This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

PRISMA

PRISMA price

DsyV6b...Pump

$0.00013124

+$0.00011600

(+760.86%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about PRISMA today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

PRISMA market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$131.24K

Network

Solana

Circulating supply

999,999,522 PRISMA

Token holders

218

Liquidity

$102.13K

1h volume

$5.17M

4h volume

$5.17M

24h volume

$5.17M

PRISMA Feed

The following content is sourced from .

🔥 Biteye AI Daily July 21

Market Cap Today: $11.85B +0.99%

The sector has followed the market to experience two consecutive weeks of continuous growth, which is a bit unbelievable, and the construction of the sector has made progress in both infrastructure and application layers.

📈24h Coingecko Trading Volume Top10:

Token trading volume market capitalization price fluctuates

1- $VIRTUAL $235.6M $1.2B $1.80 +0.9%

2- $TAO $161.6M $3.9B $413.51 -1.3%

3- $SAHARA $102.2M $170.8M $0.08 +6.7%

4- $AI16Z $73.2M $198.3M $0.18 +3.2%

5- $AIXBT $68.5M $163.3M $0.17 +0.5%

6- $BANANAS31 $65.9M $71.4M $0.01 -3.1%

7- $KAITO $40.4M $399.7M $1.66 +0.4%

8- $GOAT $35.8M $130.2M $0.13 -1.0%

9- $COOKIE $32.9M $122.0M $0.21 +4.2%

10- $PROMPT $25.4M $34.8M $0.16 +2.1%

⭐️ Key information

1. @VaderResearch Introducing Virgen Capital: a venture capital firm with multi-agent AI doing due diligence

- Data source layer: public data crawling + AI Agent interview founder + NLP psychological portrait.

- Analysis layer: Market potential, scenario deduction, and predictive analysis are completed in one stop.

Comments: Following the launch of the secondary hedge fund @AIxVC_Axelrod, the ACP multi-agent system of the @virtuals_io ecosystem has been promoted to VC business; $VADER narrative adds another link.

2. The Robot Coordination Layer @PrismaXai white paper is launched, and you can participate in the test to win points

- Introduced "Proof-of-View" to incentivize robot data collection

- Remotely control the open source stack + distributed human data engine to connect operators, robot users, fleets and manufacturers.

- Interactive white paper quizzes to earn additional PrismaX points for completing:

Comments: If you are optimistic about the robot track, this is a good early participation opportunity.

3. Bittensor Subnet No. 106 @v0idai VoidAI v2 Launched - TAO crosses over to Solana for the first time

- Trust Minimization Bridge: Lock TAO / ALPHA tokens and get wTAO / wALPHA tokens on Solana.

- Reverse burning wrapped tokens unlocks original chain assets

- Alpha bridges and liquidity pools are open today.

Comments: Phantom + Raydium can now be directly exchanged for $wTAO and alpha on various subnets, and Bittensor's asset liquidity has been further accelerated.

📊 Sources: @xhunt_ai, Cookie DAO, Coingecko

💡 Risk warning: The above is for information sharing only and is not investment advice.

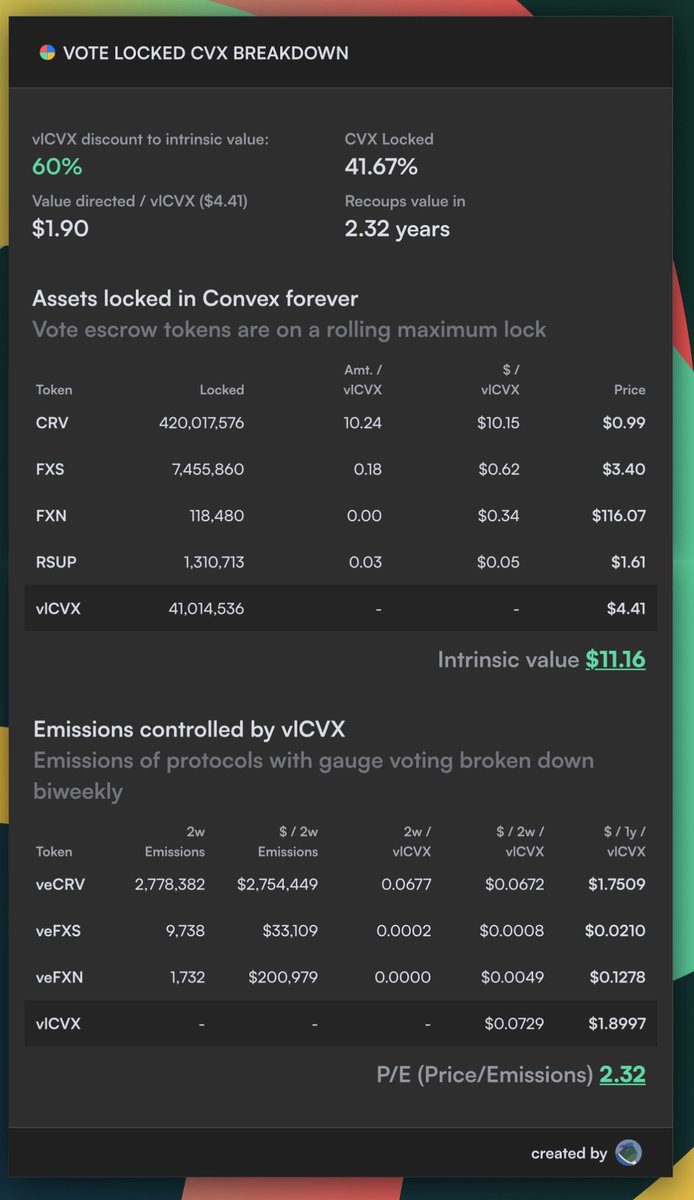

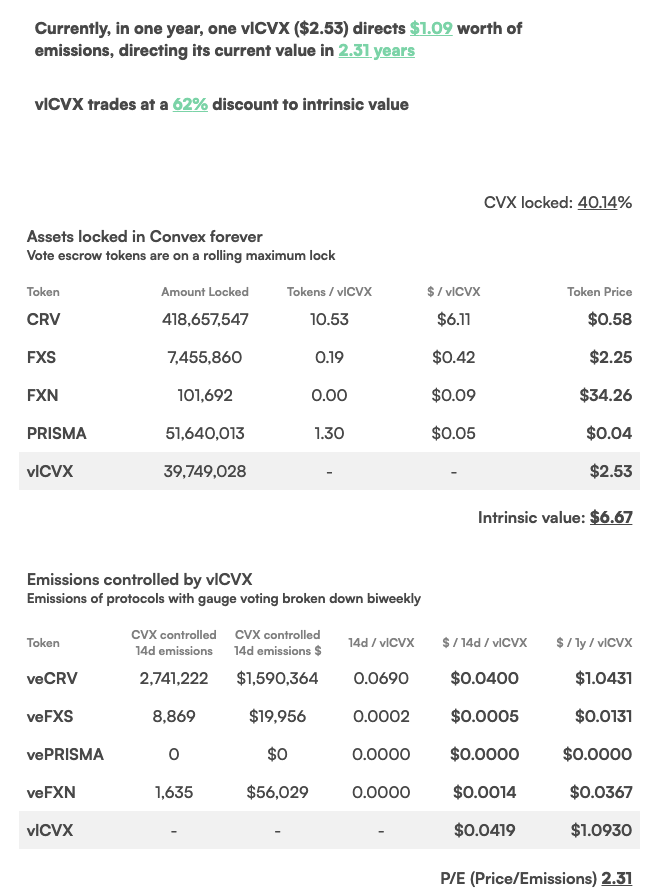

In honor of $CVX tapping $5 yesterday…

Here is a post of me begging you to buy at $2.50 while everyone was calling $CRV dead.

The good news is at $4.40 $CVX is still trading at only 39% of its intrinsic value ($11.16).

1st TP is $41 but I’m expecting $100+ $CVX in a few years

Small Cap Scientist 👨🔬🧪🥼

Let's look at the @ConvexFinance Balance Sheet.

418M $CRV ($.60) - $250.8M

7.45M $FXS ($2.25) - $16.76M

101,692 $FXN ($34.26) - $3.48M

(We didn't include $PRISMA as those tokens will be migrated to Resupply.)

Total Assets - $271M

How does that compare to the Convex Valuation?

Convex MC - $206M

Convex FDV -$251M

The Convex $CRV position is the same size as the entire $CVX FDV.

If you look at their circulating market cap they are trading at a 24% discount to their current balance sheet.

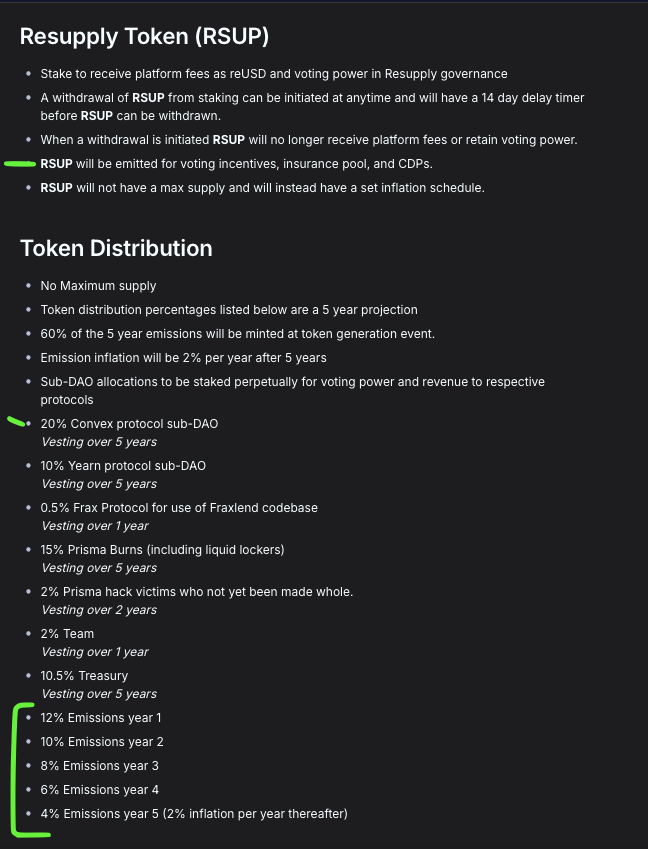

They are also the largest owners of $RSUP from Resupply.

Over five years, 20% of the total $RSUP supply will go to Convex vesting. $RSUP is currently $2.10 per token, which would value the Convex position at $62M.

Convex was significantly undervalued before @ResupplyFi went live. Adding Resupply to their arsenal of assets makes $CVX look like an absolute steal.

In addition to getting 20% of the $RSUP supply to the Convex Treasury, 50% of the resupply emissions will go directly to bribes.

At current prices, the year one $RSUP emissions alone will produce $12.6M in bribe income for $vlCVX.

If you want to bet on Stablecoin growth, @ConvexFinance gives you exposure to Frax, Curve, and Resupply.

It is hard to beat value like this in an exploding sector.

GL!

Great sum-up for those not terminally online.

Not just airdrop checkers, but info about points, TGEs, snapshots. These come weekly on @earndrop_io ⚡️

All links for each airdrop are included below (checkers), and also the eligibility criteria to get them

Earndrop (Airdrop Checker)

Weekly Earndrop Recap (21 June 2025)

🪂 $SPK: airdrop claim

🪂 $BLUM: eligibility checker

🪂 $NANSEN: season 1 points

🪂 $S: season 2 points

🪂 $NEWT: tokenomics timeline

🪂 $INK: token announced

🪂 $FRAG: NFT info

🪂 $CAMP: NFT info

🪂 $KAT: launch info

🪂 $NOBLE: point program extension

🪂 $HYLI: testnet live

🪂 $EIGEN: new investment

🪂 $PRISMA: new raise

🪂 $GRAD: new raise

🪂 $UBYX: new raise

🪂 $PUBAI: new raise

🪂 $XFX: new raise

🪂 $ELEVEN: new raise

🪂 $WILD: new raise

🪂 $TAC: new raise

🪂 $UP: new raise

Eligible wallets, checker links, and official information for each one below:

Weekly Earndrop Recap (21 June 2025)

🪂 $SPK: airdrop claim

🪂 $BLUM: eligibility checker

🪂 $NANSEN: season 1 points

🪂 $S: season 2 points

🪂 $NEWT: tokenomics timeline

🪂 $INK: token announced

🪂 $FRAG: NFT info

🪂 $CAMP: NFT info

🪂 $KAT: launch info

🪂 $NOBLE: point program extension

🪂 $HYLI: testnet live

🪂 $EIGEN: new investment

🪂 $PRISMA: new raise

🪂 $GRAD: new raise

🪂 $UBYX: new raise

🪂 $PUBAI: new raise

🪂 $XFX: new raise

🪂 $ELEVEN: new raise

🪂 $WILD: new raise

🪂 $TAC: new raise

🪂 $UP: new raise

Eligible wallets, checker links, and official information for each one below:

I recalled, I used or dug up most of these projects, but I was lucky enough to land them smoothly.

My biggest loss was $USD 0 suddenly changed the redemption rules, and finally was deducted 5% and barely escaped, but it was more than a month for nothing.

But I know that people can't always be lucky, after being distracted by the news of DeFi that has been hacked, masturbated, guarded and stolen...

The result was a huge interest in investing in government bonds 😅

Now U.S. bonds, 4.65% per annum at a locked-in interest rate for 30 years, can now even be discounted at 9.2%.

It's really the opposite...

This is also the Crypto version of the "family of origin".

Similar to being too insecure, so looking for a giant security?

Hoi

Let's talk about the Defi projects I've played and hacked. Don't talk about what you haven't played, and some of you have forgotten after playing too much, just write based on your impressions.

The following are mines that have deposited money but have withdrawn when they were hacked, and were lucky enough to escape:

YFI Finance, AC ace project, the ancestor of the machine gun pool, was also hacked;

YFV Finance, YFI's imitation disk, has been stolen two or three times, and was hacked to bankrupt;

Cream Finance was also hacked to bankruptcy, and was hacked by YFI's YUSD calculation of the collateral value above and then hacked by the revolving loan;

Sushi Finance, xsushi has a profit loophole, so it's not a big problem. At that time, aave's xsushi also had the same value calculation problem as cream, but it could not be used.

Curve Finance, I deposited U, stolen various ETH derivatives, escaped;

RDNT Finance, which was hacked to bankrupt;

Packagebunny Finance, which was hacked to the point of bankruptcy;

qubit finance, which was hacked to bankrupt;

ANKR, the ETH I deposited, the stolen was BNB, dodged;

Alchemix Fi, which was stolen long after I quit;

Abracadabra money, which I stole long after I quit;

Blast, because Deth large investors were phished, and various assets of the lending protocol were lent by hackers to form bad debts.

——

Mines that have lost part of their money:

Harvest Finance: This is actually very hurtful, I didn't save U But at that time I held a lot of farm, although the TVL of 1 billion was only 30 million, but the farm price was directly cut in half;

armor fi, was deceived by hackers to smash the project token, lost a little but was okay;

Prisma Finance, hackers took a small portion of the money from the pool.

——

Lost but recovered mines:

O3swap, this is a mine where a lot of money has been stolen, and the divine fish and many big players are also there, but fortunately they came back in the end, thanks to many white hat companies for their help;

Kava Network, a multichain used for cross-chain bridges, I have it on the KAVA official website. Then the founder of Multichain was arrested, and the deposit and withdrawal that had been open for a few days ran out, after which the door was closed forever. The u in FTM has also become waste paper;

Defrost finance, the project team claimed to have lost 3 private keys at the same time and was hacked, I spent some money to find someone to locate the project team to contact me, and let them hack into a white hat.

However, the largest depositor has almost 10m USD, which is a bankrupt institution in the United States, and after they were taken over by the lawyer, the money has not been withdrawn, maybe the lawyer will not operate, and finally the money should be taken away by the project party;

ParaSpace, the team that looks like a divine fish preemptively executed the hacker's transaction and rescued the money, thank you.

——

The mine that really lost all the principal:

Evodefi, a bridge, suddenly gets stuck and then disappears;

Cetus finance, the official Dex, has a strong background, and the accident is a bit unexpected.

——

There may be some omissions in the stolen game, as well as various rule pits and rug pull mines, so I won't write about it if it doesn't count as hacker theft.

Anyway, after playing all the way, I feel that I have been stepping on the tightrope to make money, and the later mines have also been more conservative, and this time I really stepped on the thunder.

After that, you should gradually reduce your investment in Defi, and you can sleep more peacefully by investing in stocks.

PRISMA price performance in USD

The current price of prisma is $0.00013124. Over the last 24 hours, prisma has increased by +760.86%. It currently has a circulating supply of 999,999,522 PRISMA and a maximum supply of 999,999,522 PRISMA, giving it a fully diluted market cap of $131.24K. The prisma/USD price is updated in real-time.

5m

+27.70%

1h

+760.86%

4h

+760.86%

24h

+760.86%

About PRISMA (PRISMA)

PRISMA FAQ

What’s the current price of PRISMA?

The current price of 1 PRISMA is $0.00013124, experiencing a +760.86% change in the past 24 hours.

Can I buy PRISMA on OKX?

No, currently PRISMA is unavailable on OKX. To stay updated on when PRISMA becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of PRISMA fluctuate?

The price of PRISMA fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 PRISMA worth today?

Currently, one PRISMA is worth $0.00013124. For answers and insight into PRISMA's price action, you're in the right place. Explore the latest PRISMA charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as PRISMA, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as PRISMA have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.