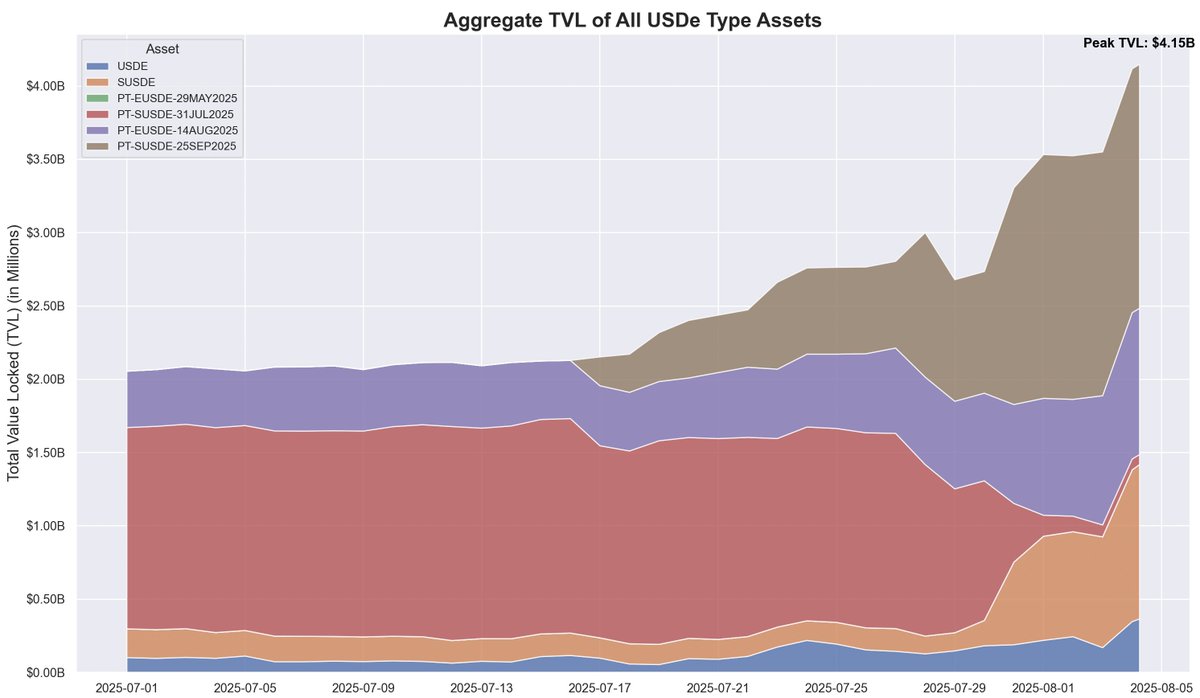

1/ Ethena's USDe supply is up $3.7B in just 20 days, driven primarily by the Pendle-Aave PT-USDe looping strategy.

With $4.3B (60% of total USDe) now locked in Pendle and $3B deposited in Aave, here's a breakdown of the PT loop mechanics, growth vectors, and potential risks:

2/ USDe is a decentralized stablecoin pegged to USD, maintaining its peg via delta-neutral hedging using ETH perpetual futures.

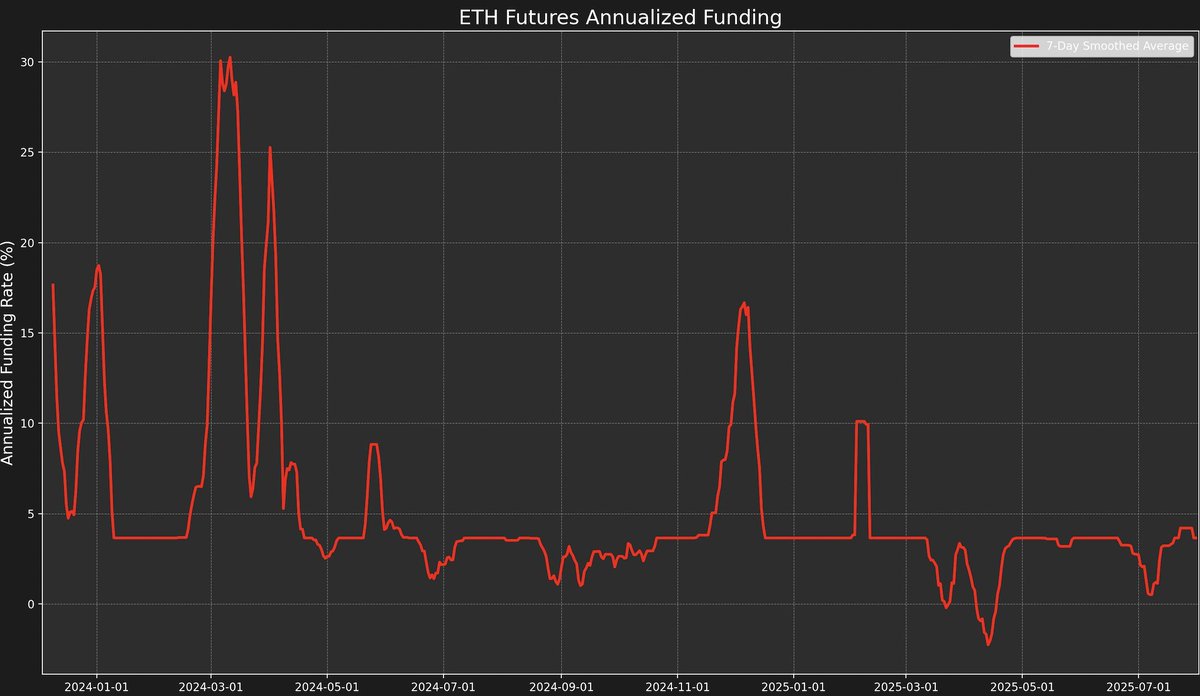

This hedging allows USDe to algorithmically stabilize its price, generating yield through both spot staking and futures funding rates.

3/ Yields from this strategy exhibit high volatility due to their dependence on funding rates (USDe YTD yield is ~9.4% with a stdv of 4.4pp).

Funding rates are driven by the premium or discount between the perpetual futures price and the underlying ETH spot price ("mark price").

When bullish sentiment rises, traders aggressively open leveraged long positions, temporarily driving perpetual prices above the mark price.

Positive funding rates then incentivize MMs to step in, shorting the perp and hedging with spot.

4/ However, funding is not guaranteed.

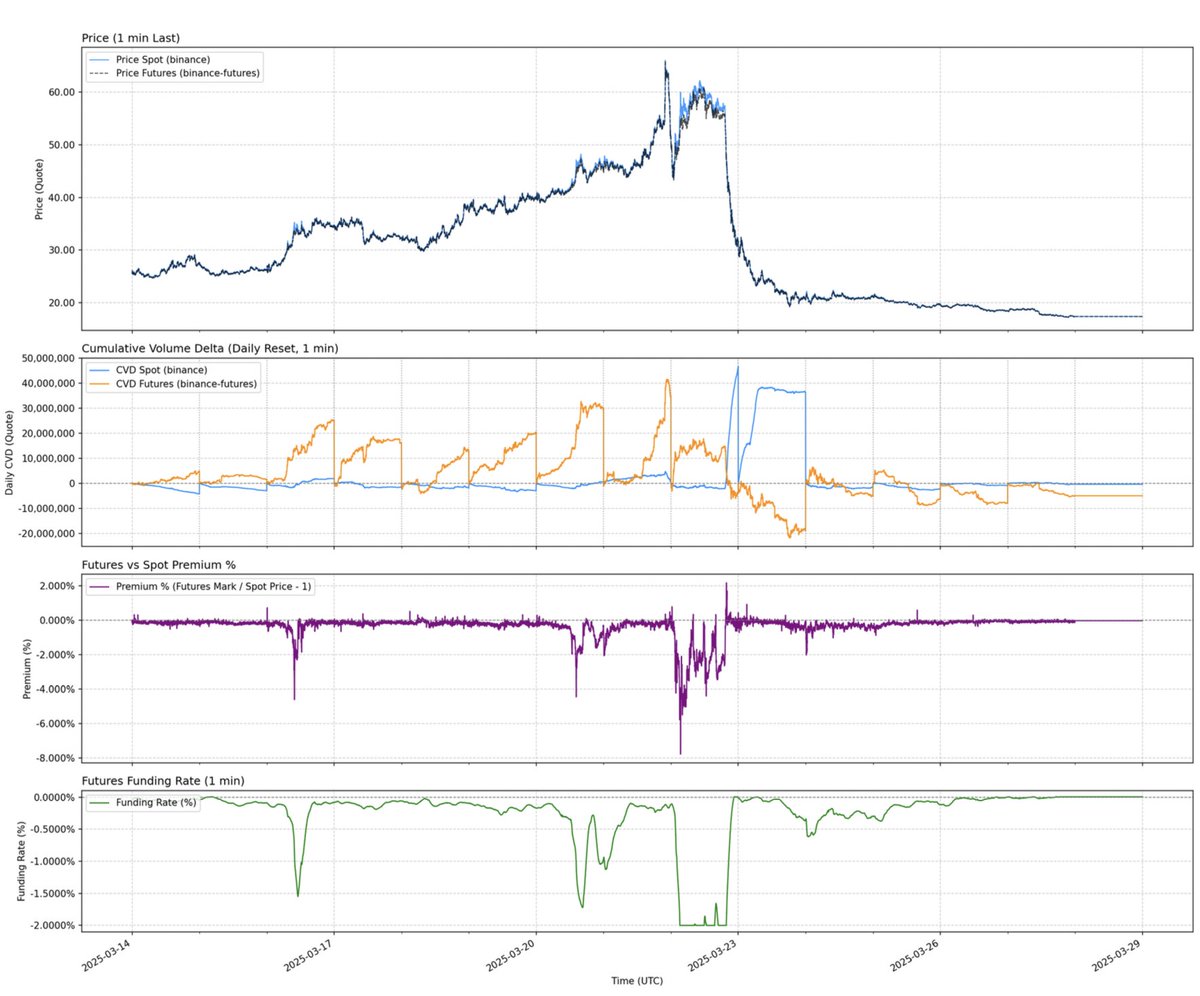

In bearish sentiment periods, funding can turn negative, driven by increased short positions pushing ETH perp prices below the ETH mark price.

For example, AUCTION-USDT recently experienced a severe dislocation caused by spot buying and perp selling, creating a Spot premium, resulting in a -2% 8-hour funding rate (~2,195% annualized).

5/ Ethena's yield strategy therefore carries inherent volatility.

This volatility creates demand for more predictable yield products: Pendle’s PT-loop strategy.

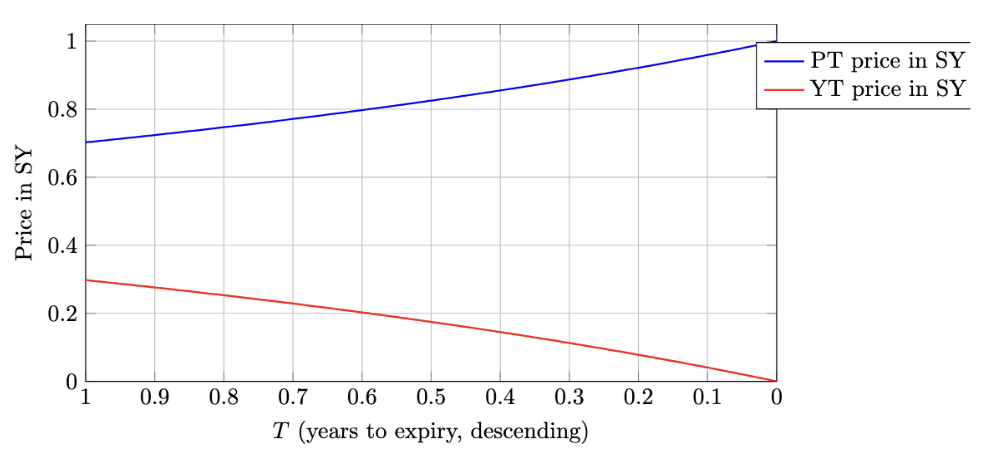

6/ Pendle is an AMM that splits yield-bearing assets into two tokens:

-PT (Principal Token): Redeemable at maturity for exactly 1 USDe.

-YT (Yield Token): Captures all yield generated by the underlying asset until maturity.

Taking PT-USDe expiring on September 16th as an example: the PT token trades at a discount relative to its maturity value (1 USDe), effectively behaving like a zero-coupon bond.

The difference between the current PT price and its face value, adjusted for the time until maturity, indicates the implied annual yield (YT APY).

7/ This creates attractive opportunities for USDe holders, enabling them to hedge volatility by locking in fixed APY.

Historically, elevated funding periods provided APYs of >20%; currently, yields are around 10.4%. PT tokens further benefit from Pendle's 25x SAT boost.

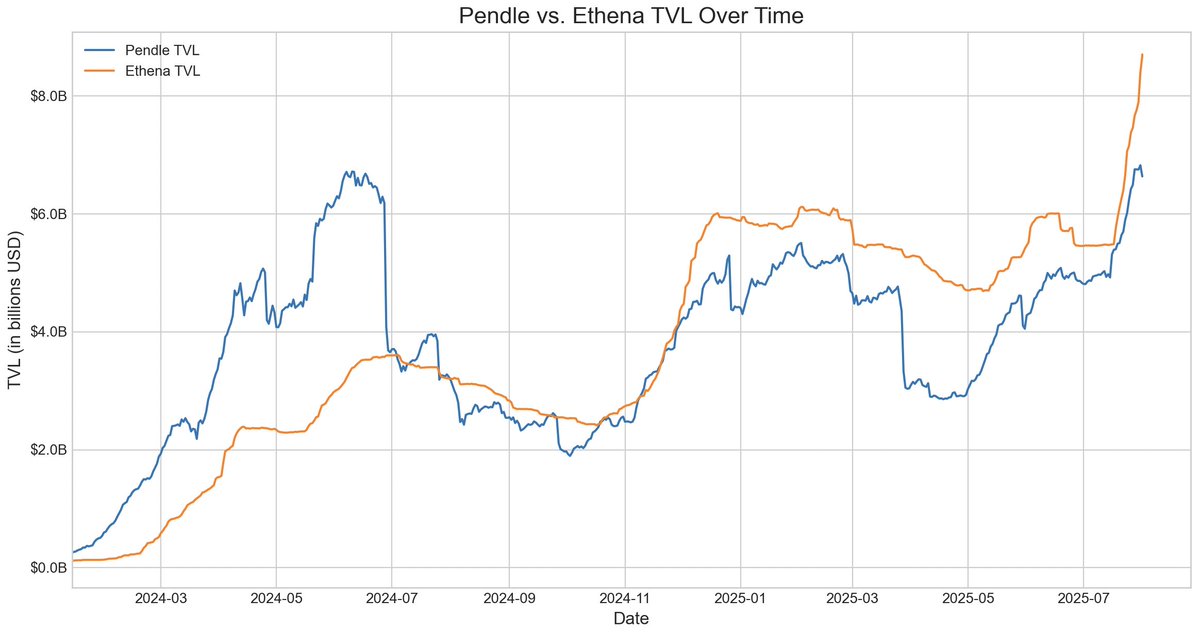

8/ This has led Pendle and Ethena to form a highly symbiotic relationship.

Pendle's TVL of $6.6B is heavily concentrated in Ethena's USDe market, accounting for $4.01B (approximately 60%) of the entire protocol's TVL.

9/ Pendle solved USDe’s volatility issue, but capital efficiency remained constrained.

YT buyers efficiently gain yield exposure, while PT holders shorting variable yields must lock $1 collateral per PT token, limiting returns to a small yield spread.

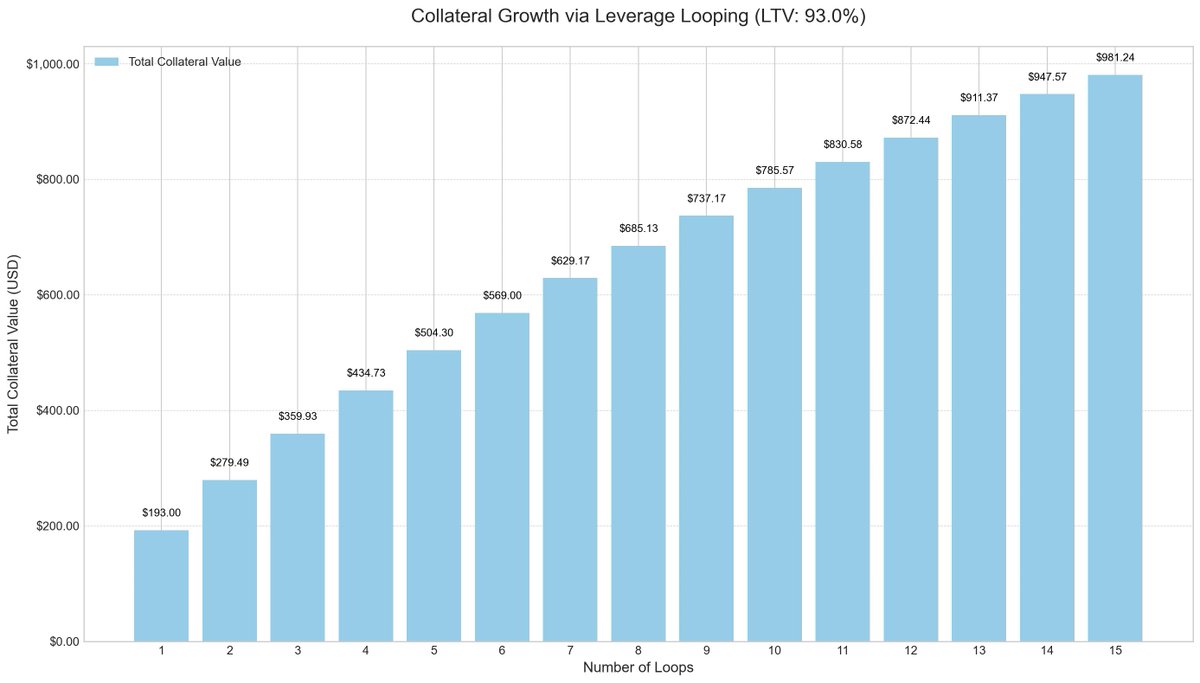

10/ The next evolution involved leveraged looping on money markets, a common carry-trade strategy that increases yields by repeatedly borrowing and redepositing collateral.

For example:

-Deposit sUSDe

-Borrow USDC at a 93% LTV

-Swap borrowed USDC back into sUSDe

Repeat the process, compounding returns achieving ~10x effective leverage

11/ This leveraged looping strategy gained popularity across multiple lending protocols, especially with USDe on Ethereum.

As long as USDe APR exceeded USDC borrowing costs, the trade remained highly profitable, but sharp yield declines or rate spikes could quickly erase returns.

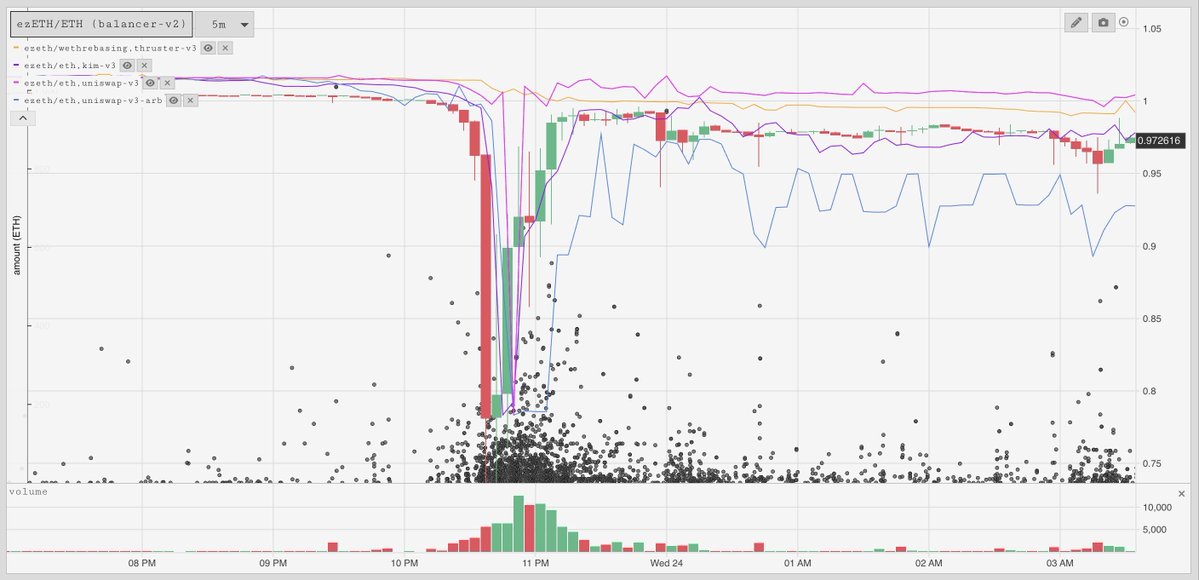

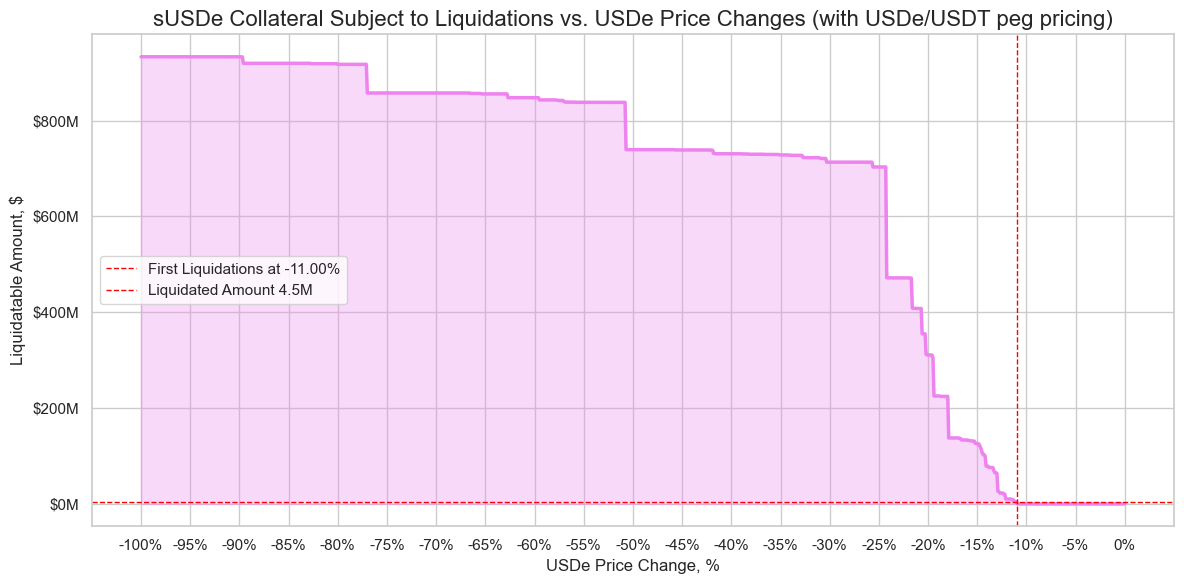

12/ The key risk lies in oracle design.

Billion-dollar positions often rely on AMM-based oracles, making them vulnerable to temporary price depegs. Such events (as seen with ezETH/ETH loops) can trigger cascading liquidations, forcing lenders to sell collateral at steep discounts, even when fully backed.

13/ Coming back to USDe, Aave recently made two key architectural decisions that enabled the USDe loop strategy to thrive.

Firstly, after risk providers highlighted significant liquidation risks for sUSDe lenders due to potential price depegs, Aave DAO pegged USDe directly to USDT's exchange rate.

This decision eliminated the primary risk factor of liquidations, leaving only standard interest rate risk inherent in carry strategies.

14/ The second decision was even more significant: Aave began accepting PT-USDe tokens directly as collateral.

This allowed users to leverage fixed-interest-rate positions, effectively removing two major constraints: capital efficiency and yield volatility, that previously limited the PT-USDe looping strategy.

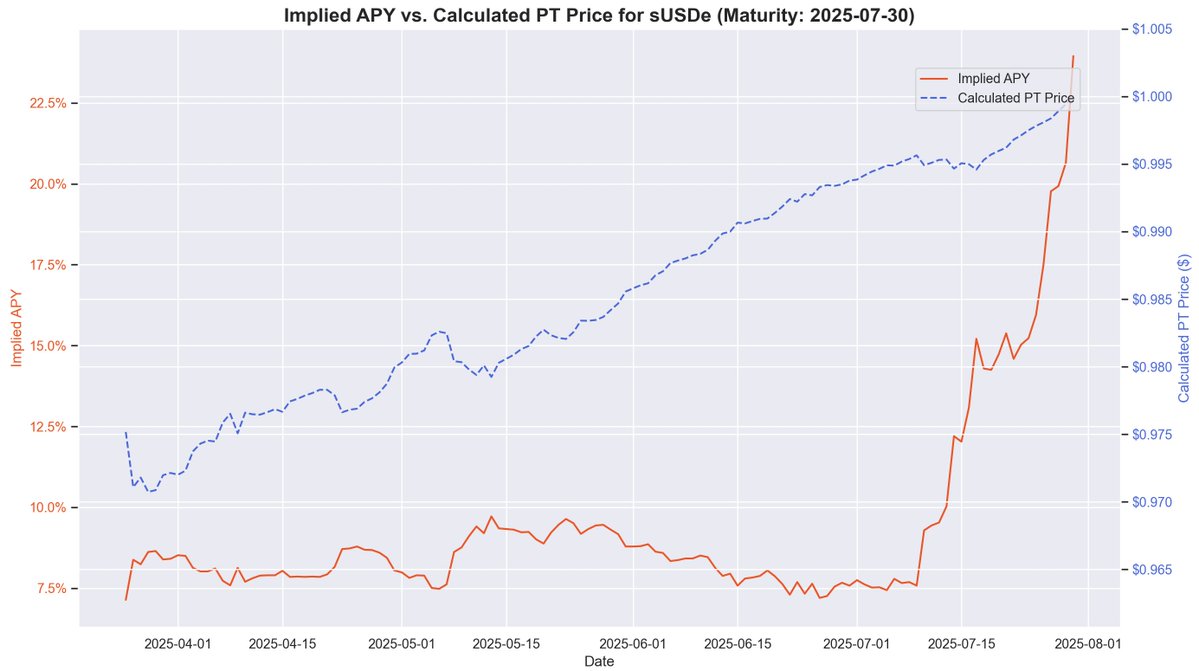

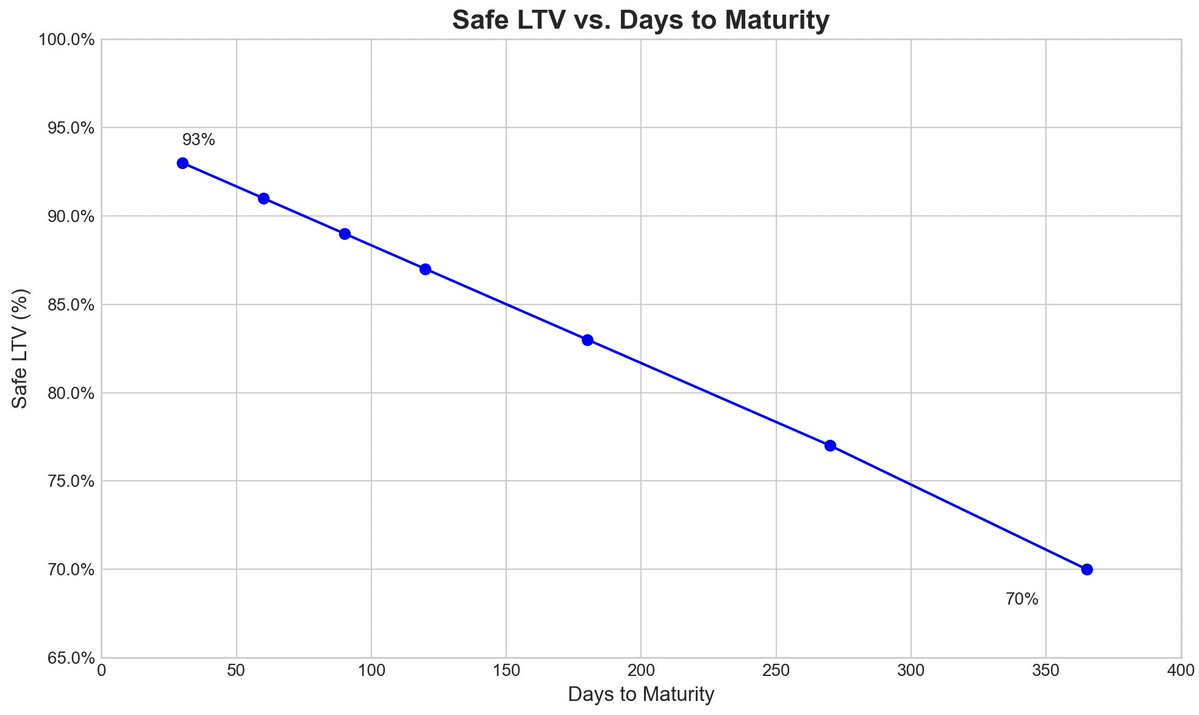

15/ For pricing PT collateral, Aave applies a linear discount based on the PT token’s implied APY, anchored to the USDT peg.

Similar to traditional zero-coupon bonds, Pendle PT tokens gradually approach their face value as maturity nears. The following chart illustrates this pricing approach using a July 30th expiry PT example.

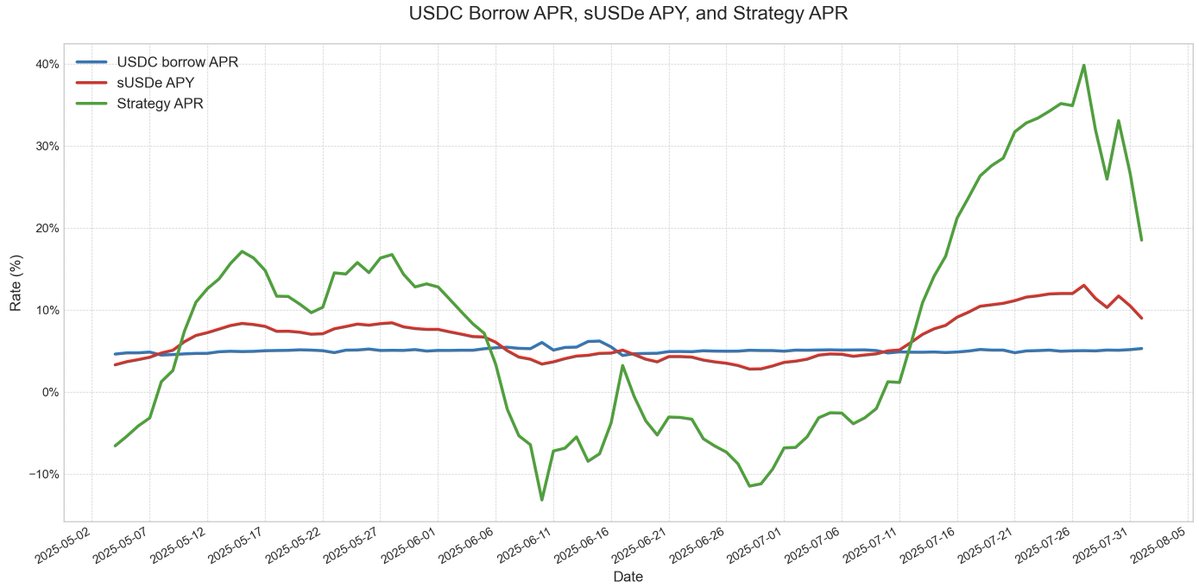

16/ This approach offers a more predictable yield, mirroring the stable value appreciation of zero-coupon bonds.

While PT token prices aren't a perfect 1:1 match due to market-based discount fluctuations, their returns become increasingly predictable as maturity approaches.

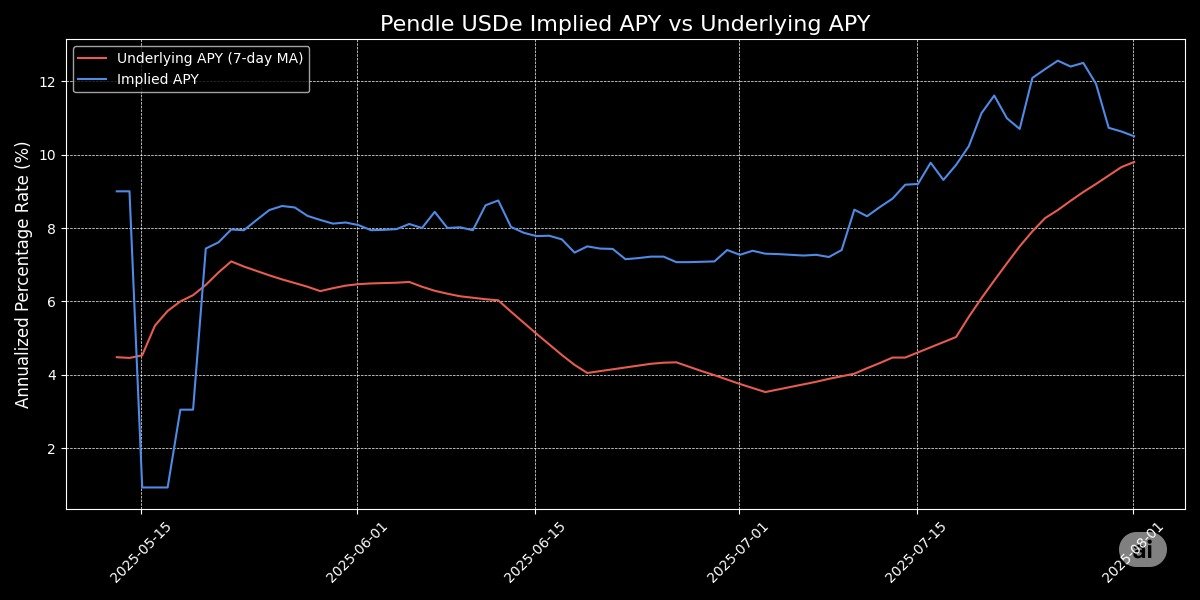

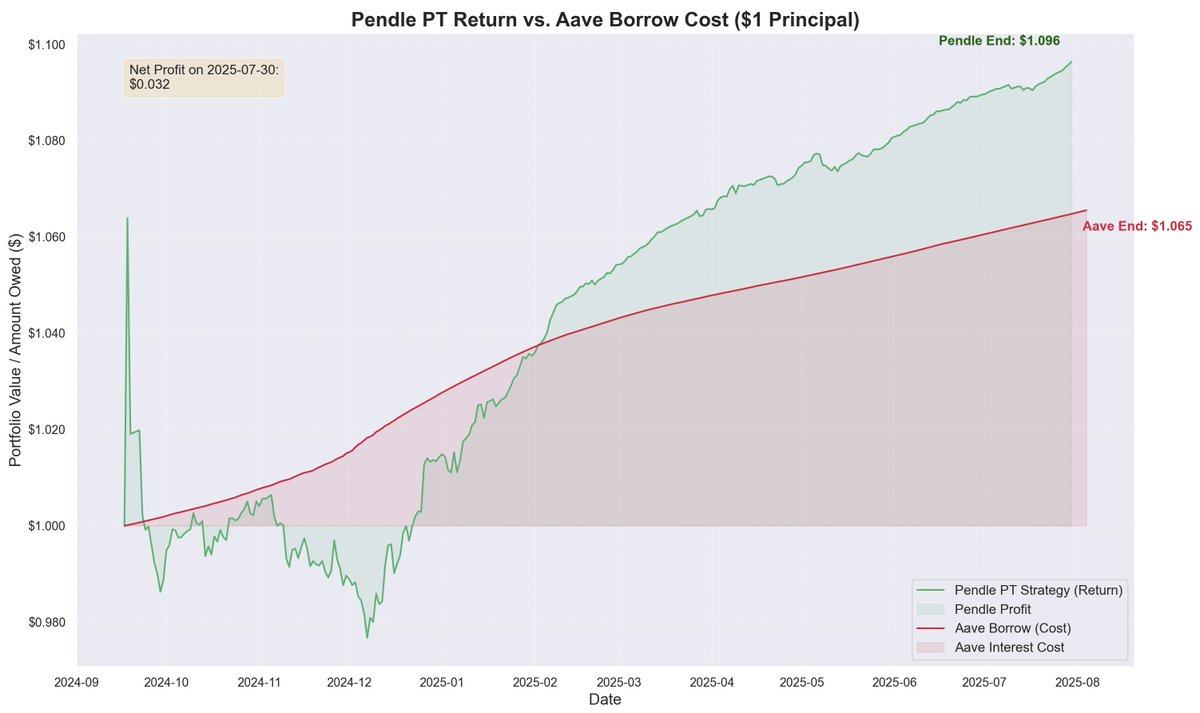

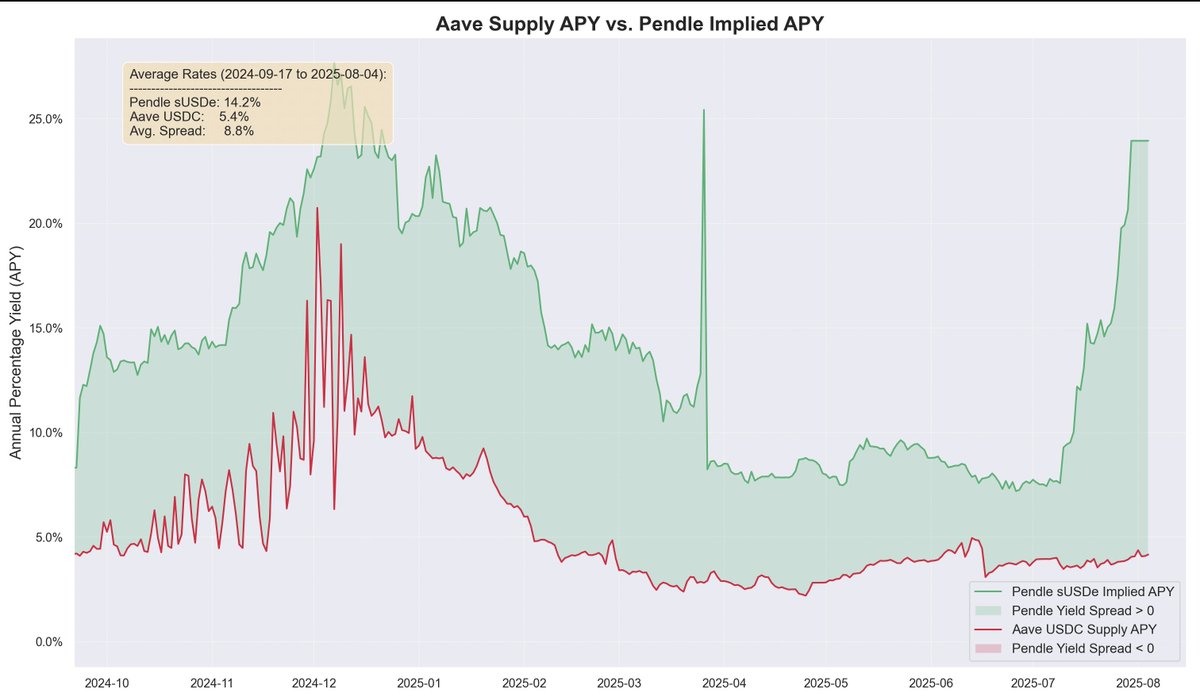

The chart below illustrates historical of PT appreciation against USDC borrow costs.

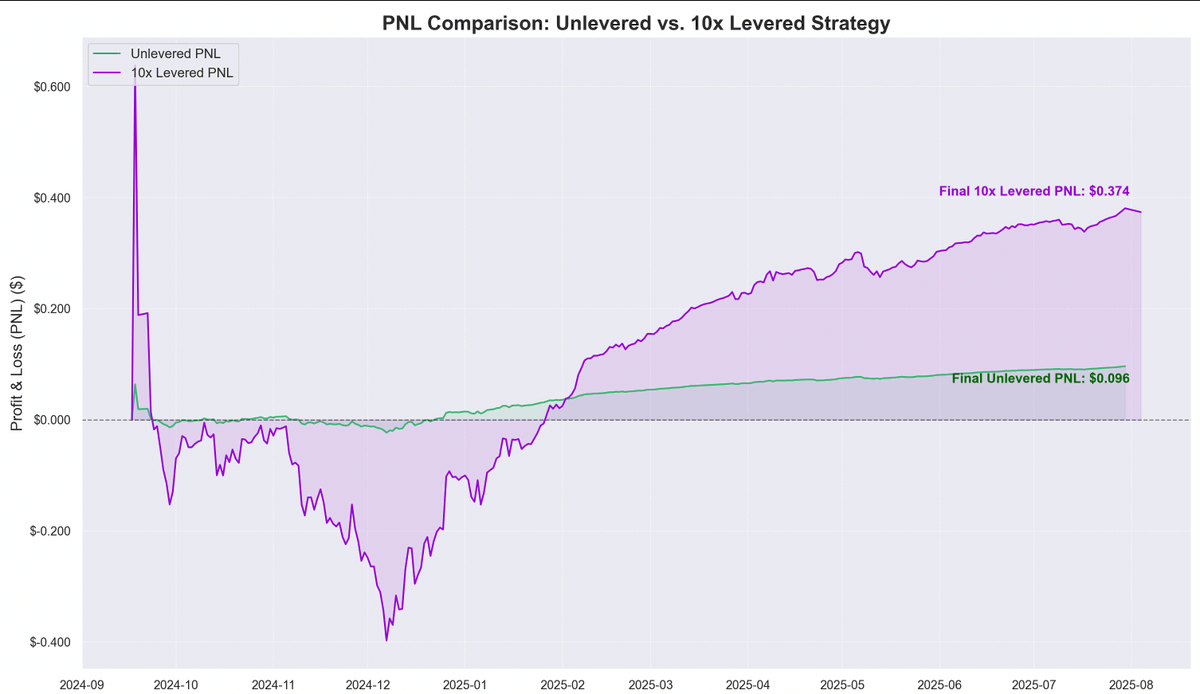

17/ Leveraged looping significantly enhances profitability, generating returns of $0.374 per $1 deposited since September, equivalent to an annualized yield of approximately 40%.

18/ This raises the question of whether the loop strategy represents risk-free returns.

Historically, Pendle yields have significantly outperformed borrowing costs, averaging an unleveraged spread of 8.8%.

Liquidation risks are also largely mitigated by Aave's PT oracle design, which incorporates a floor price and kill switch. Once triggered, LTV immediately drops to 0 and the market freezes, preventing bad-debt accumulation.

19/ For example, looking at Pendle's PT-USDe September expiry:

Risk teams set the oracle with an initial discount rate of 7.6% per year, allowing a maximum discount of 31.1% per year in extreme market stress (kill-switch level).

The chart below shows the various safe LTVs (calculated so that liquidations are effectively impossible once the discount hits the kill-switch floor, so PT collateral always remain above liquidation thresholds).

20/ By underwriting USDe and its derivatives at parity with USDT, Aave enables aggressive looping, but both loopers and the protocol share these risks.

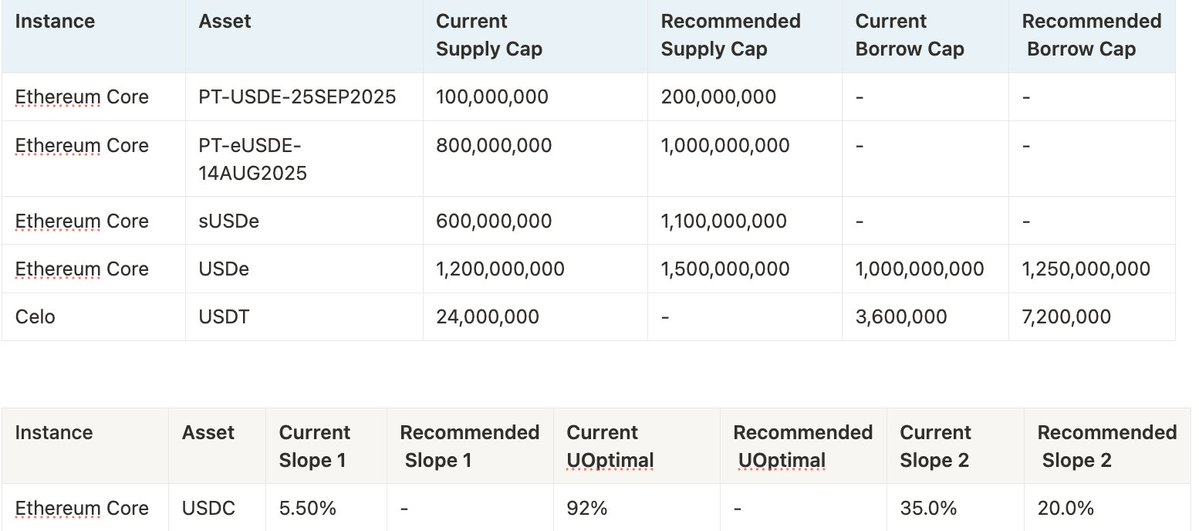

Consequently, supply caps for these assets consistently reach full capacity shortly after increases.

21/ Aave's USDC supply is now increasingly backed by PT-USDe collateral, as loopers borrow USDC to leverage into PT tokens.

In this structure, USDC acts similarly to a senior tranche: holders earn elevated APRs driven by high utilization from loopers and remain protected from risk except in a scenario of bad debt.

22/ Looking forward, the strategy's scalability depends on Aave's willingness to continue raising collateral caps.

Risk teams propose frequent supply cap increases, with another $1.1B hike already suggested, constrained only by a policy limiting each increase to a maximum of 2x the previous cap within a three-day interval

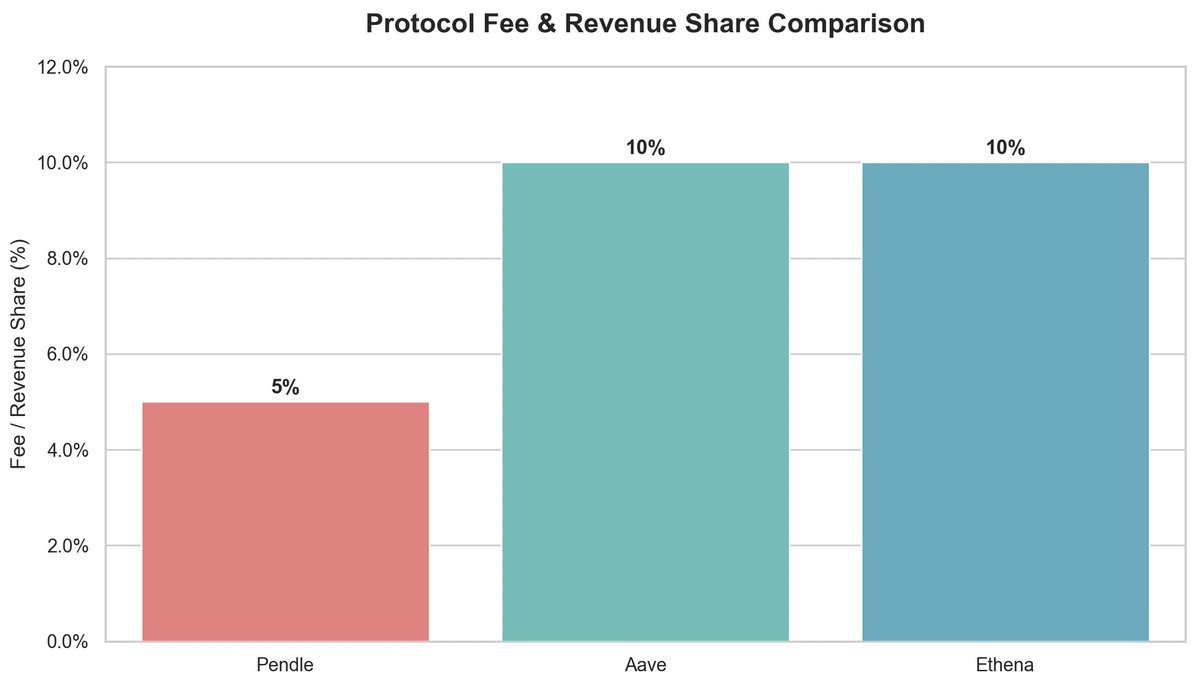

23/ What does this mean for ecosystem projects?

Pendle: Captures a 5% YT fee.

Aave: Gains via a 10% reserve factor on USDC borrow interest.

Ethena: Plans a tentative 10% cut after activating fee switch

24/ In summary, Aave's underwriting of USDe (pegged to USDT with capped discounts) has enabled a highly profitable looping strategy via Pendle PT-USDe.

However, increasing leverage also creates interconnected risks across Aave and Pendle and Ethena.

149.66K

904

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.