How to Unlock Bitcoin utility across DeFi with tBTC, a thread🧵:

1/7 This overview presents current tBTC integrations across lending markets, liquidity pools, and additional protocol functionalities. The total ecosystem TVL exceeds $600M, with over 15+ active integrations.

2/7 Let's look at some liquidity provision opportunities:

At @bluefinapp, you can view select incentivized pools such as,

a) tBTC-LBTC: 22.30% APR, $1.61M TVL

b) xBTC-tBTC: 36.78% APR, $580K TVL

c) tBTC-USDC: 3.41% APR, $1M TVL

accessible via:

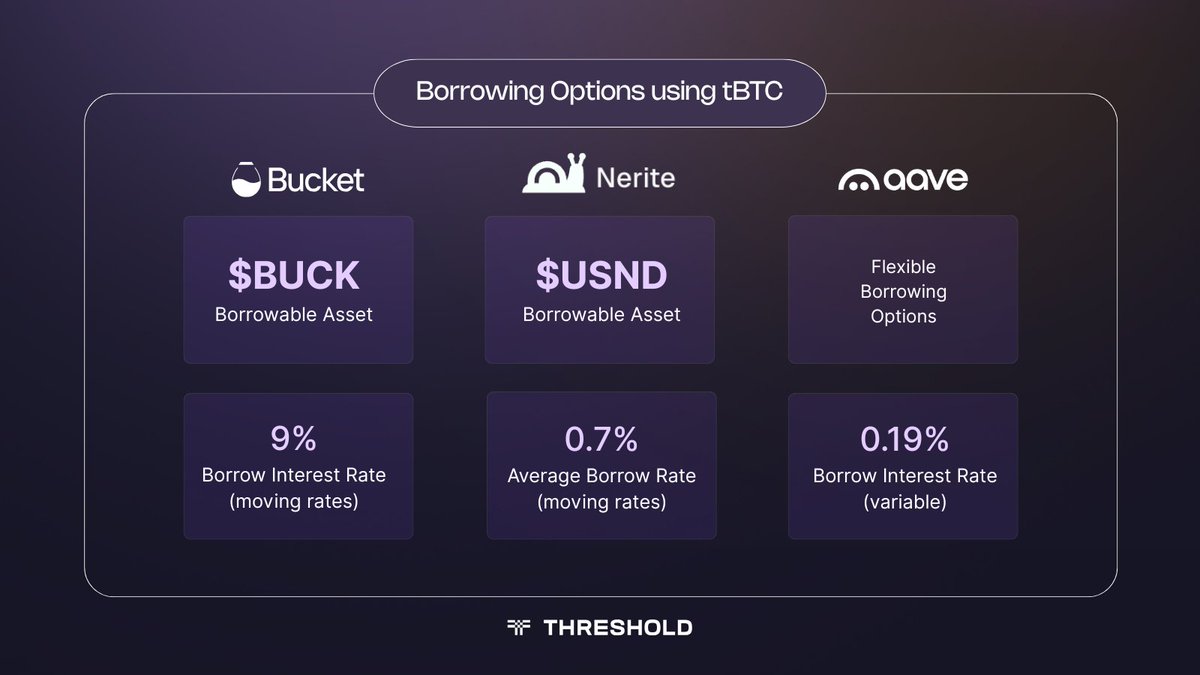

4/7 Borrowing protocol opportunities:

a) @bucket_protocol Protocol: Access BUCK stablecoins against tBTC collateral, with only 0.3% Borrow Fee, 9% interest rate via

b) @NeriteOrg : Borrow USND using tBTC as collateral at 86.96% maximum LTV ratio. Higher leverage options for qualified borrowers via

c) @Aave: Borrow through select tokens at 0.19% variable APY

6/7 Other Available Pools:

✅ Ethereum Curve tBTC/cbBTC:

✅ Arbitrum Uniswap ETH/tBTC:

✅ Base Aerodrome tBTC/cbBTC pool: […]c7CB9B682AaC

8.6K

19

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.