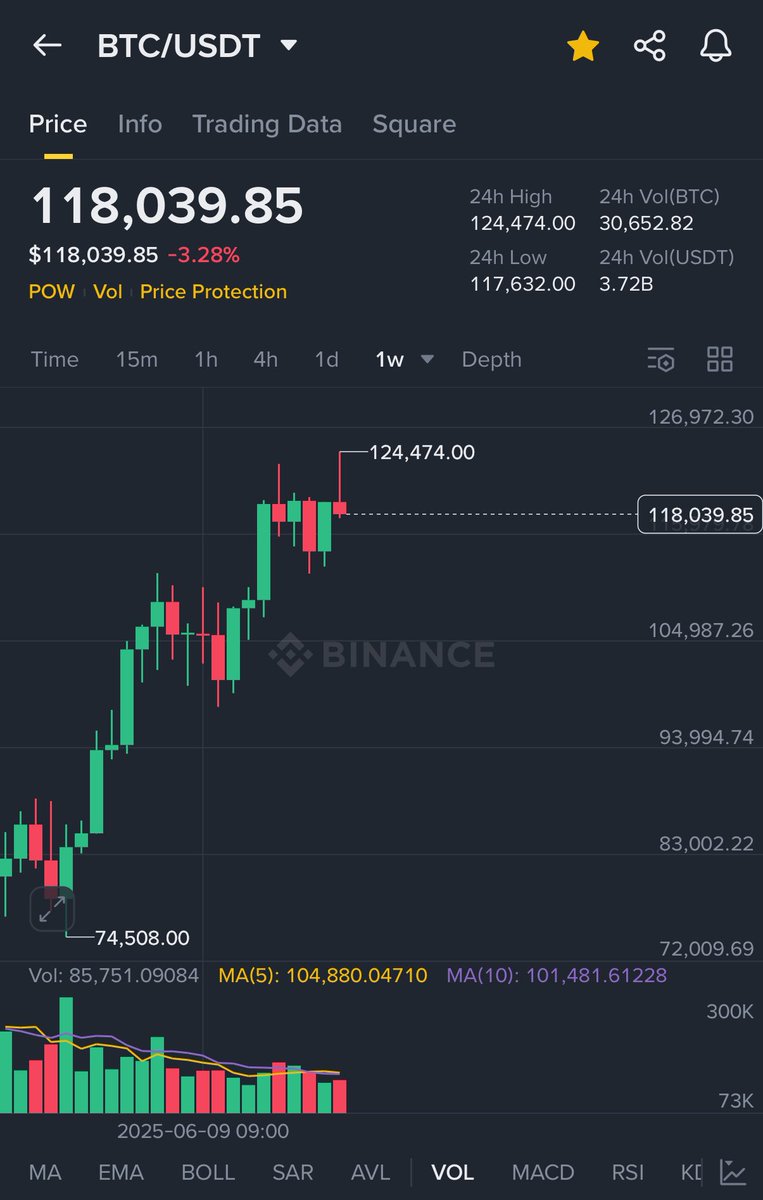

- 비트코인 & 이더리움 모두 이번주 주봉의 고점이 .00으로 끝나는 정수임. 주봉정수론을 신뢰하는 저는 주봉 마감(월 아침9시)이 이렇게 될 경우 다음주 조정 가능성이 아주 상당히 높음.

- 7/28 월요일 새로운 주봉 고점을 3941.00으로 만들고 해당 주에 일요일까지 6일동안 약 -15%를 만든 데이터가 위를 뒷받힘

- 7/26 Ethereum 스테이킹 exit queue가 사상 최고치를 찍은 이후 7/28 부터 시장의 조정이 시작됐었는데 현재도 그정도 수준으로 다시 올라왔음(같은 시그널)

두가지 모두 가능한 시나리오라고 생각이 됩니다. 그래서 결론은 주봉마감까지 기다리고 판단을 하는 것이 맞다는 생각이예요. 과거 조정에서 월요일부터 반등한 것은 나스닥이 개장하면서 SER의 매수압력 때문이 아니였을까 생각됩니다. 그래서 언제보다 공격적인 ATM 자금 조달을 하고 있는 지금 언제든지 반등은 가능하나 주봉마감 전에 고점을 넘지 못한다면 다음주는 조정이 불가피 할 것 같다는 의견.

그리고 지금은 이더리움 시즌이예요. 비트만 올랐을때를 보더라도 굳이 베타에 투자하지 마시고 그냥 알파에 투자하십쇼.

Coinangel | GMB LABS

비트코인의 경우 ETF 유입도 적고 MSTR / Metaplanet이 공격적인 매입을 하진 않지만 이더리움의 경우 매일매일 엄청난 ETF 유입량과 샤프링크가 쌓아놓은 현금 그리고 비트마인이 $20B 짜리 초거대 ATM을 진행하며 생기는 현금으로 엄청난 매수세가 아직 있다고 봄.

그래서 오늘/내일 나스닥 개장시간동안 얼마나 많은 SER 주식이 거래되냐에 따라 이더리움의 상승여부가 달려있다 생각하고 충분히 매물대도 없는데 고점갱신 가능하다고 생각함.

단, 현재 비트코인과 이더리움 모두 주봉고점이 정수임. 그래서 주봉정수론에 의해서 다음주 월요일 아침 9시까지 고점 갱신을 못한다면 리스크를 무조건 줄이는게 맞다고봄. 이더리움 3941.00 때도 3300불대 까지 떨어진거보면.

요약하자면 비트코인은 아니고 이더리움은 이번주 내에 고점갱신할 가능성 있다 하지만, 다음주 월요일 아침 9시까지 주봉 고점갱신 못하면 무조건 리스크 줄여라.

비트코인의 경우 ETF 유입도 적고 MSTR / Metaplanet이 공격적인 매입을 하진 않지만 이더리움의 경우 매일매일 엄청난 ETF 유입량과 샤프링크가 쌓아놓은 현금 그리고 비트마인이 $20B 짜리 초거대 ATM을 진행하며 생기는 현금으로 엄청난 매수세가 아직 있다고 봄.

그래서 오늘/내일 나스닥 개장시간동안 얼마나 많은 SER 주식이 거래되냐에 따라 이더리움의 상승여부가 달려있다 생각하고 충분히 매물대도 없는데 고점갱신 가능하다고 생각함.

단, 현재 비트코인과 이더리움 모두 주봉고점이 정수임. 그래서 주봉정수론에 의해서 다음주 월요일 아침 9시까지 고점 갱신을 못한다면 리스크를 무조건 줄이는게 맞다고봄. 이더리움 3941.00 때도 3300불대 까지 떨어진거보면.

요약하자면 비트코인은 아니고 이더리움은 이번주 내에 고점갱신할 가능성 있다 하지만, 다음주 월요일 아침 9시까지 주봉 고점갱신 못하면 무조건 리스크 줄여라.

All We Need to Know about $ETH

💡 @BitMNR is purchasing $ETH at a rate 12x faster than @Strategy is purchasing $BTC , from @fundstrat

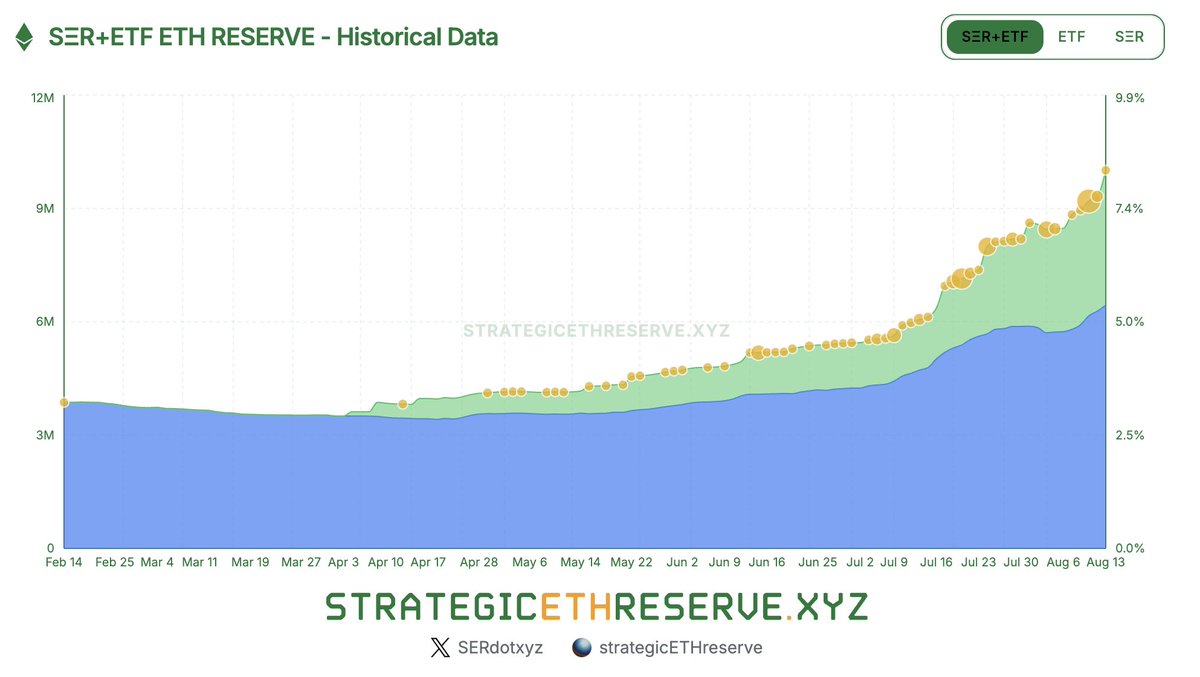

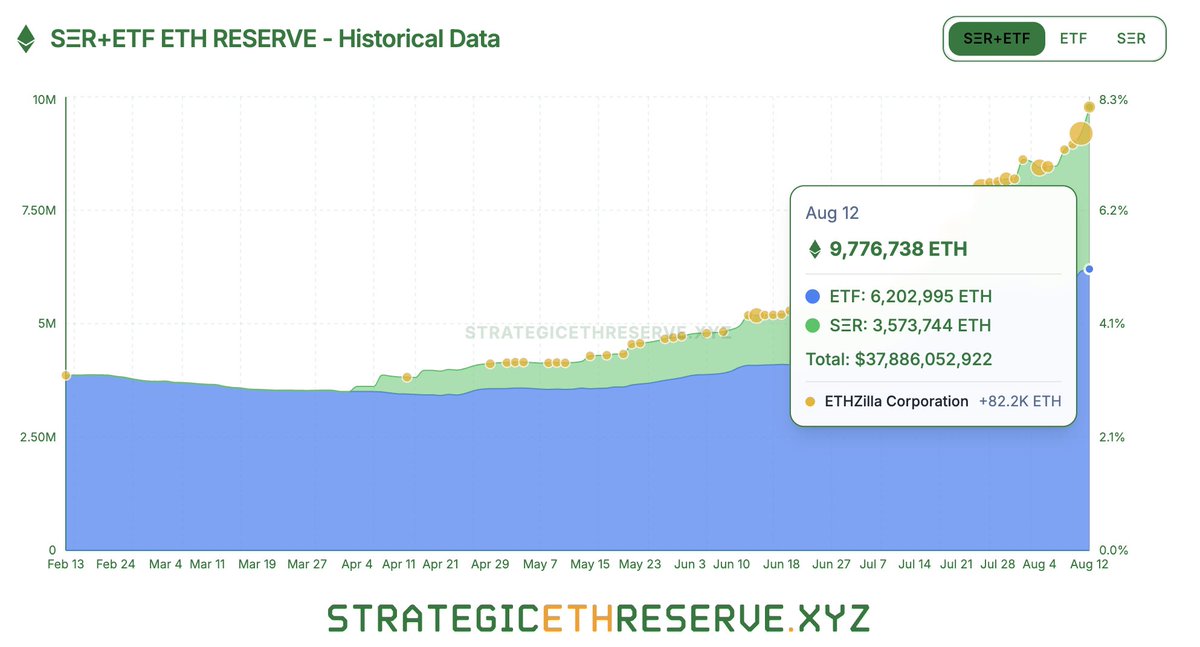

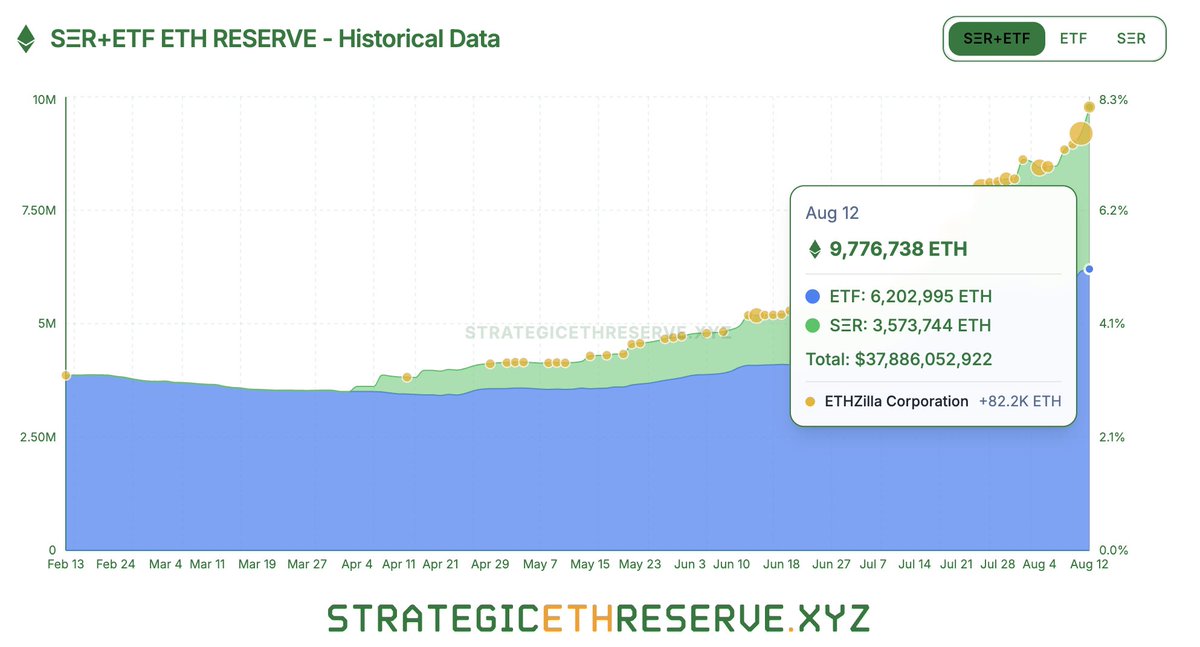

💡 Since mid-July, SΞR+ETF ETH holdings have grown from 24M to the current 37M

we see a 54% growth in one month

💡 ETH/BTC rate is also starting to show a reversal, showing a strong momentum

Eliminating short-term noise, Keep Buying 📈

alvin617.eth 🦇🔊

【 $ETH 獨強的市場, E 儲備的數據更新 💡】

建立 ETH Maxi list 也就一個月的時間, 恍如隔世

$ETH 也從 $3000 漲到了現在的 $4700 🚀🚀

新高並不是隨便說說的, 很多時候感覺幣圈仍然低估這次的機構買盤 , 就連 Tom Lee @fundstrat 本人都提及, 當前 Bitmine 購買 $ETH 的速度是 Strategy 購買 $BTC 的 12 倍之多

btw 看來市場上出現了新的「以太坊基金會」啊 Hashkey Capital 今天就轉了超過 7000 ETH 到交易所裡, 賣掉了 34M 💀

昨天晚上到今天市場很明顯大家看法都出現了分歧

💡 BTC 看似突破新高之後沒有持續往上

💡 $ETH 驚人的獨自強勢 , $SOL 跟漲

💡 山寨沒有跟漲

9 月降息這件事貌似看來也塵埃落定了, 老樣子還是要看大餅的表現, 大餅如果這次沒有突破, 山寨也會繼續無力

看了一下主流幣的現貨交易量

貌似又到了前陣子的高點了, 當時有出現短期回撤 ⚠️

當時和今日的現貨交易量分別為

ETH:42 億 , 43 億

BTC:20 億, 31 億

USDC:24 億 , 36 億

前幾天大概 ETH 是在 20 億左右的數字

$OTHERS 指標也超越了 7 月底的前高(315B , 3150 億美元) , 早上衝到 324B 後回落到現在也是 316B 左右的水準

回顧 ETH 當前購買數據

7 月中開始到現在, SΞR+ETF ETH 的持倉已從 24M 成長至當前的 37M , 一個月成長了 54%

top 3 儲備公司當前持有 9.6B 也就是將近 100 億美金的 $ETH , 以太坊基金會則是 1.07B , 相差了 9 倍之多

我認為可以以每週的時匡來關注市場變動

除非增速減緩非常多, 否則都不需要太悲觀

ETH/BTC 當前匯率也開始出現轉折

$ETH 保持強勢, 繼續衝刺 ⚡️

【 $ETH's Strong Market, E Reserve Data Update 💡】

It has only been a month since the establishment of the ETH Maxi list, yet it feels like a lifetime ago.

$ETH has risen from $3000 to the current $4700 🚀🚀

New highs are not just casually mentioned; often, it feels like the crypto space still underestimates this institutional buying, even Tom Lee @fundstrat himself mentioned that the current speed at which Bitmine is purchasing $ETH is 12 times that of Strategy's purchases of $BTC.

By the way, it seems a new "Ethereum Foundation" has emerged in the market. Hashkey Capital transferred over 7000 ETH to exchanges today, selling off $34M 💀

From last night to today, it's clear that opinions in the market have diverged.

💡 BTC seems to have not sustained its new high.

💡 $ETH is astonishingly strong on its own, with $SOL following suit.

💡 Altcoins have not followed the rise.

The interest rate cut in September seems to be settled; as usual, we still need to watch the performance of Bitcoin. If Bitcoin does not break through this time, altcoins will continue to struggle.

I looked at the spot trading volume of mainstream coins, and it seems to have reached the previous high point again, which previously saw a short-term pullback ⚠️.

The spot trading volumes then and now are:

ETH: 4.2 billion, 4.3 billion

BTC: 2 billion, 3.1 billion

USDC: 2.4 billion, 3.6 billion

A few days ago, ETH was around 2 billion.

The $OTHERS indicator has also surpassed the previous high at the end of July (315B, 315 billion USD), peaking at 324B this morning before retreating to around 316B now.

Looking back at the current purchasing data for ETH:

Since mid-July, the holdings of SΞR+ETF ETH have grown from 24M to the current 37M, a growth of 54% in one month.

The top 3 reserve companies currently hold 9.6B, which is nearly 10 billion USD of $ETH, while the Ethereum Foundation holds 1.07B, a difference of 9 times.

I believe we can monitor market changes on a weekly basis. Unless the growth rate slows significantly, there is no need to be overly pessimistic.

The current ETH/BTC exchange rate is also starting to show a turning point. $ETH remains strong and continues to surge ⚡️.

alvin617.eth 🦇🔊

If it's $ETH microstrategy moment, how high is the $ETH room to go up? 🦇🔊

Strategy announced its reserve strategy back in September 2020

In the past four years, the price of $BTC has increased from 15K to the current 117K, an increase of 681.42%. 📈

@SharpLinkGaming can be said to be a key player in bringing the ETH reserve strategy into an acceleration period

📈 The current statistics are displayed on the website (strategicethreserve[dot]xyz).

There is currently a total of 1.3M$ETH, nearly $4 billion in value, accounting for 1.11% of the circulation,

📈 According to the website, the holdings of these companies have increased from 110K ETH to 1.3M in the past three months, which is a 1,200% increase

📈 There are currently 48 entities holding more than 100 ETH

It should be noted here that the number of @BitMNR mentioned earlier is currently pending, as the news said, the $ETH reserve of $250 million will be promoted, and the position of 100K will be calculated with $2,500, and the ranking will directly enter the top ten

In addition to the original major DeFi protocols, there are also mining companies like BTC Digital

According to news on June 26, they intend to convert all $BTC positions worth $34M into $ETH

we're still early 🦇🔊

SER price performance in USD

The current price of solana-equity-reserve is $0.000071477. Over the last 24 hours, solana-equity-reserve has increased by +143.28%. It currently has a circulating supply of 999,997,615 SER and a maximum supply of 999,997,615 SER, giving it a fully diluted market cap of $71.80K. The solana-equity-reserve/USD price is updated in real-time.

5m

-36.07%

1h

+143.28%

4h

+143.28%

24h

+143.28%

About Solana Equity Reserve (SER)

SER FAQ

What’s the current price of Solana Equity Reserve?

The current price of 1 SER is $0.000071477, experiencing a +143.28% change in the past 24 hours.

Can I buy SER on OKX?

No, currently SER is unavailable on OKX. To stay updated on when SER becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of SER fluctuate?

The price of SER fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Solana Equity Reserve worth today?

Currently, one Solana Equity Reserve is worth $0.000071477. For answers and insight into Solana Equity Reserve's price action, you're in the right place. Explore the latest Solana Equity Reserve charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Solana Equity Reserve, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Solana Equity Reserve have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.