This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

AUSD

AUSD price

0x0000...012a

$0.99944

+$0.0085219

(+0.86%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about AUSD today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

AUSD market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$39.39M

Network

Avalanche C

Circulating supply

39,415,005 AUSD

Token holders

0

Liquidity

$993.07K

1h volume

$9.12K

4h volume

$61.79K

24h volume

$2.47M

AUSD Feed

The following content is sourced from .

Solid week for stablecoins on Solana!

@DeFiCarrot and @withAUSD launching a $1M borrow cap CRT Boost, filled in 17 minutes.

@fslweb3 bringing $GGUSD to Solana ecosystem.

@KaminoFinance adjusted its USDC interest rate curve to lower borrow rates and improve stability for large borrowers. With $65M+ in borrow capacity and $2.8B+ in total volume, it’s already Solana’s most-used stablecoin market.

@KaminoFinance fueling USDG adoption, distributing $280K+ in monthly rewards, with $200K+ going to lending incentives.

@Circle minted $750M in USDC on Solana, bringing total supply to $7.79B.

What exciting Solana stablecoin updates did I miss? 👀

Do share below👇

some of you will make good $$$ this cycle

if you want to actually keep it, read this

the first months of a bear market are BRUTAL and it will trick you into buying tops and selling bottoms (again)

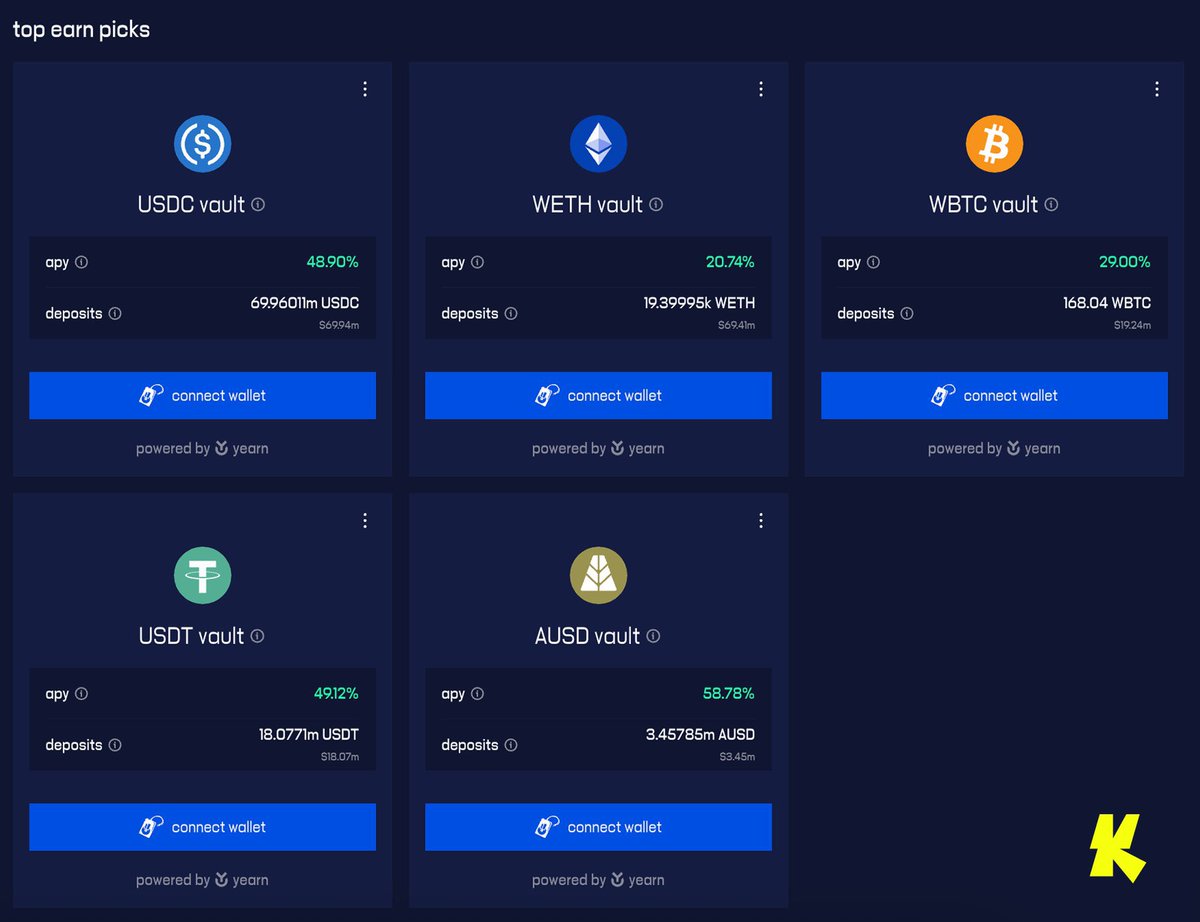

the best solution is to find a DeFi chain like @katana and let your stables + safe assets (like bitcoin) work for you

I've been down the DeFi rabbit hole since finding @turtledotxyz 🐢

Katana Network is a Layer 2 chain designed to both simplify DeFi and address it's main problems like fragmented liquidity and unstable yields

you bridge your assets there and they instantly start working for you

there's A LOT to talk about and I'm just getting started

we'll learn together how to use DeFi to save our yapping bags and how Katana works under the hood

for me 'AUSD' is the most interesting product out of Katana, a yield-bearing stablecoin backed 1:1 by US Treasuries

in my next Katana post, I'll be explaining why this is the perfect place to protect capital when the bear hits 🫡

2 weeks since the DAT announcement:

🔹over 50% surge in TVL, putting the TVL at ~$9.3B. It's just a matter of time to cross $10B

🔹APY for sUSDe remains stable at 10%

🔹Buy back is still underway in the next 4 weeks

And you say you're not bullish on $ENA yet, anon?

Ethena Labs

StablecoinX Inc. @stablecoin_x has announced a $360 million capital raise to purchase $ENA and will seek to list its Class A common shares on the Nasdaq Global Market under the ticker symbol "USDE", which includes a $60 million contribution of ENA from the Ethena Foundation

Equity markets will now have direct access and exposure to the most important emerging trend in all of finance:

The growth of digital dollars and stablecoins.

To bootstrap its acquisition strategy, StablecoinX Inc. will use all of the $260 million cash proceeds from the raise (less amounts for certain expenses) to buy locked ENA from a subsidiary of the Ethena Foundation.

Starting today, the Ethena Foundation subsidiary (via third-party market makers) will use 100% of the $260 million cash proceeds from the token sale to strategically purchase $ENA across publicly traded venues over the coming weeks, further aligning the Foundation’s incentives with those of StableCoinX shareholders.

The planned deployment schedule is approximately $5m daily from today over the course of the next 6 weeks. At current prices $260m represents roughly 8% of circulating supply.

Importantly, the Ethena Foundation has the right to veto any sales of $ENA by StableCoinX at its sole discretion. Ideally, tokens will never be sold with a sole focus on accumulation.

To the extent StableCoinX subsequently raises capital with the intent of purchasing additional locked ENA from the Ethena Foundation or its affiliates, cash proceeds from those token sales are planned to be used to purchase spot $ENA.

StableCoinX's treasury strategy is a deliberate, multi‑year capital allocation strategy that will enables StableCoinX to capture the enormous value of the secular surge in demand for digital dollars while compounding ENA per share to the benefit of shareholders.

Recently, while browsing Twitter, I came across a foreign DeFi blogger discussing Katana, claiming it’s a project that offers up to 48% annual interest on USDT/USDC even before its TGE, with the condition that funds must be locked until before 2026. Although it sounds a bit crazy, I was indeed intrigued and took a look at some previous content from Lombard, discovering that they have a close relationship with Katana!

In short, this is not just another cross-chain integration for BTC. Lombard has become the sole issuer of BTC on Katana, introducing two new assets:

※ BTCK: Decentralized BTC mapping

※ LBTC: BTC LST with built-in yield

Compared to centralized options like WBTC and BTCB, these two new tokens are thoroughly embedded in the underlying structure of Katana. In the future, when it comes to on-chain scheduling and settlement, the default will be to use them rather than some alternative. This is also why Katana has directly signed Lombard as its sole partner; they want BTC to be a foundational layer that grows together with the ecosystem, not just an add-on!

Interestingly, Katana is not a standalone chain; it is actually the DeFi and liquidity hub of the larger Agglayer network. Agglayer itself connects to many specialized L2s, such as IoTeX (DePIN), Wirex (payments), Sentient (AI), Moonveil (gaming), and more, with a bunch of use cases still in incubation.

So, from this perspective, Lombard is not just launching a new chain but has secured a strategic position: to be the official entry point for BTC liquidity within the entire Agglayer/@0xPolygon ecosystem!

For Lombard, this is actually quite smart: they don’t have to connect to dozens of L2s themselves but can instead focus on a central hub that will distribute BTC to all downstream. As Katana’s liquidity expands, the usage of LBTC and BTCK will also rise!

If you’re like me and considering an early asset allocation (or trying to catch a future Katana airdrop), this could be a relatively rare opportunity. The lock-up period is long, but sometimes, high interest and early dividends require patience!

AUSD price performance in USD

The current price of ausd is $0.99944. Over the last 24 hours, ausd has increased by +0.86%. It currently has a circulating supply of 39,415,005 AUSD and a maximum supply of 39,415,005 AUSD, giving it a fully diluted market cap of $39.39M. The ausd/USD price is updated in real-time.

5m

+0.00%

1h

+0.37%

4h

-0.18%

24h

+0.86%

About AUSD (AUSD)

AUSD FAQ

What’s the current price of AUSD?

The current price of 1 AUSD is $0.99944, experiencing a +0.86% change in the past 24 hours.

Can I buy AUSD on OKX?

No, currently AUSD is unavailable on OKX. To stay updated on when AUSD becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of AUSD fluctuate?

The price of AUSD fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 AUSD worth today?

Currently, one AUSD is worth $0.99944. For answers and insight into AUSD's price action, you're in the right place. Explore the latest AUSD charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as AUSD, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as AUSD have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.