This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

NODE

NodeOps price

0x2f71...43fb

$0.094381

+$0.0075859

(+8.74%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about NODE today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

NODE market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$4.09M

Network

BNB Chain

Circulating supply

43,296,168 NODE

Token holders

59623

Liquidity

$1.11M

1h volume

$33.98K

4h volume

$254.08K

24h volume

$1.46M

NodeOps Feed

The following content is sourced from .

Intelligently optimizing validator performance across chains

TL; DR:

Validator performance is now critical to earning and retaining stakeholder support. Downtime or missed blocks directly affect rewards and reputation.

NodeOps offers a validator intelligence platform with real-time monitoring, automated failover, and slashing protection across multiple chains.

NodeOps Staking hub helps operators scale infrastructure, publish transparent performance metrics, and analyze delegation trends.

NodeOps launched its native token, $NODE, on June 30, 2025. This launch followed significant progress and clear product market fit, evidenced by over $3.7M in accumulated revenue and more than 706K verified users across all product lines

Staking no longer guarantees passive income. As competition grows, driven by institutional validators, liquid staking protocols, and restaking ecosystems, validator performance has become a decisive factor. Delegators track metrics: missed blocks, uptime history, and slashing records. Each lapse costs yield. Each penalty erodes trust.

New systems like EigenLayer and modular networks such as Celestia introduce additional operational demands. Validators now secure multiple environments, each with its own configuration, penalty system, and performance expectations. The role has shifted from running a node to managing distributed infrastructure under strict constraints.

What was once background infrastructure now defines validator competitiveness. That shift favors operators who manage with precision.

Validators operate in a fragmented tooling stack, often relying on Horcrux for key management, Prometheus exporters for metrics, Telegram bots for alerts, and Grafana for dashboards. Each chain introduces its own quirks, scripts, edge cases, and maintenance burdens.

For seasoned teams, this becomes a cycle of patchwork fixes. For newer operators, it’s a steep and costly learning curve. One RPC lag or signing failure can trigger slashing and loss of stake. Managing across networks compounds the risk: Cosmos validators struggle with height lag, Ethereum with missed attestations during gas spikes, and Avalanche with subnet uptime rules.

Without unified visibility or automated response systems, issues are often caught only after damage is done. This patchwork model doesn’t scale, and increasingly, it doesn’t protect.

NodeOps as an Infrastructure Intelligence Layer

NodeOps addresses this operational gap by introducing a full-stack validator intelligence layer. It consolidates telemetry, alerting logic, delegation analytics, and automated failover workflows into a single control plane, built for multi-chain infrastructure.

Operators onboard through lightweight agents or containerized modules that stream real-time metrics into a unified dashboard. This includes uptime patterns, RPC latency, signing failures, peer count drift, and block proposal data. Rather than surface static charts, NodeOps analyzes these inputs for anomalies.

When deviations occur, such as height lag on Cosmos or RPC congestion on Ethereum, the platform flags the issue and offers recommended actions. Thresholds are customizable per network. An operator might trigger a failover if latency exceeds 200ms or signing lag crosses critical levels.

This turns performance monitoring into a proactive system, one that reacts before revenue or reputation is impacted.

NodeOps ranks among the top DePIN projects by 30-day revenue, generating $465K, positioning it ahead of established players like Akash, Helium, and Filecoin.

How It Works: Real-Time Data, Smart Alerts, and Automated Resilience

NodeOps continuously ingests telemetry from validators, benchmarking them against network-specific performance thresholds. On Cosmos, it tracks missed pre-commits and block height gaps. On Ethereum, it analyzes attestation timing, proposer accuracy, and inclusion delay. Avalanche and Celestia add subnet-specific metrics like finality lag and proposer liveness.

When issues like proposal failures, RPC congestion, or peer drops arise, NodeOps immediately flags anomalies and proactively triggers automated responses such as DNS redirection, validator pause, or key rotation to prevent slashing.

For example, during a high-load period on Evmos, NodeOps detected RPC latency nearing a slashable threshold. Before penalties occurred, the system triggered failover to a secondary node, adjusted the sync source, and restored validator uptime without incident. The entire response was logged and exported to the validator’s delegation partners for transparency.

This level of operational automation transforms validator infrastructure from reactive to resilient, minimizing downtime, preserving rewards, and maintaining delegator trust.

Delegation Intelligence: Transparency That Builds Trust

NodeOps doesn’t just reduce downtime, it gives validators tools to grow and defend their stake. Delegators increasingly use performance dashboards, commission history, and slashing records to decide where to allocate capital. NodeOps enables validators to publish these metrics in real time, offering transparency that builds confidence.

The platform also tracks delegation movement over time. Operators can correlate stake inflows and outflows with changes in performance, commission strategy, or community activity. If a validator raises commission after a period of 100% uptime, NodeOps can show whether delegators stayed or left, turning validator operations into a measurable business feedback loop.

Liquid staking protocols benefit as well. When selecting validator sets, many LSTs now require automated performance verification. NodeOps exposes APIs that allow these teams to audit validator health continuously, without relying on unverifiable claims or manual reporting.

Visibility, not just uptime, is becoming a key differentiator in staking. NodeOps gives validators both.

Why Revenue Visibility Matters More Than Ever

DePINs are at risk of hyperinflationary outcomes when their tokenomics strategy involves building the supply side through early emissions. NodeOps delayed its token launch to enable revenue to build ahead of listing. Once the wider market conditions favor a token launch, the historic revenue will be brought onchain, directly linking the revenue to the token price.

Furthermore, the emission schedule follows optimal control theory, meaning that emissions are correlated with onchain revenue and capped at a daily limit to protect against hyperinflation and encourage early price discovery that reflects the Network’s utility. The initial emissions apply a conservative 0.2 burn-to-mint ratio, 5 times tighter than the early DePIN models.

According to Messari’s dedicated report on NodeOps, the network generated $3.7M in annualized revenue before any token incentives were introduced, placing it among the strongest revenue-producing DePIN projects ahead of its token launch.

Having experienced how poor the observability over emerging protocols is, NodeOps took an early stance to provide transparency over its supply, demand, and product revenue metrics with a public Dune dashboard.

Its advantage is scope. Legacy tools like Horcrux focus on threshold signing or single-chain telemetry. NodeOps, by contrast, supports slashing protection, cross-chain observability, and delegation analytics, all through a single control plane.

The platform has also expanded beyond validator ops. It’s evolving into a DePIN orchestration layer, positioning itself within the emerging decentralized compute stack. Staking Hub, which supports networks like Hyperliquid and Beam, along with incentive programs like “Stakedrop,” is designed to increase engagement while reinforcing network decentralization.

In a performance-first staking economy, tools that provide transparency, automation, and proof of execution are no longer optional. They’re how validators stay relevant.

The Team behind NodeOps

NodeOps is led by Naman Kabra, Co-Founder and CEO, who brings a hybrid background in technical engineering and protocol-level business development. He began his career as a blockchain engineer at Bosch Engineering and later contributed to staking-focused projects including Persistence, AssetMantle, and Metasky. His experience spans validator onboarding, ecosystem growth, and infrastructure strategy across multiple Web3 protocols.

Pratik Balar, Co-Founder and Tech Lead, drives the technical architecture behind NodeOps’ decentralized validator infrastructure. Before NodeOps, he held infrastructure and DevSecOps roles at Shardeum, AsGuard, and AssetMantle, where he specialized in Cosmos validator operations, multi-cloud deployments, and automated security pipelines. His expertise includes Kubernetes, Terraform, and large-scale performance monitoring across modular networks.

The frontline team is distributed across Asia, America, the UK, and Europe and has deep experience in Web3.

Conclusion: The Alpha Is in the Ops

The role of the validator has shifted. It’s no longer about staying online; it’s about earning trust through consistent execution. With growing complexity across restaking, liquid staking, and modular chains, operators must now treat performance as infrastructure risk.

NodeOps gives them the system-level tools to do that: real-time alerting, network-specific automation, and telemetry that aligns with how delegators evaluate performance.

Staking no longer rewards presence. It rewards precision. The validators who operate with that mindset are the ones scaling across ecosystems and retaining delegation.

For a deeper look into how NodeOps is used in production, including validator case studies, automation workflows, and implementation guides, explore their technical documentation and resource hub.

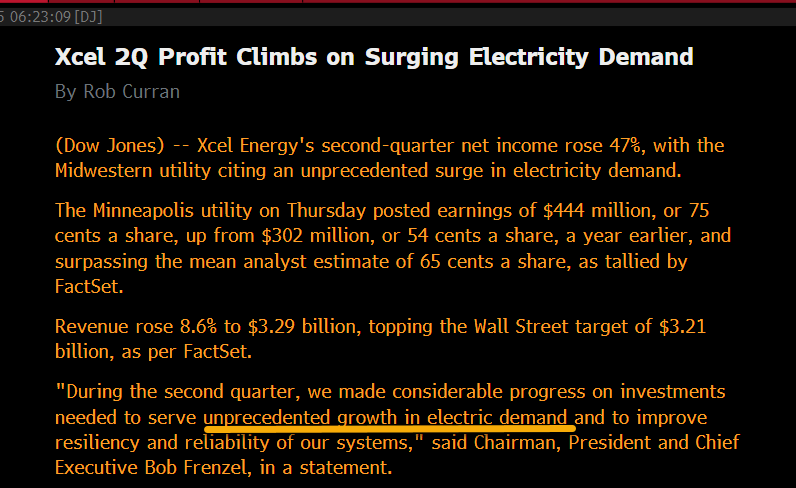

Grid-critical Utility $XEL Cites "Unprecedented Growth in Electric Demand" in EPS Beat; Capacity Shortages Prevent Guidance Raise as Customers Request 9GW in Extra Load

✅

matthew sigel, recovering CFA

Utilities are leading the S&P today, and Bitcoin miners might be partly to thank. ⚡️

Three BTC-friendly power giants posted strong earnings:

$ETR: Boosts 2027/28 guide, raises 4-yr capex 10%. Industrial load (incl. miners) growing 13% CAGR

$AEP: Beat & raise, capex up 30%

$OGE: Holding top end of guidance

Long all in $NODE 🫡

Utilities are leading the S&P today, and Bitcoin miners might be partly to thank. ⚡️

Three BTC-friendly power giants posted strong earnings:

$ETR: Boosts 2027/28 guide, raises 4-yr capex 10%. Industrial load (incl. miners) growing 13% CAGR

$AEP: Beat & raise, capex up 30%

$OGE: Holding top end of guidance

Long all in $NODE 🫡

NODE price performance in USD

The current price of nodeops is $0.094381. Over the last 24 hours, nodeops has increased by +8.74%. It currently has a circulating supply of 43,296,168 NODE and a maximum supply of 43,296,168 NODE, giving it a fully diluted market cap of $4.09M. The nodeops/USD price is updated in real-time.

5m

+0.00%

1h

-0.22%

4h

+8.85%

24h

+8.74%

About NodeOps (NODE)

NODE FAQ

What’s the current price of NodeOps?

The current price of 1 NODE is $0.094381, experiencing a +8.74% change in the past 24 hours.

Can I buy NODE on OKX?

No, currently NODE is unavailable on OKX. To stay updated on when NODE becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of NODE fluctuate?

The price of NODE fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 NodeOps worth today?

Currently, one NodeOps is worth $0.094381. For answers and insight into NodeOps's price action, you're in the right place. Explore the latest NodeOps charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as NodeOps, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as NodeOps have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.