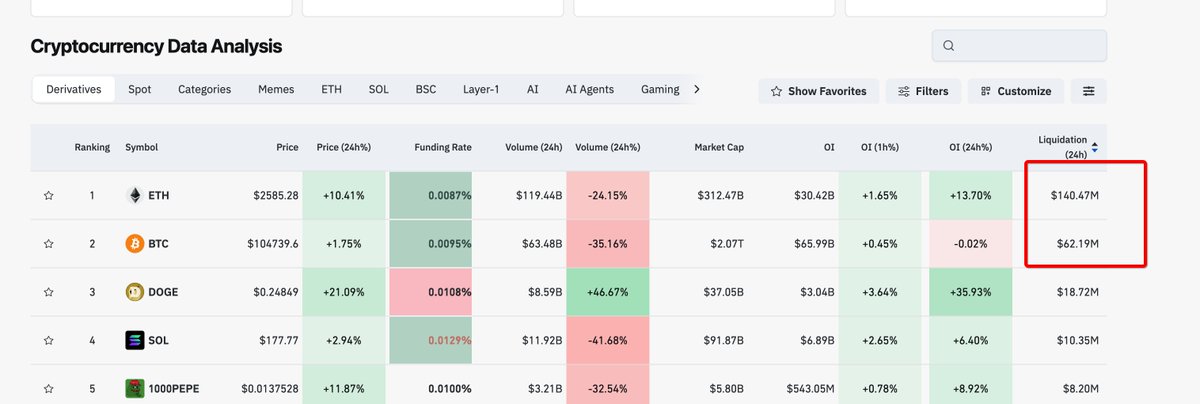

Have you ever seen a time when ETH liquidation amount is significantly higher than BTC? This is the right moment. At present, ETH is the absolute market leader, so it would be an empirical mistake to only analyse the impact of BTC on the market (because it was the rise and fall of BTC that dominated the market sentiment before).

It is true that the ETH ecosystem has not fundamentally changed, but the fuel for shorting is huge

My thinking is clearer now, it is the big rebound brought about by the ETH short market, and the later trend depends on the specific situation of the ETH Air Force, so it is invalid to refer to the BTC liquidation map to judge the market.

This perception is the biggest difference between me and other traders/analysts on Twitter, and of course, I need to continue to observe whether it is right or not, and be ready to admit my mistake at any time.

If you don't have any idea of squeezing, please refer to $alpaca

15

24.35K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.