Filecoin price

in USDCheck your spelling or try another.

About Filecoin

Filecoin’s price performance

Filecoin in the news

Currently at $2.44, token has support in the $2.38-$2.39 range, and resistance at $2.46.

Sui (SUI) rose 5% and Filecoin (FIL) jumped 4.5% from Thursday.

FIL trading volume was 75% above 30-day averages, signaling heightened institutional interest.

Filecoin (FIL) joined Uniswap (UNI) as an underperformer, declining 10.6% over the weekend.

The advance occurred alongside a strong day for broader crypto markets.

Support has been established at $2.49, with resistance at the $2.68 level.

Filecoin on socials

Guides

Filecoin on OKX Learn

Filecoin FAQ

In the Filecoin network, there are two different forms of mining: storage and retrieval. In storage mining, users generate FIL by storing data for customers and performing cryptographic proofs to continuously verify the data's integrity and ensure that the miner has not altered the data. In retrieval mining, users acquire FIL by winning bids and mining fees for a specific file, which are exclusively based on the file size's market value.

To begin using Filecoin, go to their website and look for a storage provider that meets your requirements. You must know what type of data you intend to store, how long you intend to keep it, and how much you are willing to pay. Filfix, the Filecoin explorer, displays prices, stability, and a variety of other statistics. You can also apply to become one of the 4,000 storage providers here.

Easily buy FIL tokens on the OKX cryptocurrency platform. Available trading pairs in the OKX spot trading terminal include FIL/USDT, FIL/USDC, FIL/BTC, and FIL/ETH.

You can also buy FIL with over 99 fiat currencies by selecting the "Express buy" option. Other popular crypto tokens, such as Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and USD Coin (USDC), are also available.

Alternatively, you can swap your existing cryptocurrencies, including XRP (XRP), Cardano (ADA), Solana (SOL), and Chainlink (LINK), for FIL with zero fees and no price slippage by using OKX Convert.

To view the estimated real-time conversion prices between fiat currencies, such as the USD, EUR, GBP, and others, into FIL, visit the OKX Crypto Converter Calculator. OKX's high-liquidity crypto exchange ensures the best prices for your crypto purchases.

Dive deeper into Filecoin

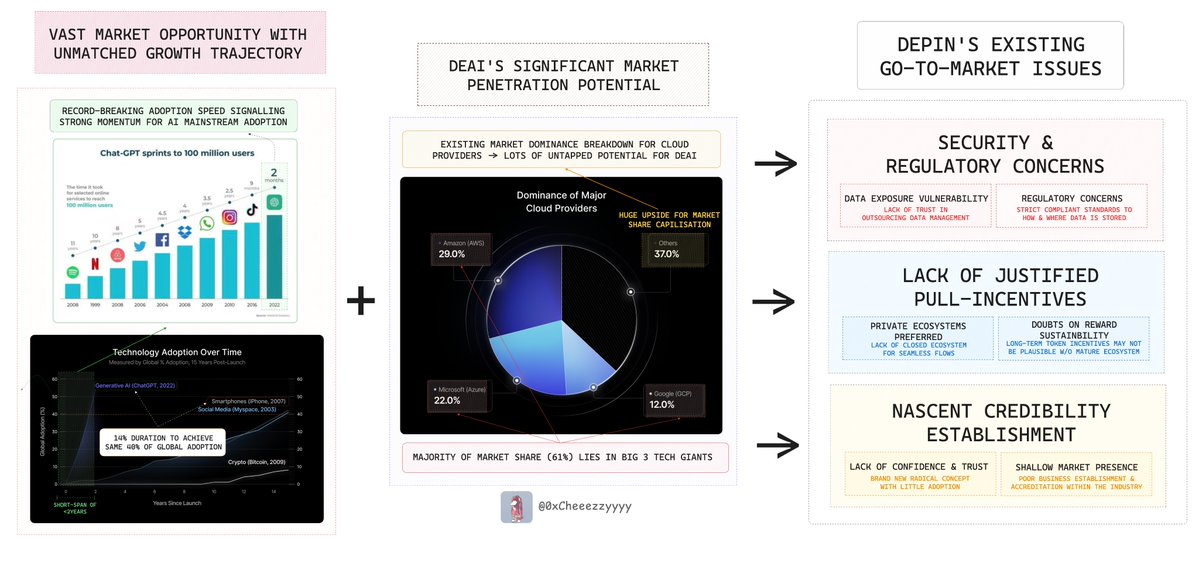

Filecoin, founded in 2014, is a peer-to-peer (P2P), open-source data storage network that uses blockchain technology to store files reliably and verifiably. Anyone needing to store their files or with storage space to spare can join and participate in the network. Consider it a cold storage, but instead of being owned by a single entity such as Google or Amazon, it is owned by everyone.

Data storage on Filecoin is entirely private; it is fully encrypted and secured, meaning no one, not even your storage provider, can read it. Additionally, Filecoin users do not need to worry about storage space because the network has a capacity of 2.5 billion gigabytes, 40 times the size of the internet.

Filecoin employs Proof of Replication (PoRep) and Proof of Spacetime (PoSt) rather than Proof of Stake (PoS). According to PoRep, miners will be compensated with FIL tokens if they can demonstrate that they received the cryptographically encoded data from the client. On the other hand, PoSt ensures that the data is kept for the time period specified in the client's contract.

Users typically pay with FIL tokens to store their files with storage providers. The price of storage on Filecoin is determined by the network's demand and supply for storage, and anyone can participate. Users are not limited to a small and defined set of storage providers but can store their files with any storage provider offering any deal available on the network. This enables users to store and access their files at extremely low prices.

Filecoin's native cryptocurrency, FIL, serves as a payment medium. Users pay FIL for storage services, and storage providers earn FIL units for staking storage space. The Filecoin blockchain immutably records FIL transactions as well as storage proofs generated by storage providers.

FIL price and tokenomics

Filecoin's ICO was one of the biggest successes in the blockchain industry, raising a total of $205.8 million. With an initial funding goal of $40 million, its initial token price was pegged at $5 when introduced into the market.

It has a maximum supply of 2 billion tokens with a market capitalization of $1.7 billion. In the fall of 2020, Filecoin organized Space Race to increase the network's data capacity by 400 pebibytes. 400 miners participated in the testnet phase and were awarded 3.5 million FIL tokens.

Filecoin is a deflationary asset with a certain amount of FIL burned with every transaction. The fees burned are sent to an irrevocable burn address to compensate for the network expenditure of resources. The idea is based on Ethereum's EIP1559.

About the founders

Juan Benet co-founded Filecoin in 2014 with the California-based company Protocol Labs, of which he is the CEO.

Benet is a Stanford University graduate with a master's degree in computer science. Before Filecoin, he was the co-founder and CTO of Loki Studios, a mobile gaming studio focused on developing location-aware games. He also founded Athena Academy, a non-profit private school in Palo Alto devoted to educating students with dyslexia.

According to official documents, Filecoin secured $205.8 million during one of the industry's largest funding rounds. The project even received backing from venture capitalists Sequoia and Andreessen Horowitz.

Filecoin highlights

First, the popular browser Brave added Filecoin to their wallet, exposing Filecoin to over 56 million Brave users. This integration helped in creating awareness among Brave users about Filecoin.

Second, instead of temporary file storage, Filecoin partnered with Lighthouse to offer their users permanent file storage within the Filecoin ecosystem, coming at a one-time cost. On Filecoin, files are removed if clients stop paying storage fees, so offering permanent file storage is essential for the most important files or irrefutable information, such as NFTs.

Next, the Filecoin Foundation recently donated $10 million worth of Filecoins (50,000 FIL tokens) to the Internet Archive after its founder joined the Filecoin Foundations board of advisors. The donation is aimed at broadening the Internet Archive's reach to help more people across the globe educate themselves.

Finally, Filecoin had a v16 network upgrade, codenamed Skyr, and switched to using the Wasm-based Filecoin Virtual Machine to operate its basic functionality. This upgrade is the first step toward enabling user programmability on Filecoin and is the network's most significant change since its launch almost two years ago.

Disclaimer

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.