Real data for 10 projects: Binance Wallet IDO Project Survival Report

Author: Klein Labs

As Web3 enters a new round of adjustment, initial coin offerings (TGEs) are no longer just a simple means of fundraising, but have become a place for projects to play games with the market. Especially in the current environment of shrinking liquidity and low investor confidence, how to start and how to start has become a topic that project parties must carefully consider.

IDO is a common way of TGE. From the early days of platforms such as Coinlist, many king-level projects have also been born through IDOs. It's just that as the number of projects increases, the wealth effect of IDO decreases. And Binance's every move also stirs the nerves of the market at all times. Since 2025, Binance Wallet IDO has become the choice for quite a few project launches. Its characteristics of "light threshold, high popularity, and strong traffic" quickly became the focus of the market, attracting the attention of a large number of start-up projects and communities, but it also exposed a series of fundamental changes in the structure of the new currency market, the valuation system and the logic of the project.

However, is this model really suitable for every project? Which projects can quickly amplify the narrative and complete the cold start through it, and which projects may encounter the dilemma of "opening high and going low" after the market hustle and bustle?

The Klein Labs Research team conducted systematic data research and structured dismantling of the 10 Binance Wallet IDO projects that have been launched, in an attempt to help project parties make smarter judgements from a strategic perspective.

1. Background: What kind of market cycle are we in?

The evolution of the market's investment preference has been evident over the past few months:

-

Early Preferences: High Valuations + Low Liquidity Models (VC-Led, Short-Term Speculation)

-

Medium-Term Fever: Fully Liquid Meme Coin Models (Zero-Threshold Hype)

-

Current Turn: The market is returning to focus on fundamentals and projects with strong sustainability

At the same time, the structure of the TGE model is also undergoing three evolutions:

-

Early model: low valuation issuance + market value discovery mechanism (narrative-driven)

-

Medium model: high valuation issuance + insider arbitrage (via OTC or sell after release)

-

Current state: Return to low valuation opening (lack of buying, no one is willing to "take over")

The most intuitive manifestation of this market state is that we have seen the Binance Wallet IDO project go live at a low valuation. The project party must exchange a very low valuation and release ratio for a trace of market attention. Behind this, there is an important logic:

TGE's valuation is not a reflection of the "future value of the project", but a comprehensive mapping of market liquidity, expectations, narrative strength and the current market-making system.

2. The traffic effect of Binance Wallet IDO is still strong, but rhythm control is the key

From the data, Binance Wallet IDO has brought obvious market attention and brand exposure to the project:

-

The average number of participants is 80,965;

-

60,000 – 443,000 BNB in a single transaction;

The -

oversubscription rate ranges from 6,900% – 36,500%.

Among them, KiloEx has reached an oversubscription rate of 36,492%.

Binance Wallet IDO can easily leverage the attention of 100,000 users, and even when the market is cold as a whole, it can still attract tens of millions of dollars in equivalent asset inflows.

Although with the optimisation of the mechanism, the threshold for user participation has been raised, it can effectively screen out high-quality users with more long-term value and stickiness, bring a healthier user structure and community foundation to the project team, and contribute to subsequent community operation and user conversion.

With the support of Binance Wallet's light-touch mechanism, the project team can still obtain strong cold start momentum, greatly reducing the user acquisition path and cold start cost.

3. The TGE model is being deleveraged, and the Wallet IDO project is generally undervalued through

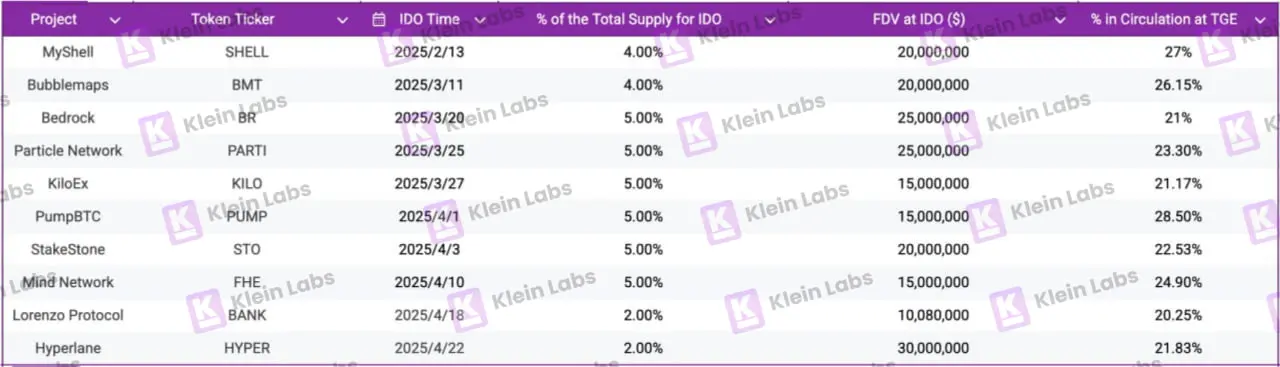

theanalysis of the data, we find that the commonality of the Binance Wallet IDO project in the token economy is very obvious:

the token release ratio of the

-

IDO stage is generally low, with a range of only 2% to 5% of the total supply, and the average is 4.44%;

The -

initial offering (TGE) phase is typically between 20% and 30% liquidity, ensuring that initial market liquidity is not excessively diluted;

The -

total dilution (FDV) corresponding to the IDO phase ranges from $10 million to $30 million. On the whole, it is a relatively reasonable or even slightly low valuation range.

At this stage, the project team is still willing to conduct TGE through Binance Wallet IDO, and there are some considerations as follows:

The-

product has been formed, and it needs to issue tokens to access the use case/incentive system/settlement system;

-

It is necessary to obtain community attention and trading support in a low-cost way, which is equivalent to a large-scale market launch and forming a liquidity starting point;

-

Adhere to the concept of long-termism, accept low valuation, low release, and slow-paced growth.

At this stage, the Binance Wallet IDO project has to accept the low valuation pressure caused by the decline in market confidence. But at the same time, it can reserve more room for market value growth for excellent project parties.

4. Exchange performance: Binance Wallet IDO is the ticket to Binance, not the terminal

Inthe imagination of many teams, Wallet IDO means "landing on Binance". However, the reality is far from the same:

-

PumpBTC rose as much as 760% on the first day, KiloEx The return performance is equally impressive.

-

Despite the high price volatility on the first day, the medium- to long-term performance of the project is more dependent on continuous operational capabilities, market management strategies and a clear long-term development plan.

-

It is worth noting that some projects (e.g., MyShell, Bubblemaps, PumpBTC) have chosen to actively expand the Korean market after IDO to drive subsequent growth.

Although Binance Wallet IDO projects tend to be very popular in the early stages, if the project team lacks long-term planning, it will be difficult to withstand the multiple challenges in the current market environment - including weak buying, investors' attitude towards short-term liquidity, insufficient medium- and long-term fundamental support, and early overdraft of narrative value. In this context, the market performance of different projects has gradually diverged significantly.

Although short-term popularity is easy to obtain, what really determines whether a project can go long-term is still the continuous operation ability and market management strategy. The project team needs to plan the control rhythm and investor relations management of the secondary market in advance to avoid a rapid price decline and achieve the steady release of long-term value.

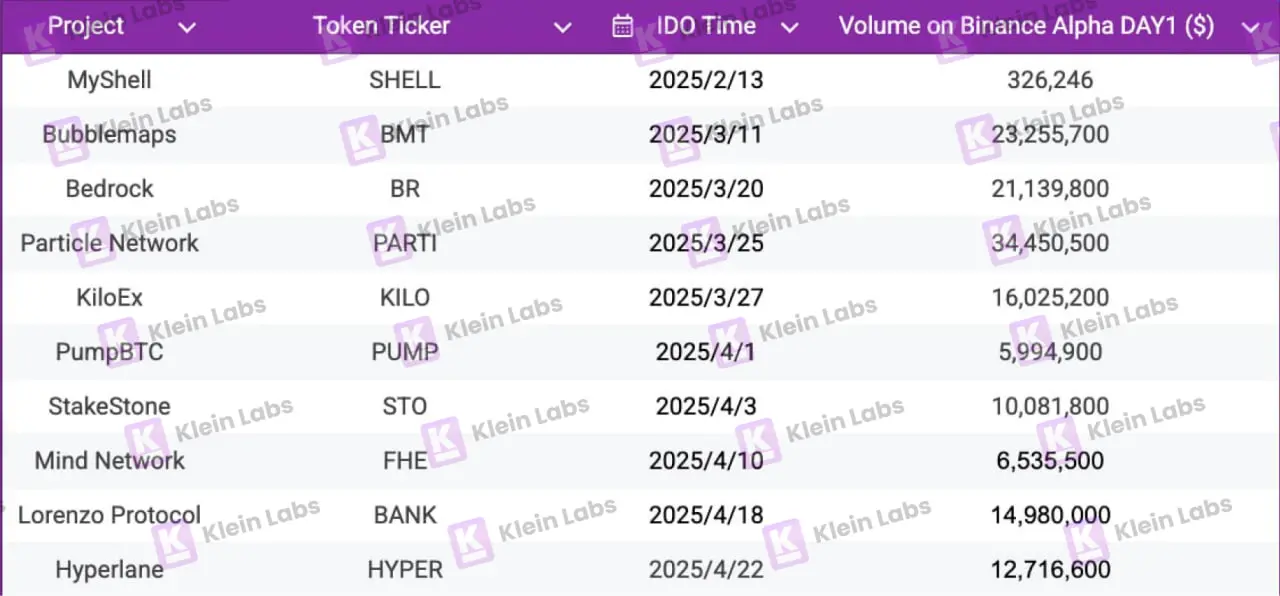

6. Trading Popularity:

The market performance ofBinance Wallet's IDO project varies from project to project, but the overall trading popularity is generally high:

PARTI, BMT and BR are outstanding, with first-day trading volumes all exceeding $20 million

The emergence of high trading volume is not only related to the initial traffic, but also closely related to the narrative strength of the project, the design of the token economy, and the management of market expectations.

IDO is only the "ignition point" of the heat, and whether it can maintain the heat and detonate the secondary market depends on the execution of the entire project and the control of the operation rhythm. Many underperforming projects quickly fall silent after TGE, either due to a lack of continuous content output to keep the topic hot, or due to a rapid decline in confidence due to uncontrolled market management.

Summary: Binance Wallet IDO is a "value screener", but also a narrative

verificationBinance Wallet IDO is a structured, high-leverage cold start method for current Web3 projects to start the narrative, build consensus, and amplify attention. It gives the project team a set of "opening scripts" to leverage large volumes through small costs, but it also puts forward extremely high requirements for the team's execution, operation planning and market management capabilities.

The data performance of Binance Wallet IDO reflects the profound evolution of the valuation logic and issuance model of the entire market. It is not a destination, nor a pass, but a window to verify the product vision and the trial-and-error market mechanism at low cost.

It is precisely because the market is currently at the end of low confidence + low liquidity + high vigilance that it is more necessary for those projects that are really willing to build for a long time to come out and demonstrate their product value, narrative rhythm and operational capabilities with the help of Binance Wallet IDO.

It's not for everyone, but it's an important springboard to the Binance ecosystem and mainstream market vision for teams with a clear story, a clear pace, and a long-term willingness to build. During the window period of bubble bursting, the market returns to its source of value. This is a good sign for teams that really want to do things and have a long-term vision.

As with all platform IDOs, how does the feast last after a short period of pleasure? This is also something that Binance Wallet needs to think about. To put it simply, if Binance Wallet IDO can continue to be the go-to launch platform for high-quality assets, its life cycle can be extended as much as possible. Behind this is the understanding of "high-quality assets". What exactly does the industry need? Which projects are suitable for development in this world? Each of us needs to think deeply.