This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

COIN

Coin price

74miKs...zFrP

$0.00024525

+$0.00016731

(+214.66%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about COIN today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

COIN market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$245.25K

Network

Solana

Circulating supply

999,999,927 COIN

Token holders

166

Liquidity

$197.33K

1h volume

$4.41M

4h volume

$4.41M

24h volume

$4.41M

Coin Feed

The following content is sourced from .

Opinion: Tokenized Equities Are Only the Sum of Their Parts

In June, investment platform Robinhood made headlines with an announcement that it would be launching tokenized U.S. stocks and ETFs — including those of private companies like OpenAI and SpaceX — for its European customers. Since then, tokenized equities have been one of the hottest topics in crypto.

The backlash Robinhood caught from OpenAI for offering the company’s private equity without consent did little to dampen enthusiasm. Indeed, Bernstein analysts continue to predict a bright future for tokenized equities. If and when they successfully merge traditional finance (TradFi) with decentralized finance (DeFi), bullish predictions for this emerging sector hint at new possibilities for asset ownership and exchange.

These “OpenAI tokens” are not OpenAI equity. We did not partner with Robinhood, were not involved in this, and do not endorse it. Any transfer of OpenAI equity requires our approval—we did not approve any transfer.

Please be careful.— OpenAI Newsroom (@OpenAINewsroom) July 2, 2025

Yet, the true potential of tokenized equities does not lie solely in putting these traditional assets on a blockchain. The real revolution begins when these assets become truly composable within the DeFi ecosystem, unlocking entirely new use cases for companies and their investors.

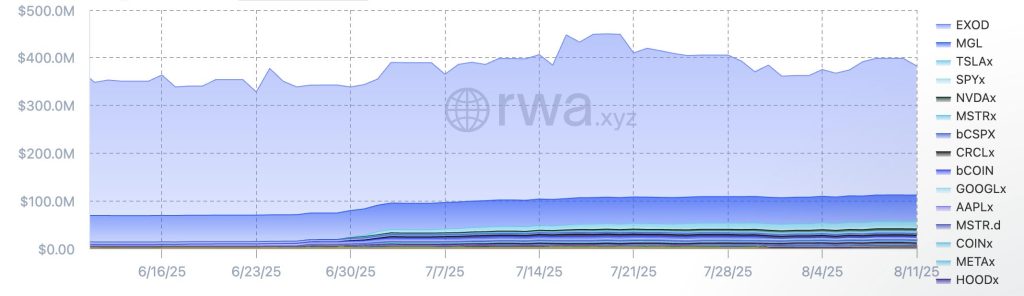

The Promise and Pitfalls of Early Equity Tokenization

The market for tokenized equities is experiencing rapid expansion, signaling a clear shift in how traditional assets are perceived and utilized within the digital economy. Over the past month, the total value of all tokenized equities in circulation surged by more than 20% to surpass $465 million, according to data published on RWA.xyz.

Meanwhile, the asset’s monthly transfer volume grew by more than 280%, reaching over $287 million. Earlier data published by CoinGecko revealed that the tokenized equities sector of Real World Assets (RWAs) had grown by nearly 300% — an increase of over $8.6 million since the start of 2024 alone.

Apart from Robinhood entering the tokenized stocks arena, other major players in the industry have also made similar leaps. BNB Chain recently joined Ondo Global Markets Alliance to bring over 100 U.S. stocks, ETFs, and funds on-chain through tokenized equities. Other centralized exchanges such as Kraken are also offering tokenized U.S.-listed stock trading, and Coinbase intends to tokenize its own $COIN shares.

However, despite this impressive growth and increasing institutional engagement, simply tokenizing an equity — in itself — offers little inherent value beyond a digital representation. All this does is transfer an existing asset onto a distributed ledger without necessarily unlocking new utility or financial primitives.

While low-volatility, reliable blue-chip stocks could theoretically serve as robust collateral in DeFi, volatile stocks bring almost no value whatsoever. Decentralized finance is a volatile sector that needs stability. The utility of any tokenized equity also remains limited if it cannot be seamlessly integrated into broader decentralized protocols.

Indeed, early steps into tokenized equities offer little to nothing more than traditional markets already provide, thus missing the fundamental innovation DeFi has to offer.

Composability as a New Equity Income Engine

Within the crypto industry, developers have long focused on building modular tools that seamlessly interact with an on-chain ecosystem. That is the promise of composability, and it is also what could set tokenized equities apart if they are used as more than just digital replicas of traditional stocks.

Essentially, composability allows different DeFi protocols to interact and build on top of each other, forming what could be described as “interconnected Lego blocks”. When talking about tokenized equities in relation to composability, we suppose an asset could be used across multiple applications.

Breaking down an equity into its constituent parts could, for example, generate new income streams and enable complex financial strategies impossible to achieve in traditional finance.

Let’s consider a theoretical journey for such a tokenized equity: an Amazon share. After acquiring a tokenized Amazon stock on-chain, rather than simply holding it, an investor could then deposit this stock into an Amazon/USDC liquidity pool on a decentralized exchange such as Curve. From this position, the investor could earn swap fees and receive native protocol tokens like CRV and CVX, alongside any Amazon dividends.

Taking capital efficiency even further, such earnings — along with the underlying liquidity provider tokens — could also be funneled into another platform to generate further income.

The ultimate potentiality would be using the auto-compounded position itself. For example, an investor might mint a new stablecoin backed by this yield-generating asset or take a loan against it to further leverage their Amazon position, gain more yield, or even off-ramp funds for real-world spending.

Such an intricate interplay of protocols and assets highlights how composability creates layered utility, pushing beyond simple tokenization.

Building the Future of Tokenized Equities

As the U.S. government continues to move along its current pro-crypto agenda, the convergence between traditional and decentralized financial ecosystems is set to continue apace. The enormous growth we have already seen in the RWA sector is not going to slow down, and we will see tokenized equities increasingly enter crypto.

The key is to make that capital inflow useful. By transforming equities into truly composable digital assets, the industry could enhance DeFi’s stability and resilience. Such an approach could strengthen a notoriously volatile ecosystem by encouraging the growth and integration of a robust, bear-market-resistant asset class.

Ultimately, the future of tokenized equities is not about simply digitizing existing assets. Rather, it lies in their empowerment through decentralized finance. By focusing on composability, we can unlock unprecedented financial strategies and create a more dynamic, accessible, and resilient financial landscape.

Such an evolution could represent a significant step toward the convergence of TradFi with DeFi, ensuring that tokenized equities become even greater than the sum of their parts.

Disclaimer: The opinions in this article are the writer’s own and do not necessarily represent the views of Cryptonews.com. This article is meant to provide a broad perspective on its topic and should not be taken as professional advice.

Senior analyst says Coinbase is a clear winner over Circle

Coinbase is becoming a better investment than Circle after the stablecoin issuer's highly anticipated but contentious public debut, said Mizuho Securities senior analyst Dan Dolev.

Mizuho Financial Group, Inc. is one of Japan's biggest "megabanks" and is also a Global Systemically Important Bank. It has companies that provide retail and corporate banking, investment banking, asset management, and other financial services across the world.

Dolev told CNBC that Circle's post-IPO value seemed too high since investors are assuming a 40% compound annual growth rate that "is not moving" in the real data. He said, "You have these really high ambitions, but the reality is it's not materializing."

Dolev said that the recent change in U.S. government policy has made it easier for stablecoins to be used, but that Circle's USDC has not been adopted as much as investors had hoped.

Join the discussion with CryptoWendyO on Roundtable here.

The stablecoin is primarily being used to settle crypto and Bitcoin transactions on Coinbase — a dynamic that significantly benefits Coinbase's bottom line more than Circle's.

When asked if he prefers Coinbase more than Circle, he replied, "Yes, 100%". According to Dolev, Coinbase has the upper hand.

"They're getting 100% of all the coins that are on their platform and 50% of the coins that are not on their platform. So they're basically getting paid either way," explained Dolev.

The analysts showed that the market as a whole is uncertain whether Circle can expand beyond specialist use cases into mainstream consumer use.

The IPO shows that there is a lot of interest in crypto-related stocks, but Dolev told investors to stick with “quality names" like Robinhood and Coinbase, which he thinks are better positioned.

At press time, Circle (CRCL) was trading at $153, down by 6.17% in the last 24 hours. Meanwhile, Coinbase (COIN) is trading at $324.65, up 0.63% in the same time.

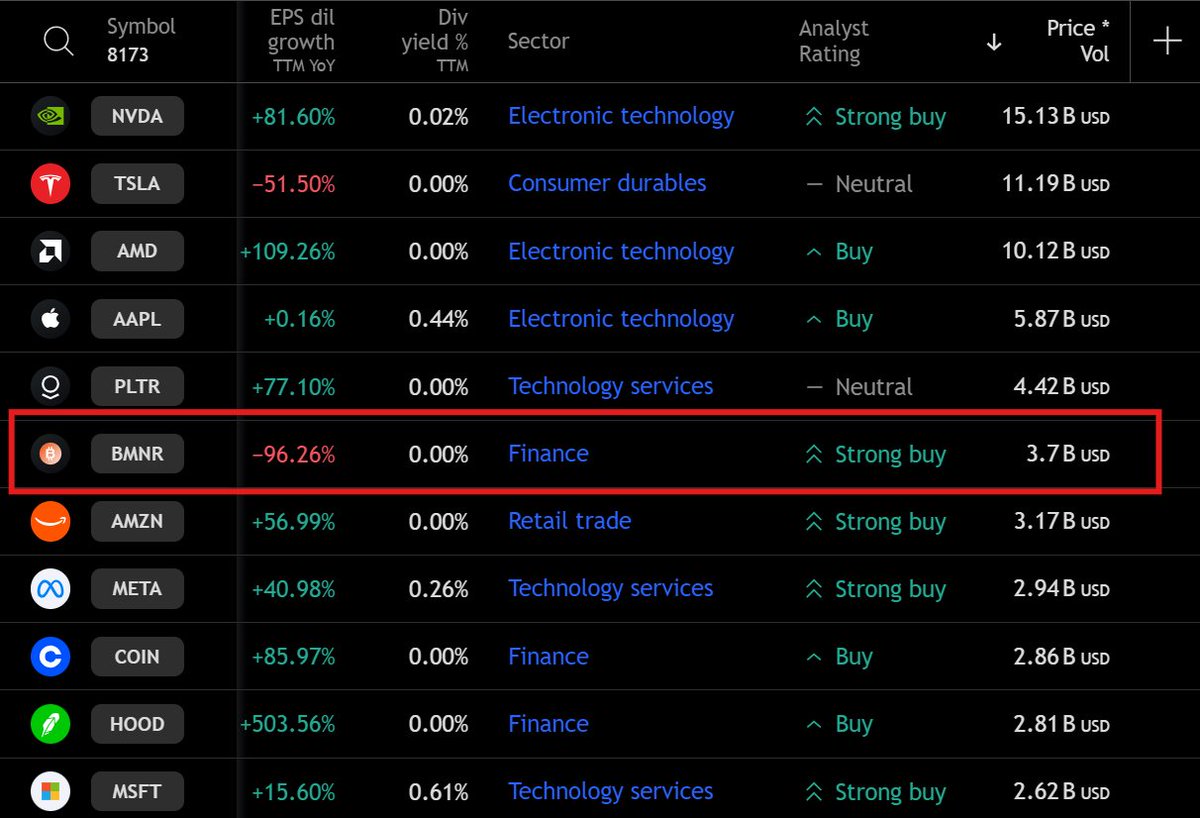

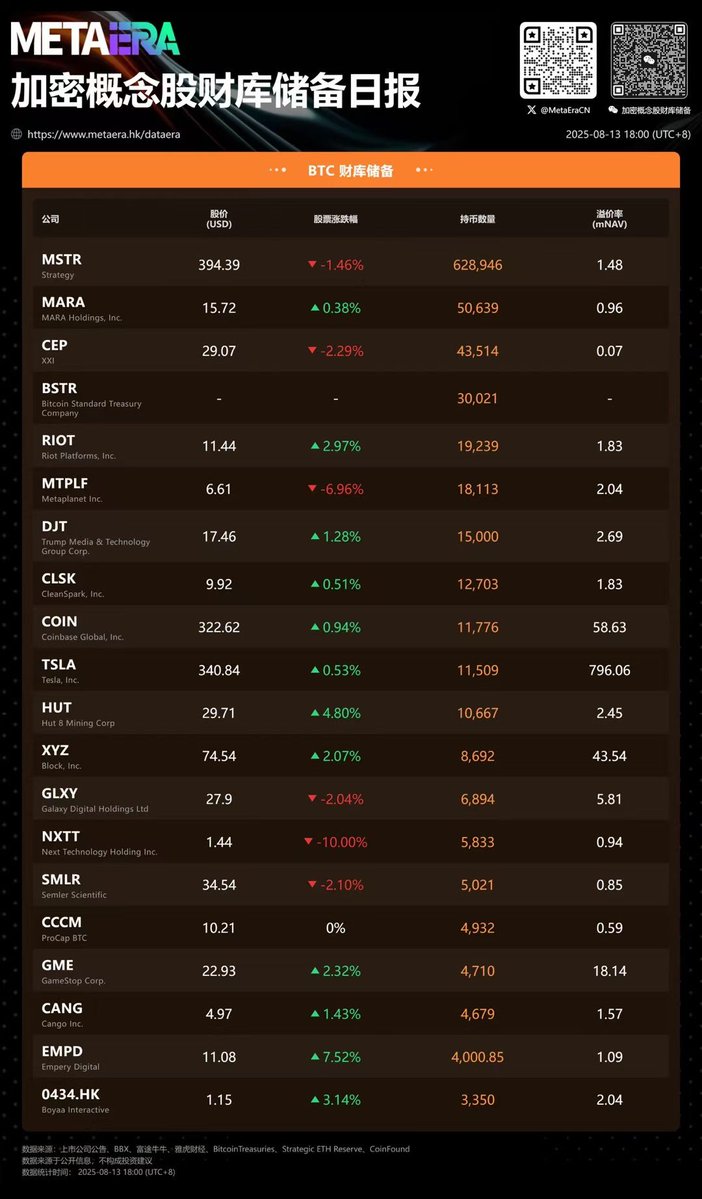

[Cryptocurrency Concept Stock Daily] August 13

- Solana's strategic reserve representative company Upexi (Nasdaq: UPXI) has appointed BitMEX co-founder Arthur Hayes as its first advisory committee member.

- BitMine (NYSE: BMNR) submitted an S-3 form on July 9 to initiate a maximum $2 billion ATM (At-the-Market) stock program, expanded to $4.5 billion on July 24, and significantly increased the ATM scale to $24.5 billion again on August 12.

agree there is no reliable ETH beta. there are too many assets. chasing this is hard

just buy ETH

i own ETH, NFTs, and DeFi longterm holds (like AAVE), and a few random speculative things to play with on L2s

highly desirable NFTs also good, but most people don’t want to hear that the “good” stuff is all consistently 20+ ETH. and a lot of it is 50-100 ETH. also not always liquid the way you want it. can be hard to trade

daddy fiskantes ⭐️🩸

The ETH beta is an elusive beast, something of a Bigfoot or Lochness monster of the crypto world

Many have claimed to spot it or even capture it on film, but so far there is no firm evidence it actually exists

Sometimes its supposed to be LDO or UNI, AAVE and myriad of other DeFi coins, sometimes its a memecoin like PEPE or MOG, other time its L2 tokens - OP, ARB...or COIN stonk...I even heard more obscure beta plays being shilled - ETC or some weird social app

The truth is, there is no reliable ETH beta that would work for longer than half a cycle

But if I had to pick one, I'd say its the thing thats denominated in ETH - Ethereum OG NFTs

But for that we need a major wealth effect from ETH first sparking an NFT season

COIN price performance in USD

The current price of coin is $0.00024525. Over the last 24 hours, coin has increased by +214.66%. It currently has a circulating supply of 999,999,927 COIN and a maximum supply of 999,999,927 COIN, giving it a fully diluted market cap of $245.25K. The coin/USD price is updated in real-time.

5m

+39.31%

1h

+214.66%

4h

+214.66%

24h

+214.66%

About Coin (COIN)

Latest news about Coin (COIN)

$200M Whale Purchases Propel DOGE 3% Higher in Breakout Session

Meme coin pushes through key levels on high volume as institutional accumulation accelerates during market turbulence.

Aug 11, 2025|CoinDesk

Red Coin, Blue Coin: The New Politics of Exposure

Bitcoin is politically neutral. But bitcoin treasury vehicles aren’t. Are we buying the coin, or the campaign?

Aug 2, 2025|CoinDesk

BONK Sinks 5% as Institutional Liquidation Intensifies

Meme coin loses ground amid broad risk-off sentiment and $0.000025 support test

Aug 1, 2025|CoinDesk

Learn more about Coin (COIN)

How to sell Pi coin when it is listed

As Pi Network continues to grow and gain attention in the crypto world, many users are eager to know how they can trade their mined PI. While the Pi Network token generation event has sparked interest

Jul 29, 2025|OKX|

Beginners

Dino coin season: studying the zombie chain resurgence

Is old gold? This has certainly never been the case in the crypto scene. While most crypto traders have been focused on shiny new projects with cutting-edge innovations, a surprising rally has brought

Jul 25, 2025|OKX|

Beginners

What is Foxy? Linea's first "culture coin" memecoin

FOXY is both the first memecoin from the Linea blockchain and a mascot token designed to build the all-important community spirit among users. So much so, the project has branded FOXY a “culture coin"

Jul 25, 2025|OKX|

Beginners

Binance Coin (BNB) and its ecosystem: an in-depth analysis

Build and Build (BNB), formerly known as Binance Coin, is a utility token used on the Binance crypto trading platform. In 2017, it was introduced as an ERC-20 token based on the Ethereum blockchain. B

Jul 25, 2025|OKX|

Beginners

COIN FAQ

What’s the current price of Coin?

The current price of 1 COIN is $0.00024525, experiencing a +214.66% change in the past 24 hours.

Can I buy COIN on OKX?

No, currently COIN is unavailable on OKX. To stay updated on when COIN becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of COIN fluctuate?

The price of COIN fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Coin worth today?

Currently, one Coin is worth $0.00024525. For answers and insight into Coin's price action, you're in the right place. Explore the latest Coin charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Coin, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Coin have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.