Notice: The trading of this cryptocurrency is currently not supported on OKX. Continue trading with cryptocurrencies listed on OKX.

NEWT

Newton price

This data isn’t available yet

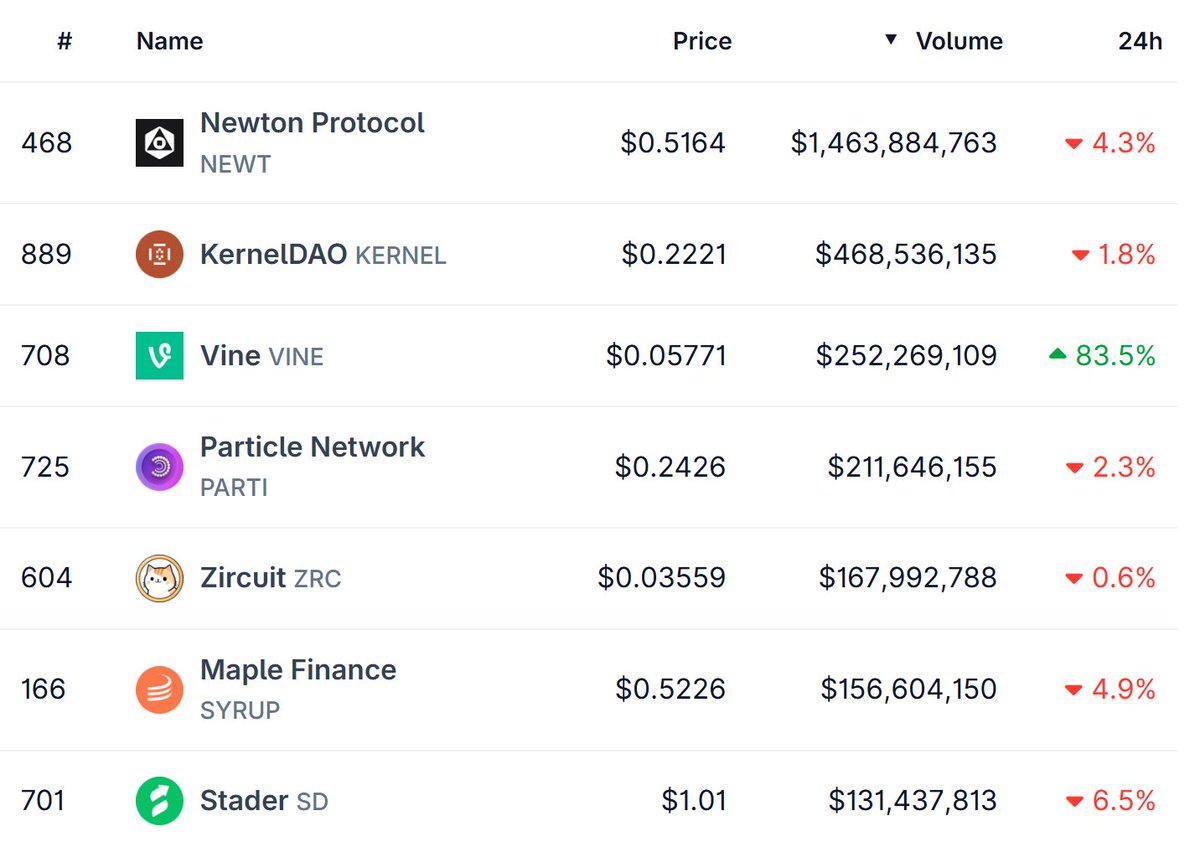

You’re a little early to the party. Check out these other crypto for now.

Newton Feed

The following content is sourced from .

My long on $HOME looking so good

Stairway to heaven 😍

New ATH

Eunice D Wong 🦄

Longed few more positions

These are high probability patterns, based n bottomed also given me confirmation for bigger wicks n breakouts

$SAHARA

$STO

$HOME

$NEWT

IMO it’s great to trade in trenches but I also like longs in daily timeframes, some spots some perps so I long them leave them there n chill, the market is in the capacity to do so

Then just let them wing their magic

Chill, drink tea n make $$

Do what u want with these infos

It's still the first time I've been interviewed, in fact, I've talked a lot haha, you can also pay attention to this brother, there are some of my new milestones in the interview.

0xcult

#0xCult In-Depth Review

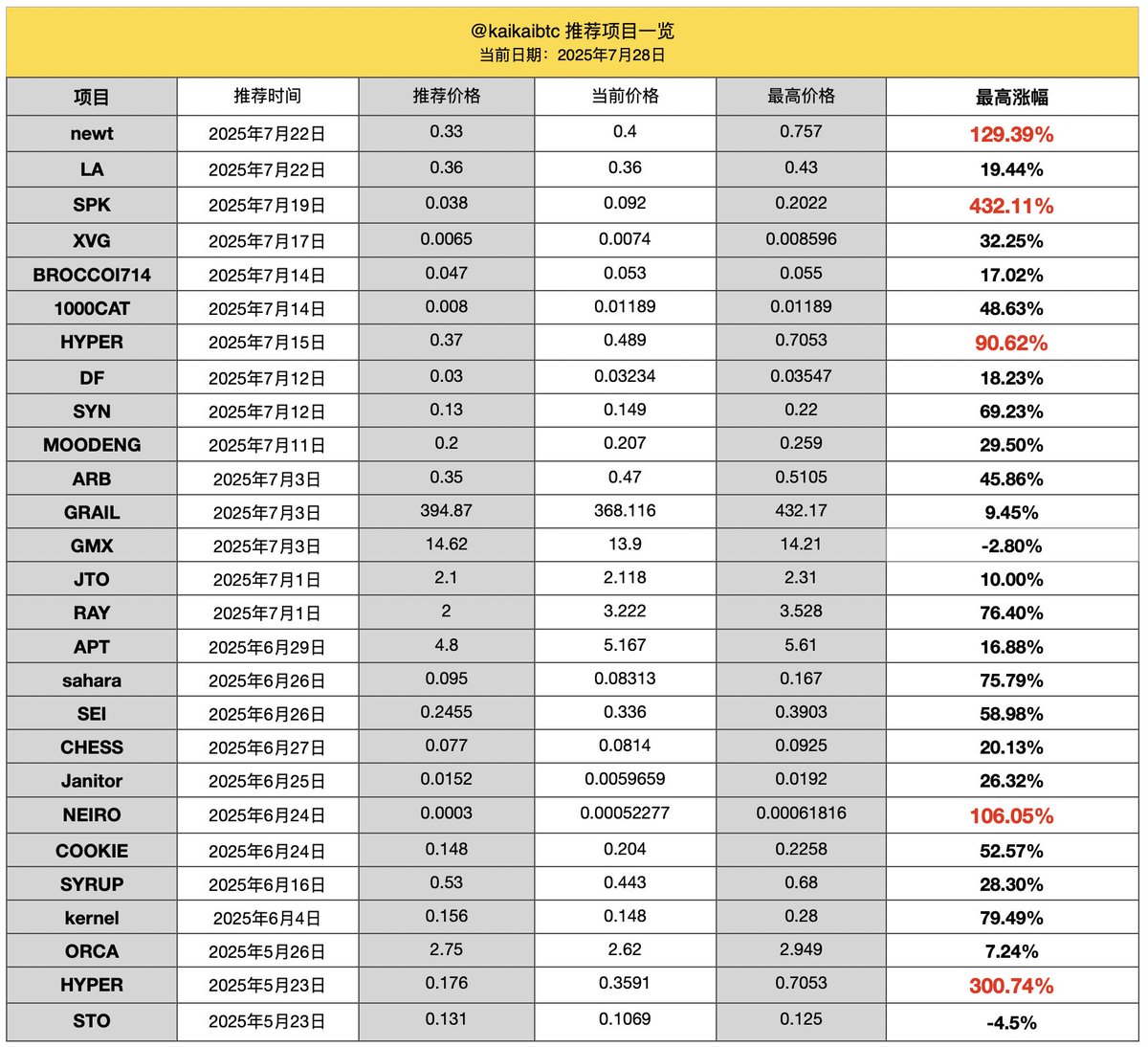

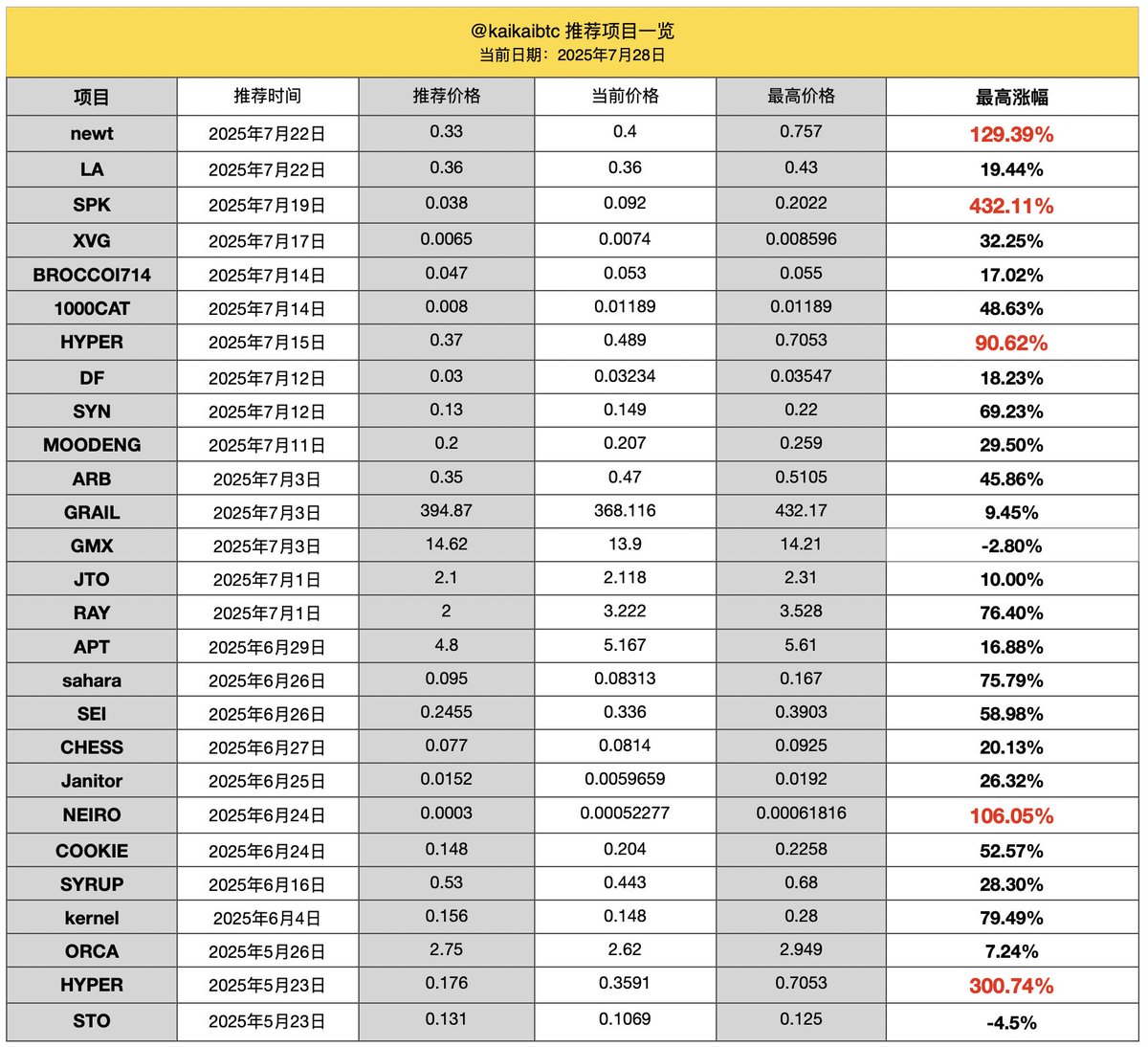

This issue features a secondary market expert I really admire—Kai Ge @kaikaibtc. As we all know, there are various teachers in the blockchain space, but it's rare to find someone like Kai Ge who provides detailed guidance on buying, stop-loss, and take-profit strategies.

Reasons for Recommendation and Guest Introduction

In the current period of low liquidity, with a clear stratification between the primary and secondary markets, buying some high-certainty secondary spot assets is a prudent choice. On one hand, it allows you to stay sensitive to the market without leaving it, and on the other hand, there is a significant possibility of preserving your capital or even growing it. Kai Ge told me that opportunities on the primary chain will always exist, but we need to do different things at different times to have a chance at achieving the results we can.

Recently, Kai Ge has had some high-performing Twitter calls, and I have always believed that the real data comes from these Twitter calls.

$newt

$spk

$hyper

$NEIRO

Following Kai Ge's trading logic in the secondary market will yield good returns. For low-performing or poor data, Kai Ge also holds back, leaving it to the market to validate.

Entrust your position to time; you need not say much, as the profits will speak for you!

Feeling disheartened but encountering a rebound, "cheat mode" Kai Ge starts with A8!

Kai Ge previously came from the traditional finance industry. Due to the industry's downturn and some unpleasant experiences, he decided to seek a new direction and eventually entered the crypto space. He was introduced to the crypto world by a friend who mentioned there were great opportunities. Coupled with his instincts from traditional finance, Kai Ge sensed incredible potential here. Unfortunately, his first project in the space was a failure, leading him to sell a house for hundreds of thousands to continue his journey. The second project was a mining machine project where he participated in daily subscriptions, and then it took off, multiplying his capital by 30 times, accumulating his first bucket of gold in crypto, and he directly started with A8!

Reflecting on this experience, Kai Ge believes he truly learned the trading model belonging to the crypto space in early 2021 and summarized his previous experiences through review. During that bull market, Kai Ge did not focus too much on candlestick charts but relied more on capital flow and news, even making decisions based on market feel. Moreover, during that bull market, no matter what you bought, it might feel like you were buying at the peak, but after a month or two, those buying points were merely halfway up the mountain.

As a result, the so-called bear market narratives emerged in the industry, whether it be chain games, NFTs, or inscriptions, all presenting new narratives to explore. It’s not like now, where Bitcoin keeps rising, but the liquidity on-chain is quite poor.

Perhaps many people know Kai Ge because he has been advocating for dollar-cost averaging into $sol and $metis for a long time. Later, $metis rose from $10 to nearly $170, and $sol went from $20 to a peak of over $290.

Facing new narratives, old experiences can be a hindrance.

Kai Ge summarized his losses in the secondary market last year and admitted he missed the opportunity in the on-chain AI market. Although he started with spot trading, he was not familiar with contract trading, so when he tried contract trading, he only chose to go long, which caused him to miss many opportunities.

Now, Kai Ge hopes to reshape his Twitter IP, interact with more young people, and learn about the latest trends on-chain. Many concepts on-chain are quite abstract, and young people tend to accept them more quickly. This is why in the last market cycle, the results achieved by young traders were relatively abundant. At the beginning of the market, many who were involved in DeFi and yield farming scoffed at low-cap coins, but when the market peaked, the real attraction for others came just as the market was slowly fading, even becoming the liquidity for young traders to exit.

On-chain narratives are everlasting; the baton may slowly be passed to the younger generation.

Whether it’s chain games, NFTs, or inscriptions, they all represent a form of on-chain narrative. As time goes on, the pace on-chain is becoming increasingly rapid, with the younger generation taking over most of the market rhythm, but the capital remains in the hands of seasoned investors. Kai Ge believes that both the on-chain market and the secondary market should progress together and complement each other. The logic on-chain is stronger, which can significantly increase the probability of making money.

Also, never reject market makers; without them, the candlestick charts would look very ugly, and basically, no coins would be able to run. The financial systems in North America and Europe have been around for hundreds of years, so there will definitely be market makers present, providing psychological support at certain price levels. Dancing with the market makers and accepting this unspoken rule is essential for better navigating the market.

#0xCult In-Depth Review

This issue features a secondary market expert I really admire—Kai Ge @kaikaibtc. As we all know, there are various teachers in the blockchain space, but it's rare to find someone like Kai Ge who provides detailed guidance on buying, stop-loss, and take-profit strategies.

Reasons for Recommendation and Guest Introduction

In the current period of low liquidity, with a clear stratification between the primary and secondary markets, buying some high-certainty secondary spot assets is a prudent choice. On one hand, it allows you to stay sensitive to the market without leaving it, and on the other hand, there is a significant possibility of preserving your capital or even growing it. Kai Ge told me that opportunities on the primary chain will always exist, but we need to do different things at different times to have a chance at achieving the results we can.

Recently, Kai Ge has had some high-performing Twitter calls, and I have always believed that the real data comes from these Twitter calls.

$newt

$spk

$hyper

$NEIRO

Following Kai Ge's trading logic in the secondary market will yield good returns. For low-performing or poor data, Kai Ge also holds back, leaving it to the market to validate.

Entrust your position to time; you need not say much, as the profits will speak for you!

Feeling disheartened but encountering a rebound, "cheat mode" Kai Ge starts with A8!

Kai Ge previously came from the traditional finance industry. Due to the industry's downturn and some unpleasant experiences, he decided to seek a new direction and eventually entered the crypto space. He was introduced to the crypto world by a friend who mentioned there were great opportunities. Coupled with his instincts from traditional finance, Kai Ge sensed incredible potential here. Unfortunately, his first project in the space was a failure, leading him to sell a house for hundreds of thousands to continue his journey. The second project was a mining machine project where he participated in daily subscriptions, and then it took off, multiplying his capital by 30 times, accumulating his first bucket of gold in crypto, and he directly started with A8!

Reflecting on this experience, Kai Ge believes he truly learned the trading model belonging to the crypto space in early 2021 and summarized his previous experiences through review. During that bull market, Kai Ge did not focus too much on candlestick charts but relied more on capital flow and news, even making decisions based on market feel. Moreover, during that bull market, no matter what you bought, it might feel like you were buying at the peak, but after a month or two, those buying points were merely halfway up the mountain.

As a result, the so-called bear market narratives emerged in the industry, whether it be chain games, NFTs, or inscriptions, all presenting new narratives to explore. It’s not like now, where Bitcoin keeps rising, but the liquidity on-chain is quite poor.

Perhaps many people know Kai Ge because he has been advocating for dollar-cost averaging into $sol and $metis for a long time. Later, $metis rose from $10 to nearly $170, and $sol went from $20 to a peak of over $290.

Facing new narratives, old experiences can be a hindrance.

Kai Ge summarized his losses in the secondary market last year and admitted he missed the opportunity in the on-chain AI market. Although he started with spot trading, he was not familiar with contract trading, so when he tried contract trading, he only chose to go long, which caused him to miss many opportunities.

Now, Kai Ge hopes to reshape his Twitter IP, interact with more young people, and learn about the latest trends on-chain. Many concepts on-chain are quite abstract, and young people tend to accept them more quickly. This is why in the last market cycle, the results achieved by young traders were relatively abundant. At the beginning of the market, many who were involved in DeFi and yield farming scoffed at low-cap coins, but when the market peaked, the real attraction for others came just as the market was slowly fading, even becoming the liquidity for young traders to exit.

On-chain narratives are everlasting; the baton may slowly be passed to the younger generation.

Whether it’s chain games, NFTs, or inscriptions, they all represent a form of on-chain narrative. As time goes on, the pace on-chain is becoming increasingly rapid, with the younger generation taking over most of the market rhythm, but the capital remains in the hands of seasoned investors. Kai Ge believes that both the on-chain market and the secondary market should progress together and complement each other. The logic on-chain is stronger, which can significantly increase the probability of making money.

Also, never reject market makers; without them, the candlestick charts would look very ugly, and basically, no coins would be able to run. The financial systems in North America and Europe have been around for hundreds of years, so there will definitely be market makers present, providing psychological support at certain price levels. Dancing with the market makers and accepting this unspoken rule is essential for better navigating the market.

BNB ($BNB) Bulls Charge Ahead to $843, Can Institutional Momentum Push It Higher?

BNB ($BNB) rocketed 6.2% to $843 in 24 hours, but parabolic rallies rarely last. As institutional money floods in and derivatives traders pile into leveraged longs, the Binance token now tests a key Fibonacci zone where past rallies have reversed.

$BNB’s rise is backed by institutional investment and network upgrades that have allowed transactions to be completed faster than ever. But overheated technicals—long/short ratios at 1.61 and weakening volume deltas—hint at an impending squeeze.

USYC is now supported as off-exchange collateral for @binance institutional clients, unlocking more capital efficient yield with tokenized U.S. Treasuries.

TMMF backed by U.S. Treasuries

Near-instant fungibility with USDC

This collaboration brings the power of tokenized… pic.twitter.com/YHBq0w7eUC— Circle (@circle) July 24, 2025

BNB’s recent price increase to all-time highs—triggering over $180 million in liquidations—reflects more than just market speculation.

Behind this bullish demand lies a powerful combination of institutional adoption, DeFi growth, and strategic technological advancements that are reshaping BNB’s role in the crypto ecosystem.

USYC is now supported as off-exchange collateral for @binance institutional clients, unlocking more capital efficient yield with tokenized U.S. Treasuries.

TMMF backed by U.S. Treasuries

Near-instant fungibility with USDC

This collaboration brings the power of tokenized… pic.twitter.com/YHBq0w7eUC— Circle (@circle) July 24, 2025

The network’s $7.1 billion Total Value Locked (TVL) and $11.8 billion market cap show strong investor confidence, but what’s truly driving momentum is the rising amount of institutional capital.

USYC is now supported as off-exchange collateral for @binance institutional clients, unlocking more capital efficient yield with tokenized U.S. Treasuries.

TMMF backed by U.S. Treasuries

Near-instant fungibility with USDC

This collaboration brings the power of tokenized… pic.twitter.com/YHBq0w7eUC— Circle (@circle) July 24, 2025

Nasdaq-listed Liminatus Pharma has committed up to $500 million in phased BNB investments, while China’s Nano Labs is targeting a $1 billion investment in $BNB, leading to a $500 million convertible note agreement with investors.

Meanwhile, hedge fund executives are rebranding a public entity as Build & Build Corporation, planning to deploy $100 million into BNB.

USYC is now supported as off-exchange collateral for @binance institutional clients, unlocking more capital efficient yield with tokenized U.S. Treasuries.

TMMF backed by U.S. Treasuries

Near-instant fungibility with USDC

This collaboration brings the power of tokenized… pic.twitter.com/YHBq0w7eUC— Circle (@circle) July 24, 2025

The network’s tech infrastructure is also witnessing a makeover, as it evolves at a rapid pace. The recent Maxwell upgrade slashed block finality to 0.75 seconds, doubling throughput and enhancing efficiency.

Looking ahead, the 2025–2026 roadmap introduces gas limit scaling and privacy features, while a Rust-based client (built on Ethereum’s Reth architecture) promises 5,000 DEX swaps per second, faster smart contract execution, and improved memory management.

These upgrades ensure that BNB remains competitive as Web3 adoption continues to grow at a rapid pace.

Binance is also deepening BNB’s utility in DeFi and institutional finance. Its partnership with Circle integrates USYC, a yield-bearing stablecoin, as collateral for off-exchange derivatives, thereby bridging traditional fixed-income products with the crypto market.

USYC is now supported as off-exchange collateral for @binance institutional clients, unlocking more capital efficient yield with tokenized U.S. Treasuries.

TMMF backed by U.S. Treasuries

Near-instant fungibility with USDC

This collaboration brings the power of tokenized… pic.twitter.com/YHBq0w7eUC— Circle (@circle) July 24, 2025

Meanwhile, Binance’s push into AI is evident with new listings like Sahara AI (SAHRA) and Newton Protocol (NEWT), signaling a broader shift toward AI-driven blockchain applications.

All in all, $BNB is no longer a regular exchange token; it’s gradually becoming an important piece in the crypto economy.

$BNB/USDT Climbs into Key Fib Zone Amid Parabolic Rally and Crowded Long Positioning

Binance Coin (BNB/USDT) has extended its sharp ascent, pumping from a local base near $745 to highs above $855 in under a week.

On the 1-hour chart, the move has unfolded in a textbook parabolic arc, now brushing into the 0.236 Fibonacci zone around $833–$860. Historically, this area has been an important level where overheated rallies often stall as traders take profits.

USYC is now supported as off-exchange collateral for @binance institutional clients, unlocking more capital efficient yield with tokenized U.S. Treasuries.

TMMF backed by U.S. Treasuries

Near-instant fungibility with USDC

This collaboration brings the power of tokenized… pic.twitter.com/YHBq0w7eUC— Circle (@circle) July 24, 2025

However, what’s unfolding on the hourly candlestick chart warrants closer attention.

The most recent cluster of candles, viewed up close, shows a distinct shift in tone. While earlier candles were large-bodied and directional (bullish marubozu candles with momentum), the current batch tells a different story.

Several of the latest candles exhibit long upper wicks, smaller real bodies, and alternating red-green sequences. Rejection tails and doji-like candles suggest buyers are losing control near these highs and are meeting overhead resistance.

This type of price action, emerging right after a euphoric run, often precedes stalling or short-term exhaustion.

Regarding volume, there’s more weight to the assessment.

During the initial breakout between $800 and $830, several large bullish candles were supported by strong volume deltas—one showing a +27.06K delta on a total of 135K trades, and another with +13.57K delta against 97K volume. This confirms that aggressive buyers were actively driving the rally.

USYC is now supported as off-exchange collateral for @binance institutional clients, unlocking more capital efficient yield with tokenized U.S. Treasuries.

TMMF backed by U.S. Treasuries

Near-instant fungibility with USDC

This collaboration brings the power of tokenized… pic.twitter.com/YHBq0w7eUC— Circle (@circle) July 24, 2025

However, as BNB approached $850, the order flow dynamics began to show hesitation. One recent footprint bar revealed a meager delta of +3.44K on 24K volume, indicating that buyers are no longer dominating with the same force.

Sellers are beginning to meet buyers at these highs, leading to a neutralization of delta even as prices tick up. Meanwhile, derivatives positioning appears stretched.

USYC is now supported as off-exchange collateral for @binance institutional clients, unlocking more capital efficient yield with tokenized U.S. Treasuries.

TMMF backed by U.S. Treasuries

Near-instant fungibility with USDC

This collaboration brings the power of tokenized… pic.twitter.com/YHBq0w7eUC— Circle (@circle) July 24, 2025

Upon closer examination, we can see that the CoinGlass data indicates a 347% increase in volume, a 37% rise in open interest, and long/short ratios skewed heavily in favor of long positions (1.61 on Binance).

This asymmetric buildup suggests the rally is increasingly driven by leverage—and that the current price zone is vulnerable to a flush if upward momentum weakens further.

All in all, the parabolic ascent has carried BNB into a high-risk technical zone. Candlestick behavior, volume imbalance, and overextended long positioning all point toward a market that is top-heavy.

Traders should watch for an extended rally above $860, followed by strong volume from the bulls. Failure to hold the $833 zone could see a deeper correction toward $793.

VINE Coin Update:

$VINE, our beloved gem on SOL, just pumped big.

Elon Musk hinted he might bring back the Vine app with some AI twist, and that sent everyone into a frenzy.

The coin is up huge from our buying zone - up by 6X+.

Elon has saved your bags a lot of times. How would you say thanks to him?

About Newton (NEWT)

Learn more about Newton (NEWT)

Newton Protocol Revolutionizes Web3 Automation with AI, Gamification, and Cross-Chain Compatibility

What is Newton Token? NEWT Coin Price and News Introduction to Newton Protocol and Its Vision Newton Protocol (NEWT) is a groundbreaking AI-driven automation platform designed to simplify complex Web3

Jun 25, 2025|OKX

Newton Protocol: Revolutionizing Web3 Automation with AI and Blockchain

Introduction to Newton Protocol: A New Era in Web3 Automation The Newton Protocol (NEWT) is revolutionizing the blockchain and decentralized finance (DeFi) landscape by introducing a cutting-edge infr

Jun 25, 2025|OKX

Magic Newton Revolutionizes Web3 Automation with AI, Gamification, and Transparency

Introduction to Newton Protocol Binance: Simplifying Web3 Operations The Web3 ecosystem has often been criticized for its complexity, which hinders mainstream adoption. Newton Protocol, a groundbreaki

Jun 24, 2025|OKX

Newton FAQ

What is cryptocurrency?

Cryptocurrencies, such as NEWT, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as NEWT have been created as well.

Can I buy NEWT on OKX?

No, currently NEWT is unavailable on OKX. To stay updated on when NEWT becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of NEWT fluctuate?

The price of NEWT fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.