If you're serious about becoming wealthy - read this thread.

If you want to stay poor, skip it

Real wealth is created during periods like now

But no one shares practical advice except "buy the dip"

Here is my playbook on how to make the most from unstable crypto periods🧵👇

➮ Before we dive in..

🕷 If u're serious about making it, in such periods you can't survive without a community of grinders

🕷 That's why I want to share real value with u, and created a new public chat where we share thoughts, moves, plays:

Also, remember to support this thread if you enjoyed it

1/➮ First, drill it into your head that the main task in a market like this is simply to survive

Many leave crypto, people get lost, lose all their savings

But for the sharpest and bravest, this is a time of new opportunities

Let me explain more👇

2/➮ Eventually, crypto will break ATHs again and again - the only question is what kind of bags you will be holding

Because not all projects will make it

That’s why it’s crucial to position yourself correctly RIGHT NOW

Let’s dive into how to do it:

3/➮ Decide what % of your portfolio you want to invest and what portion you want to keep in stables

How to decide? Think about the level of risk you're willing to take (low-risk, medium-risk, and high-risk plays)

Now, choose the projects/narratives you want to bet on

4/➮ Main Rule: Stay away from higher risk plays rn

Small caps are dying within seconds in this kind of market

So for now, ONLY blue chips

Make a choice based on the narratives you believe in - not some random infl choice

DYOR + patience + conviction = profitable investment

5/➮ Keep a large % of your portfolio in stables

Why stables?

Because they reduce your portfolio’s volatility and allow you to generate passive income

How? Farm your stables

Search for farming protocols on YT, X, and pick whatever suits you best

But it’s not that simple:

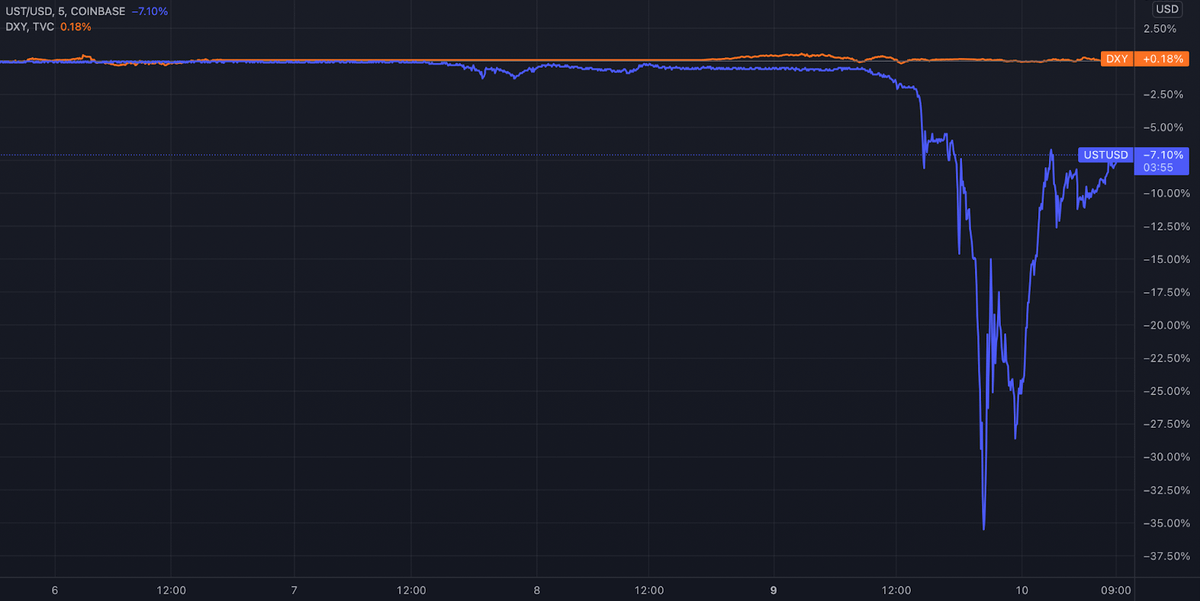

6/➮ Stablecoins aren’t RISK-FREE

They can depeg, governments can freeze assets

That’s why you need to diversify your stables

Hold a portion in USDT, USDC, and USDe

You can also keep a part in fiat (be aware of inflation risk too)

7/➮ Let’s talk about Buying the Dip

We’ve all made a bunch of mistakes - buying one dip, only to see another dip right after… and then another

But there’s a saying: “Don’t catch a falling knife.”

So, when should you actually buy the dip?

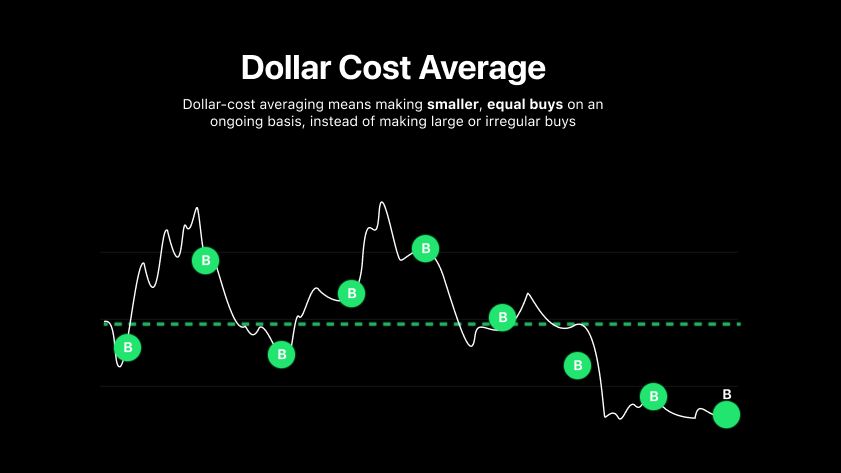

8/➮ Truth is - nobody knows when the exact bottom will happen

That’s why smart investors use Dollar Cost Averaging (DCA)

Instead of buying $1k worth of ETH all at once, you spread that buy across weeks/months

Now you’re actually making the most out of each dip

9/➮ But I know what some of you are thinking:

“Boss, what if I don’t even have money to buy the dip?”

That’s okay.

I started with just $300 — I know how that feels.

And here’s the answer: Focus on increasing your earning power

Build something that doesn’t depend on the size of your portfolio

10/➮ What can you do?

- Testnets

- Ambassador programs

- Web3 jobs

I broke all of that down in more detail here:

11/➮ Is your goal $1M+?

Then you must reflect and shift your mindset.

Doubt your limits.

Grow.

Negotiate for that higher pay, change jobs if you must

Don’t be afraid to ask for what you’re worth.

You’re way more ambitious than you think.

Thinking about doing the thing isn’t doing the thing, so make it happen

12/➮ Think about what you’re good at.

Because now is the perfect time to upgrade your skills:

- Coding

- Digital sales

- Marketing

- Copywriting

- Video editing

- Research

- Mastering AI tools

Build your edge and become a master at something

14/➮ Narrative Rotation

Narratives change less frequently during these times - and engagement often drops

But some can still thrive

Rn, I’m leaning toward RWA and AI narratives

But always be ready to rotate quickly to something else

15/➮ Forget trying to time the exact peak or bottom

Instead, just prepare for the next wave of growth and accumulate high-quality projects at discounted prices

Don’t check your portfolio 20 times a day

NEVER sell your BTC or ETH in times like this

30

11.22K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.