This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

EOS

Binance-Peg EOS Token price

0x56b6...cbd6

$0.81404

-$0.00955

(-1.16%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about EOS today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

EOS market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$52.01M

Network

BNB Chain

Circulating supply

63,889,455 EOS

Token holders

48420

Liquidity

$1.37M

1h volume

$2.71K

4h volume

$53.48K

24h volume

$3.61M

Binance-Peg EOS Token Feed

The following content is sourced from .

$BTC is directly draining the market tonight, breaking through the 120,000 mark, just 1,300 dollars away from July's 123,200 to reach a new high. Let's see if we can hit a new high again tonight!

Who knows when this feast will end? Let's eat our fill first!

时光预言机i

$BTC is currently fluctuating around 119,000. If it doesn't break through this level, it is very likely to dip down before continuing to rise to fill the CME gap below.

Watch the 120,000 level above and the 116,500 level below. Retail investors can't push BTC's price up; only when funds flow back from ETH will we see a significant rise. We're just 3.2% away from the previous high.

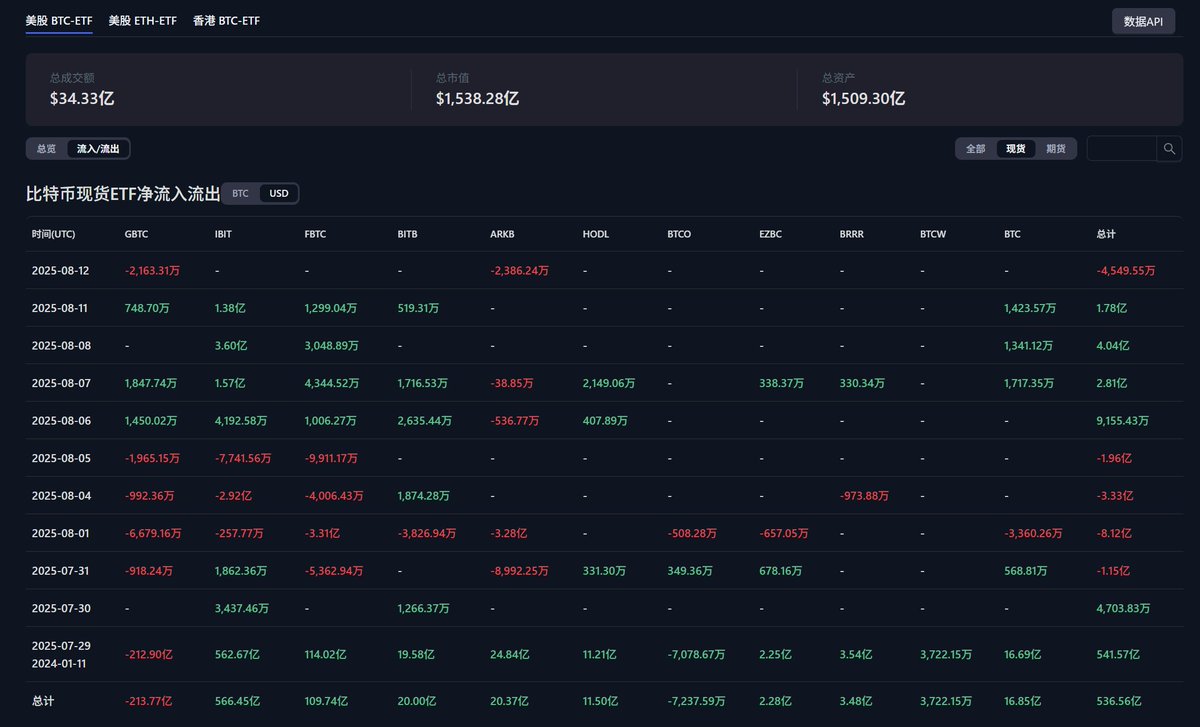

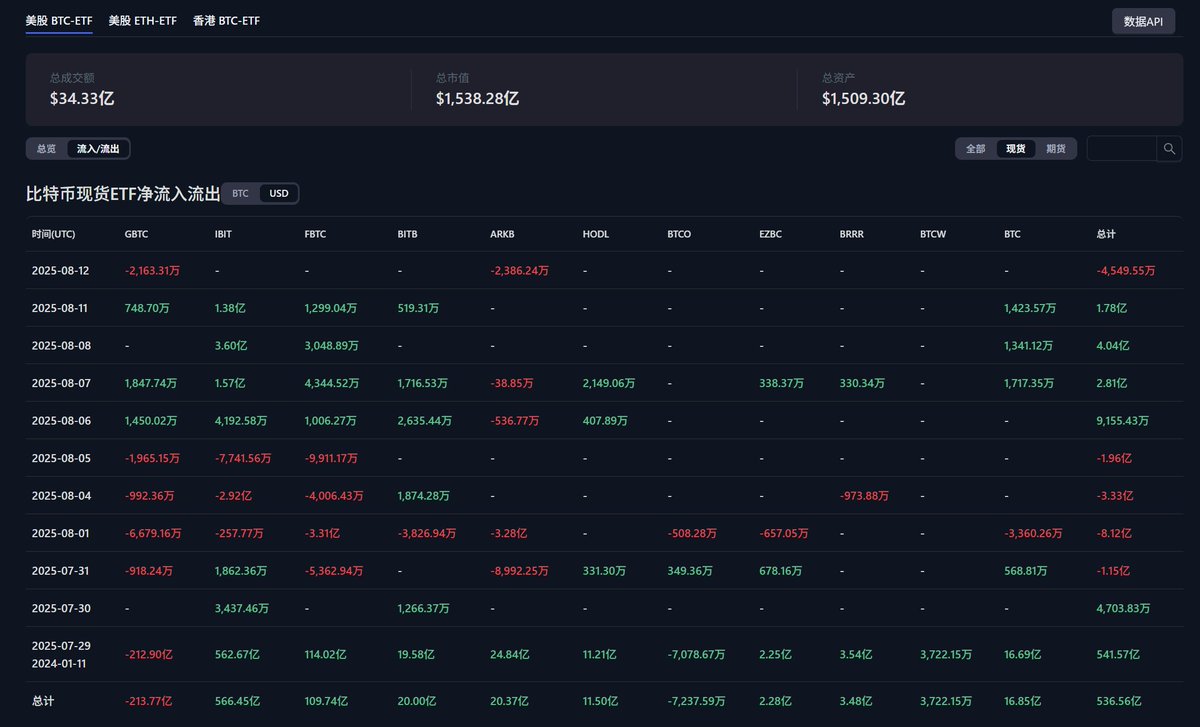

BTC ETF saw outflows last night, but the market absorbed it all. Only when the tide goes out do we know who has been swimming naked.

EOS 遗产:加密交易所 Bullish 能复刻 Coinbase 上市之路吗?

撰文:1912212.eth,Foresight News

2018 年 5 月,投资人李笑来曾放下豪言「七年之后再看 EOS」,七年过后,EOS 币价从最高点足足跌了 40 多倍。

讽刺的是,EOS 平台背后 Block.one 创立的 Bullish 将于 2025 年 8 月 13 日(刚好七年)在纽约证券交易所(NYSE)上市,股票代码为「BLSH」,预计将于北京时间 8 月 13 日 21:30 开盘交易。Block.one 通过其核心业务——机构级数字资产平台 Bullish 和 CoinDesk 媒体平台,已成为加密生态中的重要玩家。

加密公司上市潮之下,Foresight News 带你用数据视角洞察 Bullish。

目标估值 48 亿美元

Bullish 的 IPO 定价范围最近上调至 32-33 美元 / 股,发行股份增至 3000 万股,目标募资额高达 9.9 亿美元,估值约 48 亿美元。较早前的计划(以每股 28 至 31 美元出售 2030 万股)有所增加。这一调整反映了投资者对加密基础设施的强劲需求,尤其在比特币价格稳定在 11 万美元以上、机构采用率上升的背景下。

贝莱德(BlackRock)和凯西·伍德(Cathie Wood)的 ARK 已表示计划购买 2 亿美元股份。Bullish 预计将于本周二定价,次日开始交易。

Bullish 正式成立于 2021 年 6 月,总部位于开曼群岛,子公司遍布香港、美国、新加坡等地。其核心业务分为两大板块:Bullish 交易所提供现货、杠杆和衍生品交易服务,受德国、香港和直布罗陀监管;CoinDesk 则专注于指数、数据和洞察服务。

截至 2025 年 3 月 31 日,Bullish 交易所支持超过 70 个现货交易对和 45 个永续期货对,服务于全球 50 多个司法管辖区的合格客户。从交易量看,该平台自推出以来累计交易额已超过 1.25 万亿美元,其中 2024 年比特币(BTC/USDx)和以太坊(ETH/USDx)的全球现货交易量市场份额分别为 2848 亿美元和 1445 亿美元,显示出其在机构级市场的竞争力。

用户增长是 Bullish 发展的重要驱动力。2024 年其活跃机构客户数量同比增长 36%,CoinDesk 吸引了超过 5500 万独特访客,月均用户达 1070 万。CoinDesk 指数产品管理的资产规模(AUM)超过 410 亿美元,相关交易量达 150 亿美元(截至 2025 年 6 月 30 日)。Bullish 不仅在交易基础设施上发力,还通过媒体和数据服务构建生态闭环。

财务表现进一步佐证了其增长势头。根据 SEC F-1 备案,2024 年全年净收入为 8000 万美元,非 IFRS 调整后 EBITDA 为 5200 万美元。然而,2025 年第一季度录得净亏损 3.49 亿美元,主要受数字资产价格波动和运营成本影响。但调整后净收入仍为 200 万美元,显示核心业务盈利能力稳定。

第二季度初步估计显示,总收入在 6000-6200 万美元之间,调整后 EBITDA 为 1000-1400 万美元,净收入从 -200 万美元到 600 万美元不等。收入来源多样,包括交易费、价差、许可费和广告,2025 年第二季度调整后交易收入预计为 5600-5800 万美元。

持有价值 30 亿美元的加密资产

2021 年 5 月,Block.one 推出 Bullish Global 并为其注入 10 亿美元资金,包括 1 亿美元现金、164,000 枚比特币(当时价值约 97 亿美元)和 2000 万 EOS 代币。外部投资者还追加了 3 亿美元,包括 PayPal 联合创始人 Peter Thiel、对冲基金大佬 Alan Howard 和加密行业知名投资人 Mike Novogratz 等人。

该公司首席执行官 Tom Farley 曾任纽约证券交易所(NYSE)总裁,拥有深厚的传统金融市场经验,擅长推动机构级交易平台发展。David Bonanno 现在是 Bullish 首席财务官,此前是 Far Peak Acquisition Corp 首席财务官,在资本配置、业务战略和关键合作方面发挥着核心作用。此外,首席运营官 Sarah Johnson 在合规与风险管理方面表现突出,曾在香港证券及期货事务监察委员会任职,助力 Bullish 获得多地监管许可。

招股书(Form F-1)披露 Bullish 计划将 IPO 募集资金的 50% 以上转换为美元稳定币,以增强流动性并对冲加密市场波动。

Bullish 平台 2025 年第一季度 Bitcoin 交易量为 1086 亿美元,较上年同期的 800.82 亿美元增长 36%。比特币的每日交易量为 12.07 亿美元,较上年同期的 8.8 亿美元增长 37%。

招股书显示,Bullish 在 2022 年、2023 年、2024 年数字资产销售(Digital assets sales)分别为 728.9 亿美元、1164.9 亿美元、2502 亿美元;净利分别为 -42.46 亿美元、13 亿美元、7956 万美元。

时间来到 2025 年 8 月,该公司在周一提交的申报文件中表示:公司目前持有超过 30 亿美元的流动性资产,其中包括:24,000 枚比特币;12,600 枚 ETH;4.18 亿美元的现金与稳定币。第二季度末,流动资产估计增至 20.5-21.5 亿美元,净流动资产 14.99-15.99 亿美元。

Bullish 前身 Block.one 于 2017-2018 年通过 EOS ICO(初始代币发行)募资约 41.8 亿美元,这是加密历史上规模最大的 ICO 之一,用于开发 EOS 平台。

EOS 代币早已抛给了投资者,而源源不断的现金流和收入,用于购入比特币与以太坊。仅仅这一项投资,Bullish 就赚得盆满钵满。

EOS 未能在万众期待下茁壮成长,block.one 打造的交易所 Bullish 能否真正成功,或许仍得打个问号。

EOS 遗产:加密交易所 Bullish 能复刻 Coinbase 上市之路吗?

作者:1912212.eth,Foresight News

2018 年 5 月,投资人李笑来曾放下豪言「七年之后再看 EOS」,七年过后,EOS 币价从最高点足足跌了 40 多倍。

讽刺的是,EOS 平台背后 Block.one 创立的 Bullish 将于 2025 年 8 月 13 日(刚好七年)在纽约证券交易所(NYSE)上市,股票代码为「BLSH」,预计将于北京时间 8 月 13 日 21:30 开盘交易。Block.one 通过其核心业务——机构级数字资产平台 Bullish 和 CoinDesk 媒体平台,已成为加密生态中的重要玩家。

加密公司上市潮之下,Foresight News 带你用数据视角洞察 Bullish。

目标估值 48 亿美元

Bullish 的 IPO 定价范围最近上调至 32-33 美元 / 股,发行股份增至 3000 万股,目标募资额高达 9.9 亿美元,估值约 48 亿美元。较早前的计划(以每股 28 至 31 美元出售 2030 万股)有所增加。这一调整反映了投资者对加密基础设施的强劲需求,尤其在比特币价格稳定在 11 万美元以上、机构采用率上升的背景下。

贝莱德(BlackRock)和凯西·伍德(Cathie Wood)的 ARK 已表示计划购买 2 亿美元股份。Bullish 预计将于本周二定价,次日开始交易。

Bullish 正式成立于 2021 年 6 月,总部位于开曼群岛,子公司遍布香港、美国、新加坡等地。其核心业务分为两大板块:Bullish 交易所提供现货、杠杆和衍生品交易服务,受德国、香港和直布罗陀监管;CoinDesk 则专注于指数、数据和洞察服务。

截至 2025 年 3 月 31 日,Bullish 交易所支持超过 70 个现货交易对和 45 个永续期货对,服务于全球 50 多个司法管辖区的合格客户。从交易量看,该平台自推出以来累计交易额已超过 1.25 万亿美元,其中 2024 年比特币(BTC/USDx)和以太坊(ETH/USDx)的全球现货交易量市场份额分别为 2848 亿美元和 1445 亿美元,显示出其在机构级市场的竞争力。

用户增长是 Bullish 发展的重要驱动力。2024 年其活跃机构客户数量同比增长 36%,CoinDesk 吸引了超过 5500 万独特访客,月均用户达 1070 万。CoinDesk 指数产品管理的资产规模(AUM)超过 410 亿美元,相关交易量达 150 亿美元(截至 2025 年 6 月 30 日)。Bullish 不仅在交易基础设施上发力,还通过媒体和数据服务构建生态闭环。

财务表现进一步佐证了其增长势头。根据 SEC F-1 备案,2024 年全年净收入为 8000 万美元,非 IFRS 调整后 EBITDA 为 5200 万美元。然而,2025 年第一季度录得净亏损 3.49 亿美元,主要受数字资产价格波动和运营成本影响。但调整后净收入仍为 200 万美元,显示核心业务盈利能力稳定。

第二季度初步估计显示,总收入在 6000-6200 万美元之间,调整后 EBITDA 为 1000-1400 万美元,净收入从 -200 万美元到 600 万美元不等。收入来源多样,包括交易费、价差、许可费和广告,2025 年第二季度调整后交易收入预计为 5600-5800 万美元。

持有价值 30 亿美元的加密资产

2021 年 5 月,Block.one 推出 Bullish Global 并为其注入 10 亿美元资金,包括 1 亿美元现金、164,000 枚比特币(当时价值约 97 亿美元)和 2000 万 EOS 代币。外部投资者还追加了 3 亿美元,包括 PayPal 联合创始人 Peter Thiel、对冲基金大佬 Alan Howard 和加密行业知名投资人 Mike Novogratz 等人。

该公司首席执行官 Tom Farley 曾任纽约证券交易所(NYSE)总裁,拥有深厚的传统金融市场经验,擅长推动机构级交易平台发展。David Bonanno 现在是 Bullish 首席财务官,此前是 Far Peak Acquisition Corp 首席财务官,在资本配置、业务战略和关键合作方面发挥着核心作用。此外,首席运营官 Sarah Johnson 在合规与风险管理方面表现突出,曾在香港证券及期货事务监察委员会任职,助力 Bullish 获得多地监管许可。

招股书(Form F-1)披露 Bullish 计划将 IPO 募集资金的 50% 以上转换为美元稳定币,以增强流动性并对冲加密市场波动。

Bullish 平台 2025 年第一季度 Bitcoin 交易量为 1086 亿美元,较上年同期的 800.82 亿美元增长 36%。比特币的每日交易量为 12.07 亿美元,较上年同期的 8.8 亿美元增长 37%。

招股书显示,Bullish 在 2022 年、2023 年、2024 年数字资产销售(Digital assets sales)分别为 728.9 亿美元、1164.9 亿美元、2502 亿美元;净利分别为 -42.46 亿美元、13 亿美元、7956 万美元。

时间来到 2025 年 8 月,该公司在周一提交的申报文件中表示:公司目前持有超过 30 亿美元的流动性资产,其中包括:24,000 枚比特币;12,600 枚 ETH;4.18 亿美元的现金与稳定币。第二季度末,流动资产估计增至 20.5-21.5 亿美元,净流动资产 14.99-15.99 亿美元。

Bullish 前身 Block.one 于 2017-2018 年通过 EOS ICO(初始代币发行)募资约 41.8 亿美元,这是加密历史上规模最大的 ICO 之一,用于开发 EOS 平台。

EOS 代币早已抛给了投资者,而源源不断的现金流和收入,用于购入比特币与以太坊。仅仅这一项投资,Bullish 就赚得盆满钵满。

EOS 未能在万众期待下茁壮成长,block.one 打造的交易所 Bullish 能否真正成功,或许仍得打个问号。

$BTC is currently fluctuating around 119,000. If it doesn't break through this level, it is very likely to dip down before continuing to rise to fill the CME gap below.

Watch the 120,000 level above and the 116,500 level below. Retail investors can't push BTC's price up; only when funds flow back from ETH will we see a significant rise. We're just 3.2% away from the previous high.

BTC ETF saw outflows last night, but the market absorbed it all. Only when the tide goes out do we know who has been swimming naked.

时光预言机i

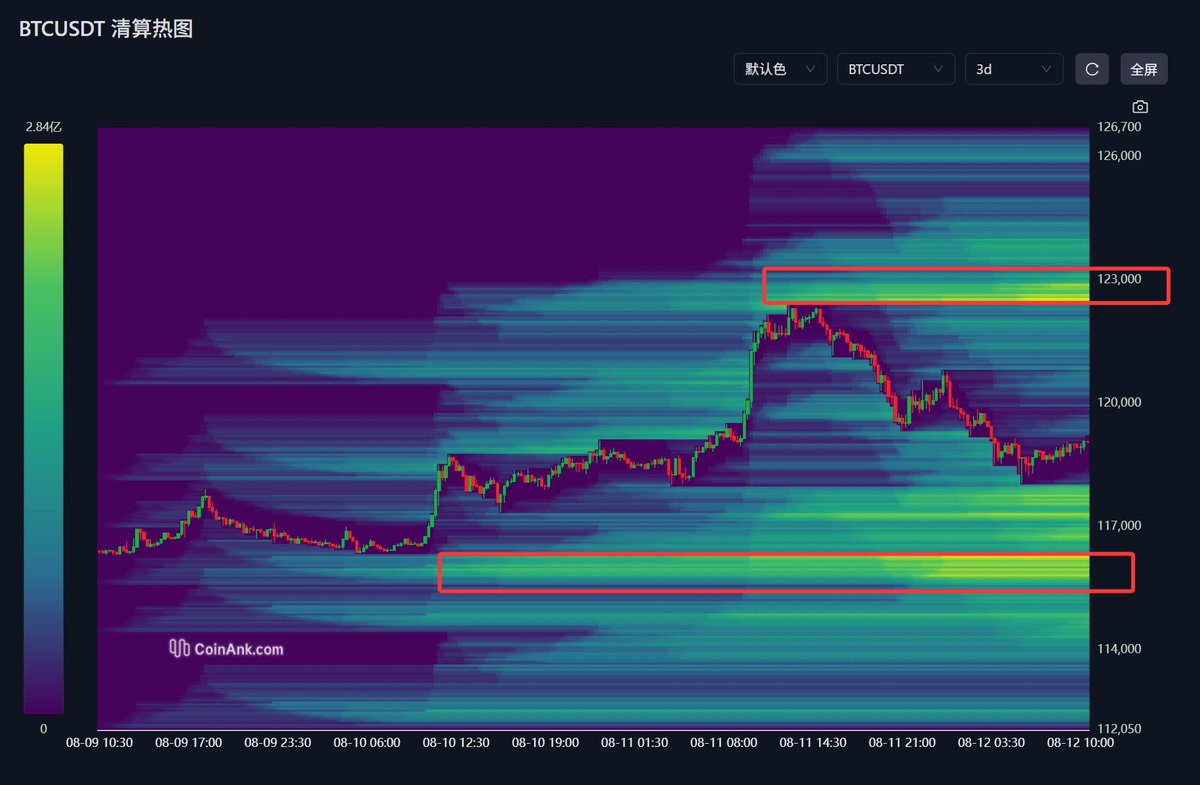

$BTC has encountered significant selling pressure at the 12.2 level.

The daily chart shows a long upper shadow candlestick, indicating that the adjustment has already taken place after the downward spike this morning. It will first rebound to around 119800 before consolidating, waiting for the CPI data to be released tonight.

It is expected to test the previous high of 123200 again. Before the market ends, it’s best to focus on buying low. While there is significant selling pressure, buying interest is also strong. This situation is suitable for some swing trading (for those with good technical skills).

Now, the shorts have become smarter; the liquidation price for the shorts has risen to 123000, with over 175 million in liquidations. The liquidation price for the longs has dropped to 116200, with 211 million.

Looking at this, there are still more people shorting...

EOS price performance in USD

The current price of binance-peg-eos-token is $0.81404. Over the last 24 hours, binance-peg-eos-token has decreased by -1.16%. It currently has a circulating supply of 63,889,455 EOS and a maximum supply of 63,890,000 EOS, giving it a fully diluted market cap of $52.01M. The binance-peg-eos-token/USD price is updated in real-time.

5m

+0.00%

1h

+0.65%

4h

-1.35%

24h

-1.16%

About Binance-Peg EOS Token (EOS)

EOS FAQ

What’s the current price of Binance-Peg EOS Token?

The current price of 1 EOS is $0.81404, experiencing a -1.16% change in the past 24 hours.

Can I buy EOS on OKX?

No, currently EOS is unavailable on OKX. To stay updated on when EOS becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of EOS fluctuate?

The price of EOS fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Binance-Peg EOS Token worth today?

Currently, one Binance-Peg EOS Token is worth $0.81404. For answers and insight into Binance-Peg EOS Token's price action, you're in the right place. Explore the latest Binance-Peg EOS Token charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Binance-Peg EOS Token, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Binance-Peg EOS Token have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.