Polkadot price

in USDCheck your spelling or try another.

About Polkadot

Polkadot’s price performance

Polkadot in the news

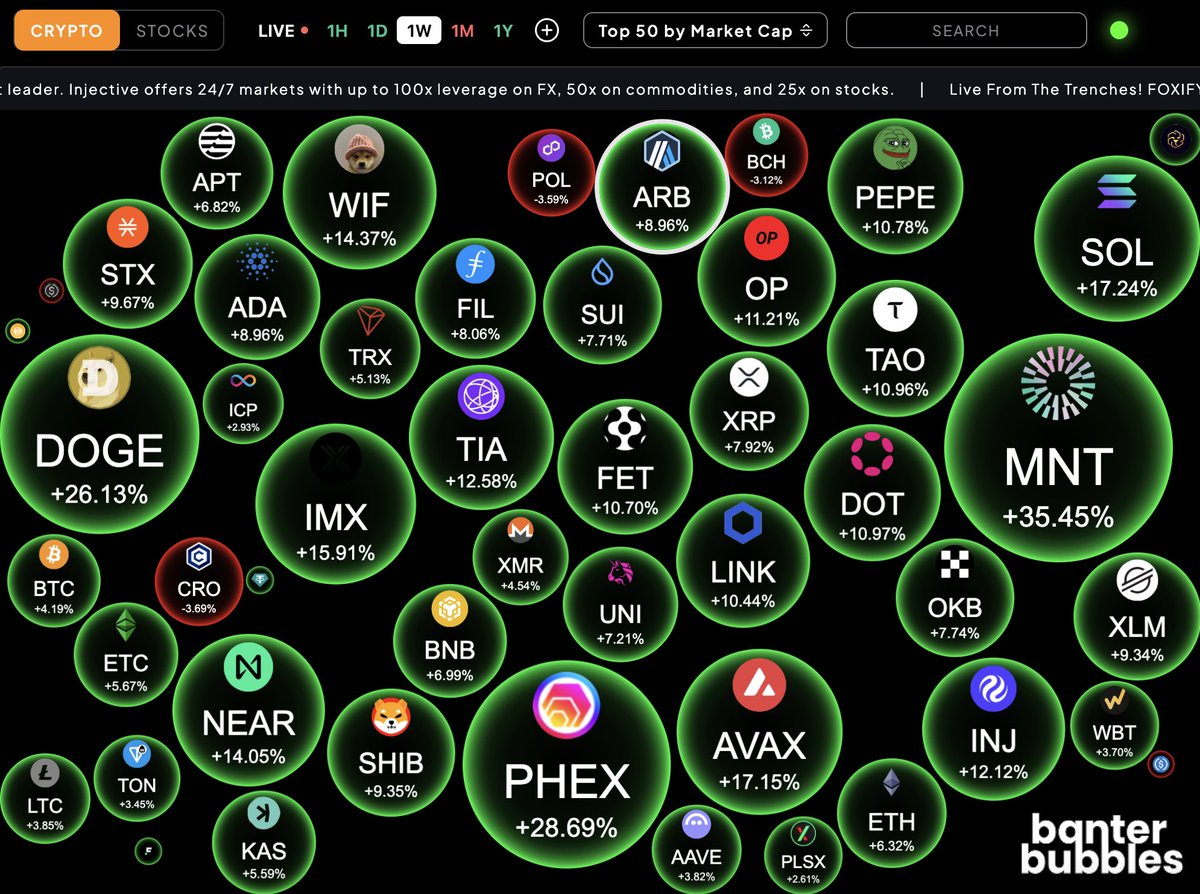

Solana (SOL) was also among the top performers, gaining 4.5% over the weekend.

The Polkadot token tumbled amid increased selling pressure as support levels failed.

Grayscale has filed registration statements with the SEC for exchange-traded funds tied to Polkadot (DOT)...

Support has formed in the $3.90-$3.91 zone, with resistance at $4.02.

Polkadot (DOT) was also among the top performers, gaining 2.8% from Wednesday.

The new group’s offerings will cover centralized and decentralized exchange infrastructure, real-world asset tokenization, staking, and decentralized finance.

Polkadot on socials

Guides

Polkadot on OKX Learn

Polkadot FAQ

Polkadot was launched with an initial supply of 10 million. However, after the redenomination, the token balance increased by 100, turning the initial supply to 1 billion. That said, as an inflationary token, the supply of Polkadot is not capped. As of September 2022, over 1.2 billion DOT tokens were in circulation.

Easily buy DOT tokens on the OKX cryptocurrency platform. Available trading pairs in the OKX spot trading terminal include DOT/USDT, DOT/USDC and DOT/BTC.

You can also buy DOT with over 99 fiat currencies by selecting the "Express buy" option. Other popular crypto tokens, such as Bitcoin (BTC), Tether (USDT), and USD Coin (USDC), are also available.

Alternatively, you can swap your existing cryptocurrencies, including XRP (XRP), Cardano (ADA), Solana (SOL), and Chainlink (LINK), for DOT with zero fees and no price slippage by using OKX Convert.

To view the estimated real-time conversion prices between fiat currencies, such as the USD, EUR, GBP, and others, into DOT, visit the OKX Crypto Converter Calculator. OKX's high-liquidity crypto exchange ensures the best prices for your crypto purchases.

OKX offers multiple ways to seek support. Our self-service support center addresses commonly asked questions about buying, selling, and trading digital assets. We also have a thriving global community, which can be reached through various channels, including Telegram, Reddit, Facebook, Line, Weibo and Twitter.

Dive deeper into Polkadot

Often referred to as the "Blockchain of Blockchains," Polkadot is a next-gen Layer 0 meta protocol and an open-source blockchain launched in May 2020 to realize the broader vision of a secure, resilient, and fair Web3.

Polkadot unites a network of native purpose-built Layer 1 blockchains called parachains and multiple external blockchains (connected to it using innovative bridging technology), allowing them to operate at scale alongside each other seamlessly.

The parachains and external blockchains can freely interact with each other, making them interoperable. This is a significant shift from the siloed design of conventional blockchains like Ethereum and Bitcoin. Parachains can process transactions simultaneously, reducing the burden on the main chain and offering ease of scalability. They also allow developers to customize their blockchains, allowing them to optimize parachains for specific use cases with their native tokens.

The Relay Chain is Polkadot's central chain, created using the Substrate framework. The Relay Chain is responsible for maintaining Polkadot's shared security, cross-chain interoperability, and consensus mechanism. It has been designed to handle minimum functions, including the network's governance and nominated Proof of Stake (NPoS). All validators are staked on the Relay Chain and confirm transactions from the connected parachains.

The Polkadot ecosystem also has parathreads, which are parachains based on a pay-as-you-go model, making them more affordable. The parachains and parathreads can connect and communicate with external blockchains like Bitcoin or Ethereum through bridges.

The network is secured using the NPoS consensus mechanism. Users can choose to participate in the consensus system as nominators or validators. Nominators can select trustworthy validators to update the network while validators verify transactions. Both nominators and validators stake DOT and receive rewards in return.

DOT use cases

DOT serves multiple purposes within the larger Polkadot ecosystem. It is the currency used to pay transaction fees when sending data or tokens across chains. It also serves as a governance token that users can stake to vote on the future of Polkadot.

DOT tokens also serve as the currency to incentivize users to maintain the system's security. Users can stake DOT to participate in the network's consensus mechanism. DOT is also used for bonding, a type of Proof of Stake. By bonding tokens, developers can create new parachains, while removing bonded assets will delete outdated parachains.

DOT tokenomics and distribution

DOT is an inflationary token, implying it doesn't have a hard cap or maximum supply. It has an approximate inflation rate of 10 percent, with new tokens generated for incentivizing validators. One can transfer DOT in fractions, with the smallest unit being 0.0000000001 DOT, called a Planck.

10 million DOT tokens were generated during its first Initial Coin Offering (ICO) held in October 2017. The tokens were distributed in the following manner:

- 50 percent: ICO buyers

- 30 percent: Web3 Foundation for Polkadot development and other Foundation activities

- 11.6 percent: Web3 Foundation for future fundraising initiatives

- 5 percent: Private sale round held in 2019

- 3.4 percent: Token sale held in 2020

A DOT redenomination took place on August 21, 2020, after a network-wide referendum. As a result, the DOT balance for all existing holders was automatically increased by a factor of 100. The original 10 million DOT supply changed to 1 billion after the redenomination, and the market value of each DOT token decreased by a factor of 100. This event is popularly referred to as "Denomination Day."

About the founders

Polkadot is the flagship project of the Web3 Foundation, which was formed by Gavin Wood, Peter Czaban, and Robert Habermeier in 2017. Web3 Foundation is a Swiss-based non-profit foundation established to support Polkadot's research, development, and fundraising efforts.

A well-known name in the crypto and blockchain world, Wood is one of the pioneers of blockchain technology. He is the co-founder and former CTO of Ethereum and the founder of Parity Technologies. In addition, Wood coined the term Web3 back in 2014.

Wood also invented Whisper, a P2P communication protocol, Proof of Authority consensus, and the Solidity programming language. He currently heads the innovation initiatives on Polkadot and Substrate.

Czaban holds a master's of engineering from the University of Oxford and co-founded Web3 Foundation and Polkadot with Wood. Serving as Web3 Foundation's Technology Director, Czaban supports the creation of next-generation distributed technologies.

Habermeier is a Thiel Fellow with extensive research and development experience in cryptography, distributed systems, and blockchain tech. As a longtime Rust Community member, Habermeier is also widely known for using Rust to develop high-performance and parallel solutions.

Disclaimer

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.