This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

FDUSD

First Digital USD price

0xf16e...DUSD

$0.99794

-$0.00020

(-0.02%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about FDUSD today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

FDUSD market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$63.45M

Network

SUI

Circulating supply

63,582,788 FDUSD

Token holders

4569

Liquidity

$1.10M

1h volume

$11.49K

4h volume

$463.71K

24h volume

$1.65M

First Digital USD Feed

The following content is sourced from .

bnbchain welcomes a major application @StableStock, currently the largest coin-stock platform on bnbchain, with strong investors that have not yet been disclosed.

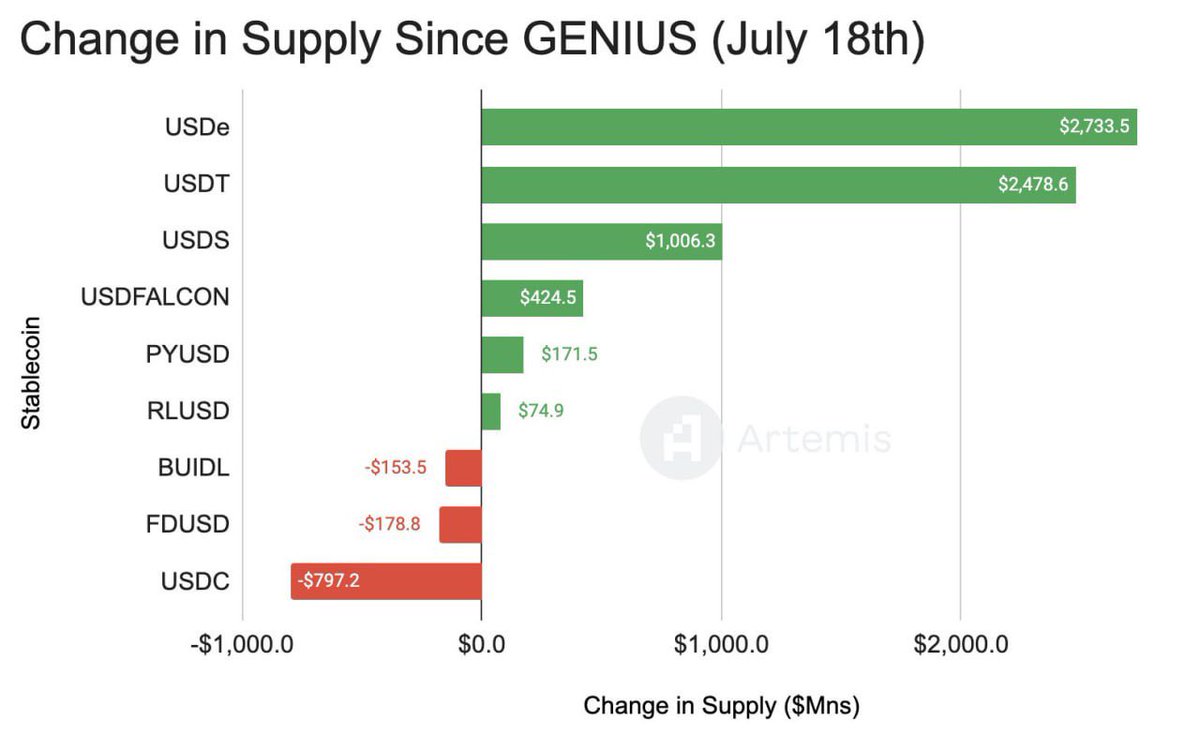

In 2024, an important turning point has quietly been crossed. According to Bitwise data, the annual trading volume of stablecoins has surpassed the total global payment volume of Visa for the first time. Assets like USDT, USDC, and FDUSD have transformed from tools into channels for thousands of emerging market users, who are accessing the dollar system through stablecoins, bypassing banks and the financial system, completing the foundational financial reconstruction with on-chain wallets.

But the question arises: the money has come in, where will it go? DeFi has won access, but it still lacks a value anchor.

Currently, the choices for on-chain liquidity remain limited. You can participate in memes or speculate on altcoins, but the essence of these assets is high volatility, high risk, and low structure.

For those who have truly made money, want to allocate long-term, and seek stable returns, what they need is not the next tenfold dog coin, but blue-chip assets that can be held on-chain.

What are the benefits of holding on-chain? Recently, I've seen everyone complaining about the taxes imposed by domestic brokers when trading Hong Kong and US stocks 🤣, even if you end up losing money, you still have to pay. But if you put it on-chain, no one will care.

This demand has hardly been met on-chain. Until we saw StableStock, which is a TraDeFi protocol that tokenizes US stock assets and introduces on-chain liquidity.

In simple terms, it has done something that seemed impossible in the past:

It allows users to purchase US blue-chip assets with USDT/USDC at the click of a button and converts them into on-chain composable, tradable, and lendable DeFi modules.

It is not issuing air, nor is it empty talk about rwa narratives, but rather a complete closed loop from compliant purchase → token minting → providing on-chain liquidity → opening to ecosystem developers.

The project's three-layer core structure:

1️⃣ Access Layer: StableBroker

This is a stablecoin-driven stock brokerage system that supports users buying US blue-chip stocks directly with USDT/USDC; all assets are genuinely purchased and held, integrating institutions like Coinbase, DBS, ANZ, KGI, Tiger, etc.; targeting user groups that cannot open accounts (Indonesia, Vietnam, Africa, and other emerging markets).

2️⃣ Liquidity Layer: sStock and StableVault

The purchased stocks can be minted 1:1 into sStock, for example:

AAPL → sAAPL

TSLA → sTSLA

Users can deposit sStock into StableVault to earn interest certificates stStock (like stAAPL) and participate in:

Providing LP (like sAAPL-USDC) 👉 collateral for lending markets 👉 cross-chain transfer to other L1s 👉 integration with other protocols.

This transforms traditional stockholding into on-chain asset participation.

3️⃣ Ecosystem Layer: Open Liquidity & Product Co-creation

The liquidity of StableVault is not closed for self-use but is completely open to external developers.

DEXs, lending protocols, and Bridges can be integrated without permission. Developers can build structured products, leveraged stock perps, and RWA index products based on sStock.

Currently, multiple on-chain infrastructure integrations have been established.

Additionally, there is a module called Stableswap, which supports 1:1 no-slippage exchanges between multiple versions of similar stock assets, such as sTSLA, xTSLA, TSLA.ondo, etc., connecting fragmented on-chain liquidity.

Many users in Asia, Latin America, and Africa cannot hold US stocks compliantly due to reasons such as:

severe depreciation of local currencies like the Argentine peso and Indonesian rupiah; strict capital and foreign exchange controls; poor quality of local stock markets; high thresholds for traditional brokers, making account opening difficult.

StableStock provides an unprecedented channel: USDT → US stock assets → on-chain participation.

Currently, the DeFi TVL is about $200B, with the vast majority being altcoins, and the truly blue-chip RWA is less than 0.1%.

When altcoins are no longer the growth engine, on-chain must seek new value anchors, and US stocks are a natural choice.

The team background is also very solid.

CEO-Zixi @Zixi41620514 has invested in projects including Sahara, Solv, MyShell, etc.

COO-Zac @piginflying is the CEO of WealthBee and was previously responsible for Rong360's overseas operations, generating annual revenue of $15M+ in the SEA region.

CMO-Evie @0xEvieYang is the founder of JE Labs, serving over 60 top projects including Aptos, HashKey, and Particle.

This is a team that truly understands Crypto, finance, and market go-to-market strategies.

What we see is not just a product, but a whole new set of on-chain financial infrastructure: bringing compliant assets truly on-chain; turning on-chain assets into financial components that can participate; transforming stablecoins from payment tools into the starting point for asset inflow; reconstructing TradFi into a composable, open financial network.

After stablecoins, what is lacking on-chain is a long-term, stable, and truly composable asset anchor.

StableStock, by minting real US stock assets, will inject new structural dynamics into DeFi with an open on-chain asset system.

If you are a user, this is your first opportunity to invest in global blue chips with USDT.

⚡️Scallop DeFi Summer: Scallop 2nd Anniversary Promotion

To celebrate Scallop's recent 2nd Anniversary on Mainnet, we are excited to announce TWO fee updates that will benefit our users.

For this quarter, we have implemented 0% Swap Fees on Scallop Swap for all assets!

In addition, Interest Spread on selected Scallop Pools has been reduced. This allows Scallopers to enjoy higher Lending APY when supplying on Scallop!

Updated Interest Spread:

🔹USDT, USDC, USDY, FDUSD Pools: 30% --> 20%

🔹DEEP and WAL Pools: 40% --> 30%

These limited-time offers will last for a period of 3 months, so don't miss out and start enjoying DeFi on Scallop today!

Get Started with Scallop:

Enjoy 0% Swap Fees:

Time to make DeFi great again🤝

FDUSD price performance in USD

The current price of first-digital-usd is $0.99794. Over the last 24 hours, first-digital-usd has decreased by -0.02%. It currently has a circulating supply of 63,582,788 FDUSD and a maximum supply of 63,582,788 FDUSD, giving it a fully diluted market cap of $63.45M. The first-digital-usd/USD price is updated in real-time.

5m

+0.00%

1h

-0.10%

4h

+0.01%

24h

-0.02%

About First Digital USD (FDUSD)

FDUSD FAQ

What’s the current price of First Digital USD?

The current price of 1 FDUSD is $0.99794, experiencing a -0.02% change in the past 24 hours.

Can I buy FDUSD on OKX?

No, currently FDUSD is unavailable on OKX. To stay updated on when FDUSD becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of FDUSD fluctuate?

The price of FDUSD fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 First Digital USD worth today?

Currently, one First Digital USD is worth $0.99794. For answers and insight into First Digital USD's price action, you're in the right place. Explore the latest First Digital USD charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as First Digital USD, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as First Digital USD have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.