This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

AMZN

Amazon.com price

AxReBd...EBKJ

$0.0018512

+$0.0011776

(+174.83%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about AMZN today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

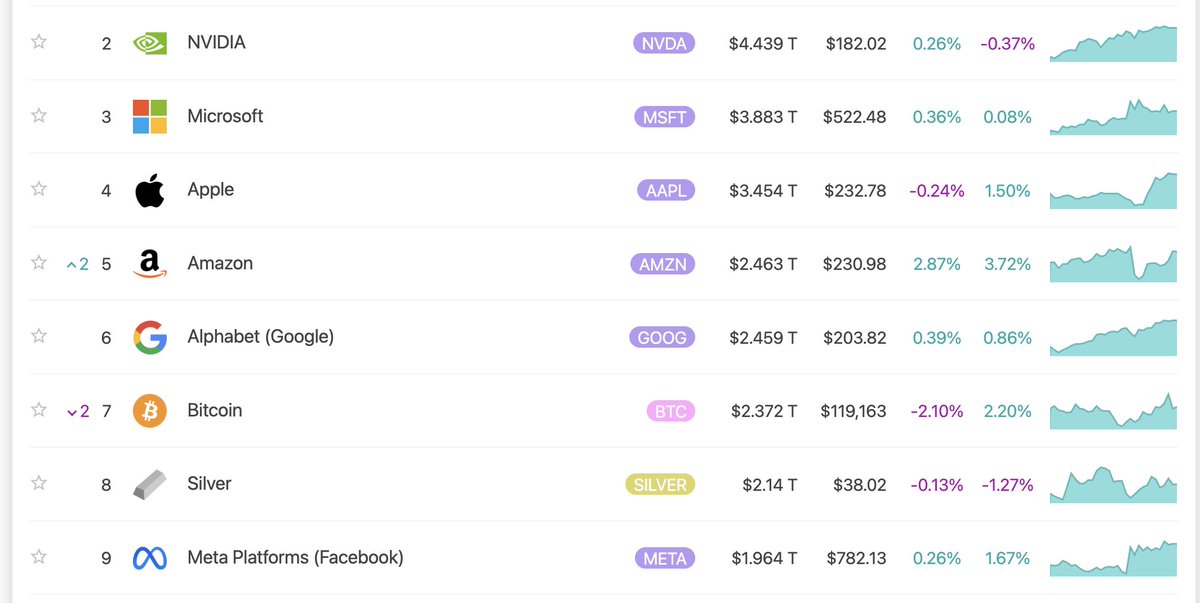

AMZN market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$1.85M

Network

Solana

Circulating supply

999,999,980 AMZN

Token holders

265

Liquidity

$126.82K

1h volume

$6.10M

4h volume

$6.10M

24h volume

$6.10M

Amazon.com Feed

The following content is sourced from .

mostly agree with this. with the caveat that using celestia for DA (read bandwidth) will not involve them having to bet on TIA, but could result in significant cost savings and interop benefits over time

the same way using aws or azure does not involve them having to bet on AMZN or MSFT

the current corporate push toward stand alone chains isn't really a sign that rollups aren't the endgame imo, but much more a sign that the current foundations for them are not good enough

e.g. in the ethereum case: da is not scaling anywhere near fast enough for their ambitions (and there’s a platform risk here due to technical challenges and open questions), slow finality is an issue, maxi alignment games (e.g. canonical bridge = rollup) are a distraction at best (and mostly detract from building a great product), all rollups (apart from facet) are upgradeable by admins... i could go on

in fact i'd argue that the foundations we've built are largely orthogonal to what's actually needed

in parentheses, AWS makes most of its money from the long tail of businesses, and interop network effects with the right foundations are a potential game changer for base layers here

but we still have a lot of work to do. the good news though is that i think we'll see pretty soon whether the celestia cloud computing thesis is directionally correct or not (i.e next 3 - 12 months)

to elaborate a little, i think celestia's success is tied to its ability to get out of the way and allow others to create and capture value -- you shouldn't even need to know it's there. it should simply exist to provide businesses and their users with a better onchain product experience (high performance + end user verifiability — if desired)

the pitch here is that you can issue and settle wherever your users are and save money while doing so. there are no alignment games to navigate. you can just focus on building a 10x better product on a maximally simple foundation

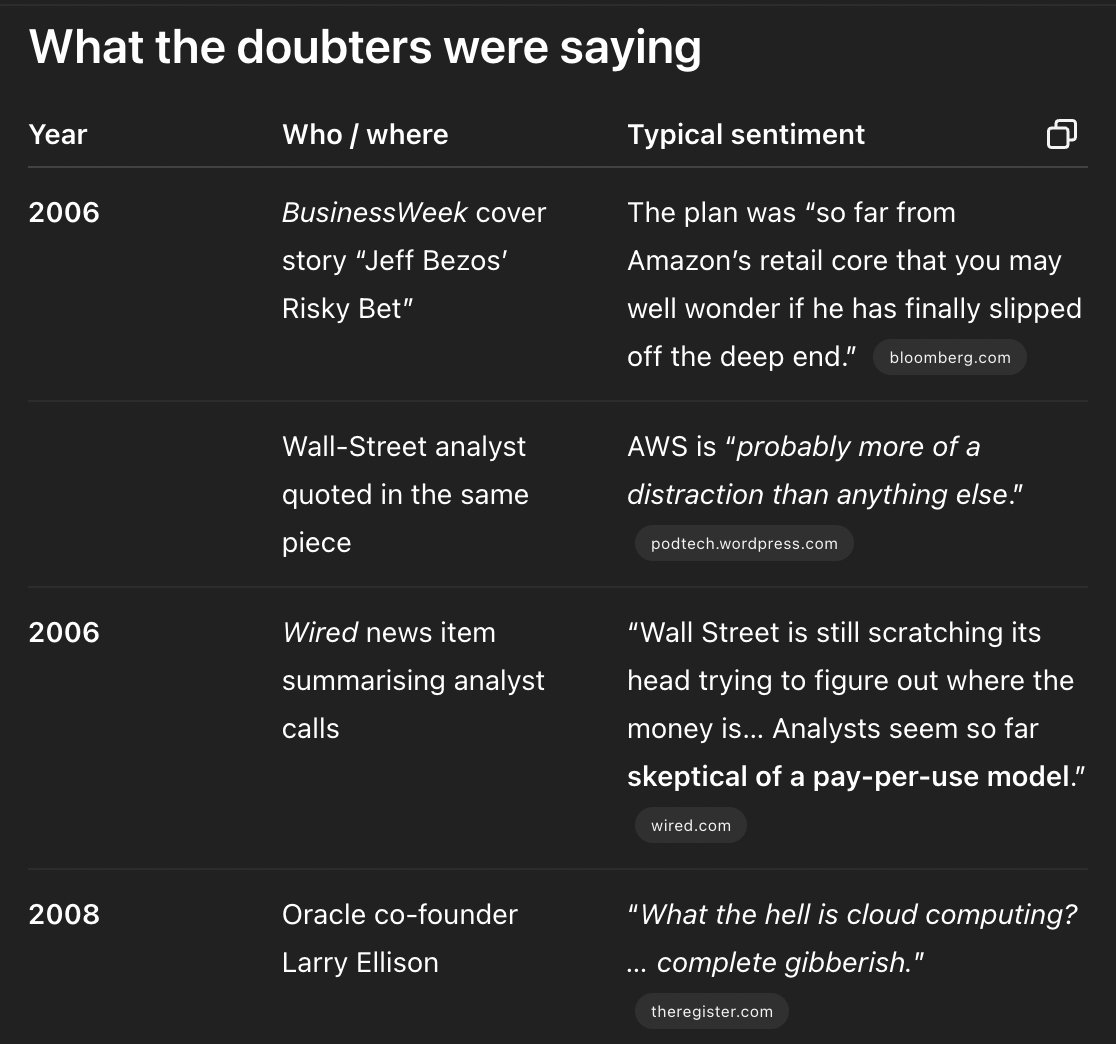

it's also important to keep in mind that in the early days of aws /cloud computing, the wall st consensus was that this was an insane bet to make. even plugged in folks like larry ellison couldn't wrap their heads around it

barry

This isn't a 1 off. This is the start of a massive trend of real businesses building their own L1 blockchains. We're in talks with tons of other companies (including some major fortune 500s) who are considering launching their own L1s.

Years ago, enterprise blockchains failed and have been a 3rd rail for a long time. So why now? Why are mature businesses starting to build blockchains again?

And why are they building L1s above anything else?

There are two major reasons enterprise blockchains are coming back:

1/ Stablecoins are maturing: The finance teams we talk to are not afraid or unfamiliar with stablecoins anymore. Thanks to the Circle IPO and coming regulation, they see stablecoins as a powerful and safe technology that can help them cut costs, streamline operations, and earn more on their cash reserves or customer deposits. Most big companies are putting in place infrastructure to hold and move stablecoins. The U.S., Japan, and many other countries are pushing forward stablecoin regulations, and the dust is settling in our favor.

2/ Payments, not provenance: In the previous wave of enterprise blockchain hype most of the use cases were around provenance (aka tracking the origin and lifecycle of some multi-company process, like tracking raw materials across a supply chain or tracking the usage of donor capital). This was always a weird use case that could technically be done with a database. The problem was trust.

Now, the corporations we're talking to are looking at payments as their first use case, almost no matter what industry they're in. Most B2B and B2C payments providers and networks charge merchants and businesses high margins, take days to settle, and have real settlement risk. These problems are much worse as soon as you go cross-border or need to deal with FX. So for multinational corporations (especially marketplaces like Airbnb), in-house blockchain-based payment solutions could lead to billions in savings and better experiences for customers, employees, and gig workers.

And why are they building L1s, not L2s, or contracts?

1/ L1s are battle-tested and familiar to technical decision makers: L1s as a technology platform are well-understood and familiar after 10+ years of development. Ethereum, Bitcoin, Solana, Sui, Aptos -- every blockchain that people who don't work in the industry know about is an L1 (base maybe being the exception). Cosmos tech alone supports 200+ chains and $70b of assets across almost every vertical, and Hyperliquid, the biggest breakout of the last year, cemented this. (Plus the most successful enterprise blockchains like Canton are L1s).

L2s are exciting but they are still nascent and poorly understood by comparison. (Try explaining the difference between a stage 1 and stage 2 rollup or what a validating bridge is to the CTO of a consumer marketplace business). Decision makers who operate mature businesses usually don't want to take risks on emerging new platforms. They're already taking a big enough risk by getting into crypto, so they need to do it in the way that is most legible to their stakeholders.

2/ Minimizing platform risk: Most of these companies don't want to bet on ETH or SOL or TIA or anything else. They just want to bet on themselves. Building an L1 is the best way to do that. Remember, big companies usually use multiple cloud providers to avoid platform risk from AWS or Microsoft. And you can bet they see Ethereum or Solana as much riskier than those partners.

3/ Control and connectivity: Open, transparent L1s give these companies a great balance of control (so they can own their own platform) and connectivity (so they can plug into and interoperate with the broader crypto-corporate landscape as it evolves). Interop between L2s and other chains like Solana relies on 3rd parties, and often struggles from finality issues due to fraud / Zk proving windows and Ethereum's slow finality. L1s don't have this issue. Settlement happens instantly and deterministically, so interop can function the same way. That is a killer feature when combined with the ability to have your own walled garden where you implement any necessary KYC/AML and application specific logic.

Very excited for the next wave of the internet of blockchains

.@VestExchange is transforming Wall Street into a 24/7, no-fee trading playground for traders.

🔹 Equity perps with instant execution

🔸 Up to 50x leverage on SPX, Nasdaq 100, AAPL & more

🔹 ~$1B total volume, $8.7M 24h volume

🔸 Backed by Jane Street, Amber Group & more

Equities, reimagined for crypto-native speed.

AMZN price performance in USD

The current price of amazon-com is $0.0018512. Over the last 24 hours, amazon-com has increased by +174.83%. It currently has a circulating supply of 999,999,980 AMZN and a maximum supply of 999,999,980 AMZN, giving it a fully diluted market cap of $1.85M. The amazon-com/USD price is updated in real-time.

5m

+20.46%

1h

+174.83%

4h

+174.83%

24h

+174.83%

About Amazon.com (AMZN)

AMZN FAQ

What’s the current price of Amazon.com?

The current price of 1 AMZN is $0.0018512, experiencing a +174.83% change in the past 24 hours.

Can I buy AMZN on OKX?

No, currently AMZN is unavailable on OKX. To stay updated on when AMZN becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of AMZN fluctuate?

The price of AMZN fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Amazon.com worth today?

Currently, one Amazon.com is worth $0.0018512. For answers and insight into Amazon.com's price action, you're in the right place. Explore the latest Amazon.com charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Amazon.com, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Amazon.com have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.