📽 It’s time for another weekly crypto roundup!

@mattzahab and @Rachelwolf00 are back with Episode 48, breaking down the latest crypto headlines.

Don’t miss out — tune in now👇

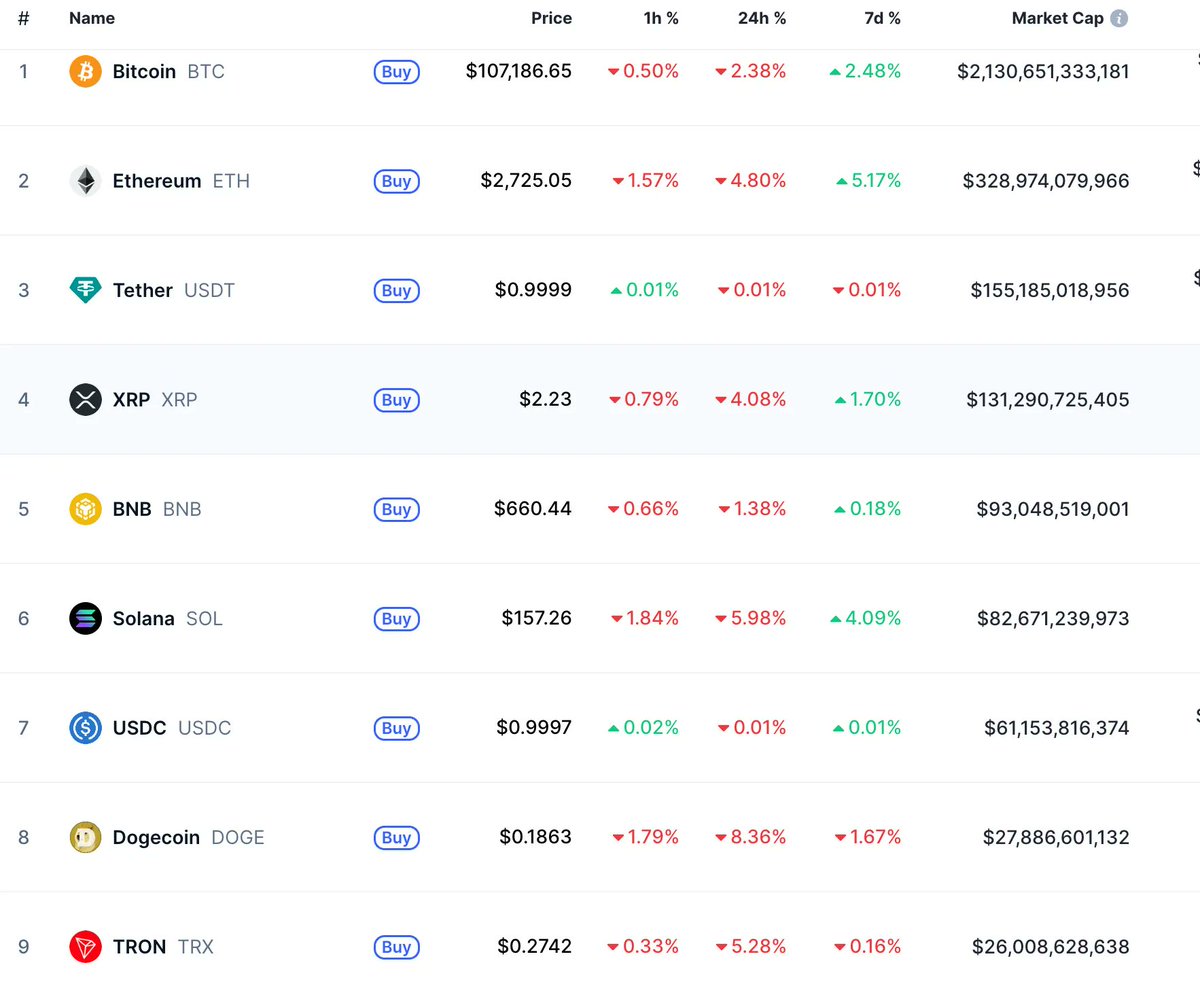

📌 Price Action

📌 GENIUS Act Faces Final Vote Amid Trump-Linked Controversy

The U.S. Senate has taken a major step toward federal regulation of stablecoins on Wednesday, voting 68-30 to invoke cloture on a substitute amendment to the GENIUS Act.

The move clears the way for a final vote on the legislation as early as Monday, unless Senate leaders agree to speed up the debate process.

📌 Donald Trump Amasses $1 Billion From Crypto In Just 9 Months: Forbes

According to Forbes’ calculations published in the report on Thursday, Trump has made $1 billion since just before the election, lifting his net worth to $5.6 billion.

The media outlet alleges Trump holds $900 million worth of liquid assets, with nearly half of that amount stemming from his crypto pursuits.

The article claims Trump profited over $390 million pre-tax from the sale of his affiliated crypto platform World Liberty Financial’s native tokens.

📌 Elon Musk’s X and Polymarket Deal Pushes Onchain Prediction Markets Into Global Social Feeds

Early Friday, X confirmed that crypto prediction market Polymarket will serve as its official prediction-market partner, an arrangement that marries real-time betting probabilities with the constant flow of posts across X.

The deal arrives after Polymarket processed more than US$8 billion in wagers last year, even while blocking U.S. users, and aligns with Elon Musk’s long-stated belief that crowd forecasts often outshine traditional polls.

📌 Hyperliquid Perps Volume Hits Record $248B in May Amid James Wynn Frenzy

Onchain perpetual futures platform Hyperliquid notched a record-breaking $248 billion in monthly trading volume for May, a 51.5% jump from April’s $187.5 billion, as market interest surged during the so-called “James Wynn” trading frenzy.

The year-on-year growth is even more striking. Just 12 months ago, Hyperliquid saw $26.3 billion in volume, making this May’s total an 843% increase.

📌 LIBRA Token: Argentina’s President Faces No Ethics Breach Over His Endorsement

Argentina’s Anti-Corruption Office has ruled that President Javier Milei did not violate public ethics laws when he publicly supported the LIBRA memecoin earlier this year.

In a resolution issued on June 5, the agency concluded that Milei’s endorsement of the LIBRA token in a Februart 14 post on X was made in a personal capacity and did not involve the use of government resources.

The ruling comes amid sharp political criticism after the token’s rapid collapse, which reportedly cost investors $251 million.

📌 Tether’s Open-Source Mining OS Could Shatter Barriers

Tether, the issuer of the USDT stablecoin, is preparing to open-source its Bitcoin mining operating system, a move that could shake up the mining industry and lower barriers for new entrants.

Announced by CEO Paolo Ardoino, the initiative seeks to provide smaller or independent miners with tools that typically require expensive third-party software or infrastructure.

📌 Blockchain Group Taps TOBAM for $342M Capital Raise to Boost Bitcoin Holdings

Blockchain Group, listed on Euronext Growth Paris, on Monday announced a $342m capital raise in partnership with asset manager TOBAM, aiming to expand its Bitcoin reserves and solidify its position as Europe’s first dedicated Bitcoin Treasury Company.

The company will issue new shares through a structure similar to an “at-the-market” program, widely used in the US.

📌 Binance Opens Door for Syrians Following US Sanctions Lift

Binance has announced that it has resumed offering a wide range of crypto services for Syrians, following the easing of US sanctions on Syria under General License 25.

“For years, people in Syria have watched the crypto world evolve, unable to participate. Not by choice, but by circumstance,” the exchange said in an official release.

“Syrian residents can now securely participate in the digital asset economy with 270+ million global Binance users.”

📌 Bringing RWAs On-Chain Is Biggest Opportunity For DeFi Says Aave Founder

Bringing traditional financial assets on-chain may be the biggest opportunity for decentralized finance (DeFi), according to Aave founder Stani Kulechov.

Speaking during a fireside discussion titled “Stablecoins, RWAs, and the Upcoming Launch of AAVE V4” at the Proof of Talk conference in Paris on June 11, Kulechov mentioned the biggest opportunity for DeFi growth will be real-world assets (RWAs) and bringing traditional financial assets on-chain.

📌 Trust Wallet Explores First Major RWA Integration in a Self-Custodial Wallet

Trust Wallet, a self-custodial wallet with over 200 million users, is preparing to integrate Real-World Assets (RWAs) into its app, according to Trust Wallet CEO Eowyn Chen.

Speaking during a panel discussion titled “What World is Crypto Building” at the Proof of Talk conference in Paris on June 10, Chen mentioned that users will eventually be able to engage with RWAs in the Trust Wallet app through an enhanced version of its “Swap flow” feature.

“This feature marks a significant step toward Trust Wallet’s vision of becoming a Web3 neobank—combining decentralized finance (DeFi), RWAs, and secure self-custody in one seamless platform,” Chen said.

6

17.14K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.