This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

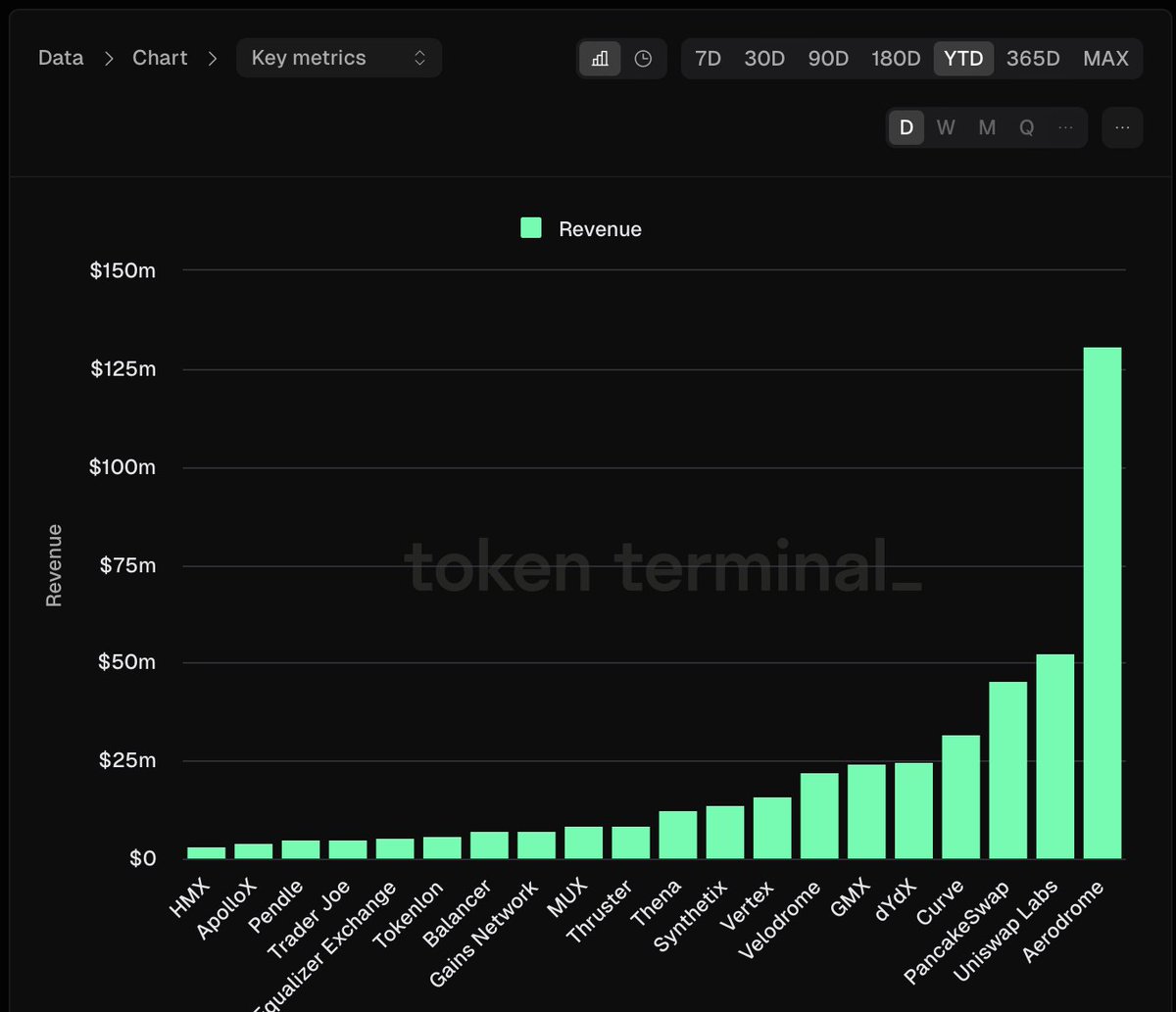

CURVE

CURVE price

Cuqvy7...fmdK

$0.00028092

+$0.0000015089

(+0.54%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about CURVE today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

CURVE market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$280.92K

Network

Solana

Circulating supply

999,999,507 CURVE

Token holders

222

Liquidity

$34.36K

1h volume

$2.63M

4h volume

$3.89M

24h volume

$3.89M

CURVE Feed

The following content is sourced from .

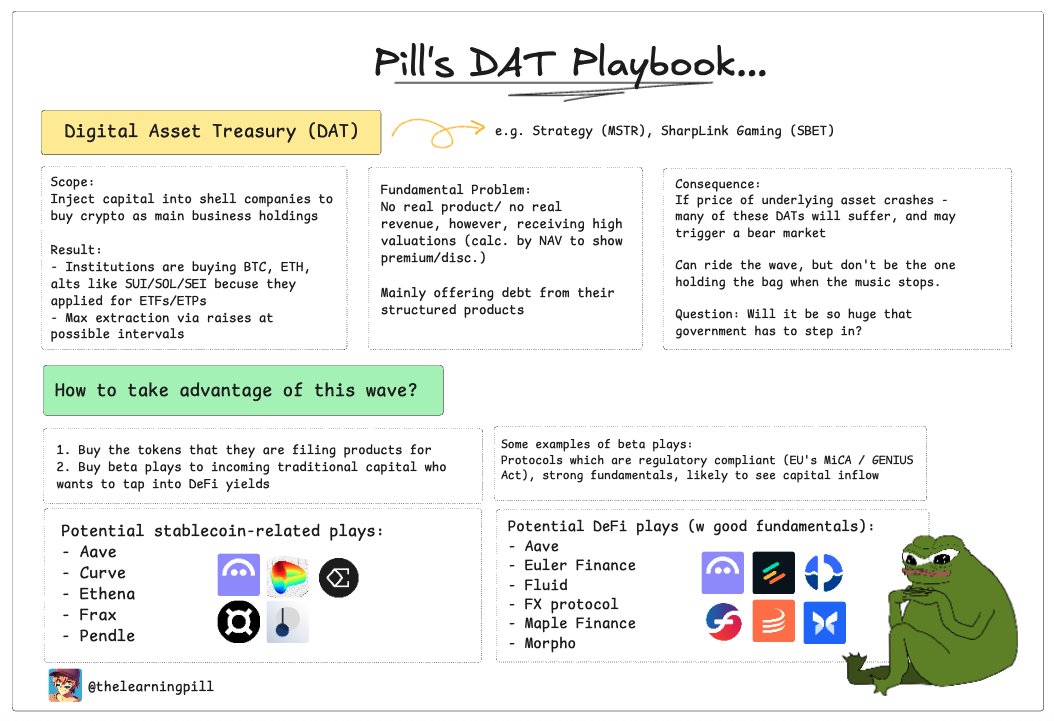

a week ago, Pill had a convo with a normie friend on the DAT trend

friend didn't know how to go about crypto → hot/cold wallets, how to buy etc., but interested in finding out about opportunities

with that, Pill came up with a raw and simple DAT playbook 👇

• what they are

• fundamental problems

• how to catch this wave

• what Pill is looking at (i.e. @pendle_fi, @ethena_labs, @aave, @maplefinance and others)

let Pill know which other projects you're looking at to ride the wave! (might expand on it if there's demand)

nfaaaa

KINETIQ — The Kinetic Engine of the Hyperliquid Ecosystem

KM!

So excited to see Kinetiq @kinetiq_xyz

becoming the first(maybe) @HyperliquidX ecosystem project to hit $1B TVL — and in just three weeks since launch! What a milestone.

Congrats to @0xOmnia~

This is the reason why I believe that I should dig into Kinetiq ,and below is my introduction about Kinetiq .

Tbh I has been curious why there is so much eyeballs on Kinetiq before it launch haha . And If I am not wrong tons of HYPE (more than 100m HYPE ) unstaked before the launch day of Kinetiq from mainnet for engaging into Kinetiq's liquid staking .

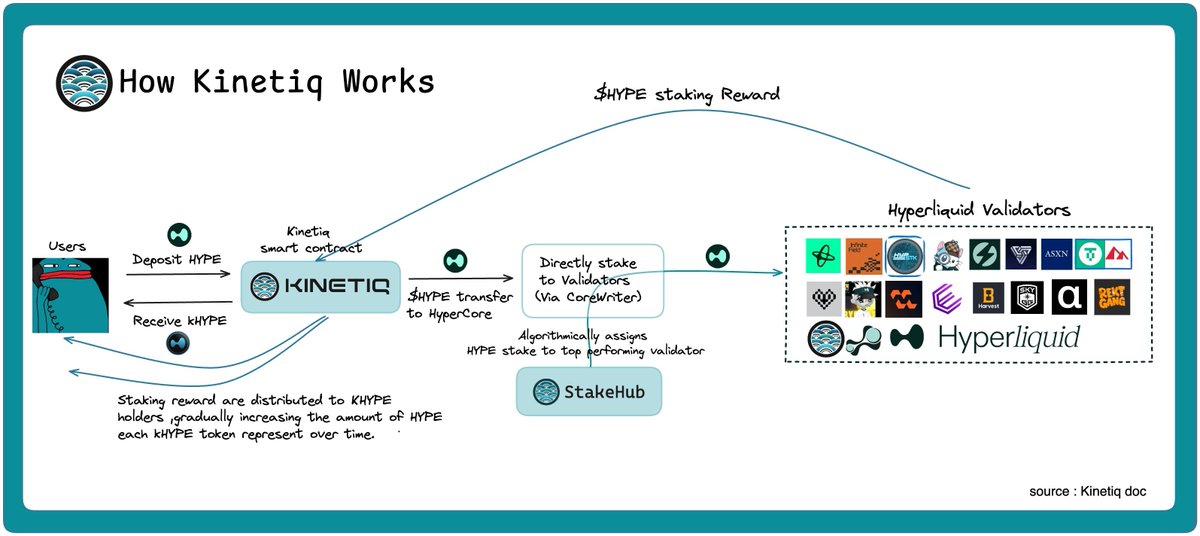

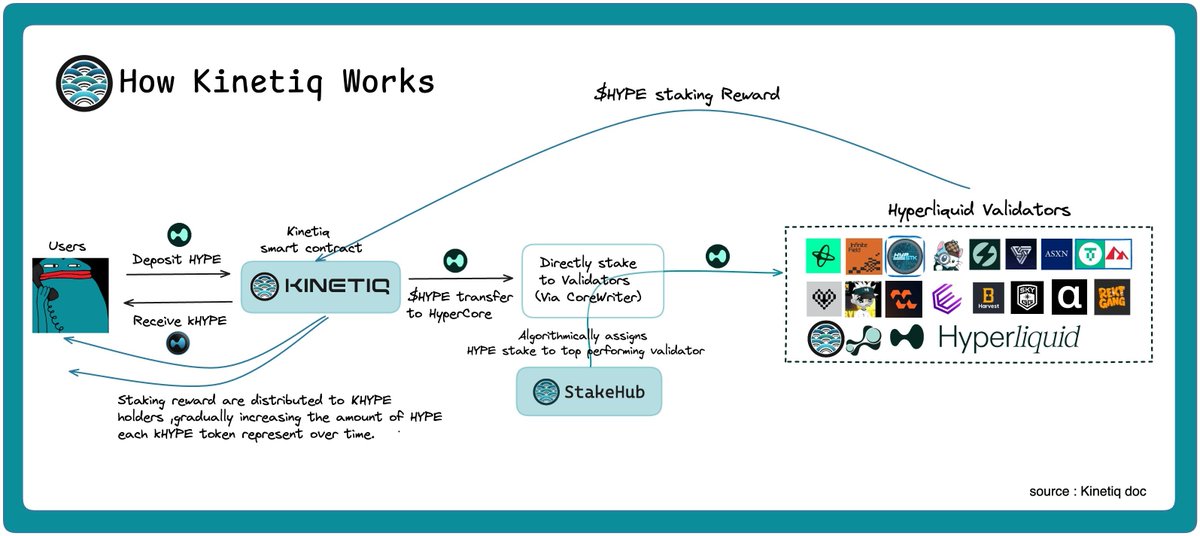

Part1 . How Kinetiq works

Kinetiq is a native Hyperliquid LST protocol designed to fully meet user needs from diff aspects :

Unlike other LST projects, Kinetiq natively integrates with the Hyperliquid PoS network. Users simply stake their HYPE to Kinetiq and receive kHYPE to get the liquidity while earning the reward from POS network .

Besides, Kinetiq’s contract autonomously delegates staked HYPE to the top-performing validator, which ranked by StakeHub based on five key metrics: Reliability, Security, Economics, Governance, and Longevity.

Can go through their validators to know much more about current status of Stakehub 's scoring system :

One thing makes me much more impressed is staking to HyperCore through Kinetiq is totally powered by CoreWriter — a native Hyperliquid system feature that allows HyperEVM contracts to write directly into HyperCore. It is HUGE!!

This means all validator delegation happens fully on chain, with no off-chain trust assumptions.

Kinetiq is the one of first HyperEVM protocol to adopt CoreWriter for validator delegation, enabling trustless, automated HYPE staking. If you want to dive deeper into CoreWriter, check out @djenn' s amazing post and video.

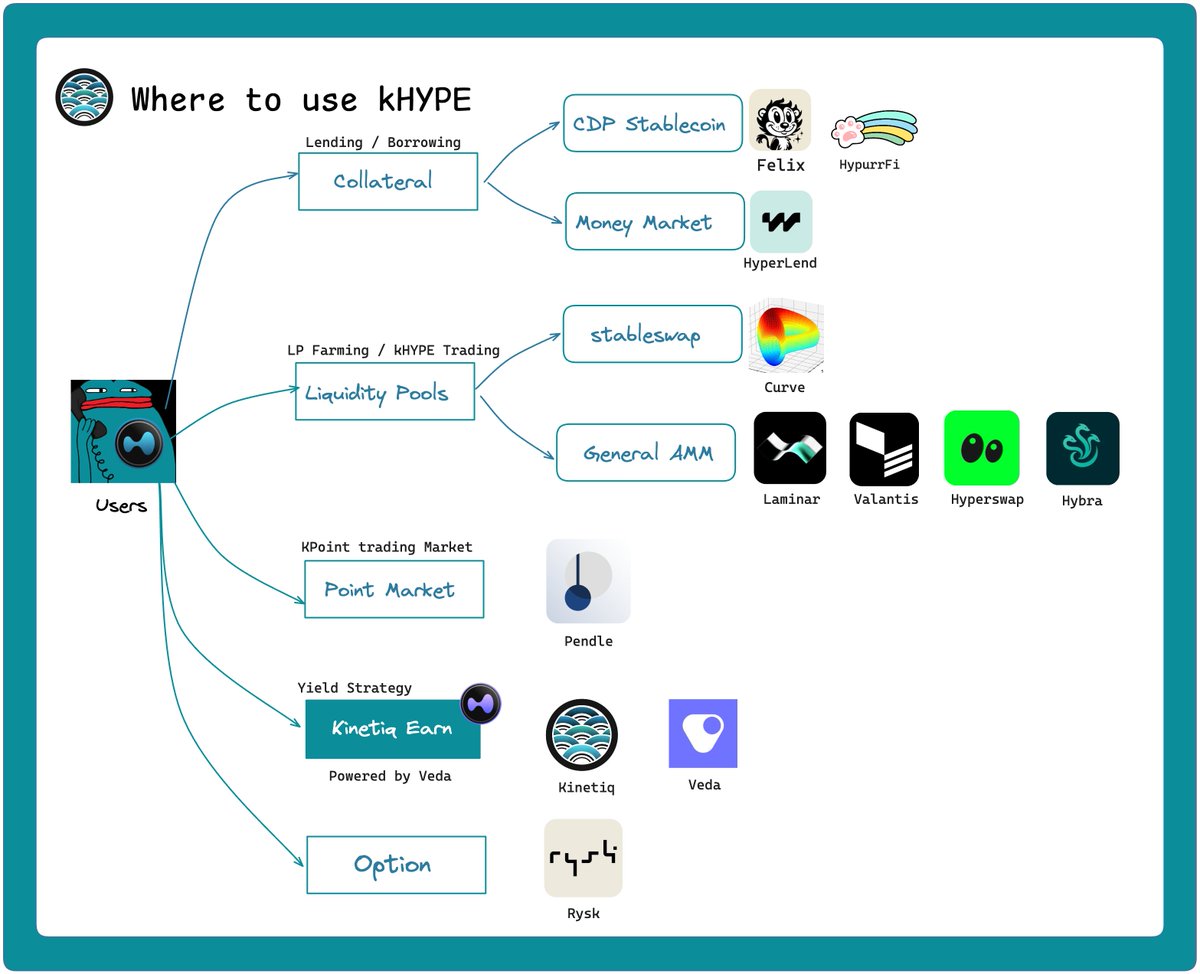

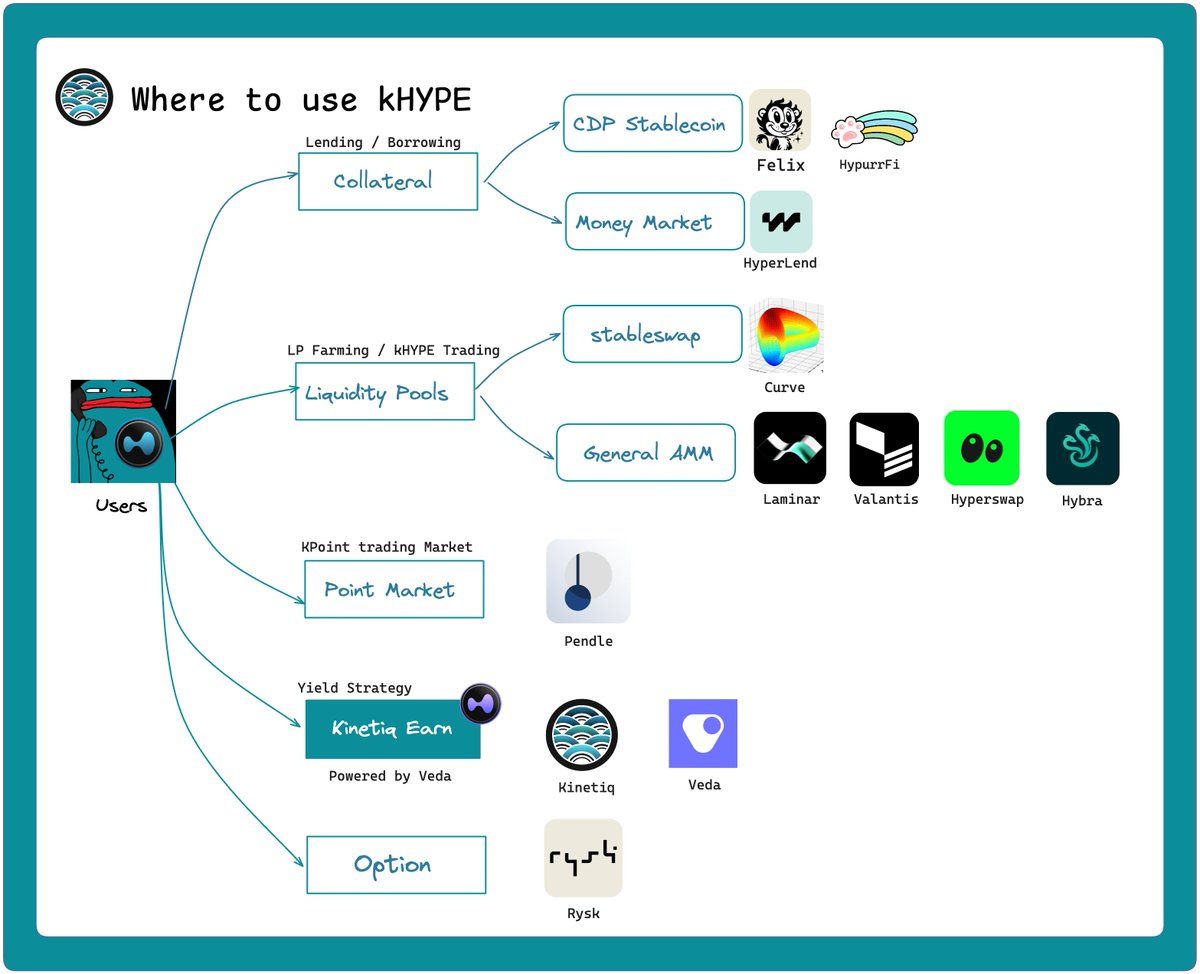

2.The Multiple Usage of kHYPE (YES from day1 )

Another massive milestone Kinetiq hit is that they almost got all the integration with the main ecosystem proj on hyperEVM on day1 . From first day of kHYPE launch, kHYPE has been usable across the HyperEVM DeFi projects.

Below is the four sectors which kHYPE already has been acceptable by the HyperEVM ecosystem project .(Pls lemme know if I miss your project here)

A. Collateral

kHYPE can be accepted as collateral on money markets and CDP protocols like @felixprotocol ,@HypurrFi which means that you can make your kHYPE as collateral to mint feUSD or USDL .

Also you can deposit your kHYPE on @hyperlendx

for lending to get yield and borrowing as adding some leverage of your HYPE if you are bullish on $HYPE

B. Liquidity Pool

kHYPE is a liquidable asset on multiple trading platform including @CurveFinance on stableswap's side ,and on general AMM part ,we can also provide the liquidity and trade kHYPE on @laminar_xyz ,@ValantisLabs ,@prjx_hl ,@HyperSwapX and @HybraFinance .

as I understanding from @0xOmnia ,kHYPE amm is the largest pool on @prjx_hl and @ValantisLabs

C . Point market

on @pendle_fi On Pendle ,they has provided the point market for Kinetiq's kPoint .

Anyone who would like to get the kPOINT can purchase their yt token to pay kHYPE and earn the point . Vise versa ,for PT there is 12% Fixed APY .

@tn_pendle your team is god ! learn more about Pendle's kPOINT market here

D. Kinetiq Earn

If Kinetiq can serve user to deposit their HYPE to the top-performance validator ,why not to provide an automatic strategy platform for kHYPE ?

Yes this is Kinetiq Earn powered @veda_labs which can put your kHYPE(also HYPE) to work across leading DeFi protocols on HyperEVM, optimizing for the best risk-adjusted returns. Currently the TVL on Kinetiq EARN is 196m with 6% estimated APY .

Yes it is largest pool on Veda so far .

check Kinetiq Earn here :

E. Option

On @ryskfinance , you can open a 21 days length option to sell your kHYPE with 3% ~ 57.93% APR

Now it is 30% TVL of Rysk. also congrats for the launch of Rysk to public @DanDeFiEd

check it here :

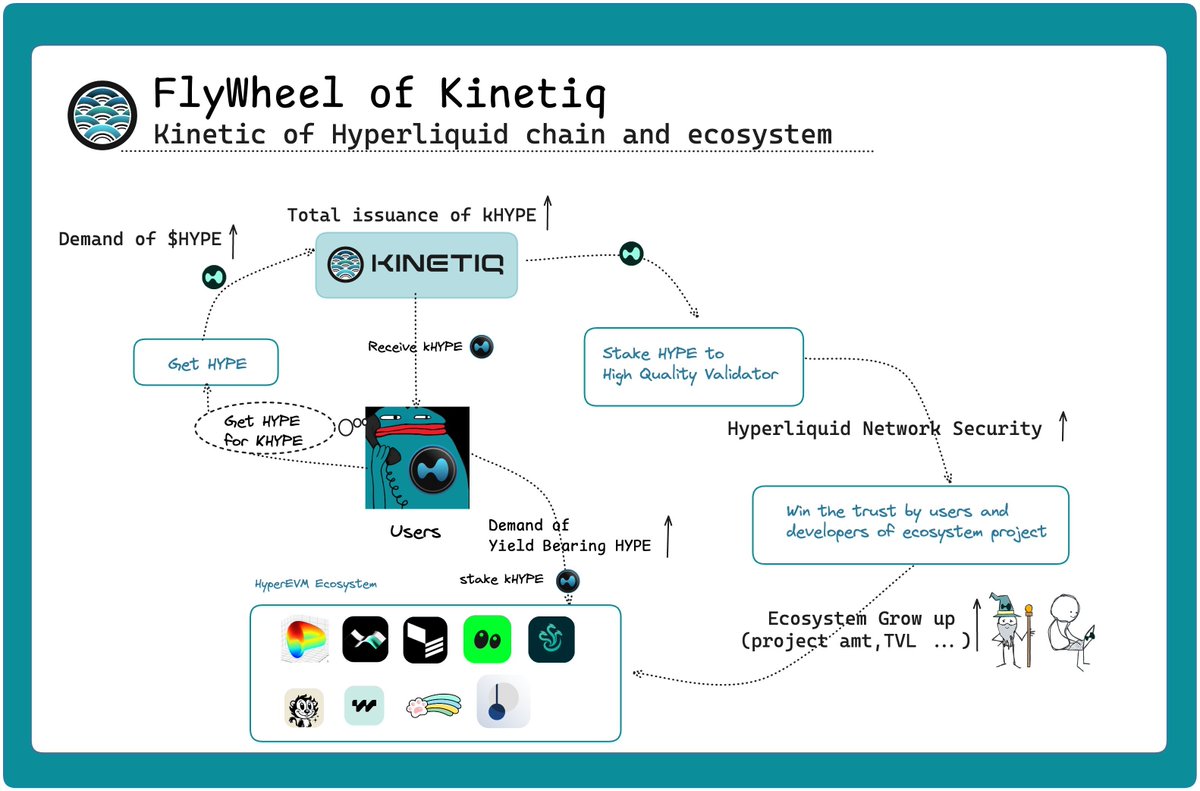

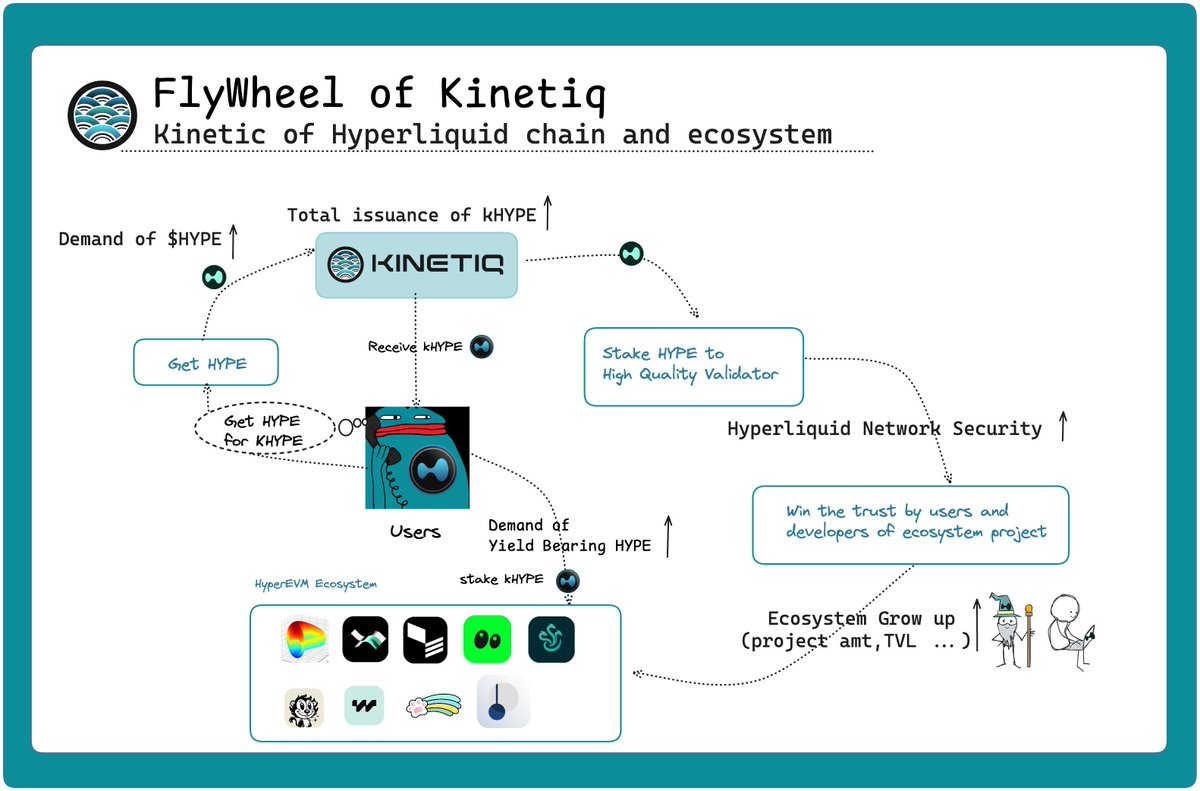

Part 3. The Kinetiq Flywheel — Kinetiq is the kinetic of Hyperliquid Network and HyperEVM ecosystem !

With Kinetiq, all of the stakeholders on Hyperliquid including users(HYPE holder) ,validator of POS network and ecosystem can benefit.

Here is my analysis for the synergy and positive led by Kinetiq.

A. User (HYPE holder)

1. YIELD : they can deposit and directly delegate their HYPE to the best validator on hypercore and earn the yield .

2. LIQUIDITY of the asset : with kHYPE ,user can earn staking rewards without giving up liquidity.

B, Validator (Network Security)

With Kinetiq, kHYPE stakers can support network security and the decentralization of HL network —without compromise while earn the high interest.

With StakeHub, Kinetiq provides a continuous incentive for outstanding validators to stay online and performant at the highest possible level, aligning with the strict criteria set by StakeHub to receive stake delegation.

When validators got the incentive from Kinetiq ,they provide the highest level validator service for HL POS network which also help Hyperliquid to win the trust from ecosystem developers and users to access into HyperEVM and HyperCore .

C.Ecosystem

With better service ,higher confident for developer to build application on hyperliquid . With the useful lst asset - kHYPE ,the more and more users have much more liquidity to engage into HyperEVM ecosystem projects while earning the staking reward from hl pos network.

esp in the early stage now ,there is still kPOINT to attract users to mint kHYPE and loop their yield on other ecosystem projects .

The design and the way to use Kinetig as the access into Hyperliquid is simple but being simple is always not easy.

The flywheel is keeping running . I believe that there would be much more innovation and integration from Kinetiq.

Special thanks to @0xOmnia to respond my question in short time.

Do let me know if you are running or about to run a project on Hyperliquid (HyperEVM).

# Recommended reading

- For kPOINT's value estimation : Well read from @0xlykt's post

- @PendleIntern about kPoint

- launch post of Kinetiq

KINETIQ — The Kinetic Engine of the Hyperliquid Ecosystem

KM! So excited to see Kinetiq @kinetiq_xyz

becoming the first(maybe) @HyperliquidX ecosystem project to hit $1B TVL — and in just three weeks since launch! What a milestone.

Congrats to @0xOmnia~

This is the reason why I believe that I should dig into Kinetiq ,and below is my introduction about Kinetiq .

Tbh I has been curious why there is so much eyeballs on Kinetiq before it launch haha . And If I am not wrong tons of HYPE (more than 100m HYPE ) unstaked before the launch day of Kinetiq from mainnet for engaging into Kinetiq's liquid staking .

Part1 . How Kinetiq works

Kinetiq is a native Hyperliquid LST protocol designed to fully meet user needs from diff aspects :

Unlike other LST projects, Kinetiq natively integrates with the Hyperliquid PoS network. Users simply stake their HYPE to Kinetiq and receive kHYPE to get the liquidity while earning the reward from POS network .

Besides, Kinetiq’s contract autonomously delegates staked HYPE to the top-performing validator, which ranked by StakeHub based on five key metrics: Reliability, Security, Economics, Governance, and Longevity.

Can go through their validators to know much more about current status of Stakehub 's scoring system :

One thing makes me much more impressed is staking to HyperCore through Kinetiq is totally powered by CoreWriter — a native Hyperliquid system feature that allows HyperEVM contracts to write directly into HyperCore. It is HUGE!!

This means all validator delegation happens fully on chain, with no off-chain trust assumptions.

Kinetiq is the one of first HyperEVM protocol to adopt CoreWriter for validator delegation, enabling trustless, automated HYPE staking. If you want to dive deeper into CoreWriter, check out @djenn' s amazing post and video.

2.The Multiple Usage of kHYPE (YES from day1 )

Another massive milestone Kinetiq hit is that they almost got all the integration with the main ecosystem proj on hyperEVM on day1 . From first day of kHYPE launch, kHYPE has been usable across the HyperEVM DeFi projects.

Below is the four sectors which kHYPE already has been acceptable by the HyperEVM ecosystem project .(Pls lemme know if I miss your project here)

A. Collateral

kHYPE can be accepted as collateral on money markets and CDP protocols like @felixprotocol ,@HypurrFi which means that you can make your kHYPE as collateral to mint feUSD or USDL .

Also you can deposit your kHYPE on @hyperlendx

for lending to get yield and borrowing as adding some leverage of your HYPE if you are bullish on $HYPE

B. Liquidity Pool

kHYPE is a liquidable asset on multiple trading platform including @CurveFinance on stableswap's side ,and on general AMM part ,we can also provide the liquidity and trade kHYPE on @laminar_xyz ,@ValantisLabs ,@prjx_hl ,@HyperSwapX and @HybraFinance .

as I understanding from @0xOmnia ,kHYPE amm is the largest pool on @prjx_hl and @ValantisLabs

C . Point market

on @pendle_fi On Pendle ,they has provided the point market for Kinetiq's kPoint .

Anyone who would like to get the kPOINT can purchase their yt token to pay kHYPE and earn the point . Vise versa ,for PT there is 12% Fixed APY .

@tn_pendle your team is god ! learn more about Pendle's kPOINT market here

D. Kinetiq Earn

If Kinetiq can serve user to deposit their HYPE to the top-performance validator ,why not to provide an automatic strategy platform for kHYPE ?

Yes this is Kinetiq Earn powered @veda_labs which can put your kHYPE(also HYPE) to work across leading DeFi protocols on HyperEVM, optimizing for the best risk-adjusted returns. Currently the TVL on Kinetiq EARN is 196m with 6% estimated APY .

Yes it is largest pool on Veda so far .

check Kinetiq Earn here :

E. Option

On @ryskfinance , you can open a 21 days length option to sell your kHYPE with 3% ~ 57.93% APR

Now it is 30% TVL of Rysk. also congrats for the launch of Rysk to public @DanDeFiEd

check it here :

Part 3. The Kinetiq Flywheel — Kinetiq is the kinetic of Hyperliquid Network and HyperEVM ecosystem !

With Kinetiq, all of the stakeholders on Hyperliquid including users(HYPE holder) ,validator of POS network and ecosystem can benefit.

Here is my analysis for the synergy and positive led by Kinetiq.

A. User (HYPE holder)

1. YIELD : they can deposit and directly delegate their HYPE to the best validator on hypercore and earn the yield .

2. LIQUIDITY of the asset : with kHYPE ,user can earn staking rewards without giving up liquidity.

B, Validator (Network Security)

With Kinetiq, kHYPE stakers can support network security and the decentralization of HL network —without compromise while earn the high interest.

With StakeHub, Kinetiq provides a continuous incentive for outstanding validators to stay online and performant at the highest possible level, aligning with the strict criteria set by StakeHub to receive stake delegation.

When validators got the incentive from Kinetiq ,they provide the highest level validator service for HL POS network which also help Hyperliquid to win the trust from ecosystem developers and users to access into HyperEVM and HyperCore .

C.Ecosystem

With better service ,higher confident for developer to build application on hyperliquid . With the useful lst asset - kHYPE ,the more and more users have much more liquidity to engage into HyperEVM ecosystem projects while earning the staking reward from hl pos network.

esp in the early stage now ,there is still kPOINT to attract users to mint kHYPE and loop their yield on other ecosystem projects .

The design and the way to use Kinetig as the access into Hyperliquid is simple but being simple is always not easy.

The flywheel is keeping running . I believe that there would be much more innovation and integration from Kinetiq.

Special thanks to @0xOmnia to respond my question in short time.

Do let me know if you are running or about to run a project on Hyperliquid (HyperEVM).

# Recommended reading

- For kPOINT's value estimation : Well read from @0xlykt's post

CURVE price performance in USD

The current price of curve is $0.00028092. Over the last 24 hours, curve has increased by +0.54%. It currently has a circulating supply of 999,999,507 CURVE and a maximum supply of 999,999,507 CURVE, giving it a fully diluted market cap of $280.92K. The curve/USD price is updated in real-time.

5m

-27.62%

1h

-92.90%

4h

+0.54%

24h

+0.54%

About CURVE (CURVE)

Latest news about CURVE (CURVE)

Metaplanet to Launch Preferred Shares, Bitcoin-Backed Yield Curve Plan

Japan’s largest public bitcoin holder aims to expand its treasury operations and integrate BTC into the country’s fixed income markets.

Aug 13, 2025|CoinDesk

Michael Saylor Builds Out Own Yield Curve With Upsized Preferred Stock Sale

Strategy's latest preferred stock issuance surpassed expectations, offering 9.5%–10.0% yield with built-in price stability mechanisms.

Jul 25, 2025|CoinDesk

Learn more about CURVE (CURVE)

Curve, Etherlink, and Liquidity: How Apple Farm Season 2 is Transforming DeFi

Introduction to Curve, Etherlink, and Liquidity in DeFi Decentralized Finance (DeFi) is rapidly transforming the financial landscape, with platforms like Etherlink and Curve leading the charge. Etherl

Aug 8, 2025|OKX

Curve Finance and Arbitrum: Revolutionizing DeFi with Scalable Solutions and Stablecoin Innovations

Introduction to Curve Finance and Arbitrum Decentralized Finance (DeFi) is rapidly transforming the financial landscape, with platforms like Curve Finance and Arbitrum driving innovation. Curve Financ

Aug 5, 2025|OKX

Curve DAO (CRV) Surges 42% in a Week: Key Technical Breakouts and Market Insights

Curve DAO (CRV) Price Surge: A Comprehensive Analysis of Recent Trends Curve DAO (CRV) has emerged as one of the most talked-about cryptocurrencies, experiencing a remarkable 42% weekly rally, includi

Jul 18, 2025|OKX

Curve DAO Token (CRV) Surges 73% in a Week: Whale Accumulation and Technical Breakout Drive Momentum

Curve DAO Token (CRV) Price Surge and Technical Breakout Curve DAO Token (CRV) has captured significant attention in the cryptocurrency market, rallying an impressive 73% over the past week, including

Jul 18, 2025|OKX

CURVE FAQ

What’s the current price of CURVE?

The current price of 1 CURVE is $0.00028092, experiencing a +0.54% change in the past 24 hours.

Can I buy CURVE on OKX?

No, currently CURVE is unavailable on OKX. To stay updated on when CURVE becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of CURVE fluctuate?

The price of CURVE fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 CURVE worth today?

Currently, one CURVE is worth $0.00028092. For answers and insight into CURVE's price action, you're in the right place. Explore the latest CURVE charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as CURVE, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as CURVE have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.