This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

BUIDL

BLACKROCK COIN price

eKAhXP...pump

$0.0000049728

+$0.00000

(--)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about BUIDL today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

BUIDL market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$4.95K

Network

Solana

Circulating supply

994,836,496 BUIDL

Token holders

493

Liquidity

$9.54K

1h volume

$0.00

4h volume

$0.00

24h volume

$0.00

BLACKROCK COIN Feed

The following content is sourced from .

H1'25 @Aptos check-in: real adoption, real throughput

• 10M+ accounts in 30 days, half active in a given month.

February 11th recorded a peak of 18M

• DAU above a million: average daily tx volume between February and May was 2.6-3.2M, with June at 4.2M as an average and 5.2M as the peak.

• $1B TVL in about 30 DeFi apps: TVL+LS ~$1.1-1.5B Borrowed: $1.5-$2.1B

• Staking over time becomes more decentralized as delegated stake increased from 37.5% to 47.1% and validators from 41 to 75.

• Commission rates are heavily clustered at 5% with a 10% level as a secondary peak.

• Liquid staking TVL: Amnis $168M, Thala $56.5M, Trufin $51.5M, KoFi $21.5M.

• Stablecoin TVL: USDT $431M -> $850M, USDC native to $276M, sUSDe ~$45M.

• RWA hit $537M(3rd among chains): PACT ~$420M, BUIDL $47.7M, BENJI $21.7M.

• Infra sprint: Raptr 250k TPS @~450ms, Shardines 1M+TPS, Zaptos ~40% less latency at sub-second finality.

• Governance: AIP-119 amended to slower cuts of staking rewards to protect decentralization.

Aptos is forming the Global Trading Engine: cheap, deep liquidity, production-ready speed.

H, time for building. More builders, more actual users ahead.

More read:

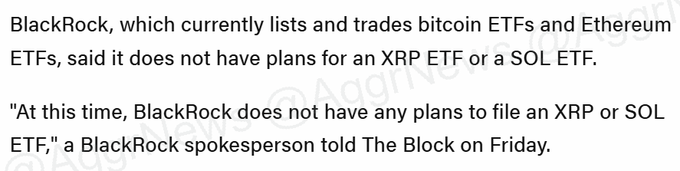

Whether Blackrock has filed for an XRP ETF already or not is really a moot point because Blackrock is already working with their BUIDL-Blackrock fund tokenizing US Treasuries on the XRPLEDGER.

Now, does anyone for a second believe that Blackrock would invest in UST tokenization on the XRPLEDGER but wouldn't want an XRP ETF after bringing that value onto the XRPLEDGER so they can make even more money on top of it all. 😎

MartyParty

Correction: After several conversations this is verified as false. The story was either made up by @TheBlock__ "journalist" or taken out of context with bias. Both $SOL and $XRP ETFs are in discussion with @BlackRock - timing cannot be confirmed - deadline is October to file. Here is the article that spread this false signal.

@NateGeraci this is verified nonsense from The Block. $XRP and $SOL Spot ETF @BlackRock ETF applications are definetely on the table.

This fake news was fabricated. To all @Ripple and @solana investors - unfollow @TheBlock__ and definetely block the reporter @ForTheWynn_ for bias fake news.

Nonsense opinion peice:

Note: This is the second lie Ive caught @TheBlock__

Where does capital hide when narratives are quiet and price is chopping?

I think the quiet rotation’s already underway… ETH ETF is live, BTC’s stuck in a crabwalk, and DeFi yields are limp.

So where’s the “safe” yield flowing?

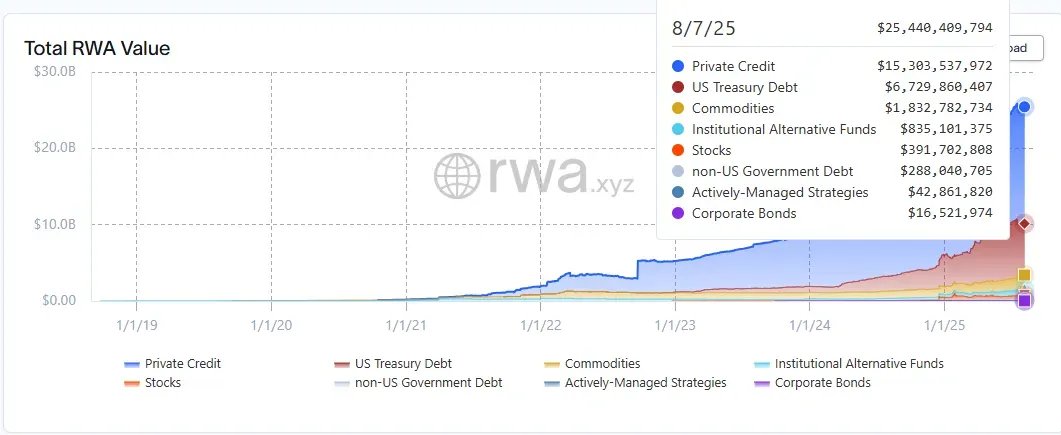

#RWAs might be creeping back into the conversation and I’m already seeing signs:

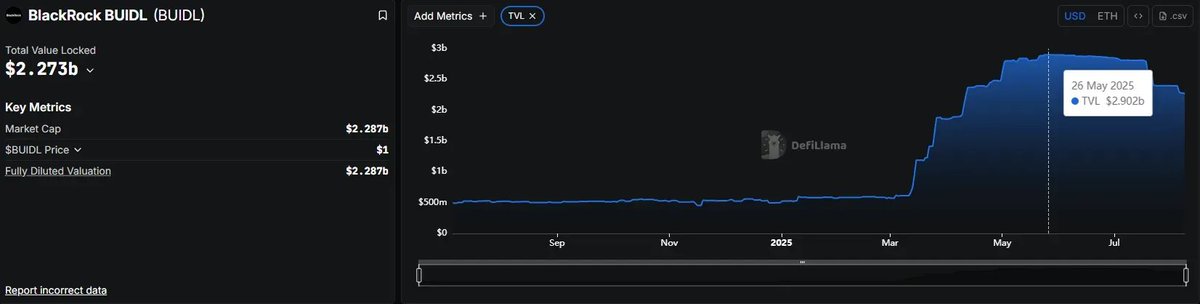

– Total RWA Onchain now $25.45B

– BlackRock’s BUIDL ballooned to nearly $3B

– #Ondo’s products gaining traction across degen DeFi, DAOs, and institutional allocators

– Tokenized Treasuries yielding ~4.5%

Meanwhile, LSDs sit around ~3%. Curve and Aave are still flat unless you’re chasing boosted pools.

What’s interesting is how the macro is on RWA’s side.

ETH ETF approval → institutional flows inbound → yield-seeking capital needs clean, scalable wrappers → RWAs are one of the few crypto-native primitives that don’t rely on retail FOMO to make sense.

The playbook now looks something like this:

– Park idle stables in Ondo’s USDY or #OpenEden’s tokenized T-bills and collect ~4.5% like it’s an onchain robo-managed money market

– Stack higher yield with #Maple or #Centrifuge pools, earn 8–12% if you’re down to take curated credit risk

– Or blend it with LSDs and RWA collateral loops if you’re comfy with leverage and smart contract spaghetti

Institutions want yield with stability and they’re comfortable parking capital in RWA wrappers that behave like money market funds.

So when farming without a strong trend, I’d argue the Q3 meta is about capital preservation with optionality:

→ 50% in tokenized Treasuries (USDY, BUIDL, OUSG) for ~4.5% base yield

→ 30% in stETH for ~3%, possibly restaked

→ 20% in volatile upside

If ETH pumps off ETF flows, I’m still long. If nothing happens for 3 more months, I’m still farming 5–7% with minimal risk.

Long boring might just outperform fast dumb again.

Great chatting with Maxwell Stein of @BlackRock at @thestablecon about the intersection of stables and tokenization, and how @ZeroHashX is powering the stablecoin funding rails for BUIDL, Blackrock’s tokenized money market fund.

zerohash

Stablecoins → Dollars → Tokenized Funds.

Maxwell Stein of @BlackRock joined our CEO @e_woodford to discuss how Zerohash bridges investor demand for stablecoin subscriptions with tokenized money market funds

“Clients convert USDC to dollars via Zerohash, we receive the funds, then mint the token.”

Real-world tokenization payment rails, built on compliant rails. 🌐

BUIDL price performance in USD

The current price of blackrock-coin is $0.0000049728. Over the last 24 hours, blackrock-coin has decreased by --. It currently has a circulating supply of 994,836,496 BUIDL and a maximum supply of 994,836,496 BUIDL, giving it a fully diluted market cap of $4.95K. The blackrock-coin/USD price is updated in real-time.

5m

--

1h

--

4h

--

24h

--

About BLACKROCK COIN (BUIDL)

BUIDL FAQ

What’s the current price of BLACKROCK COIN?

The current price of 1 BUIDL is $0.0000049728, experiencing a -- change in the past 24 hours.

Can I buy BUIDL on OKX?

No, currently BUIDL is unavailable on OKX. To stay updated on when BUIDL becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of BUIDL fluctuate?

The price of BUIDL fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 BLACKROCK COIN worth today?

Currently, one BLACKROCK COIN is worth $0.0000049728. For answers and insight into BLACKROCK COIN's price action, you're in the right place. Explore the latest BLACKROCK COIN charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as BLACKROCK COIN, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as BLACKROCK COIN have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.