Let’s talk about the gems stealing the spotlight and why they’re doing it so effortlessly.

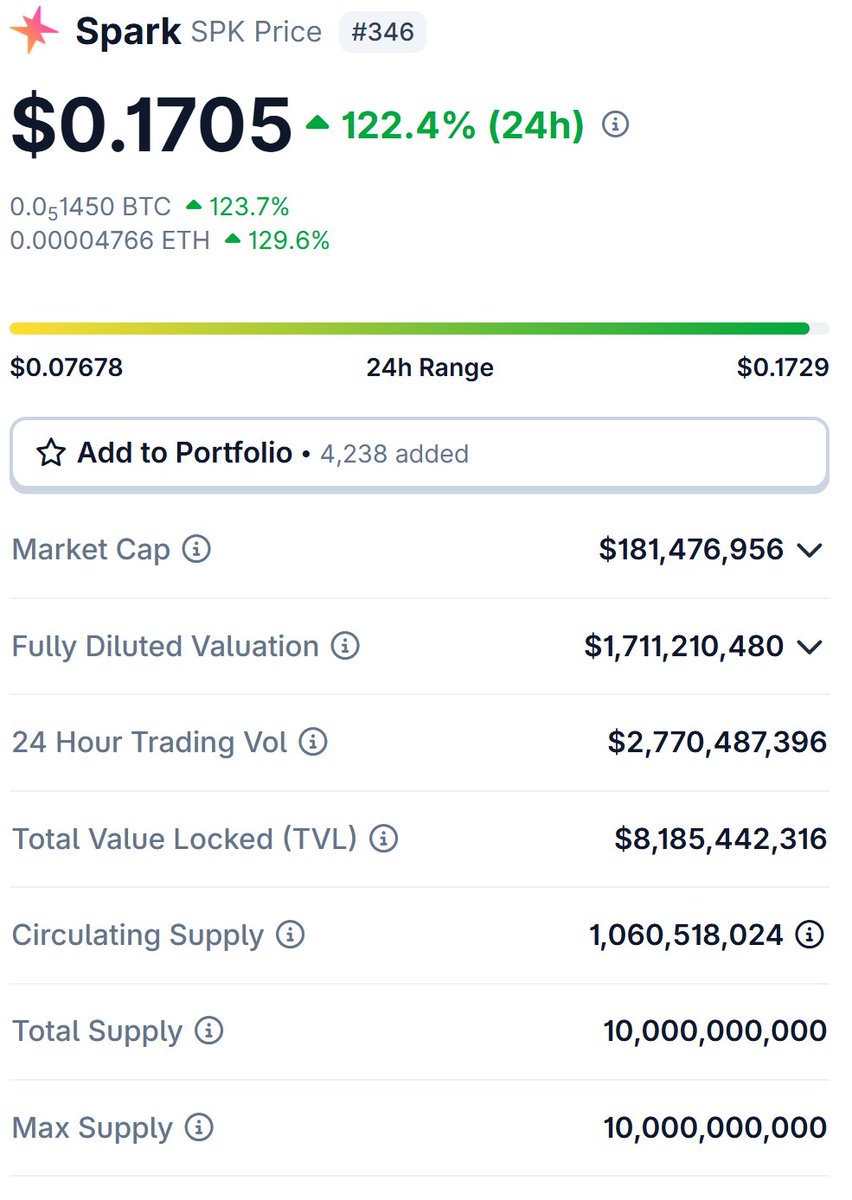

$SPK Narrative Heating Up – With $8B+ TVL and a game-changing model for onchain liquidity, $SPK is finally getting the spotlight it deserves.

This isn’t just another alt pumping. This is DeFi’s answer to BlackRock’s $BUIDL, and it just 6X’d this week while most of CT was still arguing over the next meme coin.

What Is $SPK?

Protocol: SparkFi

Core Utility: Acts as an onchain capital allocator – managing billions in TVL across stablecoin yield strategies.

Focus: Deep liquidity, stable savings returns, and yield farming through SparkLend, Spark Savings, and Spark Liquidity Layer.

Over $8B is already locked in the ecosystem.

Why It’s Gaining Momentum

$2.8B+ daily volume and $180M+ market cap; a heavy pump that’s backed by real usage and yield.

It’s being referred to as the BlackRock of DeFi; no joke.

This week’s 6x gain isn’t hype-driven. It’s because big wallets have finally caught on to how efficient this protocol is.

Yield-bearing assets are meta again and $SPK is leading that charge.

Users are actively buying in anticipation of Phase 2 of @sparkdotfi’s Ignition airdrop.

With the success of Phase 1 and growing attention on Spark’s ecosystem, many believe the next phase could offer even bigger rewards.

The narrative is getting stronger, and early positioning could be key before the next leg up.

Volume is absolutely mooning in the utility bags and you're still stuck on the sidelines?

Maybe it’s time to grind a little harder and catch some projects in early stages because in the next few months, they’re going to look exactly like the ones blowing up right now.

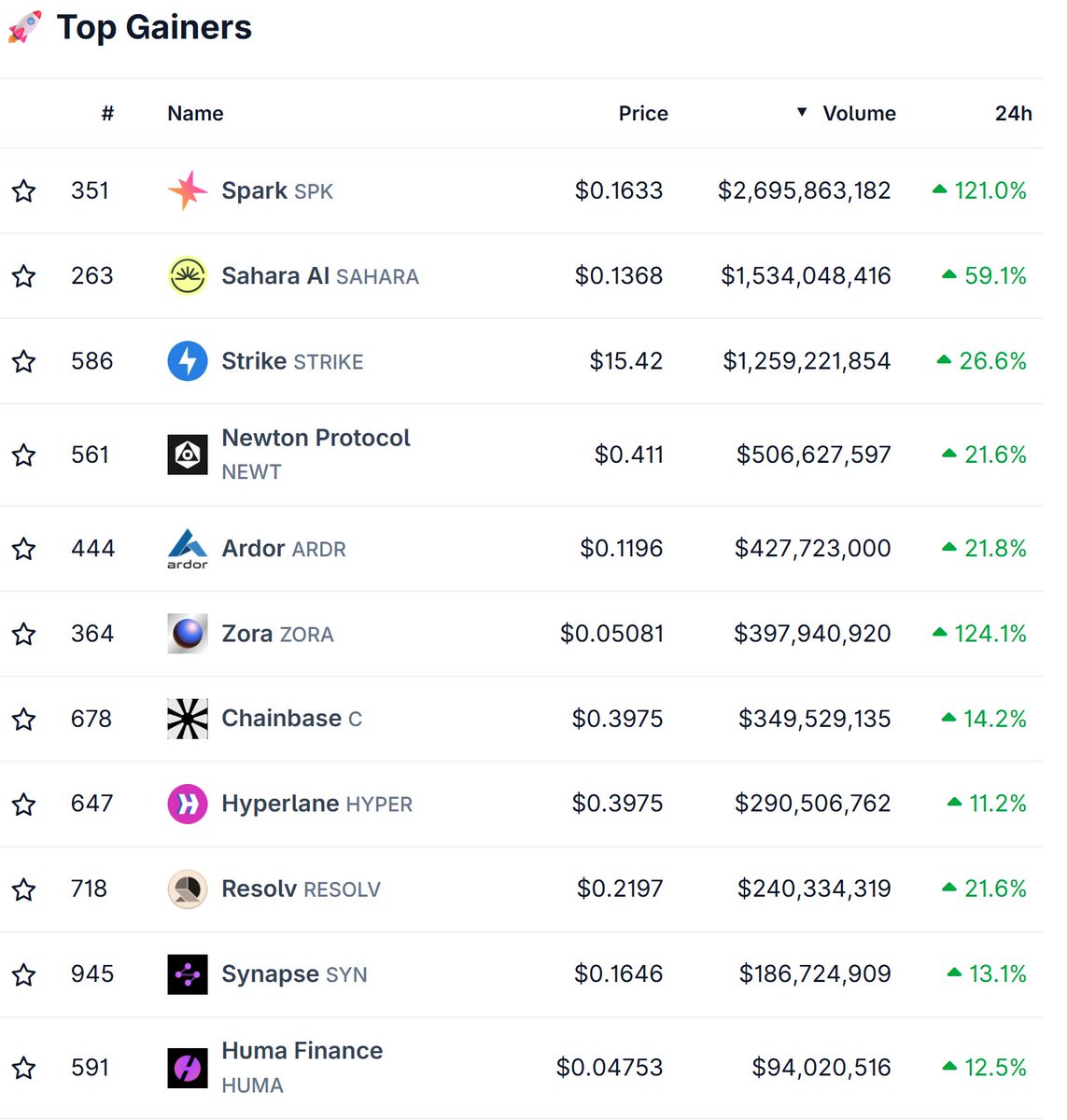

$SPK – $2.69B

$SAHARA – $1.53B

$STRIKE – $1.26B

$NEWT – $506M

$ARDR – $428M

$ZORA – $398M

$C – $350M

$HYPER – $291M

$RESOLV – $240M

$SYN – $187M

$HUMA – $94M

Do you something in your mind? Shill it.

@Carlostrader131 but keep in mind, Binance loves to mess with shorters

MM might pump it more

71.26K

110

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.