This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

LIBRA

LIBRA price

Bo9jh3...vUsU

$0.060737

+$0.0000060731

(+0.01%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

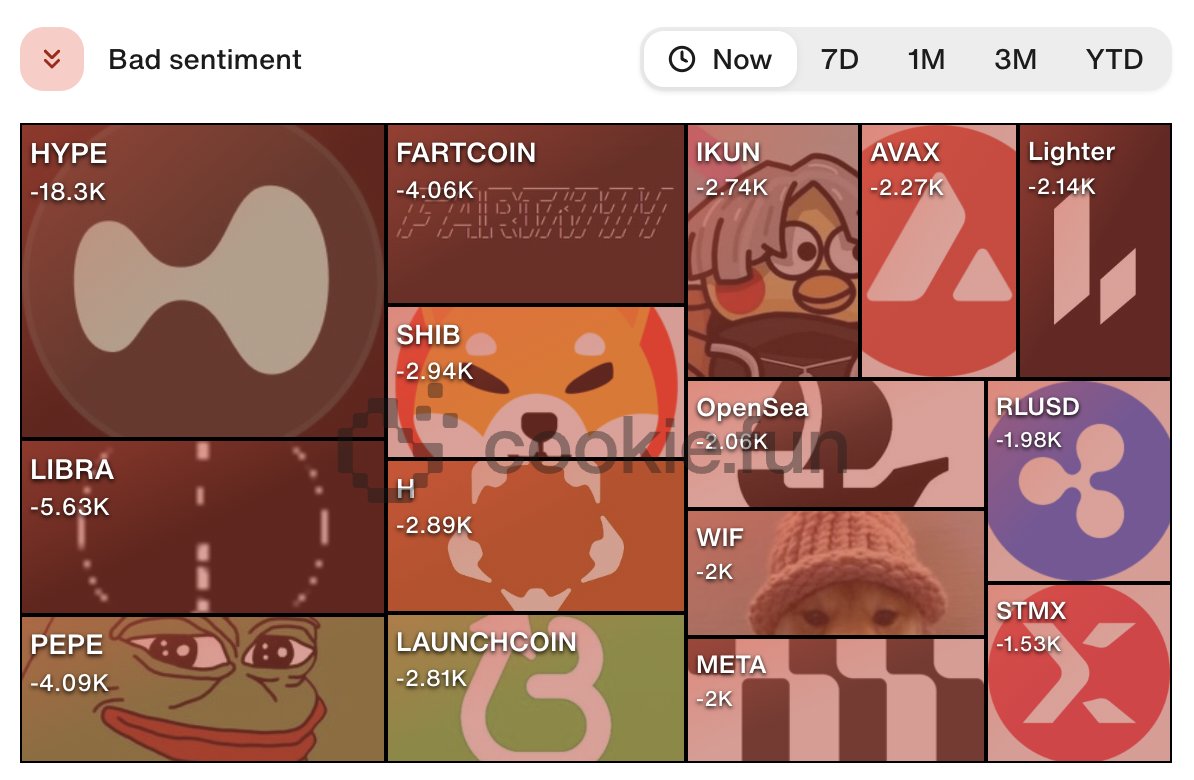

How are you feeling about LIBRA today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

LIBRA market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$60.74M

Network

Solana

Circulating supply

999,997,593 LIBRA

Token holders

26030

Liquidity

$21.87M

1h volume

$3.60

4h volume

$802.03

24h volume

$4.61K

LIBRA Feed

The following content is sourced from .

Crypto News: Flat Overall Filings, Rising Crypto and AI Suits in 2025

Key Insights:

Recent crypto news and data shows six crypto and 12 AI class actions in H1 2025 nearly match 2024’s total.

Securities suits remain flat around 114 vs. 115.

Burwick Law filed half of the crypto cases.

The first half of 2025 saw 114 new securities class-action filings, nearly matching the 115 filed in H2 2024. Seemed like, overall lawsuit volume was essentially flat.

Core filings (excluding M&A cases) were 111 in H1 2025 versus 112 in H2 2024. These figures align with the long-term semiannual average (about 113).

Notably, filings were skewed to Q1 (67 in Q1 vs. 47 in Q2). While counts held steady, risk metrics spiked: the “Disclosure Dollar Loss” index jumped 56% to $403 billion in H1 2025, and “Maximum Dollar Loss” hit $1.85 trillion. In short, the number of suits didn’t grow, but their scale did.

Crypto News and Recent Data Shows a Rise in Filings

Investor lawsuits over crypto assets are also climbing. Six new crypto-related securities class actions were filed in H1 2025 versus seven for the entire 2024.

In Cornerstone’s July report, cryptocurrency was one of the top trending topics in filings. This surge comes even as federal agencies have softened crypto enforcement under the new administration.

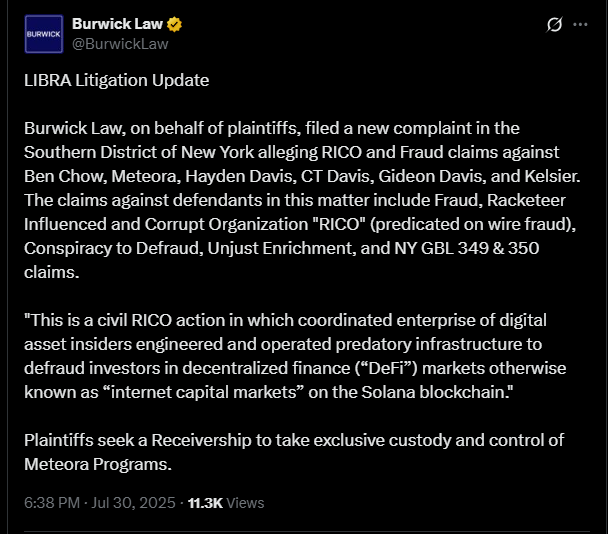

Notably, half of the 2025 H1 crypto cases were brought by Burwick Law – including a complaint over the Pump.fun platform and another over the LIBRA meme token.

Pump.fun’s UK operator, Baton Corporation, was sued Jan. 30, 2025 by investor Diego Aguilar in a New York federal court. The complaint alleges Pump.fun’s platform worked with influencers to market “unregistered security memecoins,” generating roughly $500 million in fees from investors. (Pump.fun denies wrongdoing.)

In short, crypto class suits are piling up – investor lawyers say they offer “a vital path to accountability” when regulators lag.

AI Litigation Surges

A striking exception to the flat overall trend is AI-related securities litigations. Twelve AI-focused class actions were filed in H1 2025. It was up from only five in the prior half-year and on pace to exceed the 15 total in all of 2024.

In fact, AI claims were the single largest trend category in new complaints. Many of these suits hinge on “AI washing,” where companies allegedly overstate their use of AI.

Former SEC Commissioner Joseph Grundfest captures the idea: “ChatGPT explains the increase in AI-related securities litigation as ‘primarily driven by … “AI washing” — where companies exaggerate, misrepresent, or falsify the extent or significance of their AI capabilities’,” he said.

When the truth comes out, investors sue. “I have nothing else to add to this AI explanation of AI litigation,” Grundfest quipped. In short, dollars at risk and AI are the big trends.

Notable Crypto Cases in News

In April 2025, a group of Solana token buyers filed a class action against decentralized exchange Meteora and VC firm Kelsier Labs.

The amended complaint (Apr. 21) says Meteora helped launch a token called $M3M3 by falsely touting “trusted leaders” in Solana, then inflated the price. Plaintiffs claim roughly $69 million in losses from the scheme.

Relatedly, a separate suit in March 2025 accuses promoters of the “LIBRA” meme token (tied to Argentina’s former president’s network) of a “deceptive, manipulative” launch.

Source: X

Even celebrity memecoins draw suits: creators of Haliey Welch’s $HAWK coin face a December 2024 class action claiming the token was an unregistered security.

Other recent cases involve crypto miners, exchanges and adjacent firms (e.g. hardware sellers) which is a sign that the traditional SEC playbook (Section 5 registrations, insider trading) is extending into blockchain.

The post Crypto News: Flat Overall Filings, Rising Crypto and AI Suits in 2025 appeared first on The Coin Republic.

Solana DEX volume dips 20% after co-founder slams meme coins

Solana’s DEX volume has lost nearly $700 million since Monday.

The downside follows comments from its co-founder criticizing meme tokens and NFTs.

The remarks sparked debates, especially since meme cryptos have fueled Solana’s growth.

The latest comments from Solana’s co-founder, Anatoly Yakovenko, left speculative trading enthusiasts shaken.

Meanwhile, the blockchain reflects the impact on the decentralized exchange (DEX) front.

Yakovenko dismissed NFTs and meme coins as assets without intrinsic value in a July 27 X post.

He compared them to a mobile game loot box, which serves speculative individuals.

Meanwhile, the comments dented sentiments as Solana’s DEX volume has seen a 220% decline from Monday’s $3.071 billion to $2.374 billion today.

While sudden dips are not uncommon in the cryptocurrency industry, some participants are connecting the dots.

Meme cryptos have fueled Solana’s growth

It is the irony that grabbed the community’s attention. While meme tokens lack traditional utility, they have been vital in Solana’s latest boom.

Nearly all themed cryptocurrencies that have dominated trends in the past few years launched on the SOL blockchain.

PNUT, WIF, FARTCOIN, and the current PENGU, you can name them.

Furthermore, Solana boasts the largest meme launchpads (Pump.fun and Raydium).

At times when top chains like Ethereum and Cardano were quiet, Solana flourished due to viral meme assets and NFTs.

Moreover, leading Solana DEXs like Jupiter thrived during meme coin seasons.

With these trends, Solana attained a strong community, culture, profits, and growth momentum.

Thus, many equate Yakovenko’s comments to biting the hand that fed their ecosystem.

Solana-based exchanges have experienced substantial slowdowns days following the controversial comments.

Whether the 20% slide is a usual cool-off or a reaction to Yakovenko’s remarks, Solana’s ecosystem took a hit.

The tone might have discouraged some participants, who are likely considering alternative meme launchpads.

For digital assets enthusiasts, meme tokens and NFTs represent culture, accessibility, and creativity in the crypto industry.

Moreover, they lower entry barriers into Web3.

Meme tokens lack value, but drive excitement

Yakovenko’s comments weren’t unfounded. Most meme tokens lack utility beyond attention.

They face criticism since they lack legitimate backing, use cases, and the fact that most creators launch them as speculative plays.

Projects can record staggering surges overnight and crash within minutes.

You probably remember the controversial LIBRA case.

Libra surged to $224 million market capitalization project before crashing within hours, leaving its investors with massive losses.

Its current market cap is $3.94 million.

Hype, not fundamentals, dictates the life cycles of most meme coins.

However, they also work. While themed cryptocurrencies lack substance, they attract attention and excitement in the digital currency markets.

Also, they onboard retailers who want to join the market without navigating complex protocols.

This phenomenon has benefited Solana, putting it in the spotlight during periods when top blockchains felt dormant.

Though Yakovenko’s remarks appear true, they exposed the fragility between market behavior and logic in crypto.

Besides decentralization, the fun side of the blockchain industry remains vital for the sector’s liveliness.

The post Solana DEX volume dips 20% after co-founder slams meme coins appeared first on CoinJournal.

LIBRA price performance in USD

The current price of libra is $0.060737. Over the last 24 hours, libra has increased by +0.01%. It currently has a circulating supply of 999,997,593 LIBRA and a maximum supply of 999,997,593 LIBRA, giving it a fully diluted market cap of $60.74M. The libra/USD price is updated in real-time.

5m

+0.00%

1h

-1.43%

4h

-2.96%

24h

+0.01%

About LIBRA (LIBRA)

Learn more about LIBRA (LIBRA)

LIBRA Meme Coin Scandal: Political Fallout, Investor Losses, and Economic Implications in Argentina

LIBRA Meme Coin: A Scandal That Shook Argentina's Crypto and Political Landscape The LIBRA meme coin, a Solana-based cryptocurrency, has become the epicenter of a political and financial scandal in Ar

Jul 28, 2025|OKX

LIBRA Token Collapse: Insider Activities, Tokenomics Flaws, and the Rise of Celebrity-Endorsed Memecoins

Introduction: The LIBRA Token’s Meteoric Rise and Fall The cryptocurrency market is no stranger to dramatic events, but few have been as shocking as the rapid collapse of the LIBRA token. Promoted by

Jul 23, 2025|OKX

Argentina’s Libra Crypto Scandal: Javier Milei Cleared, But Questions Remain

Argentina’s Libra Crypto Scandal: Javier Milei Cleared, But Questions Remain The Rise and Fall of Libra Token In February 2025, the Libra cryptocurrency, launched by Delaware-based Kelsier Ventures un

Jun 10, 2025|OKX

LIBRA FAQ

What’s the current price of LIBRA?

The current price of 1 LIBRA is $0.060737, experiencing a +0.01% change in the past 24 hours.

Can I buy LIBRA on OKX?

No, currently LIBRA is unavailable on OKX. To stay updated on when LIBRA becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of LIBRA fluctuate?

The price of LIBRA fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 LIBRA worth today?

Currently, one LIBRA is worth $0.060737. For answers and insight into LIBRA's price action, you're in the right place. Explore the latest LIBRA charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as LIBRA, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as LIBRA have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.