This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

DAI

Dai Token price

0x1af3...dbc3

$1.0000

+$0.00039984

(+0.04%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about DAI today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

DAI market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$36.00M

Network

BNB Chain

Circulating supply

35,999,893 DAI

Token holders

177243

Liquidity

$868.41K

1h volume

$137.54K

4h volume

$198.62K

24h volume

$1.63M

Dai Token Feed

The following content is sourced from .

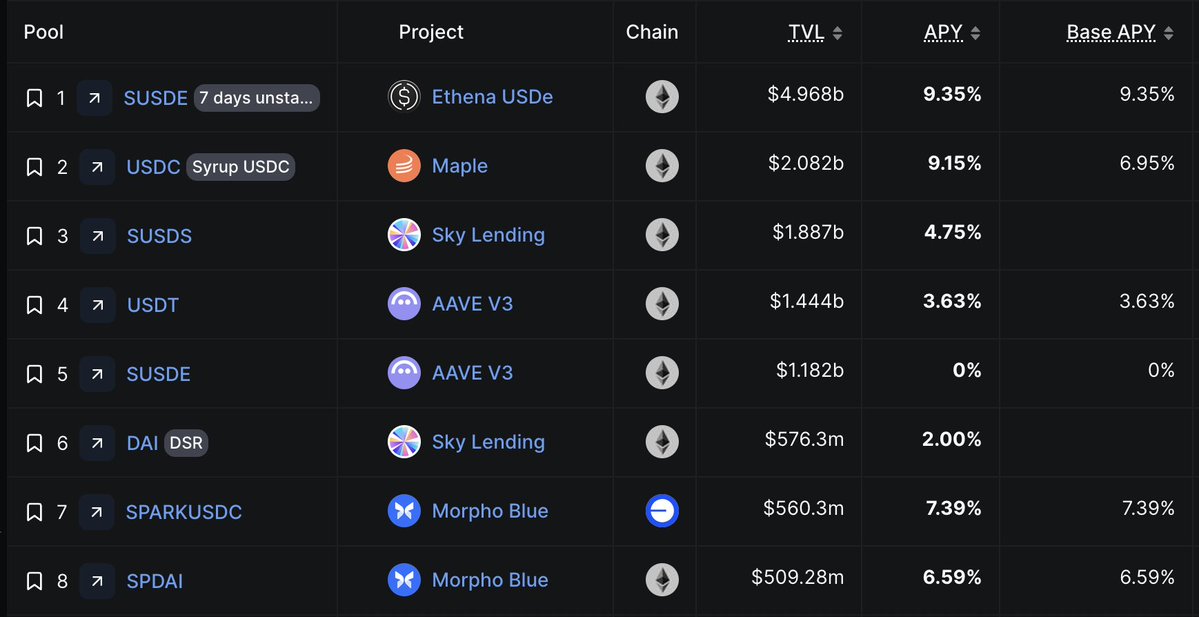

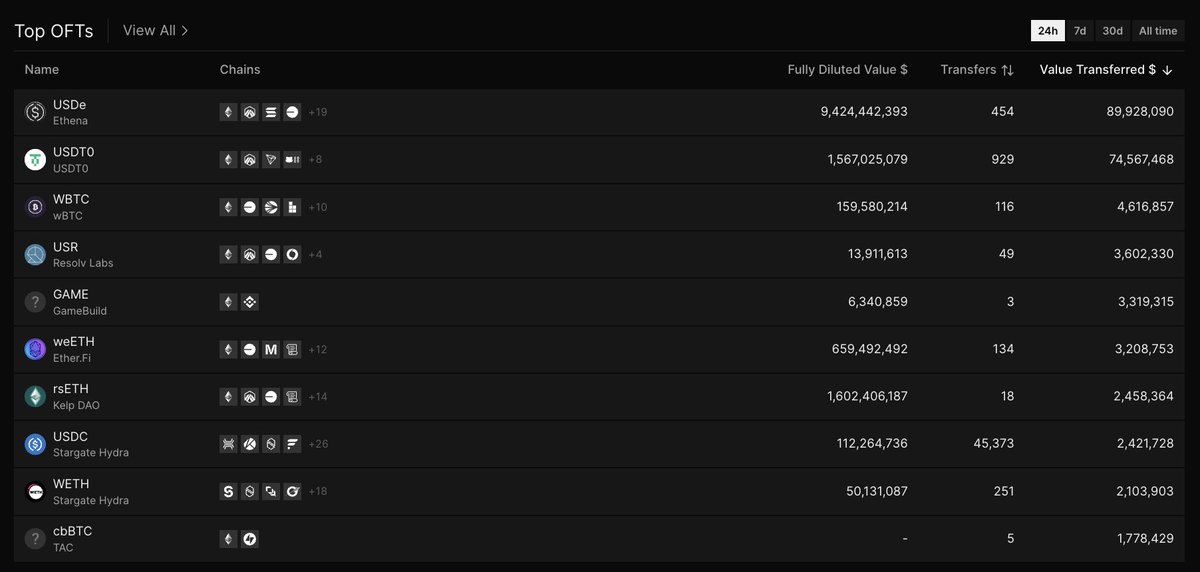

DWF's sub-project Falcon Finance has secured a strategic investment of $10 million from the Trump family @worldlibertyfi.

@FalconStable is also in the stablecoin space, but focuses on synthetic dollars.

Synthetic dollar ≠ stablecoin.

📌 The USDf issued by Falcon is not a traditional stablecoin.

Instead, it is a synthetic dollar generated by user asset collateral, with the ability to distribute yields.

This constitutes its essential difference from USDT, DAI, and even Ethena:

🔸 Unlike traditional stablecoins: USDf does not promise to peg to off-chain dollars and does not use bonds, notes, or other off-chain structures for collateral.

🔸 Unlike non-pegged stablecoins: USDf does not use a floating liquidation mechanism and stabilizes system risks through over-collateralization.

🔸 Falcon's design goal is to make USDf a universal intermediate state that can convert all on-chain assets into yield certificates.

@FalconStable core structure USDf / sUSDf / strategy custody path:

1. USDf: Asset mapping layer

Users obtain USDf by depositing different types of assets:

Stablecoins (USDT/USDC/DAI): 1:1 minting, no lock-up.

Mainstream assets (ETH, BTC, SOL): use OCR (over-collateralization ratio), supporting custom liquidation lines and lock-up periods.

Altcoins: only supports a limited list of assets, with higher minting discount rates and more Miles points incentives.

2. sUSDf: Yield-bearing layer

Users holding USDf can choose to stake it to generate sUSDf, automatically connecting to the yield strategy system managed by DWF Labs. The current annualized yield (APY) is about 14.3%, with higher multiples available through lock-up.

3. Strategy execution path

This part is entirely managed by @DWFLabs:

🔸 Basis arbitrage: Hedging price differences to obtain interest income.

🔸 Funding rate arbitrage: Capturing interest rate fluctuations in the futures market during high volatility.

🔸 Structured portfolio strategies: Multi-currency, cross-platform strategy scheduling, dynamically adjusting positions.

🔸 Centralized liquidity management: Using part of the assets for deep LP configuration, earning fees + voting incentives.

@FalconStable does not make these strategies visible on-chain but follows a professional custody path, forming a yield output relationship between the strategy manager and users.

📌 Falcon will enter closed testing in February 2024 and open public testing in April.

So far, it has achieved significant data performance:

🔸 TVL: $650 million (data from August 2025).

🔸 Total market cap of USDf: over $1.1 billion, consistently ranking among the top 15 stable assets on Ethereum.

🔸 sUSDf minting volume: over $220 million, mainly used for yield participation.

Miles points system: still in the early stages, points have not been redeemed, and potential airdrop windows remain.

Among these, the growth rate of TVL mainly comes from three paths:

Stablecoin collateral users continuously increase their holdings of USDf, directly pushing up the base supply.

LP arbitrageurs use USDf as a yield tool in Curve/Uniswap.

High-net-worth users execute large minting and lock-up strategies through the Falcon platform account.

These funds entering #Falcon do not rotate in the short term but continue to reside in the system to generate yields, which is extremely rare for long-term capital stickiness in DeFi.

The TrustWallet and OpenLedgerHQ partnership will redefine crypto wallets with AI powered, on chain intelligence.

With over 200M users, Trust Wallet is set to deliver a seamless, conversational interface -> think “Swap 50 DAI for $OPEN ” and it’s done, nothing more.

@OpenledgerHQ Proof of Attribution ensures every action is transparent, auditable, and user-approved. No black boxes, just clarity and control. This isn’t just a wallet upgrade; it’s a leap toward a smarter, more accessible Web3 future for everyone.

Anyone here still use @TrustWallet atm?

Brothers, @OpenledgerHQ and Trust Wallet have announced a partnership aimed at exploring the first AI-driven cryptocurrency wallet interface. This collaboration marks a significant leap in the field of cryptocurrency wallets, combining OpenLedger's verifiable AI technology with Trust Wallet's extensive user base, aiming to provide over 200 million users with a smarter and safer digital asset management experience.

Trust Wallet, as the world's leading non-custodial cryptocurrency wallet, has earned the trust of 200 million users with its security and user-friendliness. Now, by integrating OpenLedger's verifiable AI technology, Trust Wallet is redefining the future of cryptocurrency wallets:

1⃣ Natural language interaction: Just say "swap 50 DAI for ETH on Polygon," and the wallet will automatically bridge, optimize gas fees, and execute the transaction, eliminating cumbersome steps.

2⃣ Smart contextual suggestions: The wallet can provide the best trading times and personalized optimization plans based on network conditions and user habits, making every step more efficient.

3⃣ On-chain transparency and security: With OpenLedger's proof of attribution technology, every operation is traceable and verifiable, eliminating black-box operations and giving users absolute trust.

The core of OpenLedger lies in its verifiable AI layer, which records on-chain data for every interaction, ensuring transparency and fairness. Users can not only see the details of every operation but also trust the source and processing of the data. This unprecedented transparency transforms Trust Wallet from a mere tool into a true companion for users' digital asset management.

Overall, the partnership between @OpenledgerHQ and Trust Wallet represents a historic leap for cryptocurrency wallets from tools to intelligent companions. It not only simplifies and secures digital asset management but also outlines infinite possibilities for the future of Web3.

#OpenLedger @OpenledgerHQ

Lucy | $M | 🐜

In an era where AI has become an integral part of our daily lives, @OpenledgerHQ AI Studio revolutionizes the AI landscape by enabling users to build and deploy specialized models tailored to their specific domains. This innovative approach not only enhances the accuracy and relevance of AI applications but also ensures explainability and attribution, marking a significant shift towards truly open, verified, and explainable AI.

The current market is dominated by LLMs, which, while powerful, often lack the precision and context required for specialized tasks. This limitation has led to a growing frustration among users seeking more reliable and transparent AI solutions.

@OpenledgerHQ AI Studio provides a platform where users can train and fine-tune AI models using their own data or community-owned datasets. This ensures that the AI model is not only specialized but also deeply integrated with the user's specific needs and context. Whether it's a business optimizing operations, a researcher conducting data analysis, or an artist seeking creative inspiration, OpenLedger provides the tools to tailor these unique needs.

At the heart of OpenLedger AI Studio lies its ability to create AI models tailored to individual domains. The platform supports advanced techniques that allow for efficient deployment of multiple models on a single GPU, significantly improving performance and reducing costs. Every contribution to the model, whether it's data, computational resources, or algorithm tuning, is tracked through the blockchain, ensuring that all participants are acknowledged and incentivized in a transparent manner.

One of the most notable features of OpenLedger AI Studio is its emphasis on explainability and attribution. Users can see which model was used, what data it was trained on, and who contributed to its development. This transparency not only builds trust but also allows users to verify the accuracy of the output and understand the reasoning behind it.

At the same time, OpenLedger's approach is rooted in the principles of openness and verification. By leveraging blockchain technology, the platform ensures that all actions, from dataset uploads to model training and governance participation, are executed on-chain. This not only enhances security but also provides a tamper-proof record of all activities.

Overall, @OpenledgerHQ AI Studio represents a paradigm shift in how we think about and use AI. By focusing on specialization, explainability, and attribution, the platform empowers users to take control of their AI experience. It goes beyond the one-size-fits-all approach of generic LLMs, offering tailored, transparent, and trustworthy solutions. Truly open, verified, and explainable AI starts here, and the possibilities are endless.

#OpenLedger @OpenledgerHQ

DAI price performance in USD

The current price of dai-token is $1.0000. Over the last 24 hours, dai-token has increased by +0.04%. It currently has a circulating supply of 35,999,893 DAI and a maximum supply of 35,999,972 DAI, giving it a fully diluted market cap of $36.00M. The dai-token/USD price is updated in real-time.

5m

-0.18%

1h

-0.18%

4h

-0.01%

24h

+0.04%

About Dai Token (DAI)

DAI FAQ

What’s the current price of Dai Token?

The current price of 1 DAI is $1.0000, experiencing a +0.04% change in the past 24 hours.

Can I buy DAI on OKX?

No, currently DAI is unavailable on OKX. To stay updated on when DAI becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of DAI fluctuate?

The price of DAI fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Dai Token worth today?

Currently, one Dai Token is worth $1.0000. For answers and insight into Dai Token's price action, you're in the right place. Explore the latest Dai Token charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Dai Token, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Dai Token have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.