WOO X Research: 130% increase in TVL in a month, what's fun on Sonic?

Recently, the market has been in a narrative vacuum, with memes going out, Solana on-chain activity plummeting, and most altcoins falling by more than 80% in three months, but there is still one public chain that has seen TVL increase of more than 130% in a month, ranking first among all public chains, and that is Sonic.

What's Sonic's recent activity? What are the key projects worth noting? Let WOO X Research show you around!

Reference: Defillama

Sonic? What is the most recent airdrop activity

Sonic's predecessor is Fantom, which is a Layer 1 public chain launched in 2019 and focuses on DeFi and dApps, which was a smash hit in 2021-2022, with a TVL of around 8 billion at its peak. In 2022, AC announced its temporary withdrawal from the DeFi industry, and the market's confidence in Fantom declined; In July 2023, a vulnerability occurred in the cooperative cross-chain bridge Multichain, and the stablecoins (USDC-MULTI, fUSDT-MULTI, etc.) issued by the bridge contract on Fantom were significantly de-anchored, affecting the stability and trust of the entire ecosystem. In this context, Fantom proposed to upgrade to Sonic.

Sonic announced that it will issue a total of 190.5 million S tokens, and the reward mechanism for these tokens will be split into two parts: 25% of the rewards will be withdrawn immediately, while the remaining 75% will be released gradually in the form of tradable NFTs. There are two ways for users to qualify:

-

Points (for network participants) and

-

Gems (for developers). The return potential of these avenues may go far beyond the usual speculative airdrops.

Whereas, Sonic Points are user-directed airdrop points that are divided into passive points and active points. Passive points can be earned for holding whitelisted assets in Web3 wallets, and active points can be earned for deploying whitelisted assets in apps; WETH, SolvBTC, and SolvBTC.BBN can only earn active credits. Active credits earn twice as much as passive credits.

Sonic Popular Project

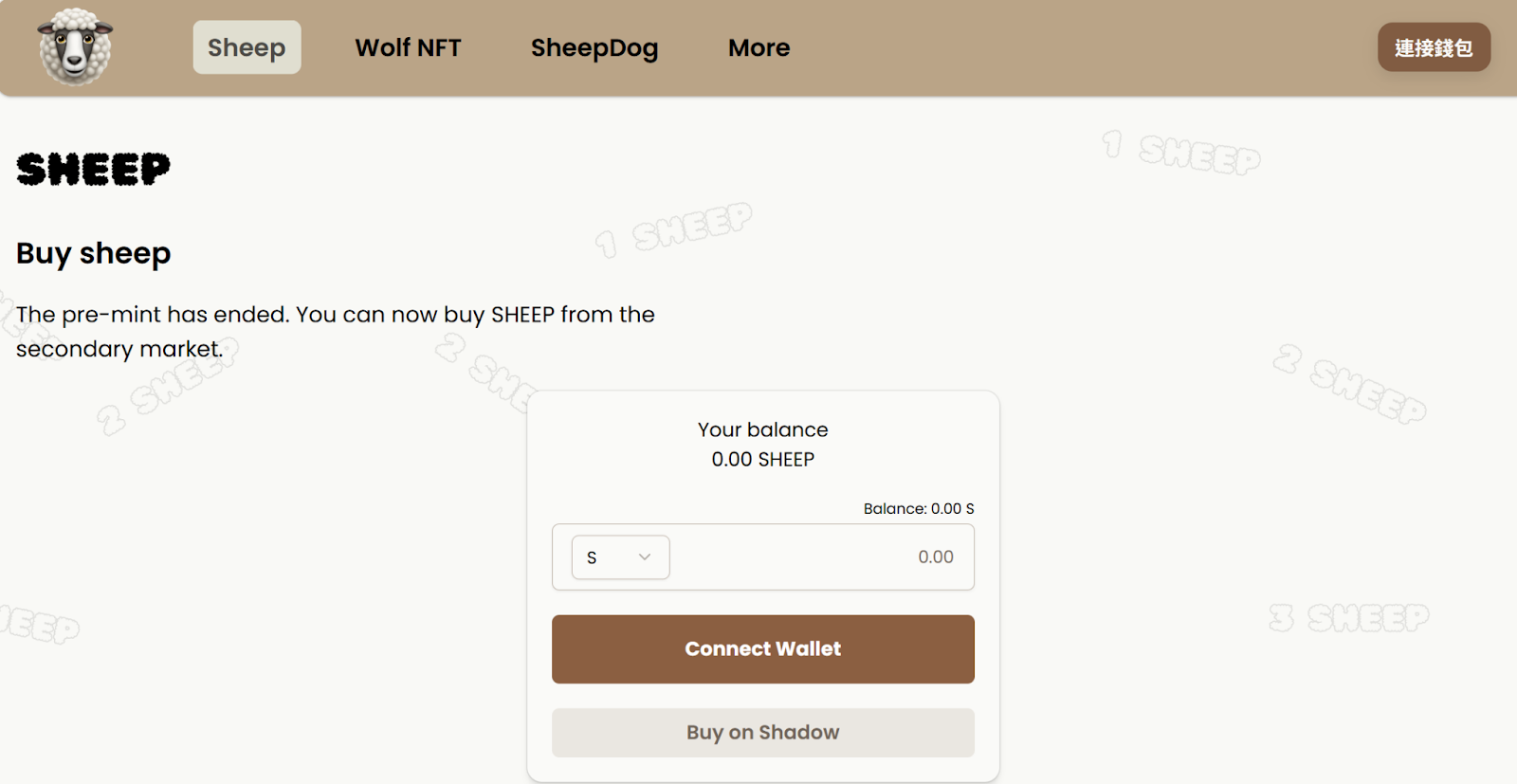

Sheep Coin (@SheepCoin69)

Reference: @SheepCoin69

Sonic Wolf Sheep Game is a strategic gaming ecosystem that combines blockchain asset management, NFT mechanisms, and DeFi protocols. Players can buy, mint, protect, and attack assets to build their advantage and earn money.

Buy Sheep Coin: Players can use $S to buy Sheep Coin at a 1:1 ratio. In this process, 95% of Sonic Token will be provided to Sheep Coin as liquidity. Once live, Sheep Coin can be traded freely.

Mint Wolf NFTs: Players can use Sheep Coin and $S to mint Wolf NFTs. The cost of each mint increases with the number of mints (1 Sheep for the 1st, 2 Sheep for the 2nd, and so on), and all Sheep Coins used to mint are permanently destroyed. This means that the total supply is reduced with each mint.

Wolf NFT MechanicsWolf NFTs are in-game assets that are offensive in nature, and they behave in the following pattern:

-

Each Wolf needs to eat Sheep every day, and the consumption increases with the number of days (1 on the first day, 2 on the second day, and so on).

-

If Wolf does not eat Sheep for 7 consecutive days, it will become unusable (presumably unable to generate revenue or participate in the game).

Wolves can eat in two ways:

-

Liquidity Pool: If you eat Sheep from a liquidity pool, 100% of your Sheep will be destroyed. Each Wolf can only eat a maximum of 3 times from the liquidity pool.

-

Wallet (own or someone else's): If you eat Sheep from your Wallet, 25% of the Sheep will be given to the Wolf owner, and the remaining 75% will be destroyed.

Shepherd Dog Protection Mechanic: Players can deposit their own Sheep into Sheep Dog for protection. To take it out, players must activate the "sleep mode", wait 2 days and pay the fee.

Shepherd Reward SystemSheep stored in the Shepherd Dog can be rewarded with S through an annualised rate of return (APR). In addition, the fees paid by players when withdrawing assets are also included as part of the rewards.

The following is the core concept of the interpretation of the game

: through the "wolf eats sheep", the sheep will continue to deflation, thereby pushing up the price of the currency

-

Although the number of sheep will gradually decrease, the Sonic Token allocated in the liquidity pool will not decrease, which means that the value of holding sheep has the opportunity to rise steadily. However, players still have to take the risk of being attacked by wolves.

About Wolves: High Cost, High Risk, but Potentially High Returns

The-

minting cost of wolves will gradually increase depending on the minting order, and whether or not they can make a profit depends largely on whether they can eat other players' sheep. If the wolf is unable to eat for a long time or the wolf is starved to death, it can lead to the loss of the investment.

-

If there are a large number of wolves on the market at the same time, the battle for sheep will be more intense; However, if the number of wolves is limited, the speed at which sheep are destroyed may not be able to support the rapid return of the wolf.

Shepherd Dogs: Daily Rental Maintenance in Exchange for Safety and Extra Income

A-

fixed 10 S per day is required as rent, of which 95% will be given back to everyone as APY. If the amount of sheep in hand is too small, it will be difficult to recover the rent; However, if there are enough sheep, it will be more attractive for the guardian sheep to appreciate in value over time.

-

Shepherd dogs exist to avoid sheep being eaten and to make an extra profit from sheep that continue to increase in value.

Game question 1: Is it worth investing in casting wolves?

-

The minting fee of the wolf is a competitive relationship between players, and although the earlier you can mint it, you can gain an advantage, but at the same time, you must consider the fierce competition and high cost.

-

The wolf's feeding strategy is crucial: a quick feed in the short term can speed up the payback, but it can also cause the wolf's demand for sheep to skyrocket. If the feeding rhythm is slow, although the wolf's survival and activity space can be extended, it will take longer to pay for the cost.

-

Since the value of sheep will gradually appreciate due to deflation, the return of eating a sheep in the later stage is not necessarily worse than that in the early stage, so "when to eat" is a major strategic consideration.

Gambling question 2: Do you want to rent a sheepdog?

-

Regardless of how many sheep the player owns, they will need to pay the same rent. To recoup this rent with APY, a relatively large number of sheep would be needed to spread out the cost.

-

The essential function of the sheepdog is to ensure that the sheep are not eaten by wolves, and at the same time enjoy the advantage of the price increase of the sheep coin.

Possible situations and corresponding strategies

-

Due to the high cost and uncertainty of wolves, there may not be a large number of players rushing to mint wolves; When wolves are relatively scarce, sheep are destroyed at a slower rate, and the wolf's profit cycle may be delayed.

-

If everyone chooses not to use a sheepdog, they may spread their sheep across multiple wallets in an attempt to reduce the risk of a lockout attack.

-

There is no fixed "best solution" in the game, because the market and player actions can change at any time; In order to make a profit in the end, it is necessary to continuously pay attention to the dynamics of the ecosystem and flexibly adjust the strategy.

Petroleum Finance (@Petroleum_Defi)

Petroleum City is a blockchain game with the theme of oil extraction. Players build, upgrade, and manage pumps to refine crude oil (cOIL) and convert it into tradable $OIL for profit. Here are the core mechanics of the game:

1. Buy a plot

-

Each player can buy and customise their own plot of land to build an oil empire.

-

The plot can be increased by adding pumps, decorations, etc.

2. Buy some Pumps

-

Pumps are the core production tool of the game, and each pump will continuously and automatically produce cOIL (crude oil).

-

Pumps can be upgraded to increase production, but over time they will decay and will need to be repaired with cOIL to continue production.

3. Add decorations:

-

Players can decorate tiles to enhance their appearance and personal style.

-

Suggestions for new decorations can be made via the app or Discord.

4. Refine your $cOIL

-

The cOIL produced must be refined by a "Refinery" before it can become a tradable $OIL.

-

The lock-up period and tax rate for refining are as follows:

-

0 - 1 day: No withdrawal is possible.

-

1 - 2 days: Withdrawals are subject to 10% tax.

-

2 - 3 days: Withdrawals are subject to 5% tax.

-

More than 3 days: Tax-free withdrawal.

-

-

The longer the refining time, the higher the profit.

Strategies & Recommendations

-

Ensure continuous production: Reserve enough cOIL for pump repairs to avoid interruptions in production.

-

Optimize your refining strategy: Try to wait until 3 days to withdraw your $OIL to avoid high taxes.

-

Upgrade & Trim Balance: At the same time, increase the pump capacity and decoration effect, and increase the overall output.

Petroleum City takes "production of cOIL → repair pump → refining into $OIL → repeated investment and upgrading" as the core cycle. Players need to plan their production, refinement, and upgrade strategies in order to earn income and expand their assets stably.

Reference: @Petroleum_Defi