PERSISTENT DCA expects to take profits in Q4 kkk

THIS CYCLE IS COMPLETELY DIFFERENT – COTTON CANDY IS OUT, ONLY ROOM FOR… COM TAM!

Remember 2017, 2021 – altcoins surged just because of hype.

The media shouted, the community FOMOed, every coin seemed as "delicious" as divine cotton candy.

But after indulging? All fluff, sweet and sticky, then deflated like a soap bubble.

This season is different.

The game has shifted to projects that are real. Winning horses are no longer chosen by cheers, but by fundamentals: real products, real cash flow, real models.

For example, back in the day at fairs, if someone shouted loudly, everyone rushed to buy. After eating, you found all fake stuff.

Now it's different: customers line up at the truly delicious com tam stall, consistently busy every day.

While the stalls that just "talk for fun" automatically close down.

--

The formula from Wall Street – super simple

- Have real revenue.

For example: DEX collects transaction fees, lending platforms earn interest.

- Use revenue to buy back tokens (Buyback/Burn).

Use real money to buy back tokens, reducing supply → like an 8-slice pizza cut down to 6, your share naturally gets bigger.

👉 Any project that has cash coming in and knows how to reduce token supply → will definitely catch Wall Street's attention.

For example, there's a pho restaurant:

The restaurant is busy → has real revenue.

Every night the owner collects some discount vouchers → the vouchers become increasingly rare.

The next day, anyone wanting to eat → has to pay a higher price.

Lessons from history

2020: those who missed out on Uniswap → jumped into SushiSwap thinking it would win.

Result? SushiSwap fell, many people burned their wallets.

Why? In the network game, the winner often takes it all.

--

Just like Facebook swallowed MySpace, or Grab pushed Uber out in Southeast Asia.

In crypto, it's the same: don’t expect a "small grocery store" to beat Big C.

Lessons learned

- Short-term investment: look at real cash flow + buyback.

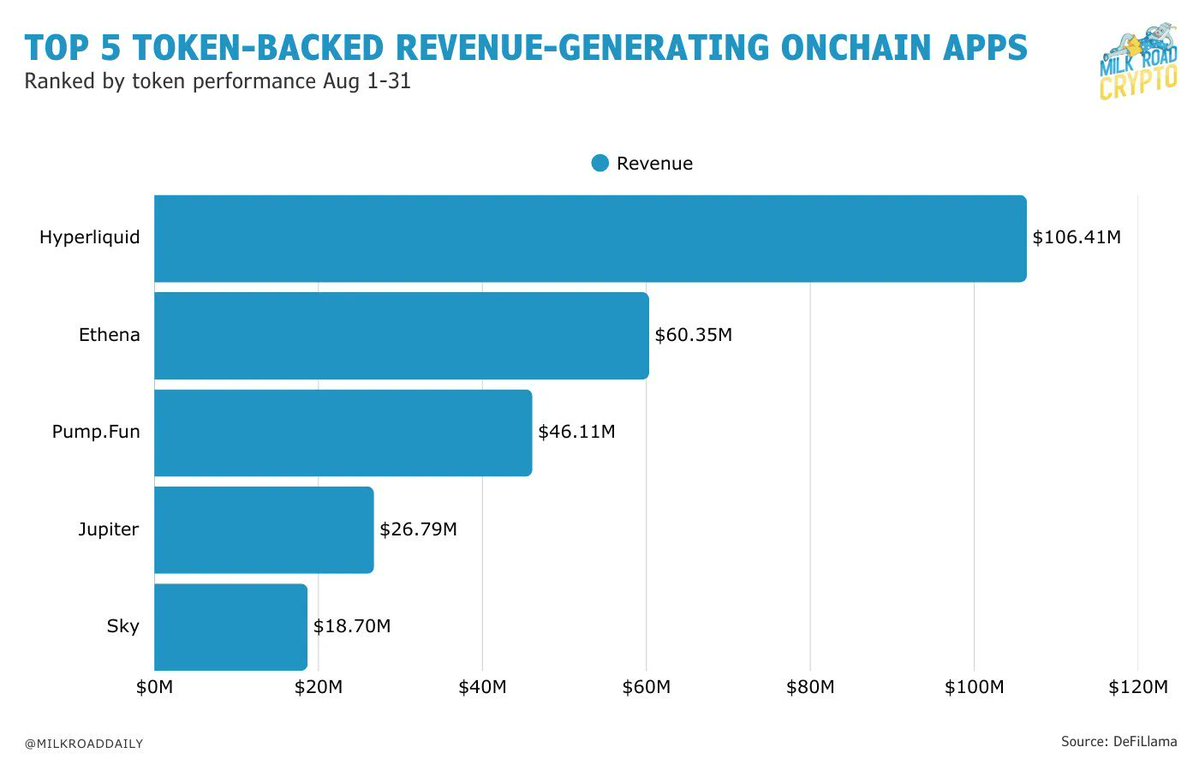

- Long-term investment: focus on winning horses (BTC, ETH, SOL, Ethena, Hyperliquid…).

- Don’t try to catch falling knives with weak tokens. In crypto: winner takes all.

To sum it up in an easy-to-remember phrase:

"In this cycle, any token that can earn money and knows how to burn tokens → will have less and less room for others to squeeze in."

26.71K

71

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.