This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

ETF

Elon Taper Fade price

G9SAG1...pump

$0.0000034286

+$0.00000

(--)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about ETF today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

ETF market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$3.43K

Network

Solana

Circulating supply

998,993,315 ETF

Token holders

488

Liquidity

$6.32K

1h volume

$0.00

4h volume

$0.00

24h volume

$281.46

Elon Taper Fade Feed

The following content is sourced from .

The Economist: If stablecoins are really useful, they will also be truly disruptive

Written by: The Economist

Compiled by: Centreless

One thing is clear: the idea that cryptocurrencies have not yet produced any noteworthy innovations is a thing of the past.

In the eyes of conservatives on Wall Street, the "use cases" of cryptocurrencies are often discussed in a mocking tone. Veterans have already seen all this. Digital assets come and go, often with endless sights, exciting investors who are passionate about memecoins and NFTs. In addition to being used as a tool for speculation and financial crime, their use in other aspects has also been repeatedly found to be flawed and inadequate.

However, the latest wave of craze is different.

On July 18, President Donald Trump signed the GENIUS Act, providing stablecoins, crypto tokens backed by traditional assets, typically the U.S. dollar, with the regulatory certainty that industry insiders have long craved. The industry is booming; Wall Street people are now scrambling to get involved. "Tokenization" is also on the rise: on-chain asset trading volumes are growing rapidly, including stocks, money market funds, and even private equity and debt.

As with any revolution, revolutionaries rejoiced, while conservatives were worried.

Vlad Tenev, CEO of digital asset broker Robinhood, said the new technology could "lay the foundation for cryptocurrencies to become the backbone of the global financial system." ECB President Christine Lagarde has a slightly different view. She worries that the emergence of stablecoins is tantamount to "currency privatization".

Both sides are aware of the scale of the change at hand. Currently, the mainstream market may face more disruptive changes than earlier crypto speculation. Bitcoin and other cryptocurrencies promise to be digital gold, while tokens are just wrappers, or carriers that represent other assets. It may not sound spectacular, but some of the most transformative innovations in modern finance have really changed the way assets are packaged, split, and restructured – exchange-traded funds (ETFs), Eurodollars, and securitized debt are prime use cases.

Currently, the value of stablecoins in circulation stands at $263 billion, an increase of about 60% from a year ago. Standard Chartered expects the market value to reach $2 trillion in three years.

Last month, JPMorgan Chase, the largest bank in the United States, announced plans to launch a stablecoin-class product called JPMorgan Deposit Token (JPMD), despite the company's CEO Jamie Dimon who has long been skeptical of cryptocurrencies.

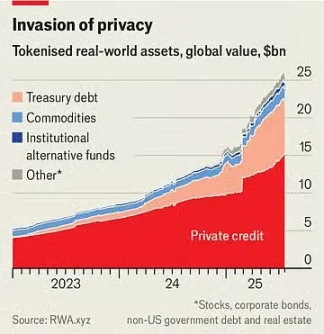

The market value of tokenized assets is only $25 billion, but it has more than doubled in the past year. On June 30, Robinhood launched over 200 new tokens for European investors, allowing them to trade U.S. stocks and ETFs outside of regular trading hours.

Stablecoins make transactions cheap and fast and convenient because ownership is instantly registered on a digital ledger, eliminating the need for intermediaries operating traditional payment channels. This is particularly valuable for cross-border transactions, which are currently costly and slow.

Although stablecoins currently account for less than 1% of global financial transactions, the GENIUS Act will give it a boost. The bill confirms that stablecoins are not securities and requires them to be fully backed by secure, liquid assets.

Retail giants, including Amazon and Walmart, are reportedly considering launching their own stablecoins. For consumers, these stablecoins may resemble gift cards, offering balances to spend at retailers and potentially at a lower price. This will kill companies like Mastercard and Visa, which have a profit margin of about 2% on sales in the US.

A tokenized asset is a digital copy of another asset, whether it's a fund, company stock, or a basket of goods. Like stablecoins, they can make financial transactions faster and easier, especially involving illiquid assets. Some products are just gimmicks. Why tokenize stocks? This may allow for 24-hour trading, as the exchanges where the stock is listed do not need to operate, but the advantages of this are questionable. Moreover, for many retail investors, the marginal transaction cost is already low or even zero.

Efforts to tokenize

However, many products are not so fancy.

Take money market funds, for example, which invest in Treasury bills. The tokenized version can double as a payment method. These tokens, like stablecoins, are backed by secure assets and can be seamlessly exchanged on the blockchain. They are also an investment that outperforms bank rates. The average interest rate on savings accounts in the United States is less than 0.6%; Many money market funds offer yields of up to 4%. BlackRock's largest tokenized money market fund is currently worth more than $2 billion.

"I anticipate that one day, tokenized foundations will be as familiar to investors as ETFs," the company's CEO, Larry Fink, wrote in a recent letter to investors.

This will have a disruptive impact on existing financial institutions.

Banks may be trying to dip their toes into new digital packaging spaces, but they are doing so in part because they realize that tokens pose a threat. The combination of stablecoins and tokenized money market funds may ultimately make bank deposits less attractive.

The American Bankers Association notes that if a bank loses about 10% of its $19 trillion in retail deposits, the cheapest way to finance, its average financing cost will rise from 2.03% to 2.27%. While total deposits, including business accounts, will not decrease, bank profit margins will be squeezed.

These new assets could also have disruptive implications for the broader financial system.

For example, holders of Robinhood's new stock tokens do not actually own the underlying shares. Technically, they own a derivative that tracks the value of an asset, including any dividends paid by the company, rather than the stock itself. As a result, they do not have access to the voting rights typically conferred by stock ownership. If the token issuer goes bankrupt, holders will be in trouble and will need to compete with other creditors of the failing company for ownership of the underlying assets. A similar situation has been encountered by Linqto, a fintech startup that filed for bankruptcy earlier this month. The company has issued shares of private companies through special purpose vehicles. Buyers are now unclear whether they own the assets they think they own.

This is one of the biggest opportunities for tokenization, but it also creates the greatest difficulties for regulators. Pairing illiquid private assets with easily tradable tokens opens up a closed market for millions of retail investors with trillions of dollars to allocate. They can buy shares in the most exciting private companies that are currently out of reach.

This raises questions.

Agencies like the U.S. Securities and Exchange Commission (SEC) have far more influence over public companies than private companies, which is why the former is suitable for retail investors. Tokens representing private shares turn what was once private equity into an asset that can be easily traded like an ETF. However, the issuer of the ETF promises to provide intraday liquidity by trading the underlying asset, which the token's provider does not. On a large enough scale, the token would actually turn a private company into a public company without any of the disclosure requirements that would normally be required.

Even pro-crypto regulators want to draw a line.

U.S. Securities and Exchange Commission (SEC) Commissioner Hester Peirce has been dubbed the "crypto mom" for her friendly approach to digital currencies. In a statement on July 9, she emphasized that the token should not be used to circumvent securities laws. "Tokenized securities are still securities," she wrote. Therefore, regardless of whether the securities are wrapped in new cryptocurrencies, the company issuing the securities must comply with the rules of disclosure. While this makes sense in theory, the large number of new assets with new structures means that regulators will be in an endless catch-up state in practice.

Therefore, there is a paradox.

If stablecoins are really useful, they will also be truly disruptive. The more attractive tokenized assets are to brokers, clients, investors, merchants, and other financial companies, the more they can transform finance, a change that is both welcome and worrying. Regardless of the balance between the two, one thing is clear: the idea that cryptocurrencies have not yet produced any noteworthy innovations is a thing of the past.

The crypto explosion is set to revolutionize finance

Source: The Economist

Compiled by: Liam

In the eyes of conservatives on Wall Street, the "use case" of cryptocurrencies is often discussed in a mocking tone. Veterans have already seen all this. Digital assets come and go, often with endless sights, exciting investors who are passionate about memecoins and NFTs. In addition to being used as a tool for speculation and financial crime, their use in other aspects has also been repeatedly found to be flawed and inadequate.

However, the latest wave of craze is different. On July 18, President Donald Trump signed the GENIUS Act, providing stablecoins, crypto tokens backed by traditional assets, typically the U.S. dollar, with the regulatory certainty that industry insiders have long craved. The industry is booming; Wall Street people are now scrambling to get involved. "Tokenization" is also on the rise: on-chain asset trading volumes are growing rapidly, including stocks, money market funds, and even private equity and debt.

As with any revolution, revolutionaries rejoiced, while conservatives were worried. Vlad Tenev, CEO of digital asset broker Robinhood, said the new technology could "lay the foundation for cryptocurrencies to become the backbone of the global financial system." ECB President Christine Lagarde has a slightly different view. She worries that the emergence of stablecoins is tantamount to "currency privatization".

Both sides are aware of the scale of the change at hand. Currently, the mainstream market may face more disruptive changes than earlier crypto speculation. Bitcoin and other cryptocurrencies promise to be digital gold, while tokens are just wrappers, or carriers that represent other assets. It may not sound spectacular, but some of the most transformative innovations in modern finance have really changed the way assets are packaged, split, and restructured – exchange-traded funds (ETFs), Eurodollars, and securitized debt are prime use cases.

Currently, the value of stablecoins in circulation stands at $263 billion, an increase of about 60% from a year ago. Standard Chartered expects the market value to reach $2 trillion in three years. Last month, JPMorgan Chase, the largest bank in the United States, announced plans to launch a stablecoin-class product called JPMorgan Deposit Token (JPMD), despite the company's CEO Jamie Dimon who has long been skeptical of cryptocurrencies. The market value of tokenized assets is only $25 billion, but it has more than doubled in the past year. On June 30, Robinhood launched over 200 new tokens for European investors, allowing them to trade U.S. stocks and ETFs outside of regular trading hours.

Stablecoins make transactions cheap and fast and convenient because ownership is instantly registered on a digital ledger, eliminating the need for intermediaries operating traditional payment channels. This is particularly valuable for cross-border transactions, which are currently costly and slow. Although stablecoins currently account for less than 1% of global financial transactions, the GENIUS Act will give it a boost. The bill confirms that stablecoins are not securities and requires them to be fully backed by secure, liquid assets. Retail giants, including Amazon and Walmart, are reportedly considering launching their own stablecoins. For consumers, these stablecoins may resemble gift cards, offering balances to spend at retailers and potentially at a lower price. This will kill companies like Mastercard and Visa, which have a profit margin of about 2% on sales in the US.

A tokenized asset is a digital copy of another asset, whether it's a fund, company stock, or a basket of goods. Like stablecoins, they can make financial transactions faster and easier, especially involving illiquid assets. Some products are just gimmicks. Why tokenize stocks? This may allow for 24-hour trading, as the exchanges where the stock is listed do not need to operate, but the advantages of this are questionable. Moreover, for many retail investors, the marginal transaction cost is already low or even zero.

Efforts to tokenize

However, many products are not so fancy. Take money market funds, for example, which invest in Treasury bills. The tokenized version can double as a payment method. These tokens, like stablecoins, are backed by secure assets and can be seamlessly exchanged on the blockchain. They are also an investment that outperforms bank rates. The average interest rate on savings accounts in the United States is less than 0.6%; Many money market funds offer yields of up to 4%. BlackRock's largest tokenized money market fund is currently worth more than $2 billion. "I anticipate that one day, tokenized foundations will be as familiar to investors as ETFs," the company's CEO, Larry Fink, wrote in a recent letter to investors.

This will have a disruptive impact on existing financial institutions. Banks may be trying to dip their toes into new digital packaging spaces, but they are doing so in part because they realize that tokens pose a threat. The combination of stablecoins and tokenized money market funds may ultimately make bank deposits less attractive. The American Bankers Association notes that if a bank loses about 10% of its $19 trillion in retail deposits, the cheapest way to finance, its average financing cost will rise from 2.03% to 2.27%. While total deposits, including business accounts, will not decrease, bank profit margins will be squeezed.

These new assets could also have disruptive implications for the broader financial system. For example, holders of Robinhood's new stock tokens do not actually own the underlying shares. Technically, they own a derivative that tracks the value of an asset, including any dividends paid by the company, rather than the stock itself. As a result, they do not have access to the voting rights typically conferred by stock ownership. If the token issuer goes bankrupt, holders will be in trouble and will need to compete with other creditors of the failing company for ownership of the underlying assets. A similar situation has been encountered by Linqto, a fintech startup that filed for bankruptcy earlier this month. The company has issued shares of private companies through special purpose vehicles. Buyers are now unclear whether they own the assets they think they own.

This is one of the biggest opportunities for tokenization, but it also creates the greatest difficulties for regulators. Pairing illiquid private assets with easily tradable tokens opens up a closed market for millions of retail investors with trillions of dollars to allocate. They can buy shares in the most exciting private companies that are currently out of reach. This raises questions. Agencies like the U.S. Securities and Exchange Commission (SEC) have far more influence over public companies than private companies, which is why the former is suitable for retail investors. Tokens representing private shares turn what was once private equity into an asset that can be easily traded like an ETF. However, the issuer of the ETF promises to provide intraday liquidity by trading the underlying asset, which the token's provider does not. On a large enough scale, the token would actually turn a private company into a public company without any of the disclosure requirements that would normally be required.

Even pro-crypto regulators want to draw a line. U.S. Securities and Exchange Commission (SEC) Commissioner Hester Peirce has been dubbed the "crypto mom" for her friendly approach to digital currencies. In a statement on July 9, she emphasized that the token should not be used to circumvent securities laws. "Tokenized securities are still securities," she wrote. Therefore, regardless of whether the securities are wrapped in new cryptocurrencies, the company issuing the securities must comply with the rules of disclosure. While this makes sense in theory, the large number of new assets with new structures means that regulators will be in an endless catch-up state in practice.

Therefore, there is a paradox. If stablecoins are really useful, they will also be truly disruptive. The more attractive tokenized assets are to brokers, clients, investors, merchants, and other financial companies, the more they can transform finance, a change that is both welcome and worrying. Regardless of the balance between the two, one thing is clear: the idea that cryptocurrencies have not yet produced any innovations worth paying attention to is long a thing of the past.

ETF price performance in USD

The current price of elon-taper-fade is $0.0000034286. Over the last 24 hours, elon-taper-fade has decreased by --. It currently has a circulating supply of 998,993,315 ETF and a maximum supply of 998,993,315 ETF, giving it a fully diluted market cap of $3.43K. The elon-taper-fade/USD price is updated in real-time.

5m

+0.00%

1h

+0.00%

4h

+0.00%

24h

--

About Elon Taper Fade (ETF)

ETF FAQ

What’s the current price of Elon Taper Fade?

The current price of 1 ETF is $0.0000034286, experiencing a -- change in the past 24 hours.

Can I buy ETF on OKX?

No, currently ETF is unavailable on OKX. To stay updated on when ETF becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of ETF fluctuate?

The price of ETF fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Elon Taper Fade worth today?

Currently, one Elon Taper Fade is worth $0.0000034286. For answers and insight into Elon Taper Fade's price action, you're in the right place. Explore the latest Elon Taper Fade charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Elon Taper Fade, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Elon Taper Fade have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.