This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

ETHM

The Ether Machine price

0x6027...e9bd

$0.0026286

+$0.0026207

(+33,372.73%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about ETHM today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

ETHM market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$2.63M

Network

Ethereum

Circulating supply

1,000,000,000 ETHM

Token holders

304

Liquidity

$283.74K

1h volume

$314.17K

4h volume

$1.38M

24h volume

$2.58M

The Ether Machine Feed

The following content is sourced from .

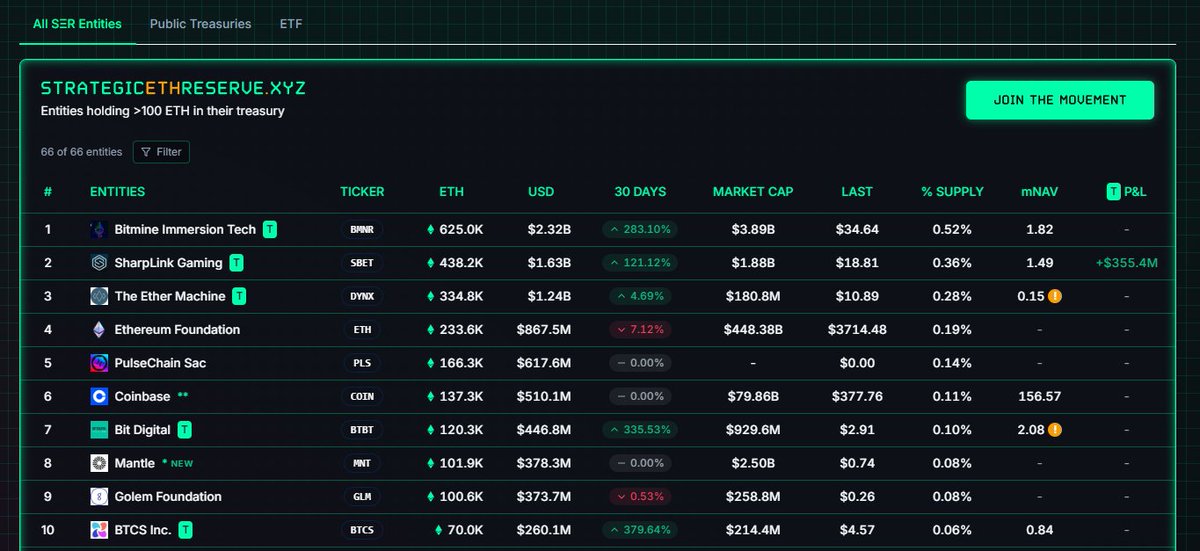

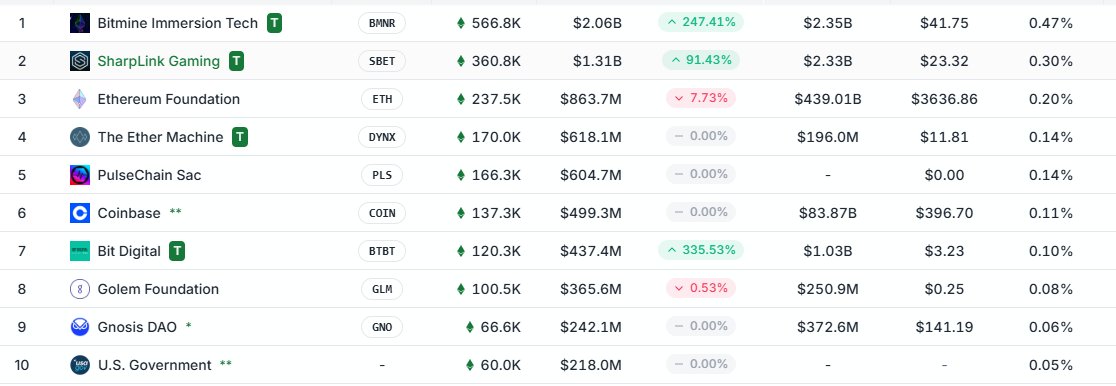

With $ETH surging past $4,000, the market is taking notice of ETH treasury plays! 🔥

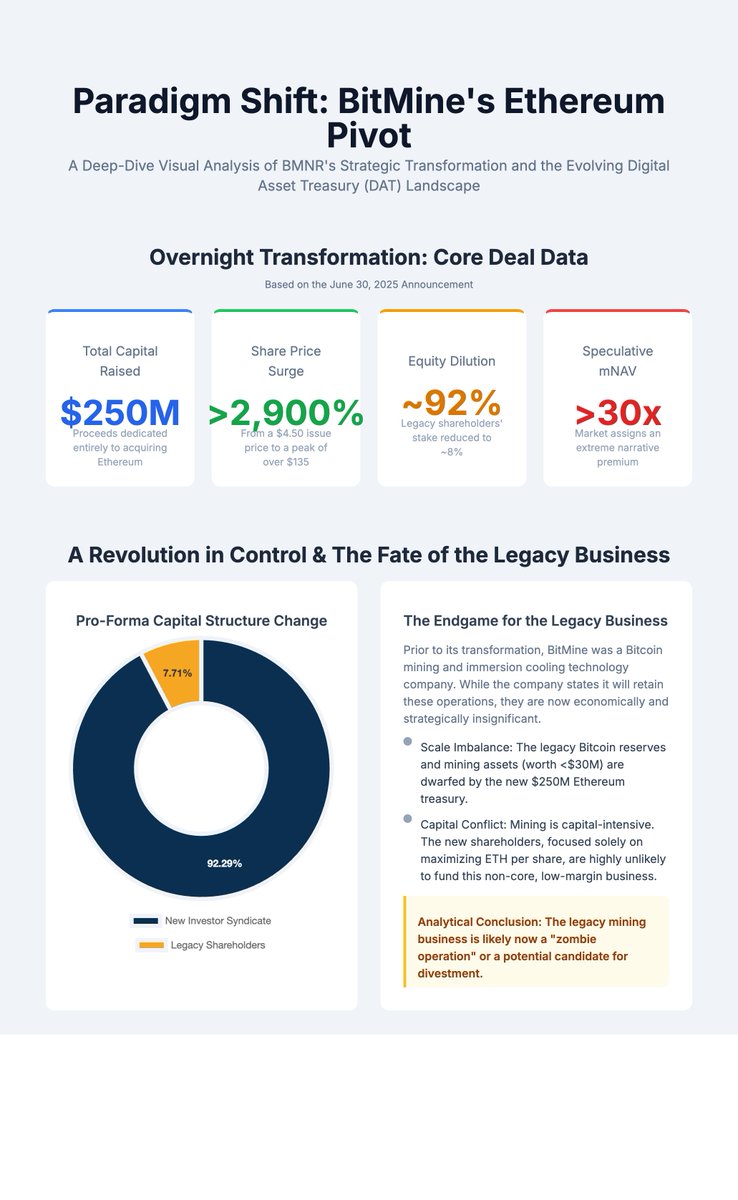

@BitMNR, the largest publicly traded Ethereum treasury, rocketed up nearly 30% today. A quick look at the data shows why the excitement is building. @fundstrat $BMNR

Key Data Comparison:

🔸ETH Holdings: $BMNR leads with a massive 833k ETH, dwarfing competitors like $SBET (522k) and $DYNX (345k). @SharpLinkGaming @TheEtherMachine

🔸Profitability: BMNR boasts a staggering $456M P&L on their holdings.

🔸Valuation: With an mNAV of 1.9x, it presents a compelling valuation case.

On top of their current holdings, BMNR has a stated goal of acquiring 5% of the entire ETH supply.

The gap in treasury size is massive, and their ambition is even bigger. Is the market just waking up to the scale of BMNR's ETH strategy?

#ETH #BMNR #Crypto #Stocks #EthereumTreasury $SBET $DYNX $ETHM

Dismantling The Ether Machine: Understanding the Birth of the $1.6 Billion ETH Whale in One Article

Author: @bruce_aiweb3

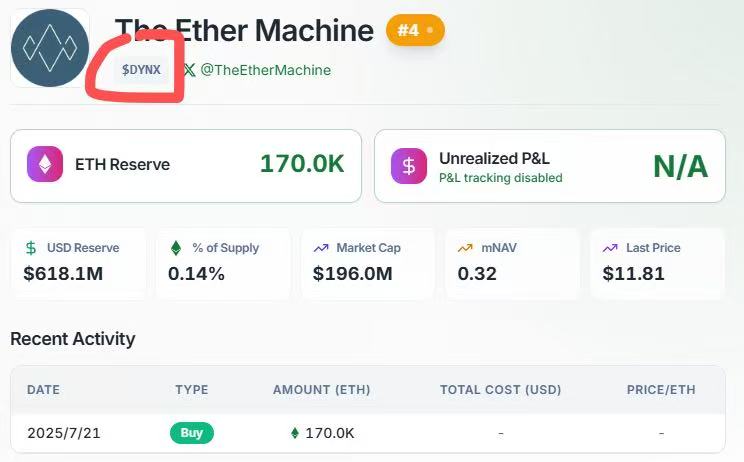

On July 21, 2025, a new entity called "The Ether Machine" announced that it will land on Nasdaq through a business combination with Dynamix Corporation (NASDAQ: DYNX), a special purpose acquisition company (SPAC). The reason why this transaction has attracted great attention in the market is not only because The Ether Machine has continued to increase its holdings since the announcement of the merger, and currently holds 340,000 ETH (worth about $1.26 billion), making it the third largest listed company with ETH holdings after BitMine Immersion Tech and SharpLink Gaming, but also because of its fundraising scale of up to $1.6 billion and the leadership of Andrew, a veteran figure in the Ethereum ecosystem A luxurious lineup with Keys himself "at the helm".

This article will provide a comprehensive disassembly of The Ether Machine from multiple dimensions such as transaction structure, core figures, financial strength, and business strategy based on its public disclosure documents.

De-SPAC: A shortcut to the open market

The Ether Machine chose a go-to-market path of De-SPAC, which merged with Dynamix, a "shell company" that has already been listed, to achieve rapid listing. Founded in 2024, Dynamix began as a typical SPAC, raising approximately $166 million through an IPO and depositing it into a trust account. It initially targeted the energy and power sector but ultimately chose the crypto space, which also reflects the flexibility of SPACs as a listing vehicle.

For The Ether Machine, the core advantage of the De-SPAC model is the certainty and efficiency of transactions. De-SPACs can lock in deal valuation and funding scale faster than traditional IPO processes, which is crucial especially in the crypto industry, where the market is volatile.

Since announcing the merger, The Ether Machine has continued to increase its holdings and now holds 340,000 ETH (worth approximately $1.26 billion), making it the third-largest ETH-holding listed company after BitMine Immersion Tech and SharpLink Gaming.

Core Figures: Andrew Keys and His "Ethereum Avengers"

To understand The Ether Machine, one must first understand its co-founder and chairman, Andrew Keys. As a "veteran" of the Ethereum ecosystem, his resume almost runs through the development history of Ethereum:

Early core member of Consensys: He led the creation of Ethereum's first "blockchain-as-a-service (BaaS)" product and partnered with Microsoft to directly push the price of ETH above $1 for the first time in 2015.

Co-founder of the Enterprise Ethereum Alliance (EEA): In 2017, he co-founded the world's largest open-source blockchain alliance, EEA, with members including giants such as Intel and BP.

Co-founder of DARMA Capital: He co-founded DARMA Capital, a CFTC-registered commodity pool operator that currently manages more than $1 billion in assets for staking, and its core technology will also be used by The Ether Machine.

Andrew Keys is not only a nominal leader, but also expresses confidence with real money. In this transaction, he personally contributed "169,984 ETH (worth approximately US$645 million)" in physical form as an anchor investment. According to its team, this commitment is more than 20 times larger than other similar projects on the market, demonstrating its long-term commitment to the company.

In addition to Keys, the company's management team, also known as the "Ethereum Avengers", brings together leading experts in technology, finance, and strategy:

CEO David Merin: Also from Consensys, he led more than $700 million in funding and mergers and acquisitions, playing a key role in the company's transformation from a distributed studio to an all-in-one software company.

Vice Chairman Jonathan Christodoro: Having worked at Icahn Capital LP, a well-known investment firm, and is still a board member of PayPal, bringing valuable experience in public company governance and fintech expansion to the company.

CTO Tim Lowe: A pioneer in the Ethereum staking space, having built a staking engine at Consensys and rebuilt a staking system at DARMA Capital that manages over $1 billion in assets.

The team is unique in that they choose to execute highly technically demanding staking and DeFi strategies in-house rather than outsourcing them to third parties, which is considered one of the company's core capabilities to create excess value for shareholders.

Financial strength: $1.6 billion in financing and top VC lineup

The public appearance of The Ether Machine can be described as "ample ammunition". The transaction raised more than $1.6 billion, the largest all-common equity financing commitment of its kind since 2021.

Its capital structure is mainly composed of three parts:

SPAC Trust Funds: Up to approximately $170 million from Dynamix Corporation's IPO proceeds.

PIPE & Strategic Investments: Over $800 million in private placement of common stock to institutional and strategic investors at $10 per share.

Founder Anchor Investment: Andrew Keys personally contributed approximately $645 million worth of ETH.

Of particular note is the "all-star" lineup of participants in its PIPE investments, including Roundtable Partners/10T Holdings, Archetype, Blockchain.com, cyber fund, Electric Capital, Kraken and Pantera Capital. The endorsement of these top institutions provides a strong market reputation for the long-term development of The Ether Machine.

It is worth noting that according to the latest disclosure, The Ether Machine has accumulated 340,000 ETH by anchoring investments before the completion of the merger transaction, with a current value of about $1.26 billion. Once the merger transaction is fully completed, its total open interest is expected to exceed 400,000, which is expected to further solidify its leading position in the market.

Core strategy: an active "ETH production machine" that goes beyond ETFs

The Ether Machine is not positioned as a "digital treasury" that passively holds ETH, but as a strategic "ether generation company". Its core strategy can be summarized in three points:

Accumulate: Continuously accumulate ETH in the market based on a strong capital of over $1.6 billion.

Compound: This is the core of its strategy. Unlike ETFs that can only passively track prices, The Ether Machine will actively manage all its ETH assets and generate ETH-based compound interest through "staking, restaking" and participating in risk-assessed DeFi protocols. The company's management expects this active management model to generate more than double the returns of future standard Staked ETH ETFs.

Grow: The company plans to become the backbone of the Ethereum ecosystem, feeding back and driving the development of the entire ecosystem through ecological cooperation, open-source contributions, and providing infrastructure solutions (such as validator management, block building, etc.).

It is important to note that according to current market data, the annualized rate of return on Ethereum staking is around 2–4%, while DeFi strategies such as re-staking can theoretically achieve higher returns.

This "actively managed for alpha yield" model is key to its differentiation from all other ETH investment vehicles in the market, especially potential ETFs. The company believes that Ethereum itself is a dynamic, yield-generating productive asset that can only be fully unlocked through professional and active management.

Current Progress and Prospects

According to the announcement, the business combination has been unanimously approved by the boards of directors of both parties and is expected to close in the fourth quarter of 2025, when the company will officially trade on Nasdaq under the ticker symbol "ETHM".

According to the latest developments, The Ether Machine has started executing its ETH accumulation strategy. From July 30 to 31, the company began purchasing nearly 15,000 ETH at a cost of $56.9 million; On August 4, the company increased its holdings by another 10,000 ETH, worth about $40 million, bringing its total holdings to more than 345,000 ETH.

All in all, the birth of The Ether Machine is a landmark event in the deep integration of crypto assets and traditional capital markets. It not only provides investors in the open market with an unprecedentedly large, compliant and transparent ETH investment channel, but also tries to answer a core question through its innovative model of "active management": can professional alpha (excess return) defeat passive beta (market return) in the field of digital assets?

The future of the company depends on the long-term development and value of the Ethereum network itself, on the one hand, and on the other hand, it will test whether Andrew Keys and his team can truly translate the theoretical "excess return" strategy into sustained, excellent shareholder returns under the scrutiny of the open market.

This is the best explanation on @TheEtherMachine company. The Bloomberg and CNBC snippets don't really do it justice.

$ETHM $DYNX $ETH

Bankless

During the Gensler era, @ak_ethermachine from @TheEtherMachine stayed quiet—not because there was nothing to say, but because there was “no upside in speaking.”

Now, with tailwinds like the Genius Act bringing regulatory clarity, it’s time to go from silence to signal. Ethereum isn’t just ready—it’s entering production.

$DYNX

0x6990314a454e6a687213540abbd65b7f8deace2a

The Ether Machine is $ETHM

The Ethereum strategy website has just been updated, and the new company with a position of 170,000 ether financing will not be listed until the end of the year, and the current stock code is still DYNX!

$BMNR High 1.2M $SBET High 12M How much can $DYNR 18K, which is currently ranked fourth?

ETHM price performance in USD

The current price of the-ether-machine is $0.0026286. Over the last 24 hours, the-ether-machine has increased by +33,372.73%. It currently has a circulating supply of 1,000,000,000 ETHM and a maximum supply of 1,000,000,000 ETHM, giving it a fully diluted market cap of $2.63M. The the-ether-machine/USD price is updated in real-time.

5m

+2.07%

1h

+22.11%

4h

+3.42%

24h

+33,372.73%

About The Ether Machine (ETHM)

Latest news about The Ether Machine (ETHM)

Ether Machine Starts 334K ETH Buying Spree With $57M Purchase

The Ether Machine started deploying its ETH treasury strategy, with over $400 million in reserves remaining for future purchases.

Jul 31, 2025|CoinDesk

Kraken-backed The Ether Machine buys 15,000 ETH on Ethereum’s 10-year anniversary

The Ether Machine, a newly formed Ethereum generation company backed by Pantera Capital, Kraken, and...

Jul 31, 2025|Crypto Briefing

Pantera-backed The Ether Machine set for Nasdaq debut, targets $1.6B raise

The Ether Machine, a newly established firm backed by a group of top-tier institutional, crypto-native,...

Jul 21, 2025|Crypto Briefing

ETHM FAQ

What’s the current price of The Ether Machine?

The current price of 1 ETHM is $0.0026286, experiencing a +33,372.73% change in the past 24 hours.

Can I buy ETHM on OKX?

No, currently ETHM is unavailable on OKX. To stay updated on when ETHM becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of ETHM fluctuate?

The price of ETHM fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 The Ether Machine worth today?

Currently, one The Ether Machine is worth $0.0026286. For answers and insight into The Ether Machine's price action, you're in the right place. Explore the latest The Ether Machine charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as The Ether Machine, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as The Ether Machine have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.