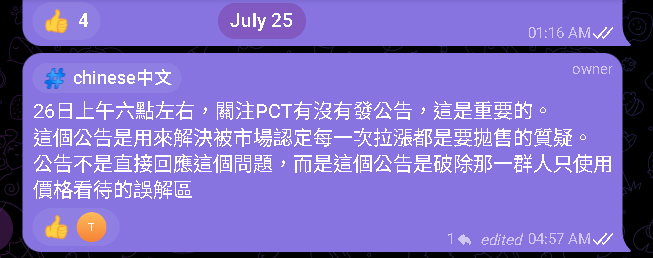

The PI mentioned at 4 a.m. on the 25th that there would be an important announcement from the PCT around 6 a.m. on the 26th. At 4 a.m. on the 2nd of today, the PCT issued an announcement.

However, this announcement is also incomprehensible to most people. But I think it's important, and there are some odd things:

But I think it's important, and there are some odd things:

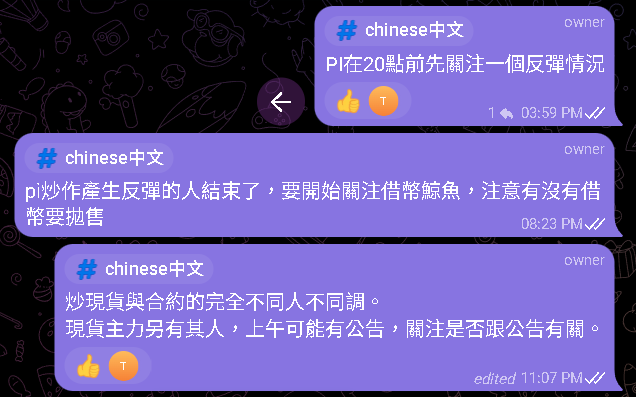

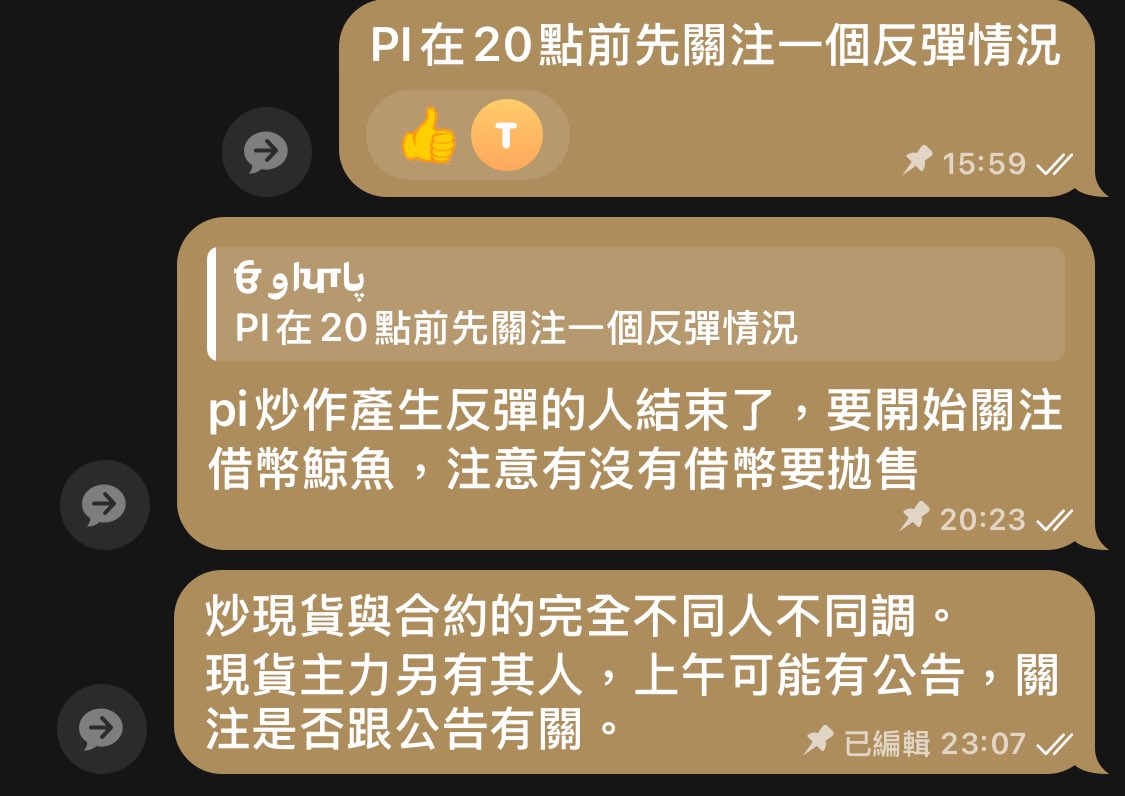

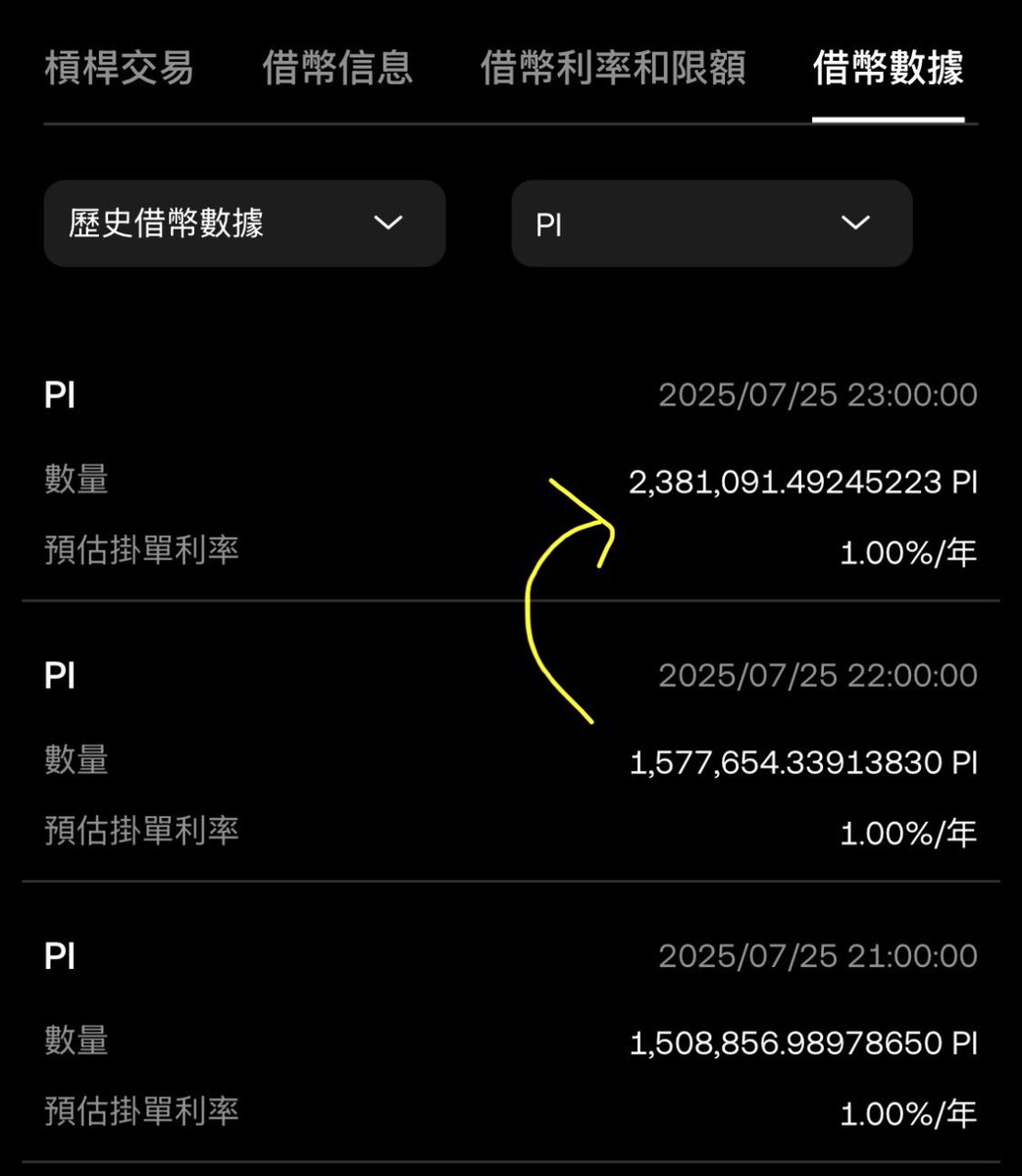

1. At 18 o'clock on the 25th, it was mentioned that after the rebound ended, it was necessary to pay attention to the borrowing whales, and at 23 o'clock, the borrowing whales borrowed 800,000 coins to sell.

Usually, borrowing whales will short sell on spot and contract at the same time, becoming the main role on spot and contract. However, I saw that the main force on the spot was different from the main force of the speculative contract, which means that the main buying force on the spot has more influence than the borrowing whale.

Then I saw that the 800,000 borrowed whales not only did not have a big downroot, but they were all taken away and pulled back. And the borrowing whale continued to borrow 300,000 more to sell, not only did not fall, but also continued to rise after all of them were taken away.

At five o'clock in the morning, the borrowing whale found that something was wrong and quickly repurchased and returned 1.1 million pieces. This proves that the spot seen has a big buying force present.

2. The PCT made an announcement at four o'clock, which is useless, but I think it is very important. My opinion is:

It looks like the KYC mapping accounts are no longer fully loaded and there are many vacancies.

"I don't think normal operators would expect that their project has so many users"

"I think the number of people expected in the early days of the PCT design before June was much lower than the current number."

Therefore, I think that there are too many people now, and the PCT believes that it has exceeded expectations a lot and can be done better, so it continues to carry out KYC mapping to increase network security and has not moved the mainnet until now.

Therefore, my view is that there is already enough pi for the main migration, so it is better for everyone to take a step back and stop KYC new users, so that the PCT feels that the global number of people is almost processed and can be migrated to the mainnet. Finally, after the mainnet is migrated, new users will start KYC.

In this way, most investors can see that the price has broken through the dilemma.

What do you think?

#PI

#pi

PI mentioned the end of the rebound at 20 o'clock and paid attention to the follow-up borrowing whales.

The decline was just seen when borrowing whales borrowed 800,000 coins to sell. However, there are other things at this time.

When the borrowing whale wants to borrow the currency to sell and short the contract for arbitrage, it is normal that the main force of the spot and the contract is whales, but at this time, the main force is different from the contract.

This means that the main spot force is bigger than the borrowing whale, and this spot main force easily took away the 800,000 pi of the borrowing whale, so that the pi will not take root.

However, yesterday mentioned that on the morning of the 26th, the PCT seemed to make an announcement. So will this spot buying force be related to this announcement?

This announcement looks like the same situation, after the announcement, retail investors in the market still do not understand and continue to be negative and bearish.

However, the announcement will be the opposite of the market retail investor, if someone wants to deliberately sell the hype when they see the announcement, then they will also be pulled back by the announcement after the hype. You should pay attention to what is announced.

#PI

#pi

162.86K

10

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.