This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

APU

Apu Apustaja price

0x594d...5bfa

$0.00023678

-$0.00006

(-19.34%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about APU today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

APU market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$99.61M

Network

Ethereum

Circulating supply

420,690,000,000 APU

Token holders

33004

Liquidity

$2.99M

1h volume

$14.76K

4h volume

$268.36K

24h volume

$1.67M

Apu Apustaja Feed

The following content is sourced from .

The 70-fold god collapsed, can the meme DeFi IMF come back?

Written by: Cookies, Rhythm

From early June to early July this year, $IMF has risen nearly 70x as a MemeFi project on the Ethereum mainnet. While $IMF gradually pulled back 50% after hitting an all-time high of $70 million in market capitalization, yesterday a huge drop that peaked at nearly 85% sent shockwaves through the market.

$IMF's drop shocked Zhu Su

What exactly happened to $IMF to see such a huge drop?

What is the IMF?

IMF (International Meme Fund) is a decentralized finance platform tailored for mainnet memes, allowing users to lend stablecoin $USDS with their $PEPE, $JOE, $MOG, and other meme coins as collateral and monetize them without selling. At the same time, through modules such as Accelerate and Amplify, project parties or whales can also add leverage pulls, circular lending and protection, and even create the illusion of "lock-up", which actually realizes early shipments and shadow fund management.

Through the IMF, you can realize the circular lending of meme coins and achieve "left foot on right foot", such as:

· Buy $10,000 PEPE

· Deposit PEPE into the IMF and lend a $5000 USDS loan

· Swap USDS for PEPE

· Deposit the remaining $5000 in PEPE to reduce the loan-to-value ratio (LTV)

At present, the IMF's TVL is still about $166.5 million, with a total of about $54 million in $USDS deposits, about $29.22 million in $PEPE, about $20.58 million in $stETH, about $44.4 million in $MOG, about $5.88 million in $JOE, about $4.94 million in $SPX, and about $7.5 million in $IMF as collateral.

Why did $IMF plummet?

According to the IMF's official tweet, the sudden plunge of $IMF was not due to problems with the protocol itself, but because the $IMF token itself suffered a sell-off, and the more panic selling caused by the sell-off and the series of liquidations led to a sharp drop in $IMF's price.

The official also said in a tweet that due to the speed and frequency of liquidation, some bad debts (about 1% of USDS deposited) have accumulated. This is less than the total yield generated by the lender, so there is no net loss. In addition, issues in the $IMF lending market do not affect other borrowing pairs on the platform.

@2025Spider tweeted that his friend sold $100,000 worth of $IMF for 1.02U, triggering a series of liquidations. He said his friend had no intention of sabotaging the IMF project and said that the project team should close the IMF lending position, otherwise USDS would be at great risk. He also said that the team's oracles are slow to update, and when most IMF/USDT positions are insolvent, oracles still don't update to the latest prices in time.

Regarding the IMF's opening of collateral lending for its own platform currency $IMF, both @2025Spider and the Chinese KOL "Professor Suo said" have raised questions:

Someone asked him under @2025Spider's tweet, "Is the IMF a scam"? @2025Spider said that the team members are good, but they should not open up $IMF collateral lending, otherwise there is reason to think that they want to sell their own tokens in disguise to cash out like the CRV founders. He also said that the amount of loans issued to $IMF exceeds the $IMF UniSwap pool itself, which should not be done from a risk control perspective

"Professor Suo said" is through on-chain records, more directly questioning the IMF team's own collateral to trigger FOMO and then sell tokens to cash out:

The IMF official Twitter released a detailed report on the series of liquidations this afternoon. A total of 260 liquidations involving 126 independent borrowers accounted for 15.47% of the total $IMF supply being liquidated.

epilogue

After the incident, $IMF rebounded nearly 4 times from its lowest point and is still nearly 3 times the price from its lowest point, with its market value rising to nearly $21 million.

However, the controversy that accompanies $IMF may not end. On July 24, @alex_eph612, a major player in the well-known meme coin $APU on Ethereum, fired at the IMF. He said that the IMF was initiated by the cabal of $PEPE, $MOG and Milady, and its business model is actually to ask other organic meme coin communities for free tokens in exchange for short-term buying that the IMF can bring, and then the cabal sells them with the tokens:

The IMF quickly hit back, claiming that no bribes were being solicited and that the criteria for listing lending pairs were public and voted on by $IMF holders:

Ethereum's "meme flywheel" may still have to endure storms.

Dear all engagement farmers like this guy

U are missing a massive trick not mentioning $REKT

Easy way to get myself and the rest of the rektguy army to comment and RT your post.

Cheers

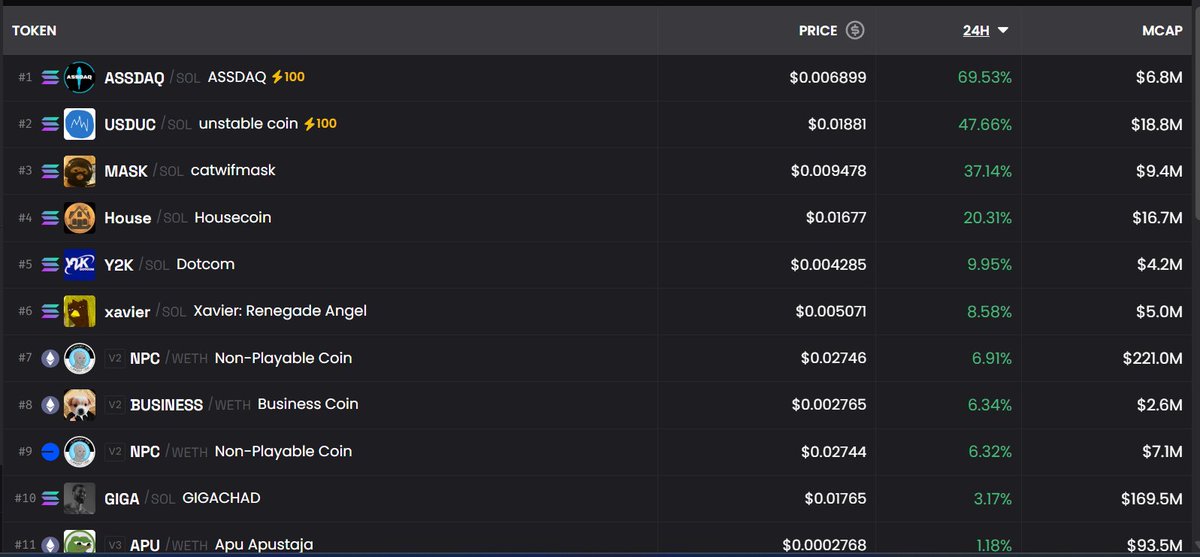

The Alchemist (🧪,⚗️)

The cult communities are waking up

Position accordingly

My top 10 potential 💯

1. #Fartcoin - $1.06B

2. $SPX - $1.72B

3. $GIGA - $170M

4. $NPC - $221M

5. #USELESS - $285M

6. $MASK - $9.4M

7. $USA - $11M

8. $SIGMA - $15M

9. $XAVIER - $5M

10. $ASSDAQ - $7M

Others: #MSTR2100, #BUSINESS, #Y2K, $MLG, $POPCAT, $UFD, $FAT, #OIIAOIIA, $IQ, #Crashout $USDUC $MASK, $NEET, #RETARDIO

APU price performance in USD

The current price of apu-apustaja is $0.00023678. Over the last 24 hours, apu-apustaja has decreased by -19.34%. It currently has a circulating supply of 420,690,000,000 APU and a maximum supply of 420,690,000,000 APU, giving it a fully diluted market cap of $99.61M. The apu-apustaja/USD price is updated in real-time.

5m

+0.00%

1h

-1.20%

4h

-7.02%

24h

-19.34%

About Apu Apustaja (APU)

APU FAQ

What’s the current price of Apu Apustaja?

The current price of 1 APU is $0.00023678, experiencing a -19.34% change in the past 24 hours.

Can I buy APU on OKX?

No, currently APU is unavailable on OKX. To stay updated on when APU becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of APU fluctuate?

The price of APU fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Apu Apustaja worth today?

Currently, one Apu Apustaja is worth $0.00023678. For answers and insight into Apu Apustaja's price action, you're in the right place. Explore the latest Apu Apustaja charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Apu Apustaja, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Apu Apustaja have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.