This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

FRAX

Frax price

0x853d...b99e

$0.99911

-$0.00230

(-0.23%)

Price change for the last 24 hours

How are you feeling about FRAX today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

FRAX market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$314.62M

Network

Ethereum

Circulating supply

314,901,093 FRAX

Token holders

9590

Liquidity

$95.57M

1h volume

$54,817.74

4h volume

$547,466.49

24h volume

$2.44M

Frax Feed

The following content is sourced from .

NFTevening ɢᴍ

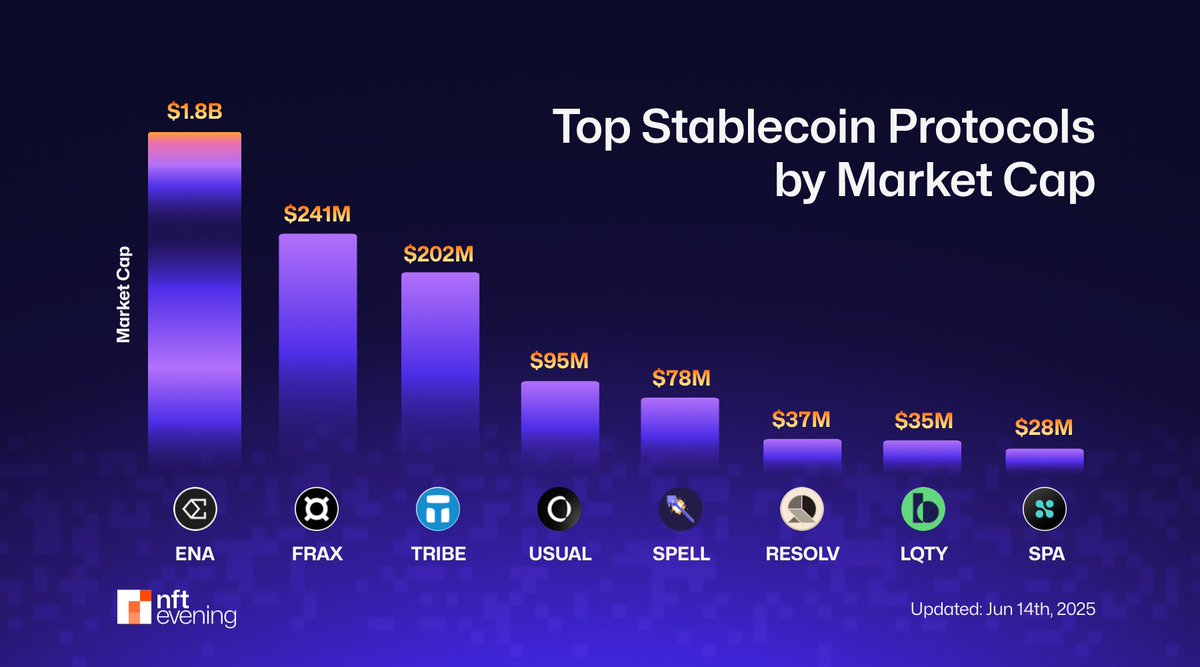

Stablecoins are crypto’s killer app 🔥

They power DeFi, remittances, and real-world adoption.

Here are the top stablecoin protocols by market cap as of June 2025 👇

Will $ENA keep the crown, or will a new player rise?

What do you think? 👀

Top stablecoin protocols

- @ethena_labs | $ENA

- @fraxfinance | $FRAX

- @feiprotocol | $TRIBE

- @usualmoney | $USUAL

- @MIM_Spell | $SPELL

- @ResolvLabs | $RESOLV

- @LiquityProtocol | $LQTY

- @SperaxUSD | $SPA

Show original

36.37K

7

siren

$MKR is trading at $2,142.50 with a 24-hour volume of $143.2 million and a market cap of $1.81 billion—up 17.8% in the last day. This surge was sparked by last week’s community vote to lower the Stability Fee on Ether vaults—making borrowing cheaper and immediately driving a 12% uptick in new DAI issuance—was further amplified by MakerDAO’s announcement of its FRAX integration roadmap (which opens the door to cross-protocol liquidity and expanded real-world asset collaterals), and was turbo-charged by a decisive technical breakout above the $2,000 pivot on heavy volume that lured momentum traders back in, even as on-chain data show whales accumulating MKR and tightening effective supply ahead of the impending Governance Module V2 upgrade.

Show original35.99K

55

0xfffCrypto.sui

$CRCL conducted a shallow analysis of the short- to medium-term trends and several key points.

【Short-term】High U.S. Treasury yields maintained, expectations for legislation to take effect.

Neutral to bullish: High coupon rates lock in high profits; policy catalyzes IPO sentiment, valuations have reflected some positive factors. (Interest rates are key)

【Medium-term】Implementation of legislation, Fed rate decline, expansion of merchant access. Divergence: narrowing interest spreads vs. increasing transaction fees, more competitors; market share ≥ 30% is a decisive factor.

TLDR: Circle's stock is not a traditional "growth stock" or "financial stock," but rather a "U.S. Treasury coupon leverage stock":

Rising interest rates, Float expansion → EPS amplification → P/E naturally compresses;

Falling interest rates or market share erosion → EPS contraction → P/E passively increases, stock price pressure rises.

Therefore, before looking at P/E, one must first examine T-Bill trends and USDC market share to discuss whether valuations are cheap or expensive.

Analysis:

Circle (CRCL)'s core profit driver relies almost entirely on the short-term U.S. Treasury yield spread earned from USDC reserves. The stock price is highly "elastic" due to the rising yield spread: in the current environment of approximately 5% T-Bills, the static P/E remains as high as ~170 times; if U.S. Treasury yields fall to 3%, assuming no growth in circulation and non-interest income, the P/E will passively rise to approximately 290 times. Therefore, to value Circle, one must incorporate interest rate paths, USDC circulation scale, and partner profit-sharing structures into scenario analysis, rather than looking at traditional P/E in isolation.

Situation 1: FOMC rate cut / curve steepening

🔻Interest spread EPS downgrade → valuation inflation → stock price pressure

Situation 2: USDC Float ≥ $80 B 🔺scale neutralizes interest spread decline, P/E falls

Situation 3: Renegotiation of profit-sharing ⚖️ If Circle retains > 40%, EPS elasticity amplifies

Moat and competition analysis:

1) Offshore stablecoins

Tether USDT (circulation $155 B)

Economies of scale, profits $13 billion / 24 years.

Shortcomings: However, compliance audit pressure may require relocation or submission of reserve information.

2) FinTech stablecoins

PayPal USD (PYUSD), Stripe-USDC direct charge.

Built-in payment scenarios, large user base.

Shortcomings: Need to obtain federal/state licenses, may not allow holding 100% U.S. Treasury bonds.

3) Bank tokenized deposits

Visa VTAP, BBVA Pilot

Deposit insurance, interest payable

Shortcomings: Insufficient technology/blockchain interoperability

4) Decentralized solutions

DAI, FRAX, etc.

Trustless, flexible collateral

Shortcomings: Regulatory exemptions tightening, transparency requirements

🗡️Differentiated competitive points:

1) Regulatory first mover: Proactively disclose weekly reserve audits, subject to dual constraints from SEC and public markets post-IPO.

2) Transparent reserve structure: Circle Reserve Fund, in collaboration with BlackRock, invests 100% in U.S. Treasuries & reverse repos, net value and duration are public.

3) Global payment API ecosystem: Interfaces with Visa, Stripe, Shopify, Remote, Bridge, etc., covering e-commerce, freelance payments, and card clearing.

4) Cross-chain composability: CCTP + smart contracts allow USDC to migrate across multiple chains without loss, supporting BlackRock BUIDL for instant redemption.

#CRCL #interest_rate_sensitive #Stablecoin

Show original29.88K

2

0xfffCrypto.sui

$CRCL has conducted a shallow analysis of the short to medium-term trends and several key points.

【Short-term】High U.S. Treasury yields maintained, expectations for legislation to take effect.

Neutral to bullish: High coupon rates lock in high profits; policy catalyzes IPO sentiment, valuations have reflected some positive factors. (Interest rates are key)

【Medium-term】Implementation of legislation, Fed rate decline, expansion of merchant access. Divergence: narrowing interest spreads vs. increasing transaction fees, more competitors; market share ≥ 30% is a decisive factor.

TLDR: Circle's stock is not a traditional "growth stock" or "financial stock," but rather a "U.S. Treasury coupon leverage stock":

Rising interest rates, Float expansion → EPS amplification → P/E naturally compresses;

Falling interest rates or market share erosion → EPS contraction → P/E passively increases, stock price pressure rises.

Therefore, before looking at P/E, one should first look at T-Bill trends and USDC market share before discussing whether valuations are cheap or expensive.

Analysis:

Circle (CRCL)'s core profit driver relies almost entirely on the short-term U.S. Treasury yield spread earned from USDC reserves. The stock price is highly "elastic" due to the rising yield spread: in the current environment of approximately 5% T-Bills, the static P/E remains as high as ~170 times; if U.S. Treasury yields fall to 3%, assuming no growth in circulation and non-interest income, the P/E will passively rise to approximately 290 times. Therefore, to value Circle, one must incorporate interest rate paths, USDC circulation scale, and partner profit-sharing structures into scenario analysis, rather than looking at traditional P/E in isolation.

Situation 1: FOMC rate cut / curve steepening

🔻Interest spread EPS downgrade → valuation inflation → stock price pressure

Situation 2: USDC Float ≥ $80 B 🔺scale neutralizes interest spread decline, P/E falls

Situation 3: Renegotiation of profit-sharing ⚖️ If Circle retains > 40%, EPS elasticity amplifies

Moat and competition analysis:

1) Offshore stablecoins

Tether USDT (circulation $155 B)

Economies of scale, profits $13 billion / 24 years.

Shortcomings: However, compliance audit pressure may require relocation or submission of reserve information.

2) FinTech stablecoins

PayPal USD (PYUSD), Stripe-USDC direct charge.

Built-in payment scenarios, large user base.

Shortcomings: Need to obtain federal/state licenses, may not allow holding 100% U.S. Treasury bonds.

3) Bank tokenized deposits

Visa VTAP, BBVA Pilot

Deposit insurance, interest payable

Shortcomings: Insufficient technology/blockchain interoperability

4) Decentralized solutions

DAI, FRAX, etc.

Trustless, flexible collateral

Shortcomings: Regulatory exemptions tightening, transparency requirements

🗡️Differentiated competitive points:

1) Regulatory first mover: Proactively disclose weekly reserve audits, subject to dual constraints from SEC and public markets post-IPO.

2) Transparent reserve structure: Circle Reserve Fund, in collaboration with BlackRock, invests 100% in U.S. Treasuries & reverse repos, net value and duration are public.

3) Global payment API ecosystem: Interfaces with Visa, Stripe, Shopify, Remote, Bridge, etc., covering e-commerce, freelance payments, and card clearing.

4) Cross-chain composability: CCTP + smart contracts allow USDC to migrate across multiple chains without loss, supporting BlackRock BUIDL for instant redemption.

#CRCL #InterestSensitive:

Show original27.27K

0

The Rollup

We asked @samkazemian founder of @FraxFinance which DeFi friends he would bring to the White House to talk with @BoHines.

"I would have said @StaniKulechov, but I think he's already way ahead there."

"If it was a math lesson, I would bring @newmichwill from @CurveFinance for DeFi math."

"Maybe @haydenzadams from @Uniswap for stablecoins and DeFi."

"@rleshner from @superstatefunds would be valuable too."

Show original16.98K

2

FRAX price performance in USD

The current price of frax is $0.99911. Over the last 24 hours, frax has decreased by -0.23%. It currently has a circulating supply of 314,901,093 FRAX and a maximum supply of 314,901,093 FRAX, giving it a fully diluted market cap of $314.62M. The frax/USD price is updated in real-time.

5m

-0.24%

1h

-0.22%

4h

-0.22%

24h

-0.23%

About Frax (FRAX)

FRAX FAQ

What’s the current price of Frax?

The current price of 1 FRAX is $0.99911, experiencing a -0.23% change in the past 24 hours.

Can I buy FRAX on OKX?

No, currently FRAX is unavailable on OKX. To stay updated on when FRAX becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of FRAX fluctuate?

The price of FRAX fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Frax worth today?

Currently, one Frax is worth $0.99911. For answers and insight into Frax's price action, you're in the right place. Explore the latest Frax charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Frax, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Frax have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials