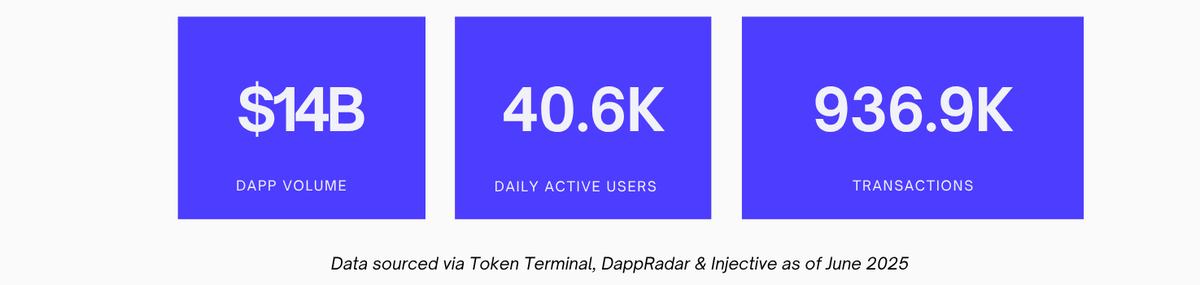

Since November 2024, @injective has displayed growth across its ecosystem, with daily active users rising from 9.3K to 40.6K, network transactions surging from 536.1K to 936.9K and dApp volume growing from $1.6B to $14B

So what could be contributing to this growth?

Applications like @HelixApp_, @hydro_fi and @neptune_finance led the way for enhanced liquidity through automated market makers (AMMs), for advanced trading strategies.

In relation, the network also leveraged gas-free transactions, enabled by fee delegation, to lower the barrier of entry for retail users and institutions.

Recent developments in the last six months also played a contributing factor in the growth of Injective’s dApp activity.

The iAssets framework, as well as the TradFi Index, brought traditional equities for trading onchain. This opened the doors for new use cases in how users were able to interact with the financial world.

The Libre integration also brought in tokenized funds from BlackRock and Nomura’s Laser Carry Fund, enabling secondary trading and collateralized lending.

AI tools and RWAs contributed to Injective’s dApp growth by enhancing functionality and attracting diverse users.

The TradFi Stock Index and BlackRock BUIDL Fund Index offered onchain exposure for users to traditional equities, expanding dApp appeal.

Collectively, these development looked to position Injective as a leader in the $42.3B RWA market and drive user adoption.

12

6.2K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.