An open-source, decentralized marketplace for intelligence.

Bringing decentralized, predictive intelligence to onchain agents on @arbitrum via @EmberAGI's vibekit.

Study @AlloraNetwork.

Allora Network: Predictive Intelligence for Onchain Agents

@AlloraNetwork is a game-changer for how onchain agents operate by bringing decentralized predictive intelligence to market.

Through its integration with @EmberAGI's VibeKit on @arbitrum, it transforms reactive bots into systems able to anticipate and forecast, positioning ahead of market movements.

Let me break this down ↓

➀ 𝗧𝗵𝗲 𝗖𝗼𝗿𝗲 𝗜𝗻𝗻𝗼𝘃𝗮𝘁𝗶𝗼𝗻

Current DeFi automation is largely deterministic, which means agents execute predefined logic based on a current state. This creates massive inefficiencies: agents (or rather bots) react after optimal windows pass, strategies remain static as markets evolve, and value leaks through suboptimal execution.

Allora solves this through a decentralized network of ML models competing to provide context-aware predictions. Built on the Cosmos SDK and running a CometBFT consensus, the app-specific chain creates a ML-powered prediction market where accuracy directly drives rewards (kind of similar to Bittensor).

The architecture is quite sophisticated:

- Topics are sub-networks dedicated to a specific ML tasks (price prediction, image classification, sentiment analysis, etc.)

- Workers deploy models and submit predictions

- Reputers evaluate accuracy using normalized regret (performance relative to peers under similar conditions)

- Validators maintain onchain coordination infra

- Consumers/users (primarily automated agents) pay for insights

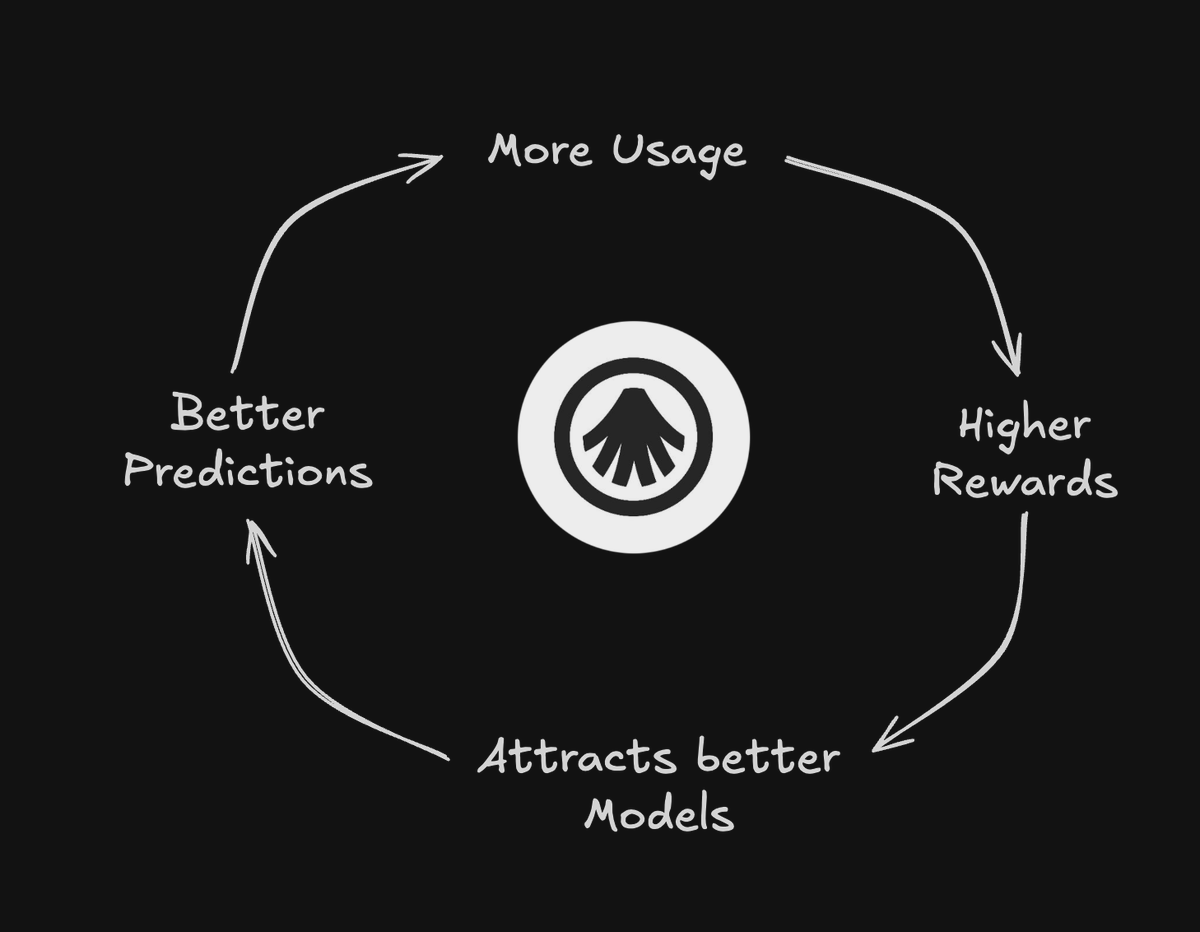

This ultimately creates a self-improving system where better predictions attract more usage, driving higher rewards and attracting better models.

➁ 𝗖𝗼𝗻𝘁𝗲𝘅𝘁-𝗔𝘄𝗮𝗿𝗲 𝗣𝗿𝗲𝗱𝗶𝗰𝘁𝗶𝗼𝗻 𝗦𝘆𝗻𝘁𝗵𝗲𝘀𝗶𝘀

Allora's key breakthrough is context-aware weighting. Rather than treating all predictions equally, the network dynamically weights models based on historical performance in specific conditions.

A model that excels during high volatility gets weighted heavily when volatility spikes. One that predicts well during Asian hours gains influence during that timeframe.

This peer-reviewed consensus mechanism, combined with stake-based reputation risk for Reputers, creates robust, manipulation-resistant predictions that continuously improve through real-world feedback loops.

➂ 𝗘𝗺𝗯𝗲𝗿 𝗔𝗜 𝗜𝗻𝘁𝗲𝗴𝗿𝗮𝘁𝗶𝗼𝗻: 𝗧𝗵𝗲𝗼𝗿𝘆 𝗠𝗲𝗲𝘁𝘀 𝗘𝘅𝗲𝗰𝘂𝘁𝗶𝗼𝗻

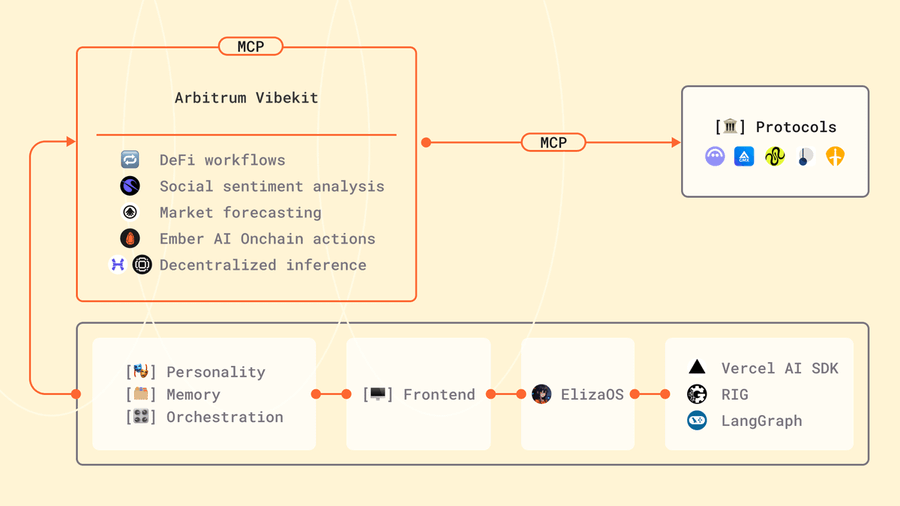

Vibekit leverages Ember's Model Context Protocol (MCP) to simplify complex DeFi interactions, allowing devs to rapidly deploy agents capable of executing sophisticated onchain strategies. The Allora integration adds predictive capabilities without requiring architectural changes. Devs maintain full control while gaining access to probabilistic forecasts that enhance agentic decision-making.

On Arbitrum, this unlocks sophisticated strategies previously hard or impossible to realize on-chain, including:

- Autonomous Yield Optimization: Agents predict APY changes and impermanent loss scenarios before they materialize, dynamically reallocating across pools and adjusting leverage based on volatility forecasts.

- Algorithmic Trading: Multi-asset strategies that adapt positions preemptively based on predicted correlations and regime changes, moving beyond simple momentum plays to true anticipatory positioning.

- Intelligent DCA: Forecast-driven execution that identifies local bottoms within accumulation windows, optimizing entry prices while minimizing gas costs through timing predictions.

- Proactive Leverage Management: Looping strategies that adjust exposure before liquidation risks emerge, using collateral volatility forecasts to maintain optimal risk levels.

➃ 𝗪𝗵𝘆 𝗧𝗵𝗶𝘀 𝗠𝗮𝘁𝘁𝗲𝗿𝘀

The integration positions Arbitrum as a primary hub for intelligent DeFi automation, a.k.a. advanced DeFAI, while Allora delivers probabilistic, context-aware predictions specifically designed for agentic on-chain consumers, and going far beyond what the market currently offers in terms of forward-looking data.

Additionally, the economic model aligns incentives perfectly: prediction accuracy drives rewards, creating compounding network effects as better models attract more users, generating higher fees that attract even better models. Topic-based rewards and delegated staking ensure both participation and security.

➄ 𝗧𝗵𝗲 𝗥𝗲𝗮𝗹𝗶𝘁𝘆 𝗖𝗵𝗲𝗰𝗸

While this sounds highly promising, success depends on execution. Model quality must scale with network growth and latency considerations may limit ultra-high-frequency applications.

The cold start problem for new prediction topics remains challenging too. Most critically, developers must build agents sophisticated enough to properly leverage probabilistic inputs, which is a non-trivial challenge requiring both DeFi and ML expertise on the builder side.

Yet, early production data shows promising results. But the real test comes as strategies become more complex and TVL scales. The technology enables a paradigm shift from reactive to predictive automation, but realizing this potential requires continued model innovation and dev adoption.

For builders and users of @EmberAGI's vibekit on @arbitrum and beyond, Allora represents the next evolution in onchain intelligence. Ushering in an era where competitive advantage comes not from faster reactions but from better predictions.

The infrastructure is live, the incentives are aligned, and the integration works.

Now it's about execution at scale.

20

2.48K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.