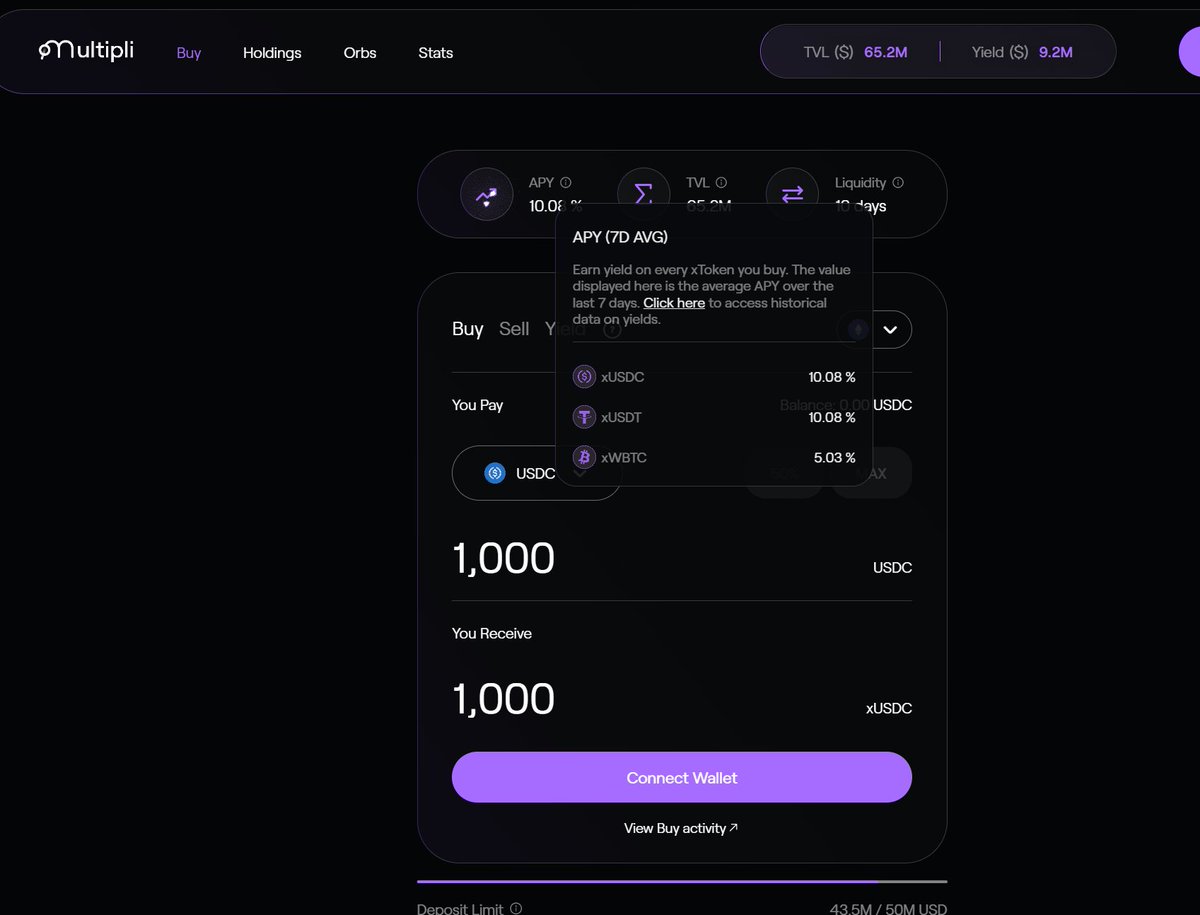

I just logged into @KaitoAI to check if the data has been updated, and unexpectedly saw that @multiplifi made it onto the list. I also checked their official Twitter, and it seems to be a stablecoin DEFI project. However, the annualized returns for exchanging xUSDC and xUSDT on the platform can actually reach over 10%, which is pretty impressive.

Plus, @multiplifi publishes a profit report every week, making it feel like a project that is serious about its work. It’s worth paying close attention to, and if you have idle funds, putting them into Multipli seems quite profitable.

Multipli’s 7D Yield Summary

From 18th to 24th July, Multipli distributed over $126,508 in yields, with an average APY of 10.13%.

1/5

26.5K

111

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.