CRYTPO IPO SEASON IS UPON US

Institutional demand is well and alive for crypto and crypto-related companies. Everyone wants to be a publicly listed company now 📈

What's next to watch for institutional crypto investors? 👇

The success of $CRCL has reignited institutional interest in crypto companies.

$CRCL hit an ATH of $138.57, 4.47x its original IPO price.

Its rise shows the overwhelming demand for crypto equity exposure which has long been limited to $COIN, miners or BTC treasury firms.

$CRCL's success could be the key to open the floodgates to the next wave of crypto IPOs.

This is especially true under the new administration, which has put forward greater clarity surrounding crypto regulations and a more favorable stance on crypto activities.

Several other prominent crypto companies have also been speculated to be prime IPO candidates:

- Kraken

- ConsenSys

- Ledger

- Chainalysis

For one, Kraken has previously floated the idea of an IPO back in 2021, although new speculation suspect an IPO before Q1 2026.

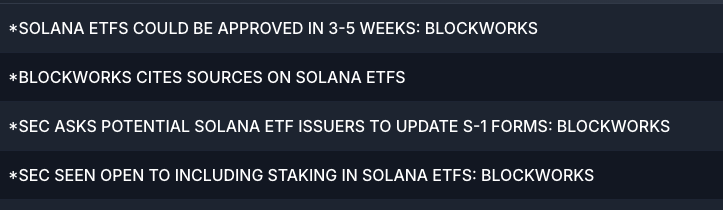

@FarsideUK Sources have also reported progress on $SOL spot ETFs, which could be approved in the next 3-5 weeks.

The approval would further the selection of digital assets available to institutional investors via spot ETFs.

Which crypto company would you like to see IPO next? 🤔

(Tether not included, they're not gonna do it man)

44

15.34K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.