Listed companies launched a $500 million "buy, buy, buy" model, and SOL became the next BTC for microstrategies

On April 23, 2025, SOL Strategies Inc., a publicly traded Canadian company, announced that it had signed a separate agreement with ATW Partners on the same day to establish a convertible note financing facility of up to $500 million, with proceeds earmarked for the purchase of SOL tokens, which will be staked through validators directly operated by SOL Strategies, and the proceeds generated will be shared between both parties.

Under the financing facility announced by the Company, convertible notes with an aggregate principal amount of US$20 million will be issued in the first tranche, with up to US$480 million being withdrawn in tranches subject to certain conditions. The first closing is expected to be completed on or about May 1, 2025, subject to regular closing conditions. Under this innovative architecture, note interest will be paid in SOL tokens, calculated as 85% of the staking yield generated by SOL tokens purchased through this mechanism and staked by SOL Strategies.

SOL Strategies is sacred

Founded in 2002 and headquartered in Toronto, Canada, SOL Strategies Inc., formerly known as Cypherpunk Holdings Inc., was listed on the Italian Stock Exchange in 1998 and transferred to the Canadian Stock Exchange in 2012 under the symbol HODL.

Under the leadership of Leah Wald, who became CEO on July 9, 2024, the company focused on the Solana blockchain ecosystem, including the SOL token as a core asset on its balance sheet, operating cutting-edge validators, and developing sophisticated smart staking tools. To reflect this strategic transformation, the company officially changed its name from Cypherpunk Holdings Inc. to SOL Strategies Inc. on September 9, 2024. The company filed a listing application with the NASDAQ in late 2024, but has not yet completed the listing process, and its shares are still traded on the Canadian Stock Exchange and trading on the OTC market in the United States under the symbol CYFRF.

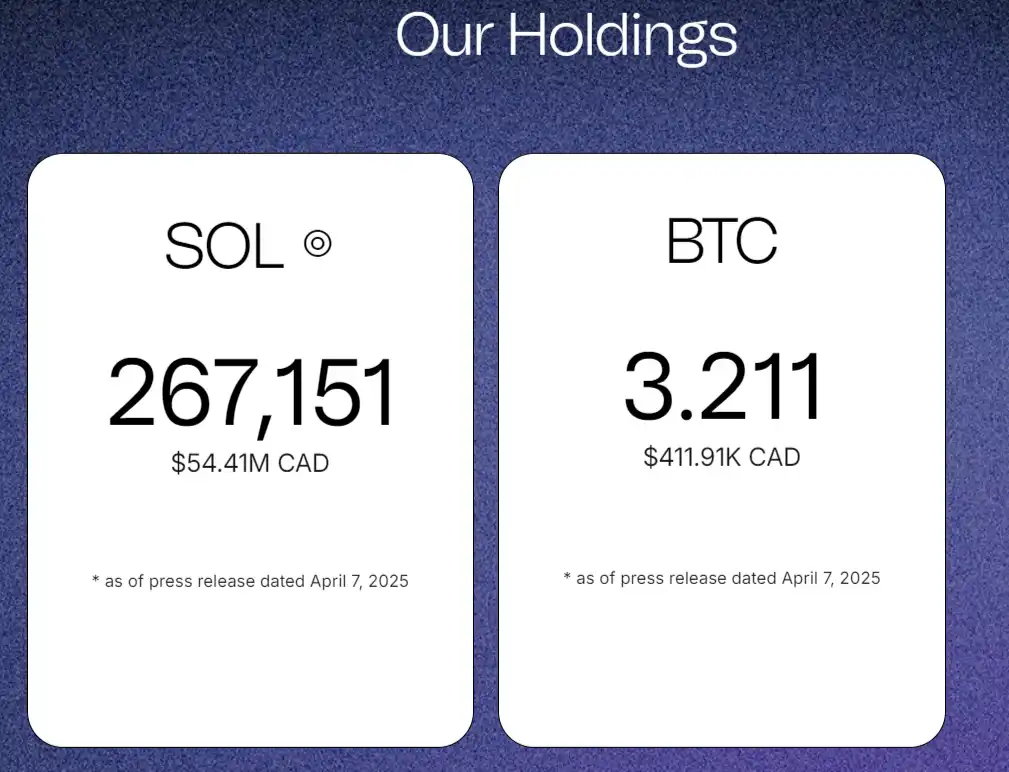

Once the transformation goals were established, SOL Strategies began to increase its holdings in Solana assets, reduce its exposure to Bitcoin, and dispose of other non-core assets. According to its Q1 2025 financial report, SOL holdings have increased from zero to 267,151 so far, and Bitcoin holdings have gradually decreased from 215.37 on September 30, 2023 to 56.25 on September 30, 2024, and further reduced to the current 3.21, reflecting the strategic transfer of resources to the Solana ecosystem project. In addition, the company realized a gain of $1.8 million from the liquidation of its stake in Animoca Brands and redeployed funds to core business areas through the sale of other non-core assets.

In addition to swapping core assets, SOL Strategies has also made great progress and steady growth in validator acquisition and revenue, and staking business:

In terms of validator acquisition and growth, as of March 3, 2025, the company's validators have pledged 1,653,752 SOL tokens, an increase of 1,434% from the end of 2024, of which 239,607 are the company's own SOL tokens. These validators are optimized for high scalability, high availability, and competitive yields to ensure operational efficiency.

In terms of staking revenue growth, 239,607 of the 239,623 SOL tokens held by SOL Strategies have been dedicated to staking its self-operated high-performance validators, a significant increase of 137% from 101,200 staking as of September 30, 2024. These staked SOL tokens generate 12,800 SOL on an annualized basis, with an average annualized yield of around 7% for validators.

In terms of validator revenue, validator revenue reached 26,512 SOL on an annualized basis starting January 1, 2025 (the first day when SOL Strategies took full control of the three Solana validators). This revenue is derived from commissions generated by the company and third parties on SOL tokens delegated to SOL Strategies' high-performance validators.

Listed companies are piling up to invest, is Solana's spring coming?

Perhaps due to the impact of Canada's approval of a staking-based SOL ETF, a large amount of money poured into the SOL ecosystem this week, and SOL Strategies is not the first company to do a "SOL version of microstrategy".

On April 21, cryptocurrency trading and investment firm GSR announced that it was leading a $100 million private equity investment in NASDAQ-listed Upexi, Inc. Upexi is a brand owner focused on the development, manufacturing, and distribution of consumer products. The investment follows Upexi's announcement of a strategic shift to a cryptocurrency-based financial strategy aimed at generating long-term value and benefits for shareholders. Upexi has committed to developing Solana's financial strategy, which includes an increase in Solana holdings and staking. Subsequently, Upexi shares rose by 659.91% to $17.25, reflecting the market's positive attitude towards Solana's strategy.

In addition, on April 22 local time, DeFi Development Corporation (NASDAQ: JNVR) announced that it had purchased 88,164 SOL tokens, worth about $11.5 million. On April 23, another 65,305 SOL worth $9.9 million was purchased, increasing the total holdings to 317,273 SOL worth $48.2 million.

As the first and largest pure Solana ecosystem listed company in North America, SOL Strategies has built a broader channel between traditional finance and blockchain innovation, providing investors with economies of scale and compliant investment channels in the Solana ecosystem, which can continue to contribute to the development and expansion of the Solana ecosystem.

SOL Strategies is strategically similar to Micro Strategy. Micro Strategy became an avenue for investors to invest indirectly in Bitcoin by holding it heavily as a core asset on their balance sheet. Similarly, SOL Strategies offers investors the opportunity to invest indirectly in Solana by holding SOL and operating validators, both of which provide exposure to cryptocurrencies for traditional investors through publicly traded companies.

However, SOL Strategies not only holds SOL, but also actively participates in the Solana ecosystem, earning additional income by operating validator nodes and investing in Solana projects, and actively participating in the SOL ecosystem can in turn feed back the value of the company's assets. As Leah Wald, CEO of SOL Strategies, explains, SOL Strategies is the largest funding facility of its kind in the Solana ecosystem, and every investment will generate immediate revenue, increasing the company's assets and growing validator businesses.

Solana's new money printing machine seems to be starting to move, the SOL ETF has been approved in Canada, the expectations of the SOL ecosystem are gradually improving, the meme sector is gradually active, and traditional financial funds are pouring in. Whether it is SOL Strategies' $500 million funding and GSR's $100 million investment in UPXI, or DeFi Development Corporation's purchase of more than $20 million worth of SOL in two days, it indicates that the Solana ecosystem will have a broader development space in the future. Let's wait and see when the SOL ecosystem will have a second spring.