Genius Act Final Vote is TODAY. What will happen to Tether?

For the first time, it creates a comprehensive US licensing framework for stablecoins. Final voting in hours.

Let's dive into what this means for $USDT, $USDC, $USD1 and the broader ecosystem 🧵

1. The Senate's final voting for the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act) is on June 17, today.

The Act has already progressed through the Senate Banking Committee approved it 18-6 on March 13 and secured a successful cloture vote.

2. We are going to have three categories of permitted issuers:

1. Federal qualified nonbank issuers regulated by the Office of the Comptroller of the Currency - e.g. Circle and PayPal

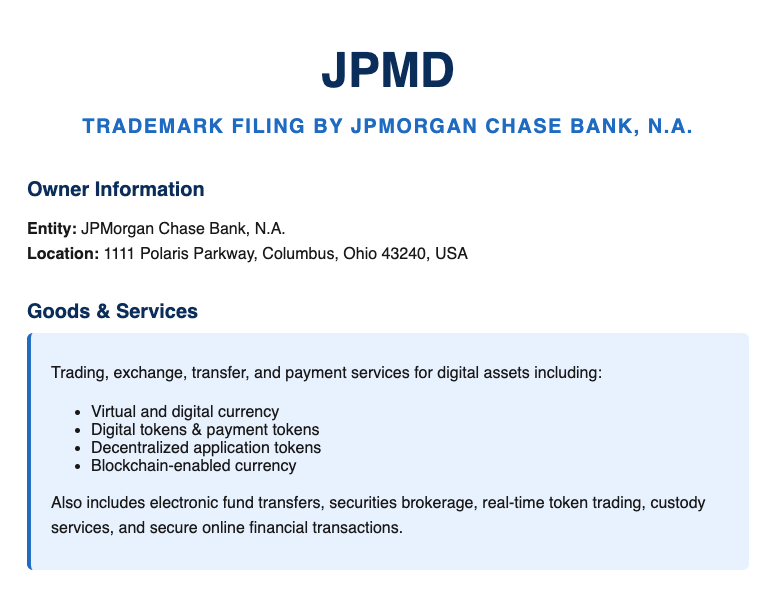

2. Subsidiaries of insured regulated banks - e.g. JPMorgan, Bank of America

3. State-qualified issuers <$10 billion in mcap - startups, fintechs.

3. But what ACTUALLY is the bill about?

The most important parts are here:

- 100% reserve backing (USD + short-term treasuries),

- monthly independent attestations of reserve adequacy and custody of reserves,

- AML programs,

- guaranteed redemption at par value,

- *explicitly prohibits yield-bearing stablecoins*

4. Is USDe and other stables going to be banned? No.

Not banned outright, but excluded from the regulatory framework.

Simply cannot be marketed as "payment stablecoins".

5. When implementation hits (18 months post-enactment or 120 days after final rules), expect the floodgates to open. Trump pushing for August recess signing adds urgency to this timeline.

TradFi already prepare for stablecoin market entry with JP Morgan pioneering.

6. Tether potential issues?

Tether has never submitted to a full audit. As a foreign issuer (Salvador based), Tether must comply with US court orders or face prohibition from US markets.

Tether's CEO Paolo Ardoino said in Bloomberg's interview that "We are getting comfortable with the genius act" and the company is open to creating a separate domestic stablecoin to meet the needs of the U.S. market.

16

5.75K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.