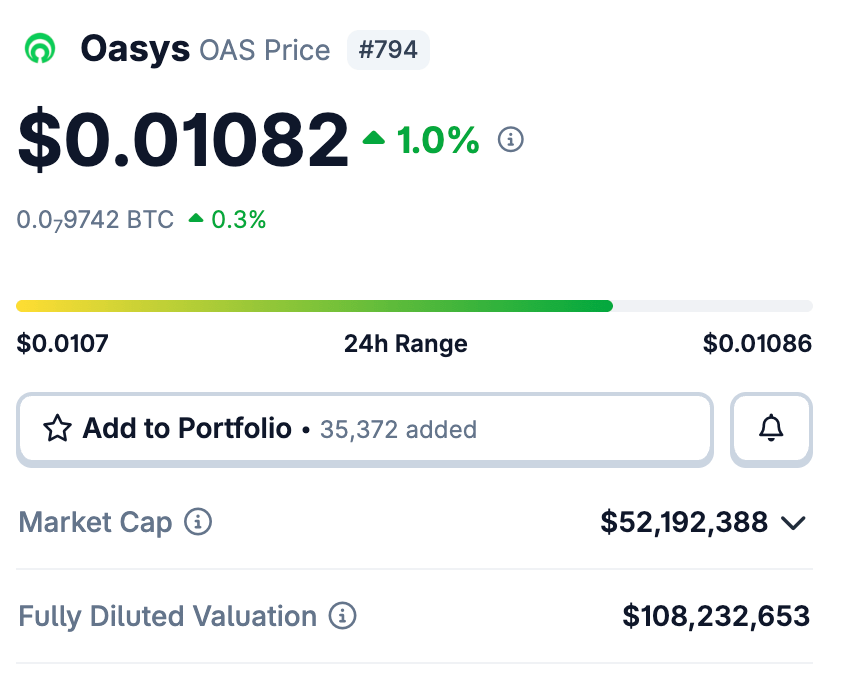

Oasys price

in SGDCheck your spelling or try another.

About Oasys

Oasys’s price performance

Oasys on socials

Guides

Oasys FAQ

Oasys (OAS) is a decentralized finance (DeFi) platform that bridges traditional finance and blockchain technology. It offers users a secure and efficient ecosystem for managing and transacting digital assets, including features like lending, borrowing, and trading. Oasys leverages smart contracts and blockchain technology to facilitate transparent and direct peer-to-peer transactions, removing the need for intermediaries.

OAS tokens offer several benefits to users within the Oasys ecosystem. As a medium of exchange, they provide access to the platform's diverse features and services. Holding and staking OAS tokens allow users to earn rewards and actively participate in the platform's governance through voting rights.

Additionally, OAS tokens can be utilized for discounted transaction fees, unlocking premium features, and participating in exclusive events or offerings. The versatility of OAS tokens fosters user engagement and incentivizes sustained involvement in the dynamic Oasys ecosystem.

Easily buy OAS tokens on the OKX cryptocurrency platform. One available trading pair in the OKX spot trading terminal is OAS/USDT.

Dive deeper into Oasys

Oasys (OAS) has gained attention as a promising project to revolutionize decentralized finance (DeFi). With a dedicated team and innovative technology, Oasys aims to bridge the gap between traditional finance and blockchain, providing users with a secure and efficient platform for financial transactions.

What is Oasys

Oasys is a blockchain-based DeFi platform that offers users a seamless experience in managing and transacting digital assets. It bridges traditional finance and the world of cryptocurrencies, providing a secure, transparent, and efficient ecosystem for financial activities. With a focus on eliminating barriers and inefficiencies in traditional financial systems, Oasys empowers individuals to have complete control over their funds and enjoy the benefits of DeFi.

The Oasys team

The Oasys team consists of experienced professionals involved in blockchain games and non-fungible tokens (NFTs)since 2018, contributing to developing well-known titles like My Crypto Heroes.

Led by Representative Director Ryo Matsubara, the team's extensive expertise enables them to create a robust and user-friendly platform that addresses the challenges individuals and institutions face in the crypto space. Their commitment to innovation and dedication to delivering a seamless user experience drive Oasys' success.

How does Oasys work

Oasys uses smart contracts and blockchain technology to enable secure and transparent transactions. Through the power of decentralized networks, the platform offers a wide array of financial services, such as lending, borrowing, and trading.

Its goal is to establish a decentralized ecosystem where users can freely engage with diverse financial instruments and partake in activities traditionally limited to centralized institutions. By removing intermediaries and facilitating direct peer-to-peer transactions, Oasys ensures enhanced efficiency and reduced user costs.

OAS: Oasys's native token

OAS serves as the native token of the Oasys platform, playing a crucial role within the ecosystem. The token functions as a medium of exchange, granting users access to the platform's features and enabling participation in various activities.

OAS token holders can stake their tokens, earning rewards and actively engaging in the platform's governance through voting rights. This mechanism fosters community involvement and empowers token holders to contribute to shaping the future of the Oasys ecosystem.

Oasys tokenomics

Oasys implements a meticulously crafted tokenomics model to establish stability and foster growth within its ecosystem. The total supply of OAS tokens is capped at 10 billion, with a portion reserved for rewarding early adopters and facilitating platform development.

Additionally, the platform incorporates a deflationary mechanism whereby a percentage of transaction fees are burned, progressively decreasing the overall supply of OAS. This mechanism enhances scarcity and can potentially drive value appreciation for token holders, aligning incentives for long-term participation.

Oasys token use cases

The OAS token serves diverse use cases within the Oasys ecosystem. Beyond its role as a medium of exchange and a governance token, OAS tokens can be used to access premium features, enjoy discounted transaction fees, and participate in exclusive events and offerings. The versatility of the OAS token ensures its integral role in the Oasys ecosystem, promoting adoption and fostering a vibrant community around the platform.

Oasys token distribution

The distribution of OAS tokens is thoughtfully structured to promote fairness and broad engagement. These tokens are made available through different channels, including initial token sales, airdrops, community rewards, and partnerships.

Specifically, the distribution is as follows:

- Thirty-eight percent was allocated to support the ecosystem and the community.

- Twenty-one percent is dedicated to staking rewards.

- Fifteen percent is reserved for furthering the development of the project.

- Fourteen percent is set aside for early backers who supported the project.

- Twelve percent is allocated to the foundation to sustain and advance the project's mission.

Empowering the future of DeFi

Oasys revolutionizes traditional finance by seamlessly merging it with the power of DeFi. Through its secure, transparent, and efficient platform, Oasys empowers individuals to take control of their financial future.

With a strong team, advanced technology, and comprehensive tokenomics, Oasys is well-positioned to emerge as a prominent player in the DeFi landscape. As the platform continues to evolve and gain momentum, it presents an exciting opportunity for individuals to leverage the benefits of blockchain technology in their financial endeavors.

Disclaimer

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.