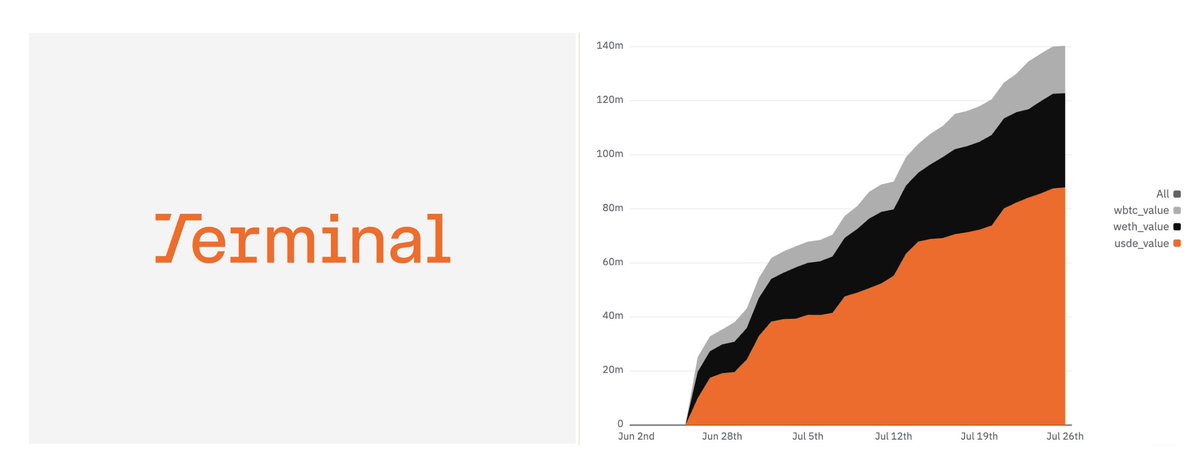

$155M TVL in a month - now that's a huge W for @Terminal_fi

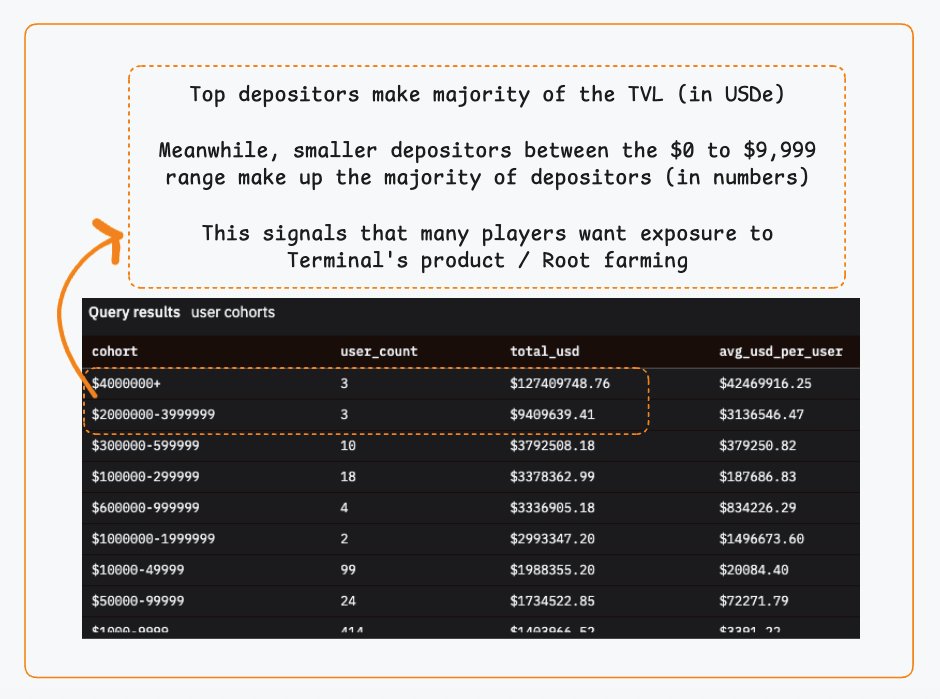

The top 3 users alone poured in $127M, reshaping the landscape.

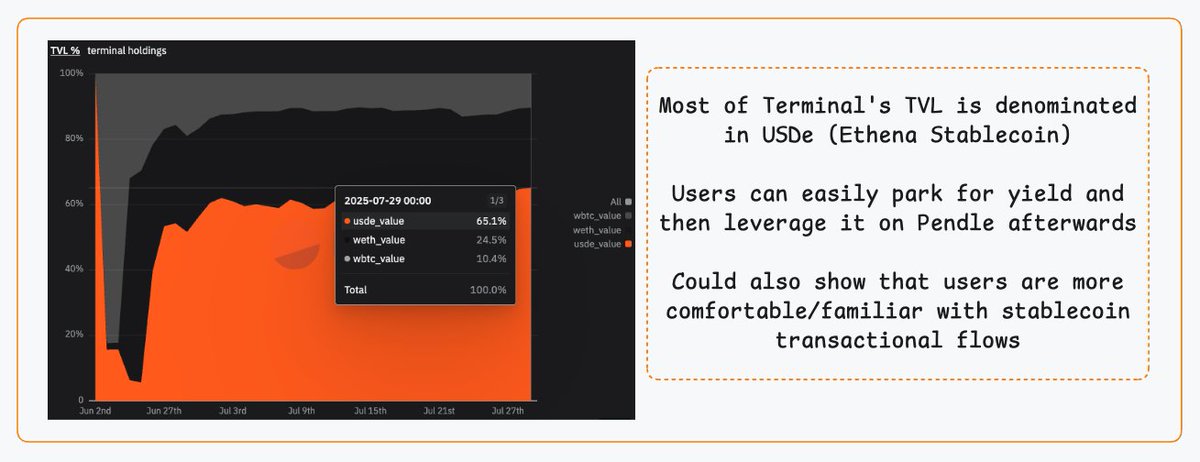

Terminal's pre-deposit holdings breakdown:

✦ USDe: 65%

✦ WETH: 25%

✦ WBTC: 10%

Dive deeper into the story below 👇

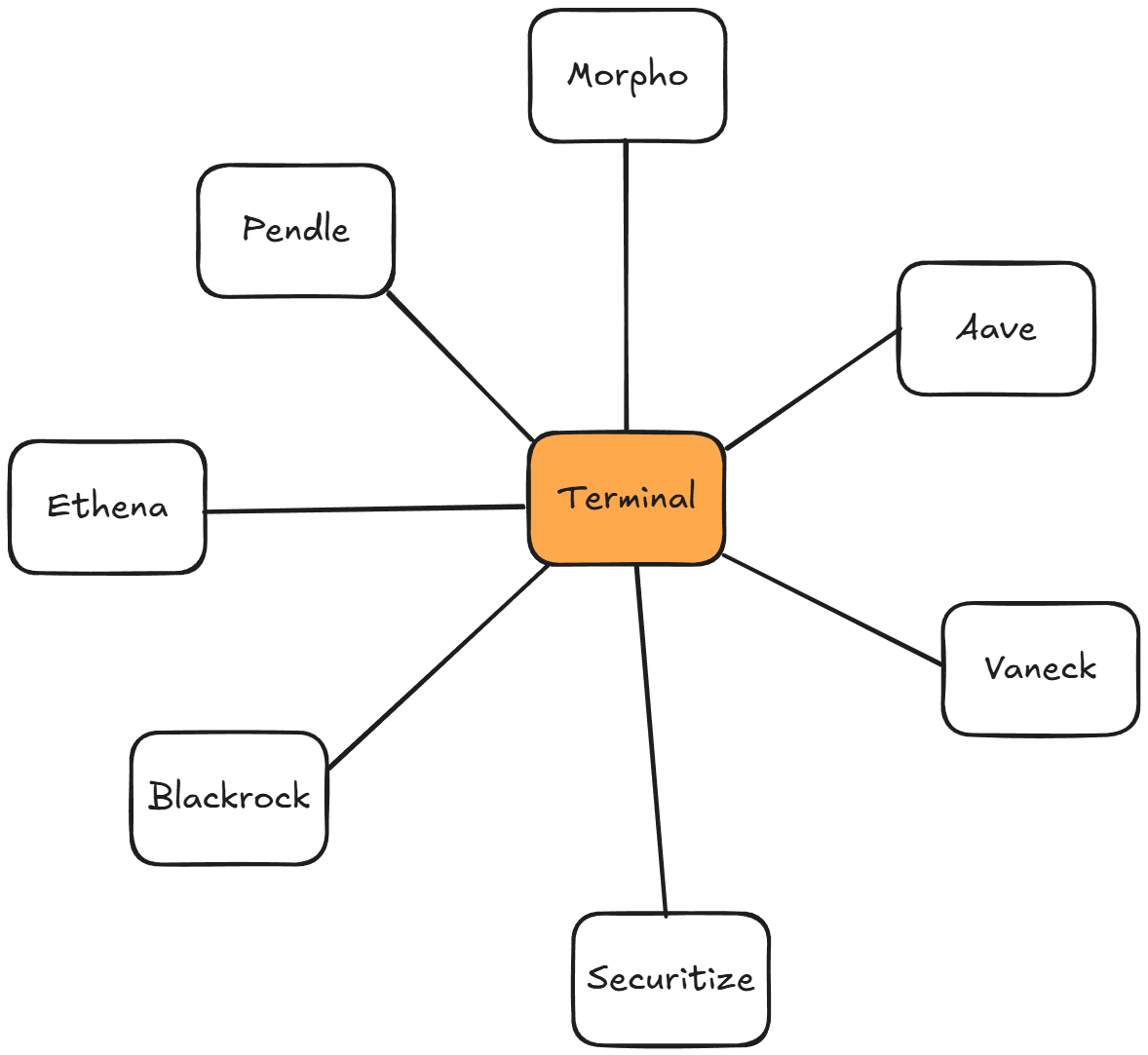

Quality mega projects like Ethena, Aave, Morpho are on @convergeonchain, and @Terminal_fi joining them would naturally bring about the right set of eyes on them

So far, most of Terminal's TVL is in USDe followed by WETH and WBTC

This could signal that users:

• find more functional DeFi composability with USDe

• more comfortable/familiar with stablecoin transactional flows

The spread of TVL depositors is top heavy - a few large depositors make up majority of the $155M TVL on Terminal

What is encouraging is the larger quantity of users (despite smaller deposits), highlighting the demand for exposure to Terminal's product / Roots

Overall, do you know what's a common link for projects on Converge?

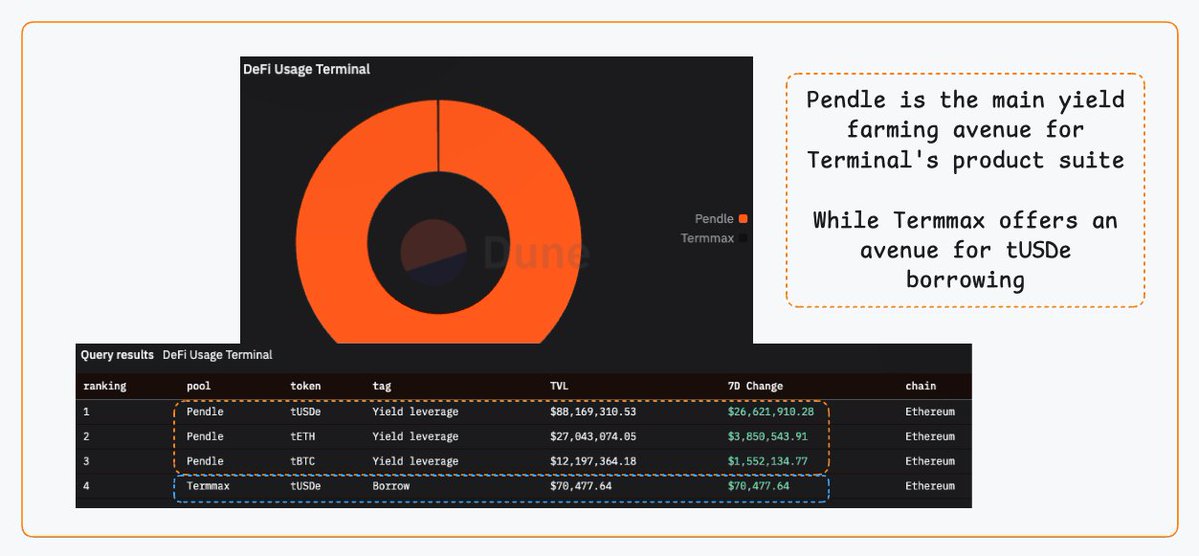

Most of Ethena's TVL is on @pendle_fi

Similarly, most of Terminal's TVL is also on @pendle_fi

Pendle will be the de facto yield amplifier for DeFi

Converge just surpassed $1B in pre-deposit, with @pendle_fi contributing ~86% of the total liquidity 👀

• Ethereal: $744M / $847M = 87.8%

• Terminal: $123M / $152 = 80.9%

• Strata: ?????

We’re watching the largest institutional onchain rail take shape in real time. IYKYK.

Launching on Pendle not only unlocks extra yield-tility (e.g. fixed APY) for your yield-bearing assets, but also helps establish another liquidity catchment for protocols to bootstrap TVL.

Every dollar added to Pendle = dollar added to the underlying protocol too

The DeFi Sparkplug does not compete....We complete 🫶

Users know what they need to do for boosted yields, do you?

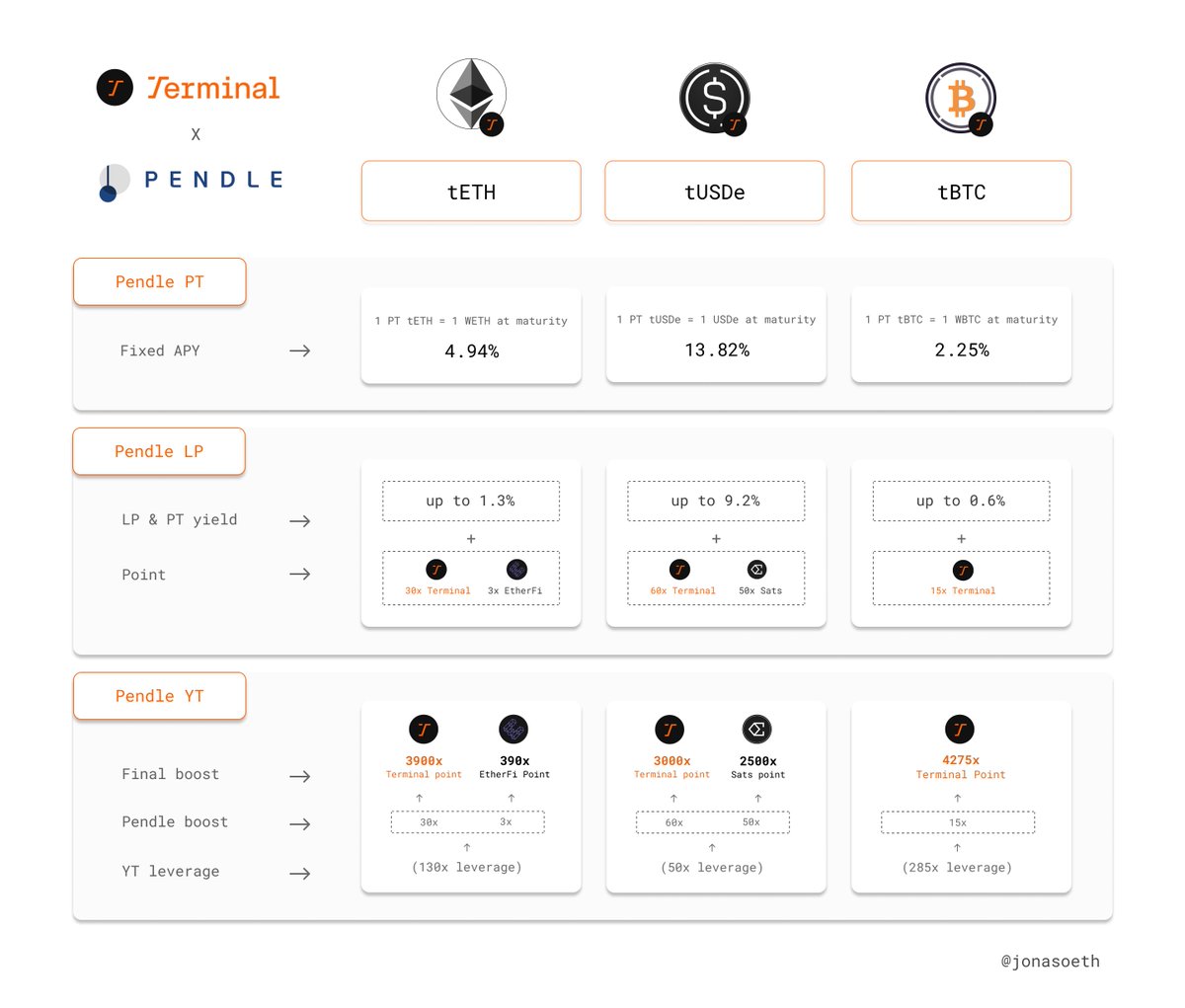

tUSDe, tETH, tBTC are all options to stack multiple points like Roots, Sats etc.

Here's a fantastic breakdown of the yield options available (YT/PT/LP) 👇

Welcome to the fastest lane to yield + points farming in DeFi.

If you're serious about farming Roots and locking in real yield, it’s time to activate next-level leverage with @pendle_fi.

Pendle now features 3 leveraged pools on @Terminal_fi , designed to accelerate point accumulation and boost your yield

Here’s how to play it smart ↓

➢ Pendle PT

• Earn 13.82% fixed APY with PT tUSDe, The Highest Ethena Fixed Yield

• Earn 4.9% fixed APY and with PT tETH

• Earn 2.2% fixed APY with PT tBTC

➢ Pendle LP

• LP tUSDe with 9.2% APY, 60x Roots + 50x Sats

• LP tETH for 1.3% APY, 30x Roots + 3x EtherFi

• LP tBTC for 0.6% APY, 15x Roots

➢ Pendle YT

• Holding 1 YT tUSDE → Earn 60X Roots + 50X Sats

• 1 USDe = 50 YT tUSDe → YT Rewards: 3000X Roots+ 2500X Sats

• Holding 1 YT tETH → Earn 30x Roots + 3x EtherFi

• 1 tETH = 130 YT tETH → YT Rewards: 3900x Roots + 390x EtherFi

• Holding 1 YT tBTC → Earn 15x Roots

• 1 tBTC = 285 YT tBTC → YT Rewards: 4275x Roots

→ If you're not farming Terminal through Pendle, you're leaving a ton of points and master yield on the table

Furthermore, Pill found a dune dashboard for @Terminal_fi pre-deposit stats from reading @splinter0n 's thread

Now you can stay up to date with pre-deposit strats using this dashboard by @outputlayer 👇

What else are you excited about for @Terminal_fi ?

@monosarin

@0xAndrewMoh

@CryptoShiro_

@poopmandefi

@eli5_defi

@marvellousdefi_

@0xCheeezzyyyy

@crypto_linn

@YashasEdu

@CipherResearchx

@splinter0n

@belizardd

@lenioneall

@FabiusDefi

@St1t3h

@the_smart_ape

@cryppinfluence

@TheDeFiPlug

@defi_mago

@0xDefiLeo

@kenodnb

@bullish_bunt

@Mars_DeFi

@nursexxl

@0xTindorr

@PenguinWeb3

@Tanaka_L2

@0xKaiFi

@cryptorinweb3

@CryptoRick98

@rektdiomedes

@Nick_Researcher

@RubiksWeb3hub

What are your thoughts?

Thanks for reading till the end, hope you enjoyed it!

Disclaimer: All opinions expressed remain objective, and are for informational and/or entertainment purposes only. NFA, as always DYOR.

I will be diving deeper and sharing more alpha along the way!

24.19K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.