In the past two days, I have talked about Meme a little more,

From @19ys_GGboy CTO's #旺财 to the first wave of @cookingcityHQ $CHEF, and the Book of Aether $BOOE and more.

Although the multiple is good, but after all, the position is small, and the real profit has to be the target of the heavy position, take advantage of tonight's fine, talk about a few targets in the hand to focus on.

$AAVE $HYPE $DBR

----------------------------

01| $AAVE

Judging from the performance of the past 90 days, the $AAVE has risen by about 120%, which is much higher than other lending agreements: $COMP, $MORPHO, etc., and behind this trend is the result of further consolidation of dominance in the market structure.

The data is honest, let's look at some of the data.

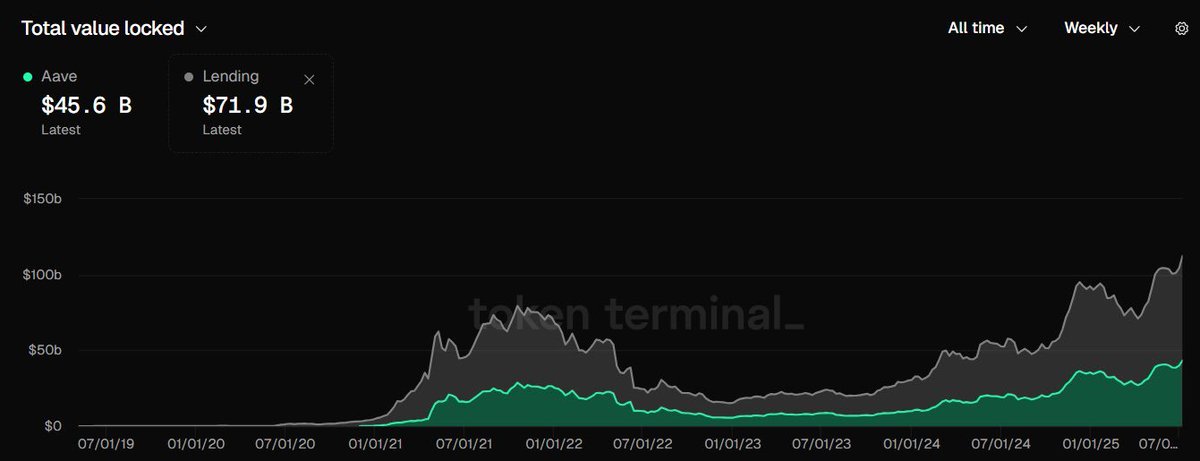

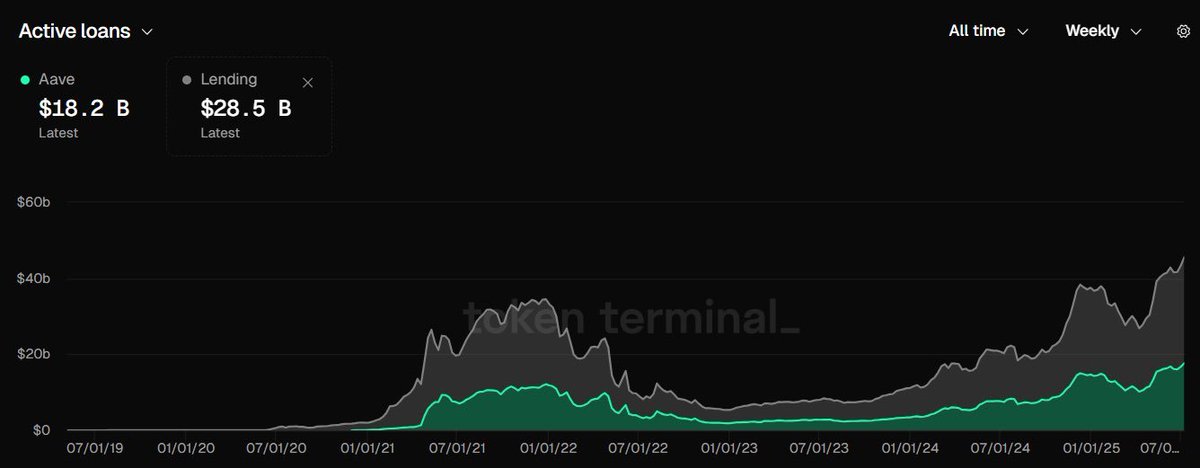

TVL recently hit an all-time high of $45.6B, and YTD grew by 32.6%, more than the next 30 lending protocols combined.

Active loans were $18.2B, accounting for 62.8% of the total lending market. The annual revenue of the agreement is $603M, accounting for 63% of the track, and the head effect is obvious.

If you look at it from a valuation perspective, the FDV/annualized revenue is around 7.6x, I personally think it is a relatively reasonable range, on the one hand, the revenue is solid enough, and on the other hand, the product updates such as V4 and umbrella modules do have the potential to continue to improve efficiency and safety.

Let's talk about the key updates:

The V4 architecture is being promoted, and the "Hub-and-Spoke" model is adopted to unify liquidity, open up funds from different markets into centralized pools, improve capital utilization, and facilitate subsequent multi-chain deployment.

At the same time, V3 has been deployed to Aptos, which is the first time that Aave has expanded to non-EVM chains, which is more critical and means that it is actively chasing multi-chain dividends.

The stablecoin $GHO is also available on Avalanche.

There is another update that I think is easy to overlook, but very critical: the Umbrella Module.

To put it simply, it is to allow aToken to be staked, obtain additional income, and participate in the construction of the protocol's security buffer pool.

It can also control emissions in a smarter way and reduce inflation, which is a real benefit to coin holders.

To sum up, I understand that the $AAVE of this kind of continuous update, with revenue of the old agreement, will become more and more valuable in every market switch.

----------------------------

02| $HYPE

$HYPE In the past few days, it has been playing a fluctuation intensity of 2-3σ in a row, which is statistically called an "extreme market", but behind the market is real growth data.

Revenue:

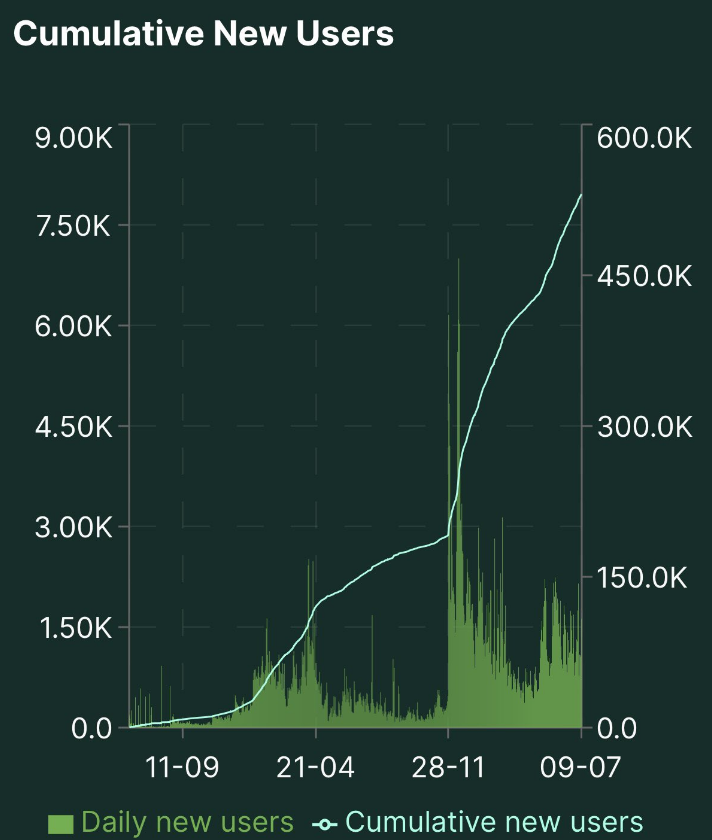

Yesterday $4.8M, Today $3.4M; The annualized revenue is close to $1B, which is not small if it is valued according to the CEX class. The number of users has exceeded 500,000, and the continuous growth is very stable.

The technical side is advancing rapidly, and the CoreWriter contract has been launched on the mainnet; Spot matching orders support multi-currency quotations, and the experience is closer to centralization; The number of validators will expand from 21 to 24, and the network will continue to grow.

In addition, it can also be seen from the launch of PUMP that the team follows up quickly every time, including some good big brothers around me, and now the billing has basically migrated to the top.

----------------------------

03| $DBR

$DBR is my heart and mind, and it's also the target I expect to grow the most in my hands, and the just-concluded @deBridge TownHall is very informative, summarizing a few core updates.

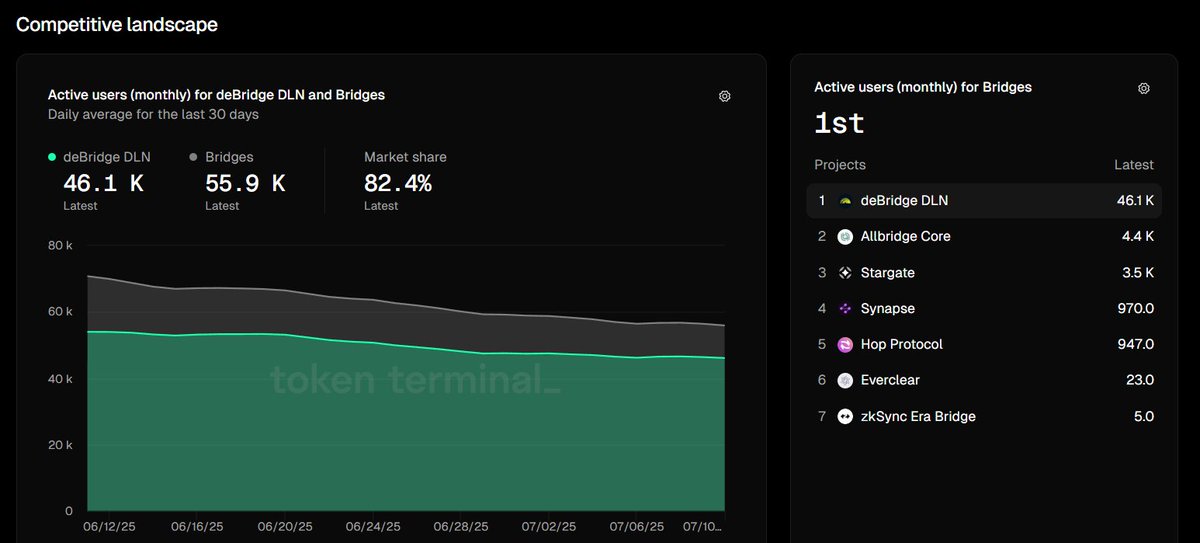

Last 30 days data:

- Added $600M in trading volume, over $12.5B in total

- 50K+ new users

-Protocol revenue is approaching $1M, and all of it goes into the DAO treasury

On-chain distribution:

-Solana remains the main source of transactions, with the fastest growth rate

-Base and Arbitrum users are also climbing rapidly

-CEX-level maker order experience, Gasless cross-chain, native asset trading, these details are very smooth

The new integrations are also worth noting:

After integration with @SeiNetwork, the bridging time was reduced from 20 minutes → to 1-2 seconds;

@TakaraLend and @YakaFinance are also being connected, and the project team has a strong delivery ability.

My personal judgment is that $DBR's narrative is no longer a "cross-chain bridge", but the core infrastructure of inter-chain transactions, and its place will only become more important as on-chain transactions become mainstream.

Behind every iteration of the product layer is actually expanding the capture radius of DAO revenue, so that the protocol continues to run out of a positive closed loop of funds.

Its growth does not depend on FOMO, but on the general trend of on-chain transactions and the product moat that continues to be polished.

The above continues to be followed up.

(Graphic limitations, next time disassemble the first issue separately $DBR , remember 1st.

Show original

41.27K

23

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.